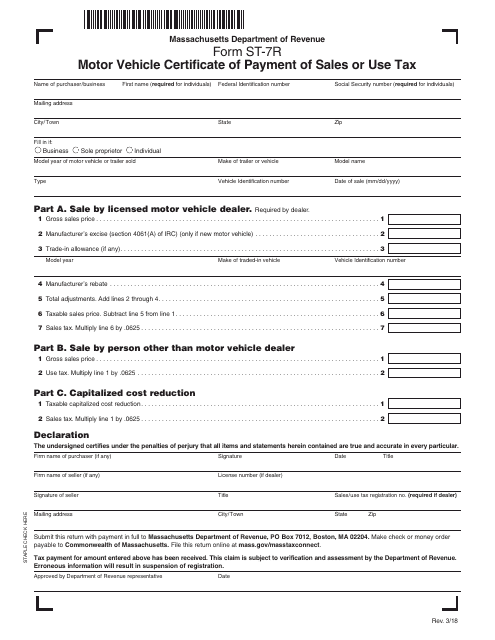

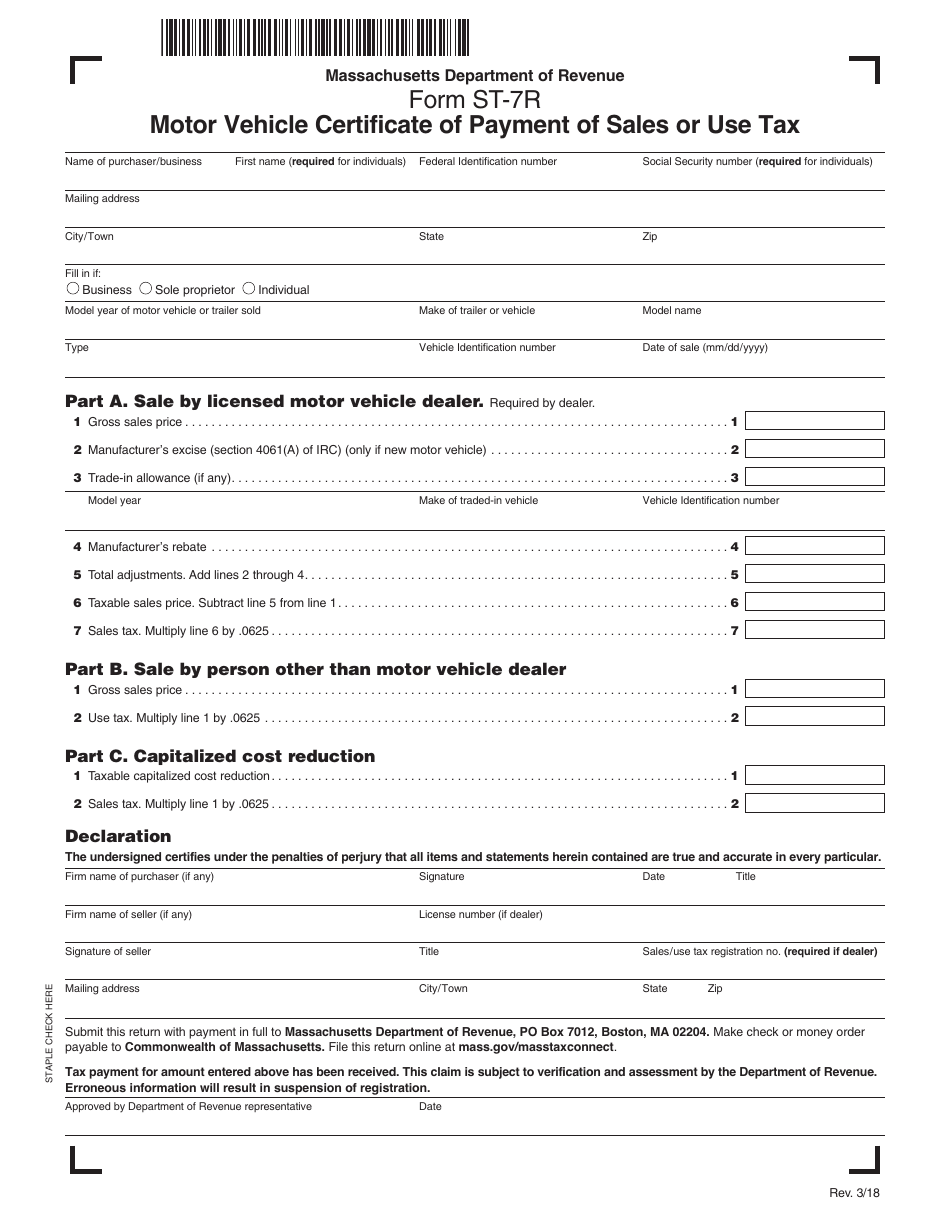

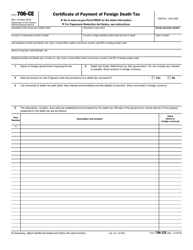

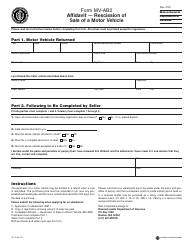

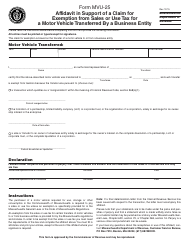

Form ST-7R Motor Vehicle Certificate of Payment of Sales or Use Tax - Massachusetts

What Is Form ST-7R?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

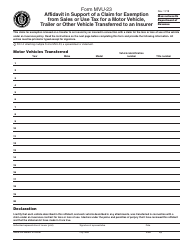

Q: What is Form ST-7R?

A: Form ST-7R is the Motor Vehicle Certificate of Payment of Sales or Use Tax for the state of Massachusetts.

Q: Why is Form ST-7R used?

A: Form ST-7R is used to report and pay sales or use tax on motor vehicle purchases in Massachusetts.

Q: Who needs to file Form ST-7R?

A: Anyone who purchases a motor vehicle in Massachusetts and wants to register it must file Form ST-7R.

Q: When should Form ST-7R be filed?

A: Form ST-7R should be filed within 10 days of purchasing a motor vehicle.

Q: Is there a fee to file Form ST-7R?

A: No, there is no fee to file Form ST-7R.

Q: Are there any penalties for not filing Form ST-7R?

A: Yes, failure to file Form ST-7R or underpaying the required sales or use tax may result in penalties and interest.

Q: Do I need to attach any documents to Form ST-7R?

A: Yes, you need to attach a copy of the bill of sale or lease agreement for the motor vehicle.

Q: What is the sales or use tax rate for motor vehicles in Massachusetts?

A: The sales or use tax rate for motor vehicles in Massachusetts is 6.25%.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-7R by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.