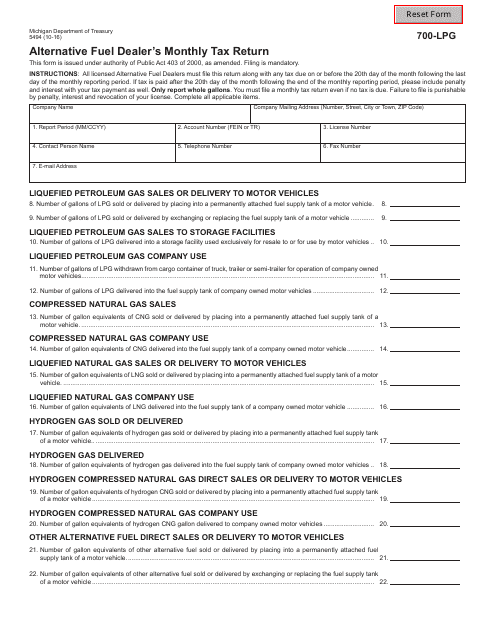

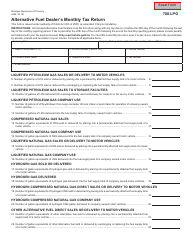

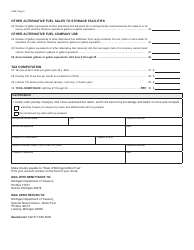

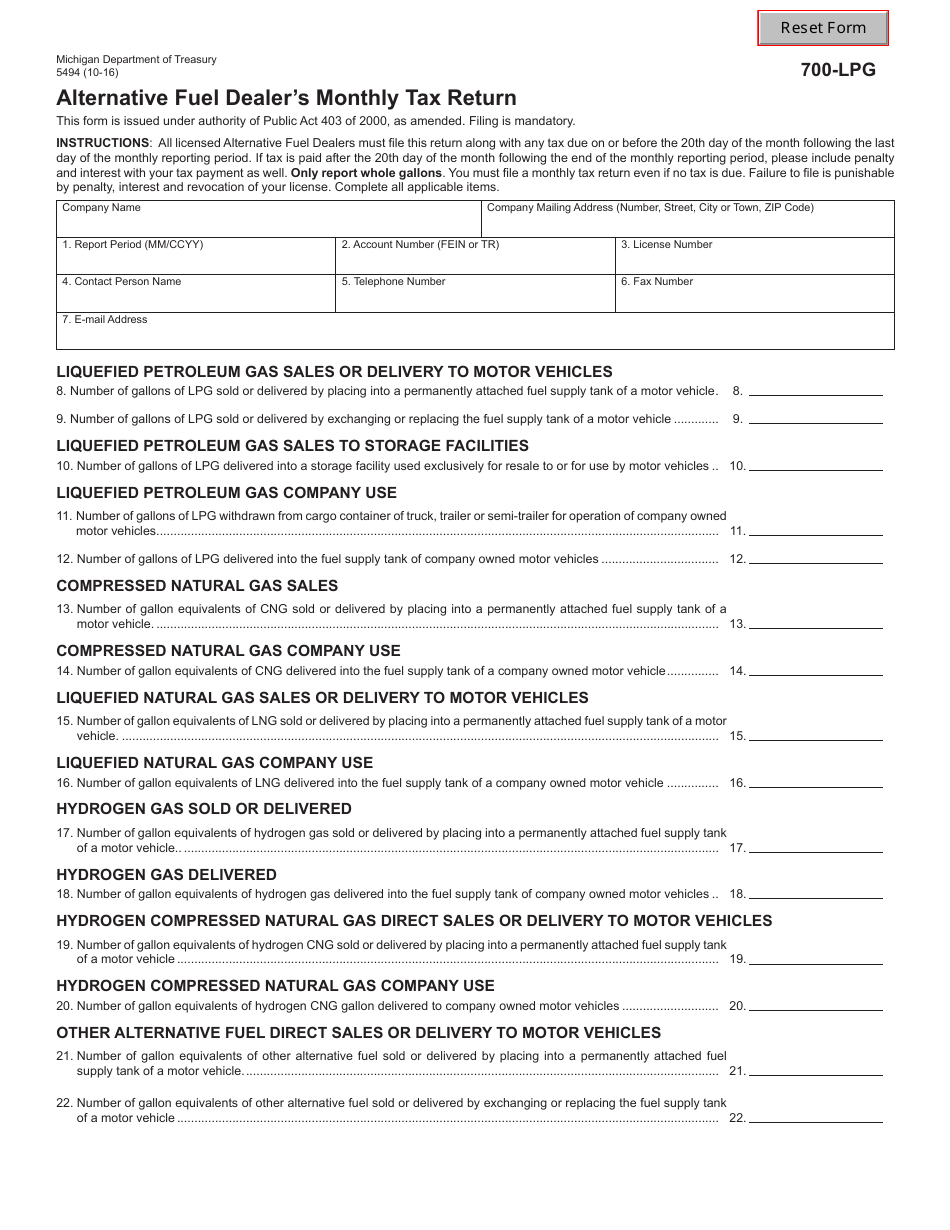

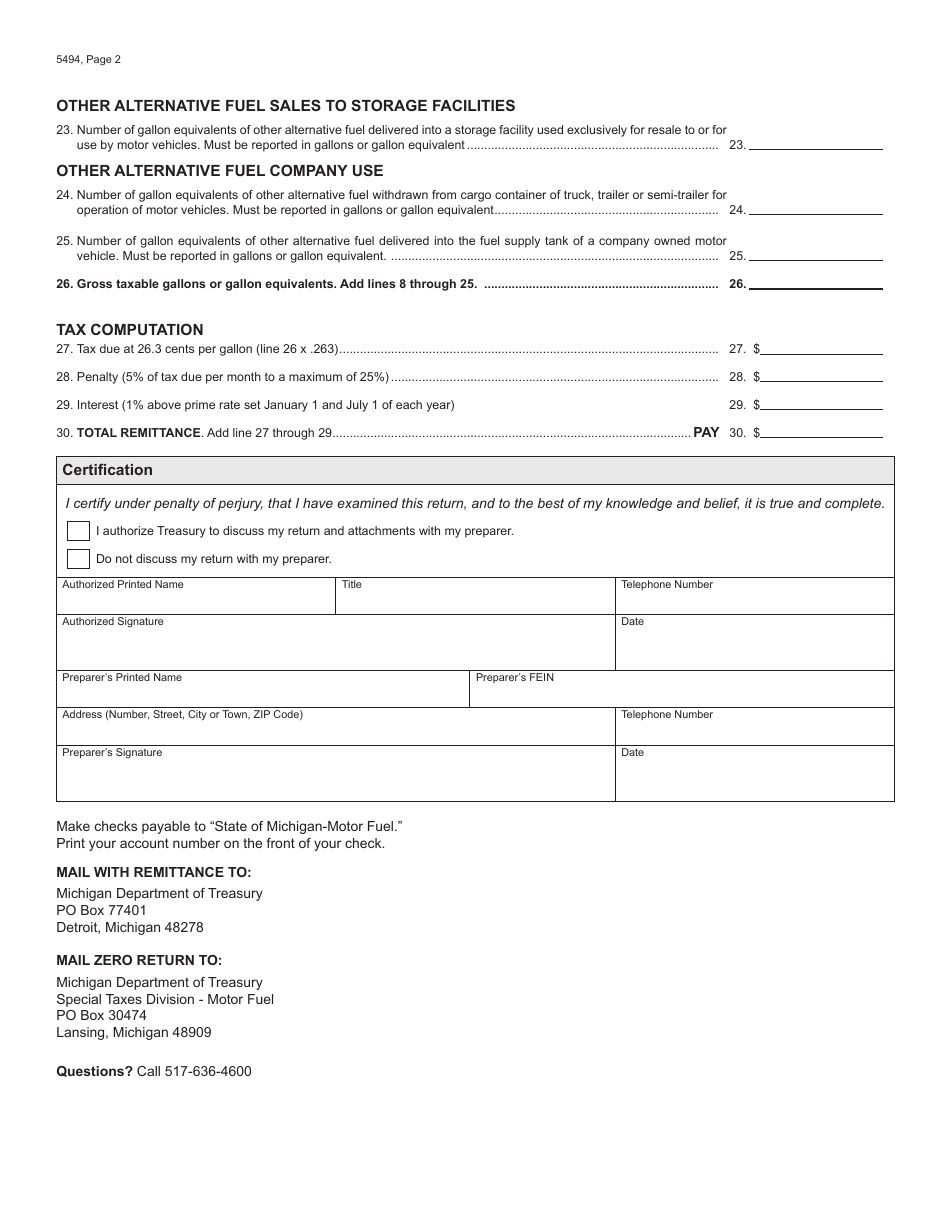

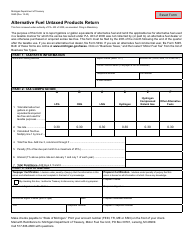

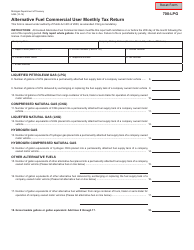

Form 5494 (700-LPG) Alternative Fuel Dealer's Monthly Tax Return - Michigan

What Is Form 5494 (700-LPG)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5494?

A: Form 5494 is the Alternative Fuel Dealer's Monthly Tax Return specifically for Michigan.

Q: Who needs to file Form 5494?

A: Alternative fuel dealers in Michigan need to file Form 5494.

Q: What is the purpose of Form 5494?

A: Form 5494 is used to report and pay taxes on alternative fuel sales in Michigan.

Q: What information is required on Form 5494?

A: Form 5494 requires information about the quantity and types of alternative fuel sold, as well as the tax owed.

Q: When is Form 5494 due?

A: Form 5494 is due on the last day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there can be penalties for late or incorrect filing, including interest and late payment penalties.

Q: Can I e-file Form 5494?

A: Yes, you can e-file Form 5494 through the Michigan Department of Treasury's e-file system.

Q: Is there any other documentation required with Form 5494?

A: No, there is no additional documentation required with Form 5494.

Q: Who can I contact for more information?

A: For more information, you can contact the Michigan Department of Treasury directly.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5494 (700-LPG) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.