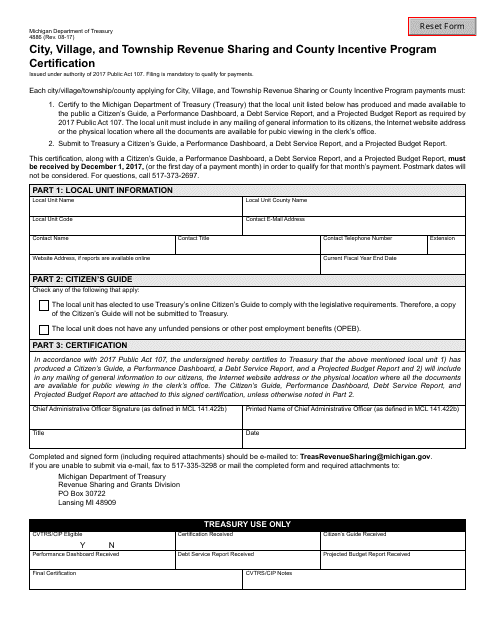

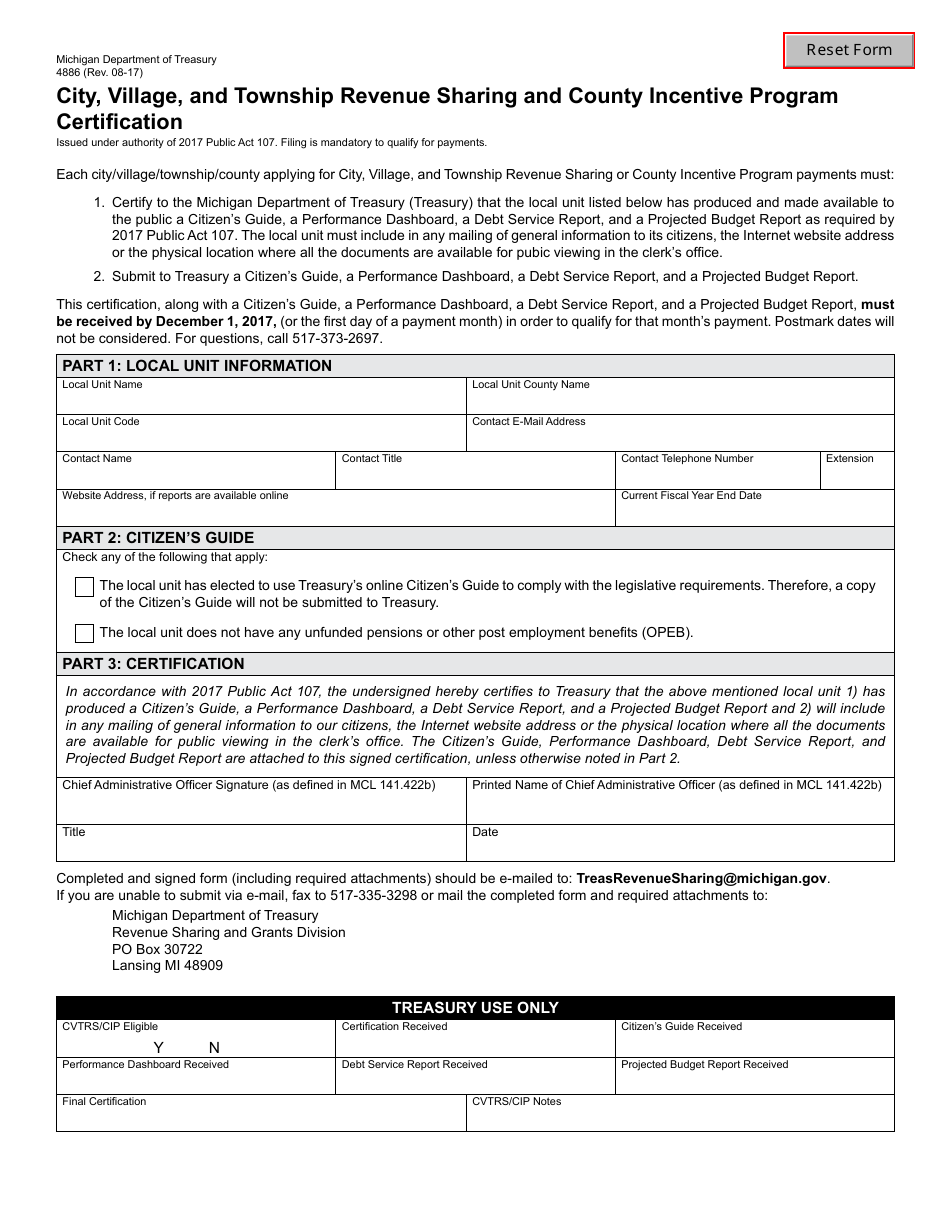

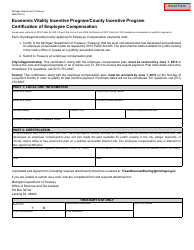

Form 4886 City, Village, and Township Revenue Sharing and County Incentive Program Certification - Michigan

What Is Form 4886?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4886?

A: Form 4886 is the City, Village, and Township Revenue Sharing and County Incentive Program Certification form in Michigan.

Q: What is the purpose of Form 4886?

A: The purpose of Form 4886 is to certify a city, village, township, or county's eligibility for revenue sharing and incentive programs in Michigan.

Q: Who needs to fill out Form 4886?

A: Cities, villages, townships, and counties in Michigan that want to qualify for revenue sharing and incentive programs need to fill out Form 4886.

Q: What information is required on Form 4886?

A: Form 4886 requires information about the local unit's property, finance, census, and other relevant data that determine eligibility for revenue sharing and incentive programs.

Q: Is there a deadline for submitting Form 4886?

A: Yes, the deadline for submitting Form 4886 is determined by the Michigan Department of Treasury and may vary each year.

Q: What happens after submitting Form 4886?

A: After submitting Form 4886, the state will review the information provided and determine the city, village, township, or county's eligibility for revenue sharing and incentive programs.

Q: Are there any penalties for not submitting Form 4886?

A: Failure to submit Form 4886 may result in the local unit's ineligibility for revenue sharing and incentive programs.

Q: Is there a fee for submitting Form 4886?

A: No, there is no fee for submitting Form 4886.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4886 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.