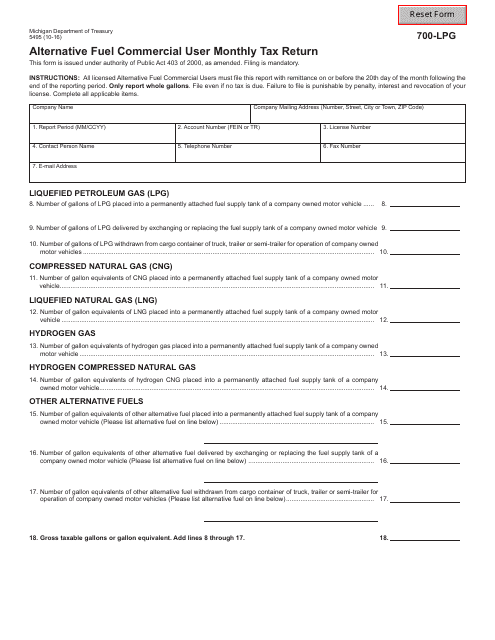

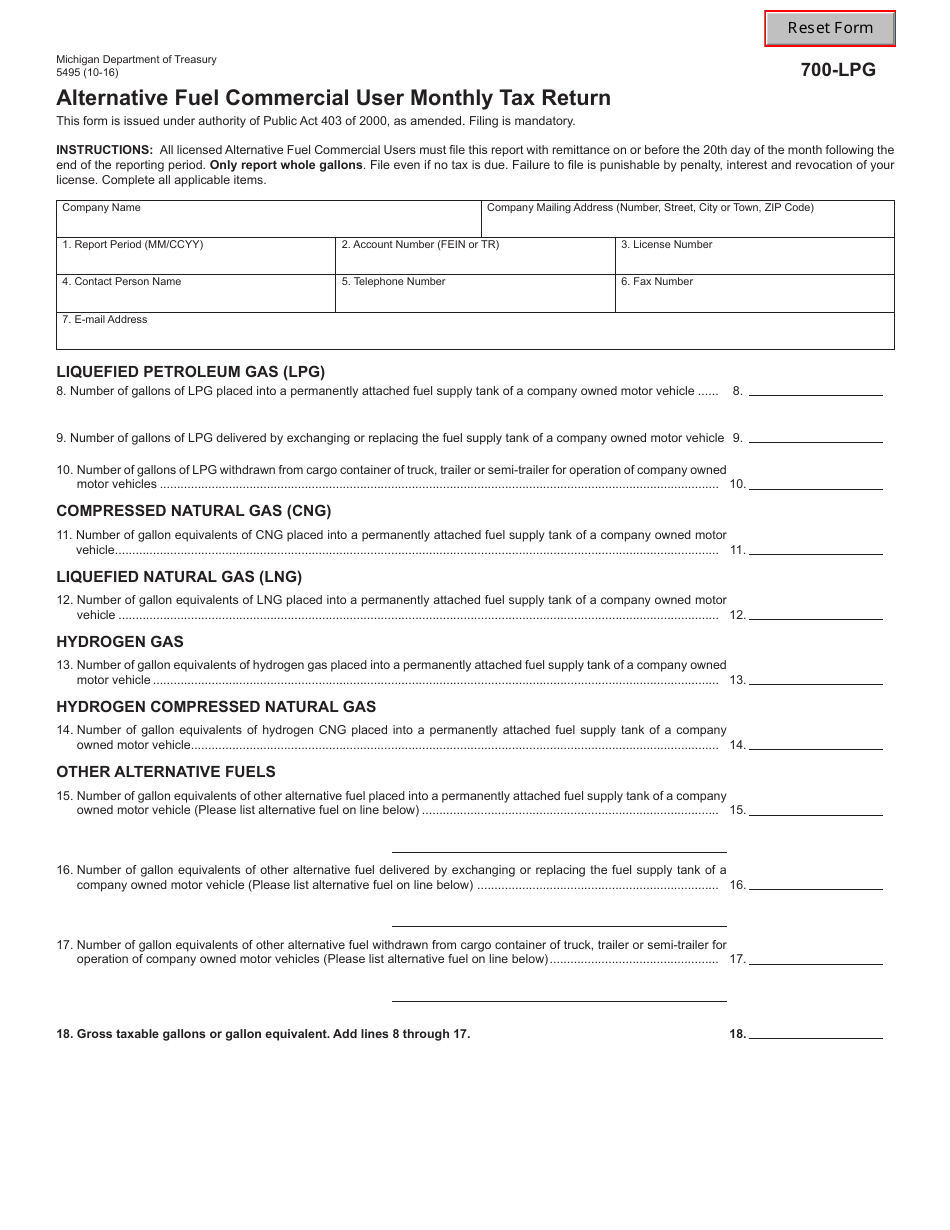

Form 5495 (700-LPG) Alternative Fuel Commercial User Monthly Tax Return - Michigan

What Is Form 5495 (700-LPG)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5495?

A: Form 5495 is a monthly tax return used by alternative fuel commercial users in Michigan.

Q: Who needs to file Form 5495?

A: Commercial users of alternative fuel in Michigan need to file Form 5495.

Q: What is the purpose of Form 5495?

A: The purpose of Form 5495 is to report and pay monthly taxes on the use of alternative fuel.

Q: Is Form 5495 specific to Michigan?

A: Yes, Form 5495 is specific to alternative fuel commercial users in Michigan.

Q: When is Form 5495 due?

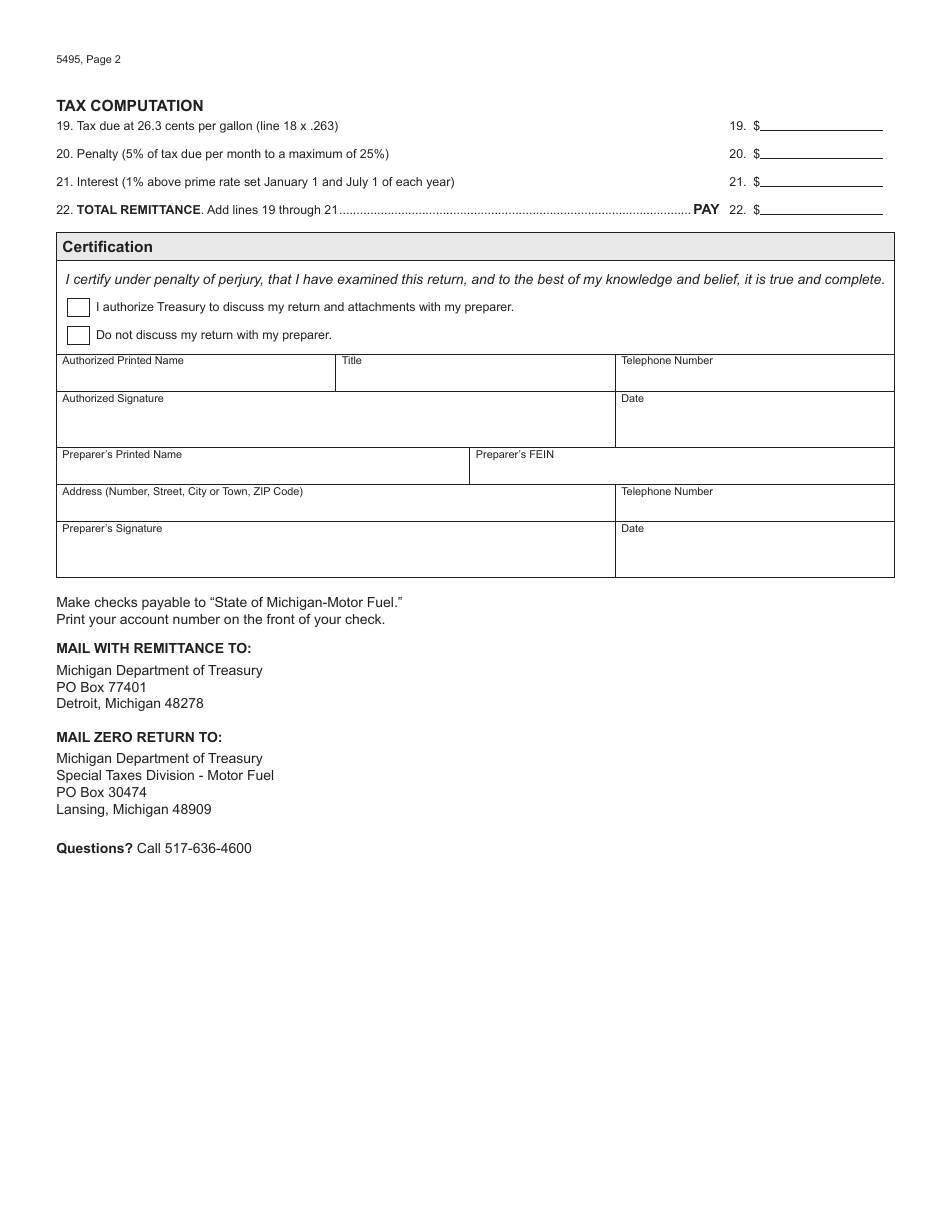

A: Form 5495 is due by the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form 5495?

A: Yes, there may be penalties for late filing of Form 5495, including interest charges.

Q: Is there any other documentation required to accompany Form 5495?

A: Yes, supporting documentation such as purchase or sales invoices may be required to accompany Form 5495.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5495 (700-LPG) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.