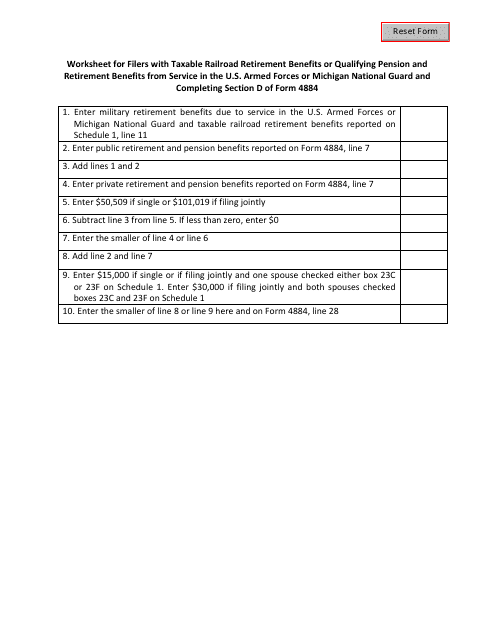

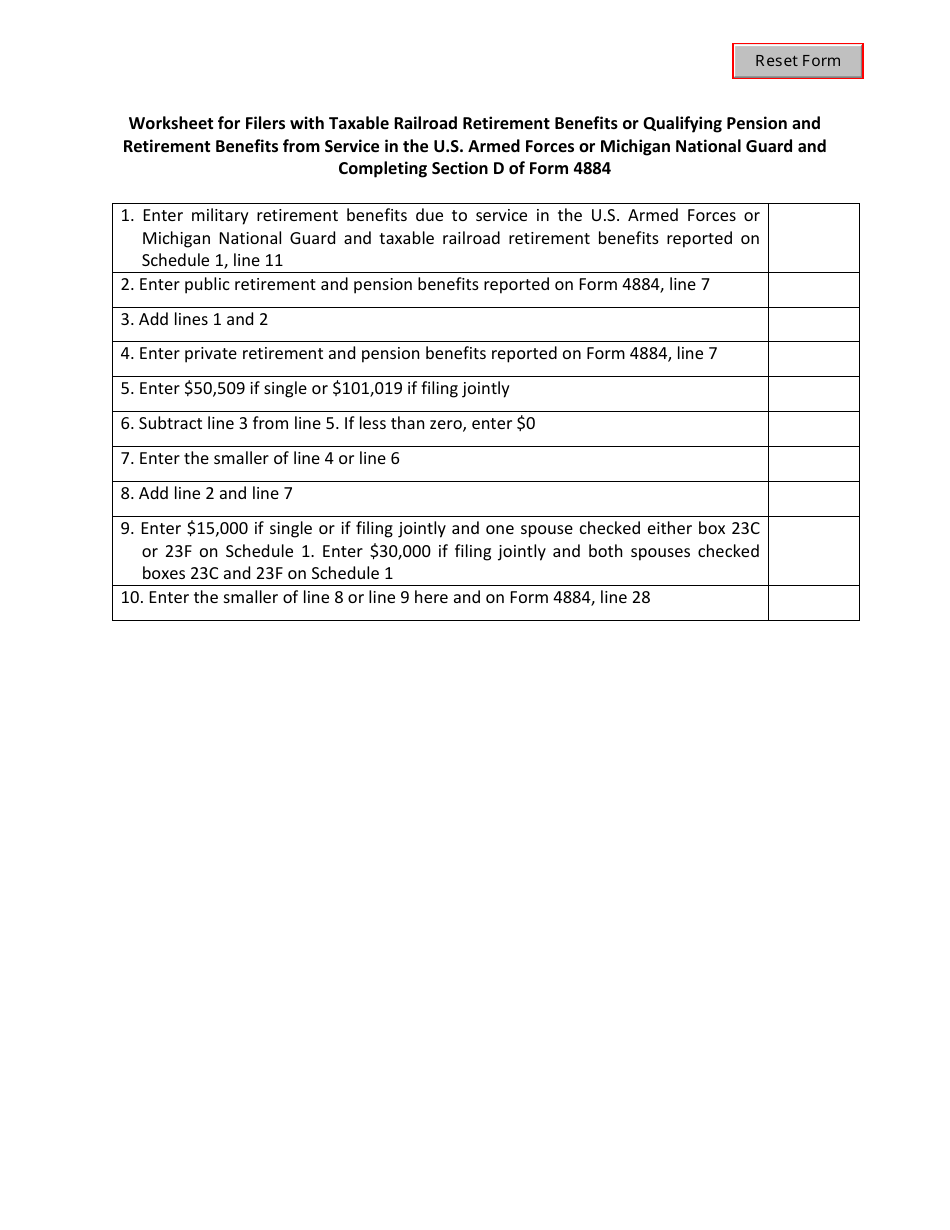

Worksheet for Filers With Taxable Railroad Retirement Benefits or Qualifying Pension and Retirement Benefits From Service in the U.S. Armed Forces or Michigan National Guard and Completing Section D of Form 4884 - Michigan

Worksheet for Filers With Taxable National Guard and Completing Section D of Form 4884 is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What is Form 4884?

A: Form 4884 is a form used by Michigan residents to account for taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard.

Q: Who needs to use Form 4884?

A: Michigan residents who receive taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard need to use Form 4884.

Q: What is Section D of Form 4884?

A: Section D of Form 4884 is a section where Michigan residents need to provide details about their taxable railway retirement benefits or qualifying pension and retirement benefits.

Q: What information is required in Section D of Form 4884?

A: In Section D of Form 4884, Michigan residents need to provide details such as the type of income, amount received, and the federal taxable amount.

Q: What is the purpose of completing Section D of Form 4884?

A: Completing Section D of Form 4884 helps Michigan residents determine the amount of taxable railway retirement benefits or qualifying pension and retirement benefits for their state tax return.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.