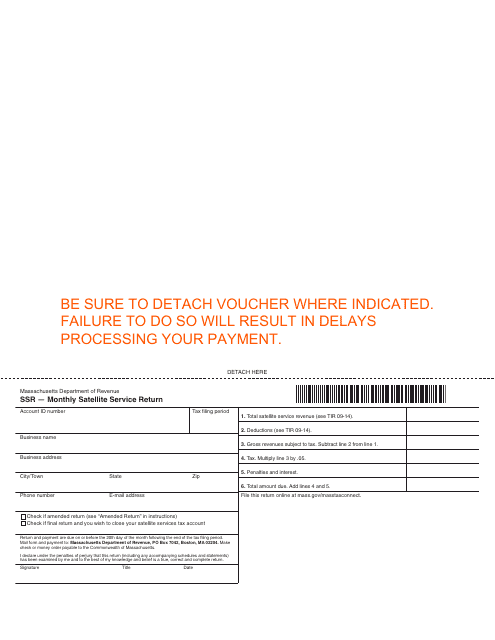

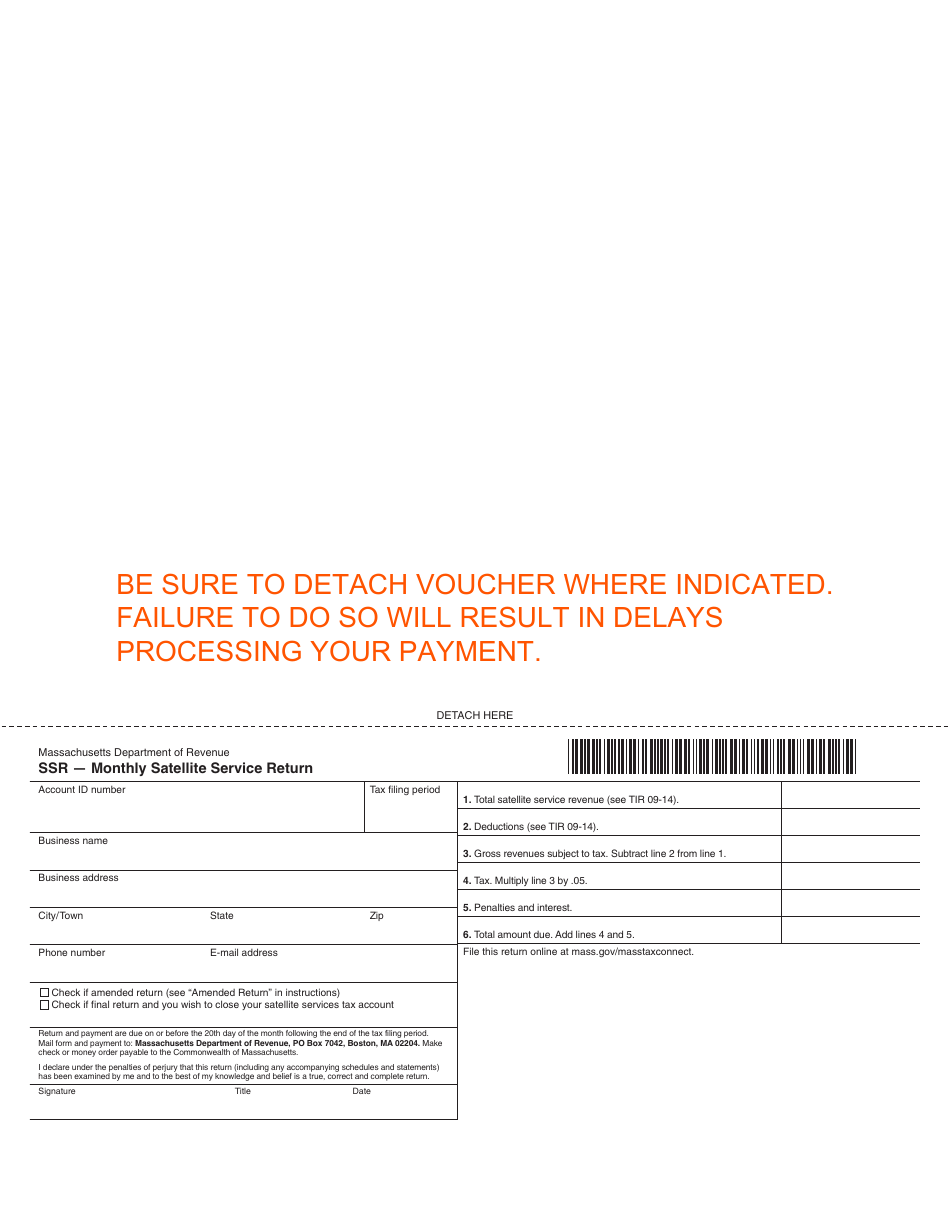

Form SSR Monthly Satellite Service Return - Massachusetts

What Is Form SSR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SSR Monthly Satellite Service Return?

A: The SSR Monthly Satellite Service Return is a form used in Massachusetts to report satellite service gross revenues.

Q: Who needs to file the SSR Monthly Satellite Service Return?

A: Satellite service providers operating in Massachusetts need to file the SSR Monthly Satellite Service Return.

Q: When is the due date for filing the SSR Monthly Satellite Service Return?

A: The SSR Monthly Satellite Service Return is due on or before the 20th of each month.

Q: What are the consequences of not filing the SSR Monthly Satellite Service Return?

A: Failure to file the SSR Monthly Satellite Service Return may result in penalties and interest.

Q: Are there any exemptions or deductions available for satellite service providers?

A: Yes, there are exemptions and deductions available for satellite service providers. You can refer to the instructions on the SSR Monthly Satellite Service Return form for more information.

Q: What should I do if I have questions or need assistance with the SSR Monthly Satellite Service Return?

A: If you have questions or need assistance with the SSR Monthly Satellite Service Return, you can contact the Massachusetts Department of Revenue for guidance.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SSR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.