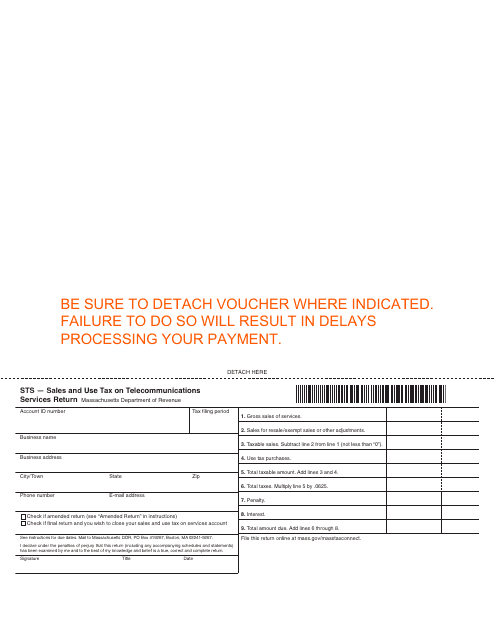

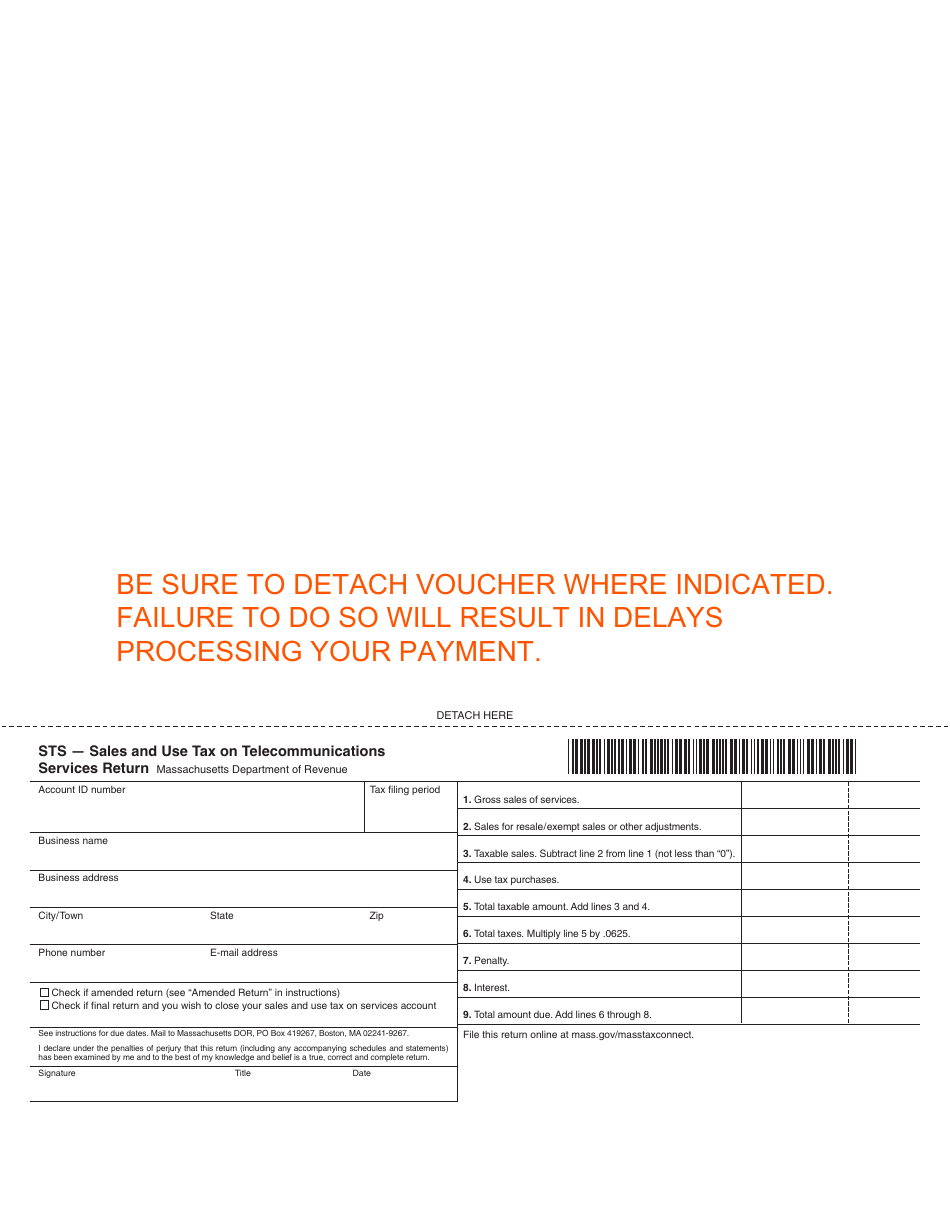

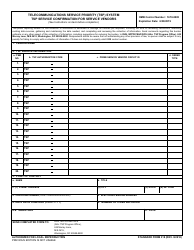

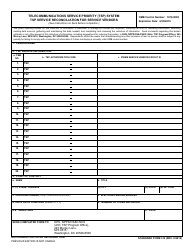

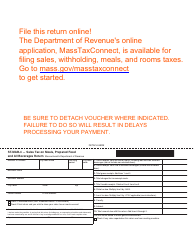

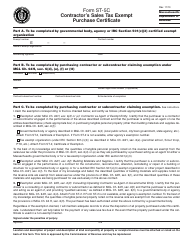

Form STS Sales and Use Tax on Telecommunications Services Return - Massachusetts

What Is Form STS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form STS?

A: Form STS is the Sales and Use Tax on Telecommunications Services Return.

Q: Who needs to file Form STS?

A: Anyone who provides or purchases telecommunications services in Massachusetts and is subject to sales and use tax.

Q: What is the purpose of Form STS?

A: The purpose of Form STS is to report and pay sales and use tax on telecommunications services.

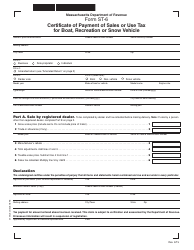

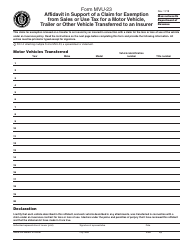

Q: What information is required to complete Form STS?

A: You will need to provide information about your business, the telecommunications services provided or purchased, and the amount of sales and use tax due.

Q: When is Form STS due?

A: Form STS is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter (March 31, June 30, September 30, and December 31).

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form STS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.