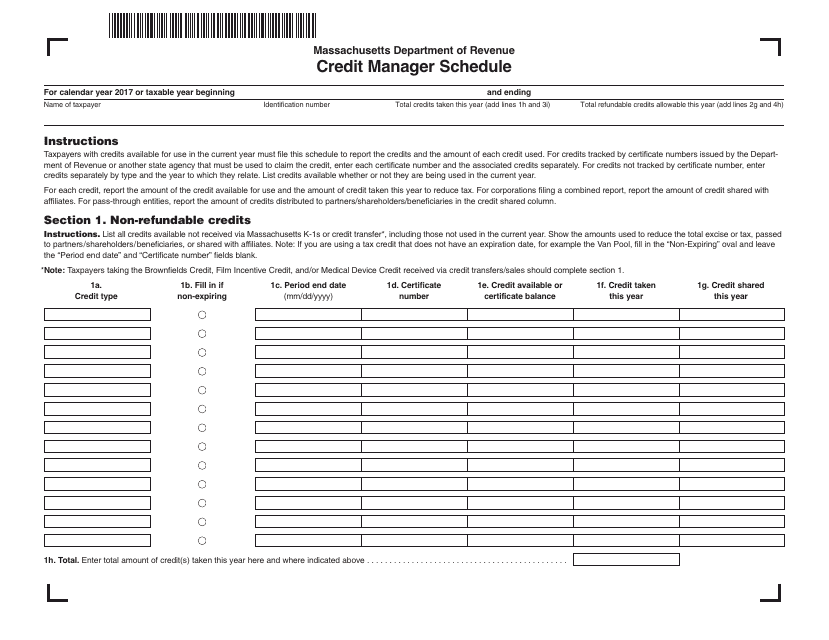

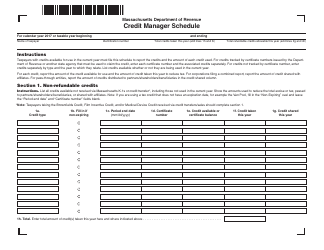

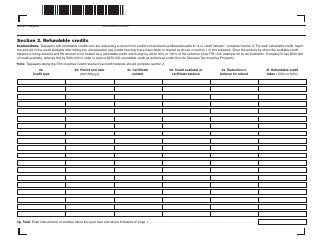

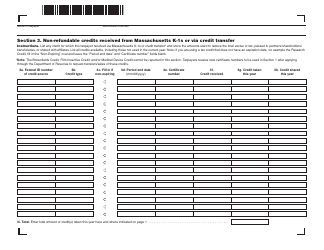

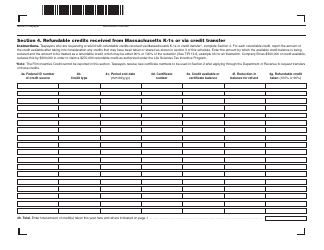

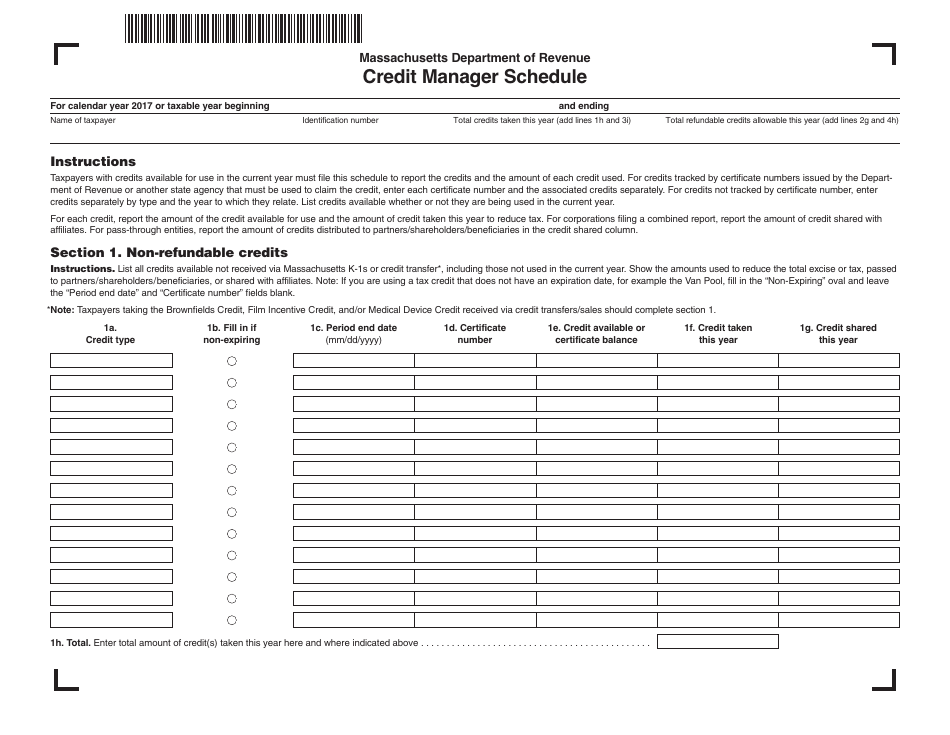

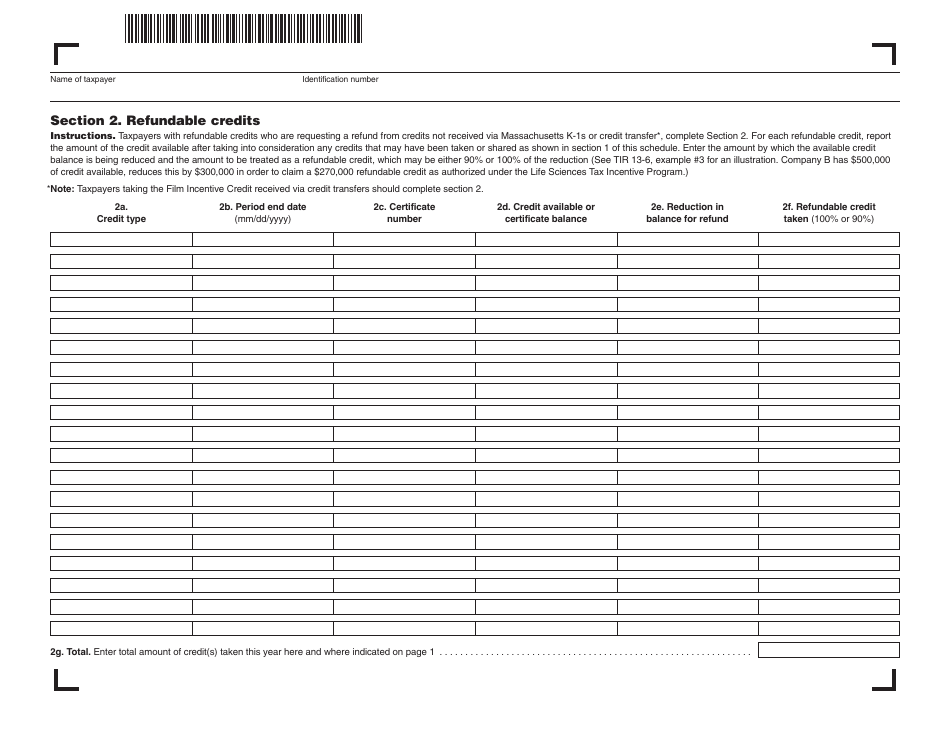

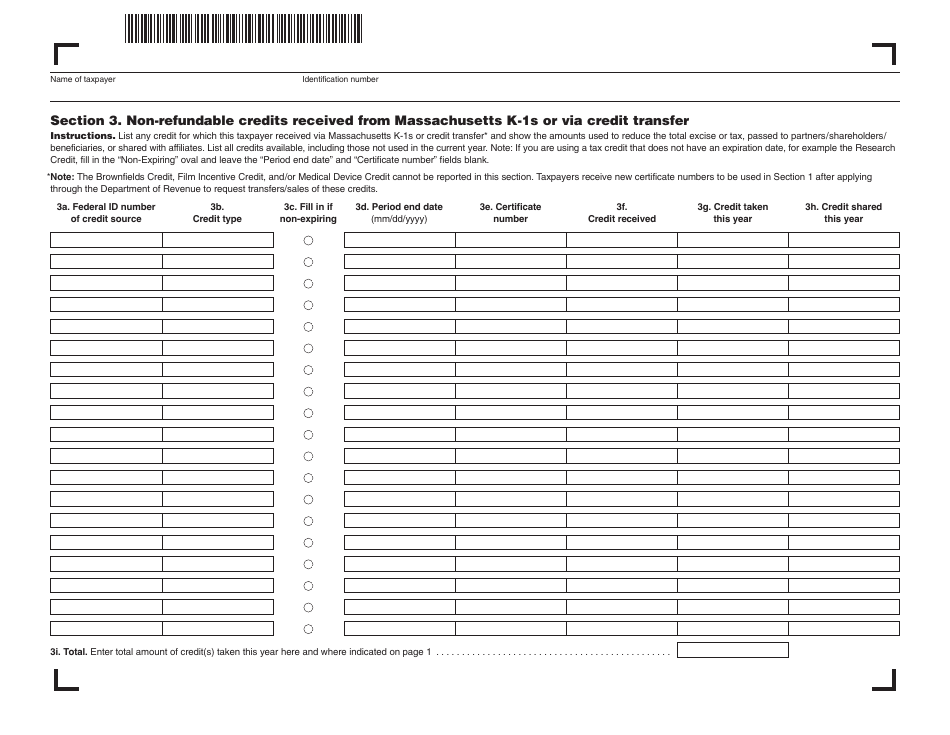

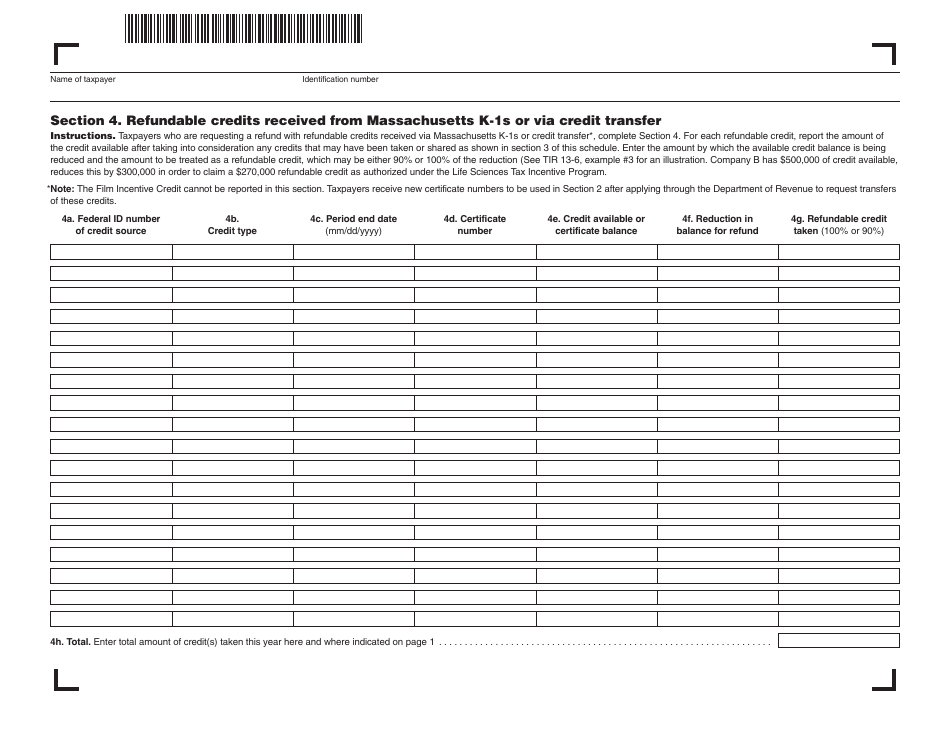

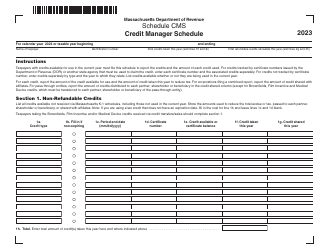

Credit Manager Schedule - Massachusetts

Credit Manager Schedule is a legal document that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts.

FAQ

Q: What is the role of a Credit Manager?

A: A Credit Manager is responsible for overseeing the credit operations of a company.

Q: What are the key responsibilities of a Credit Manager?

A: Key responsibilities of a Credit Manager include evaluating creditworthiness, setting credit limits, ensuring timely payments, managing collections, and minimizing credit risks.

Q: What skills are required to be a Credit Manager?

A: Skills required to be a Credit Manager include strong analytical and decision-making skills, attention to detail, excellent communication and negotiation skills, and knowledge of financial and credit analysis.

Q: How can I become a Credit Manager in Massachusetts?

A: To become a Credit Manager in Massachusetts, you typically need a bachelor's degree in finance, accounting, or a related field, as well as several years of experience in credit management or a related role.

Q: What is the average salary of a Credit Manager in Massachusetts?

A: The average salary of a Credit Manager in Massachusetts varies depending on experience and company size, but it is typically around $80,000 to $100,000 per year.

Form Details:

- Released on January 1, 2017;

- The latest edition currently provided by the Massachusetts Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.