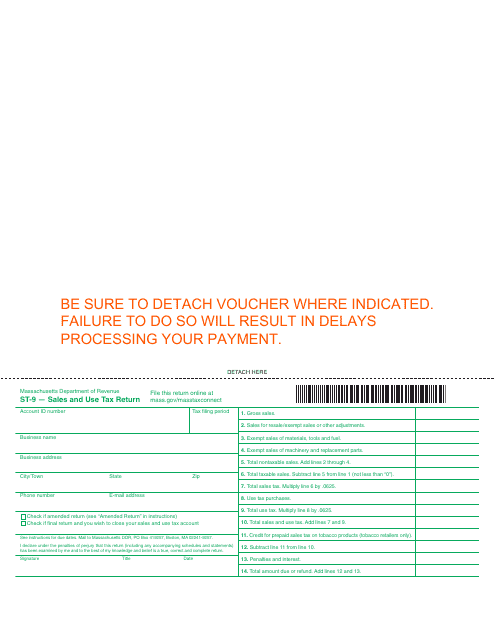

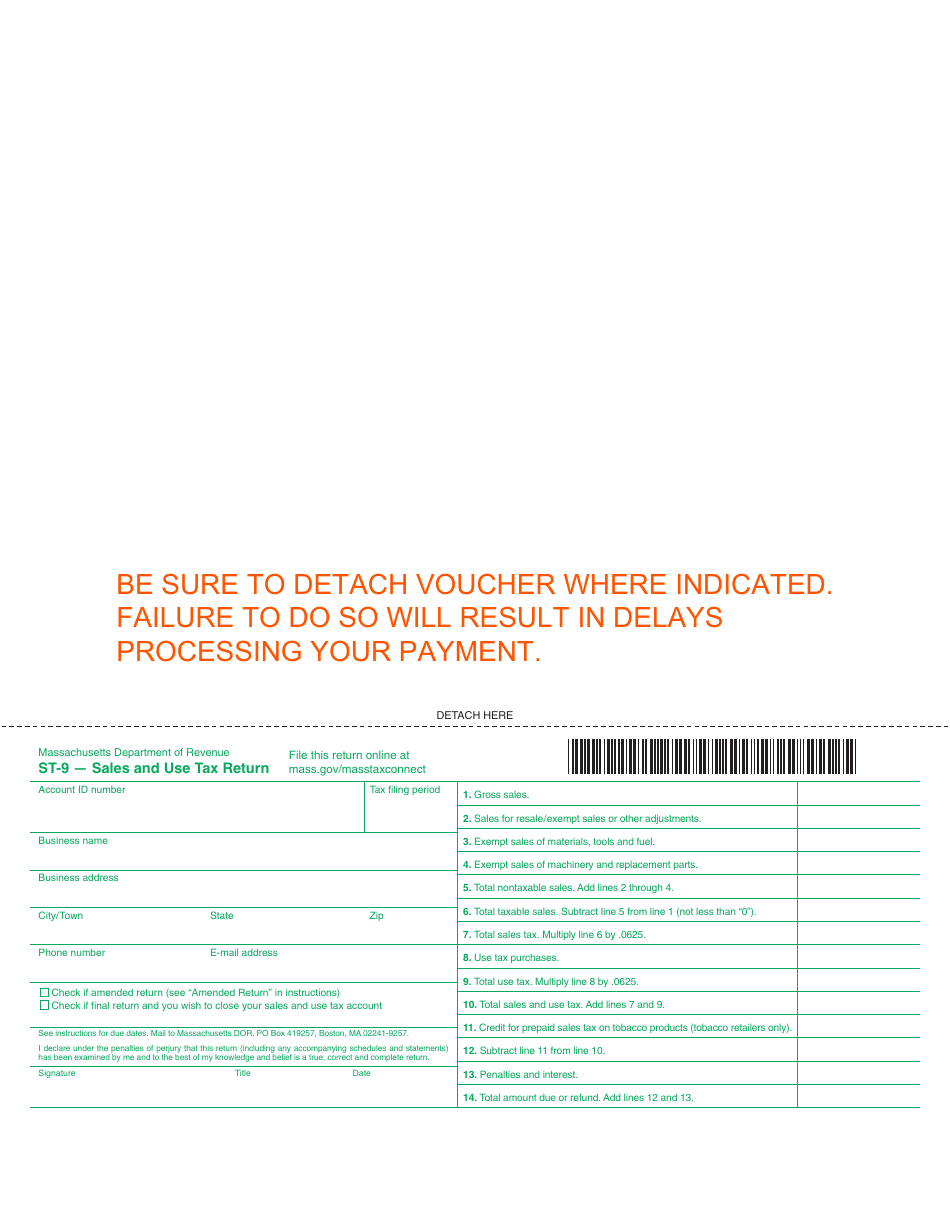

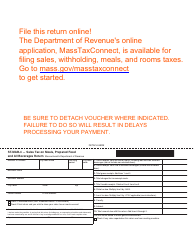

Form ST-9 Sales and Use Tax Return - Massachusetts

What Is Form ST-9?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-9?

A: Form ST-9 is the Sales and Use Tax Return for Massachusetts.

Q: Who needs to file Form ST-9?

A: Businesses registered for sales and use tax in Massachusetts need to file Form ST-9.

Q: What is the purpose of Form ST-9?

A: Form ST-9 is used to report the sales and use tax collected by a business in Massachusetts.

Q: How often should Form ST-9 be filed?

A: Form ST-9 should be filed on a regular basis, generally monthly or quarterly, depending on your tax liability.

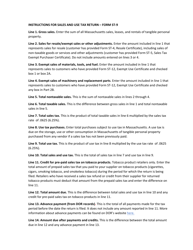

Q: What information is required on Form ST-9?

A: Form ST-9 requires information about your business, sales and use tax collected, and any applicable exemptions.

Q: Are there any penalties for not filing Form ST-9?

A: Yes, there are penalties for failure to file or pay the sales and use tax on time in Massachusetts.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-9 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.