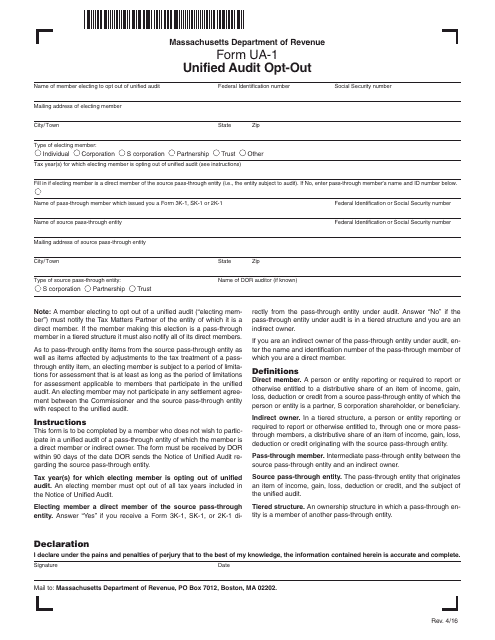

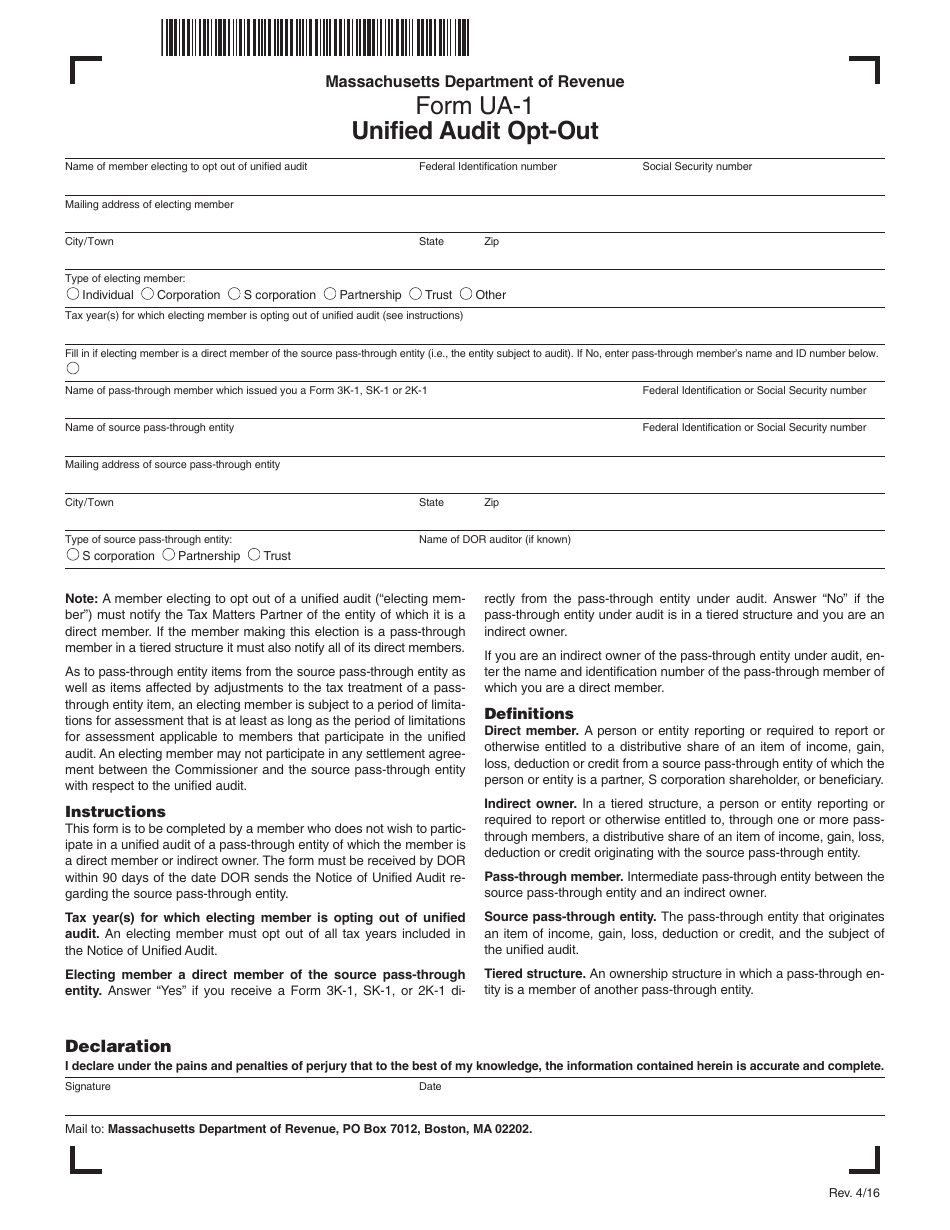

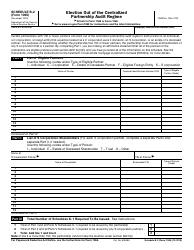

Form UA-1 Unified Audit Opt-Out - Massachusetts

What Is Form UA-1?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UA-1?

A: Form UA-1 is the Unified Audit Opt-Out form.

Q: What is the purpose of Form UA-1?

A: The purpose of Form UA-1 is to opt out of the unified audit program in Massachusetts.

Q: Who is required to file Form UA-1?

A: Any business entity that wants to opt out of the unified audit program in Massachusetts is required to file Form UA-1.

Q: When is Form UA-1 due?

A: Form UA-1 is due on or before the original due date of the tax return for the taxable year.

Q: Are there any penalties for not filing Form UA-1?

A: Yes, failure to file Form UA-1 may result in the business entity being subject to a unified audit by the Massachusetts Department of Revenue.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UA-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.