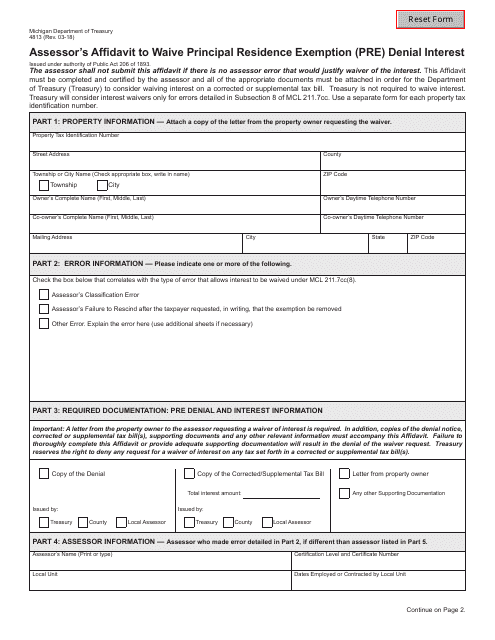

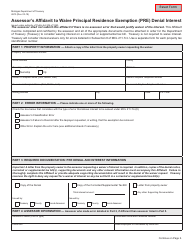

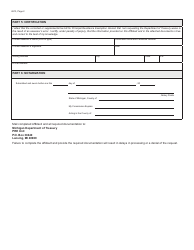

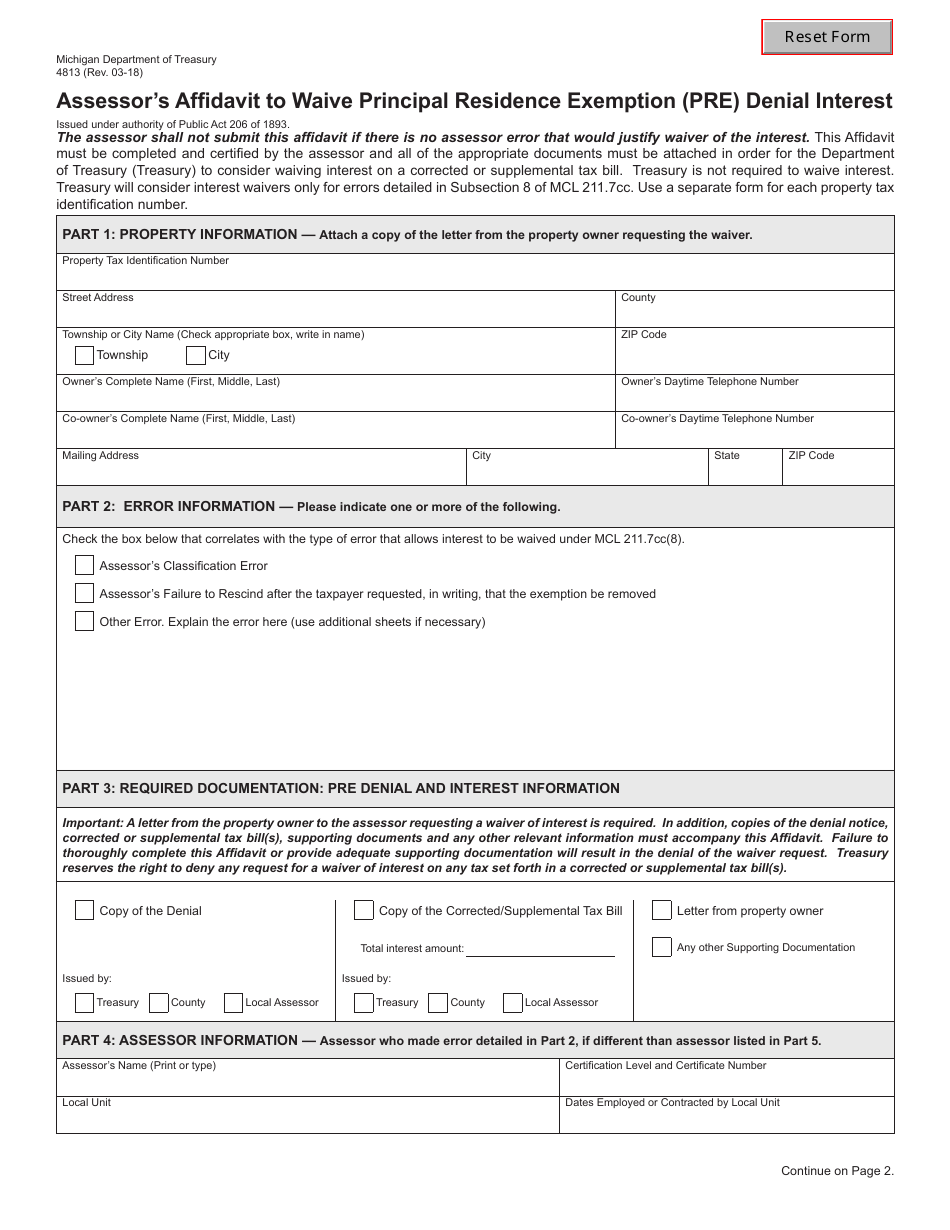

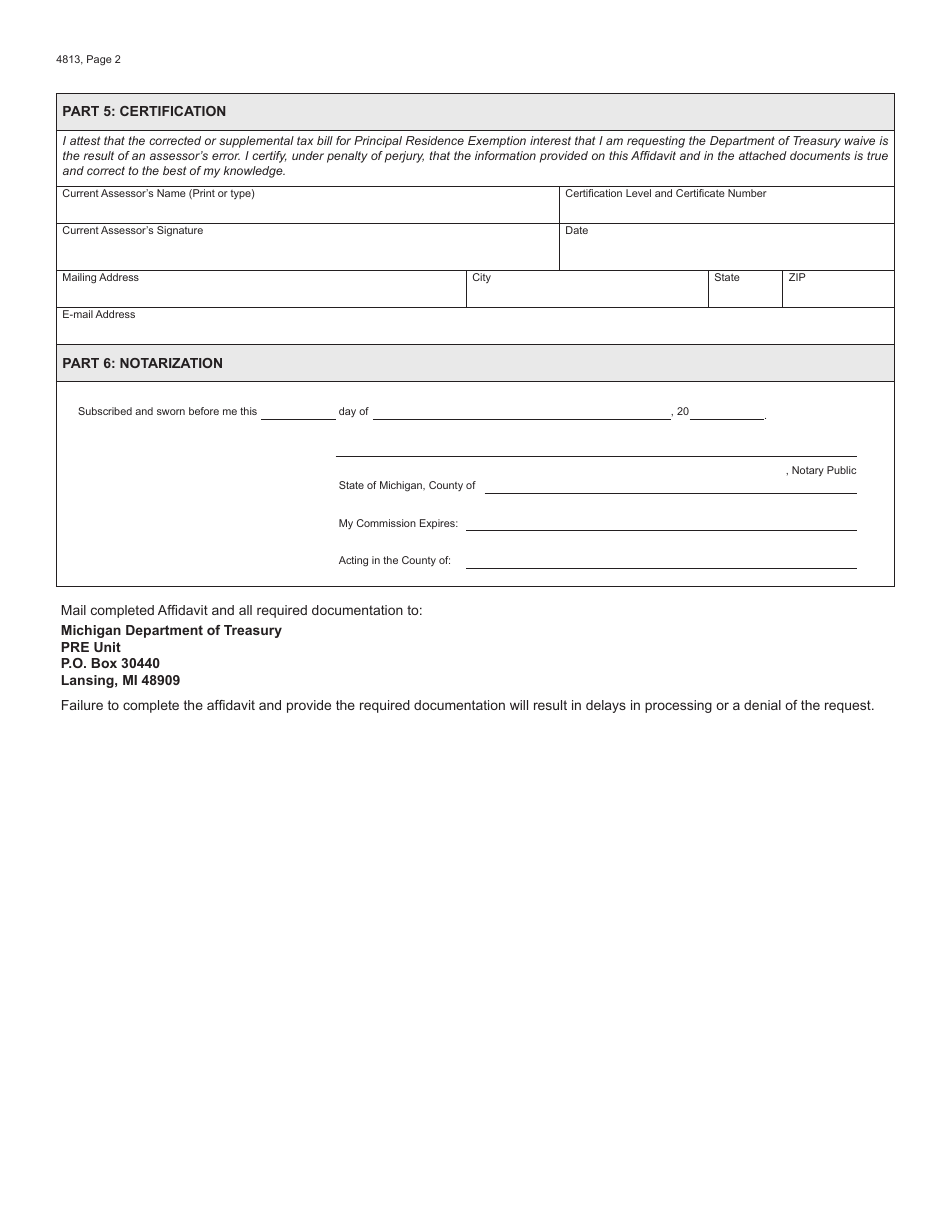

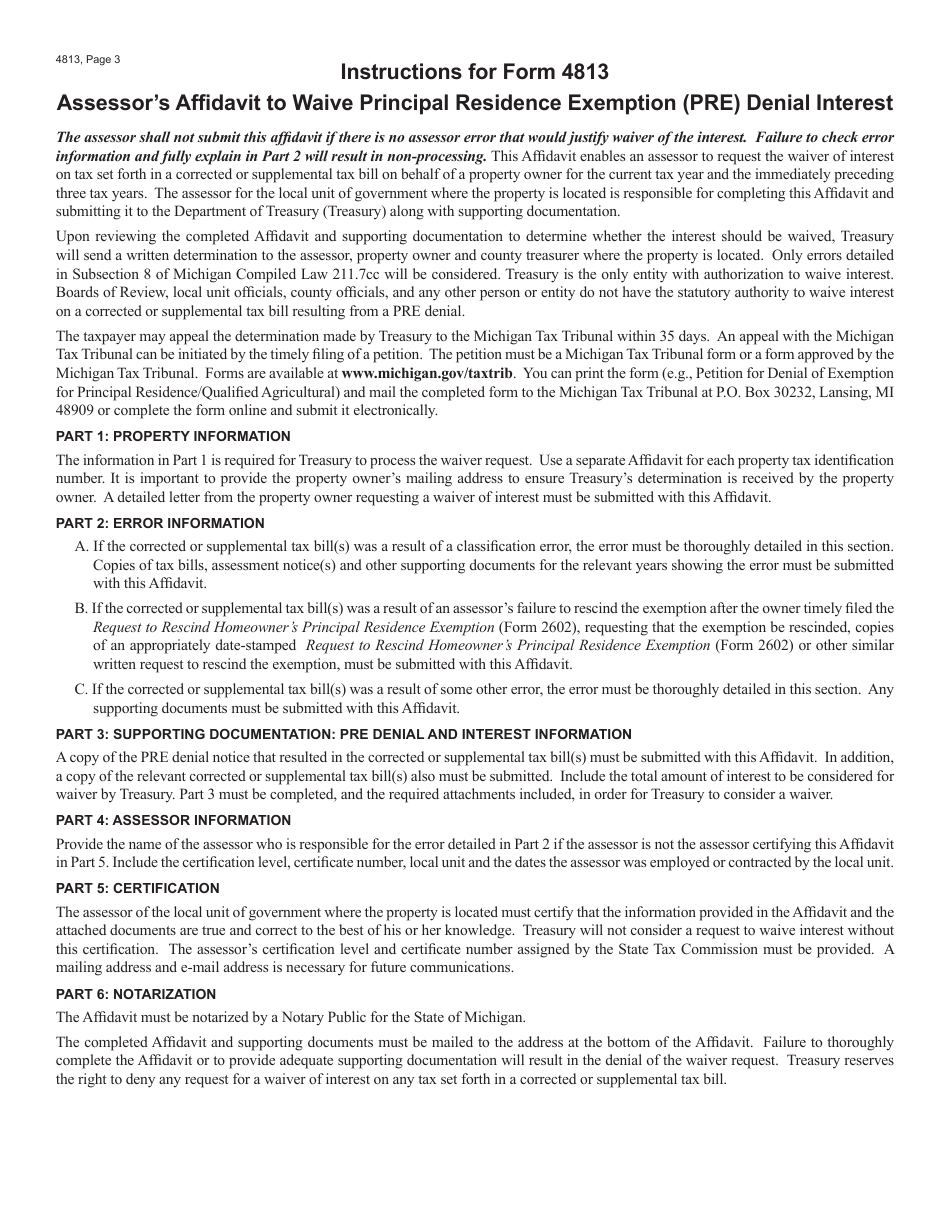

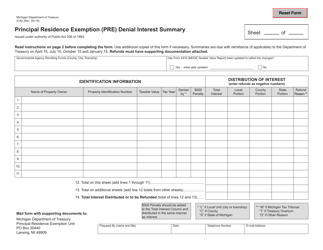

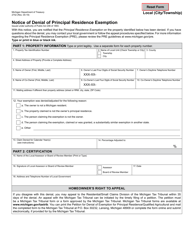

Form 4813 Assessor's Affidavit to Waive Principal Residence Exemption (Pre) Denial Interest - Michigan

What Is Form 4813?

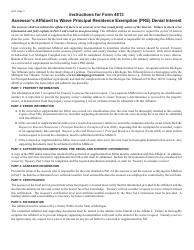

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4813?

A: Form 4813 is the Assessor's Affidavit to Waive Principal Residence Exemption (PRE) Denial Interest in Michigan.

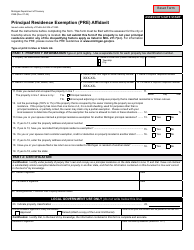

Q: What is the Principal Residence Exemption (PRE) in Michigan?

A: The Principal Residence Exemption (PRE) is a tax benefit that allows Michigan homeowners to have their property taxes reduced by exempting a portion of their property's assessed value.

Q: What is the purpose of Form 4813?

A: Form 4813 is used to request a waiver of the interest associated with the denial of a Principal Residence Exemption (PRE) in Michigan.

Q: When is Form 4813 required?

A: Form 4813 is required when the Principal Residence Exemption (PRE) is denied for a property and the owner wishes to request a waiver of the interest charged on the unpaid taxes.

Q: Who can use Form 4813?

A: Form 4813 can be used by property owners in Michigan who have had their Principal Residence Exemption (PRE) denied.

Q: What information is required on Form 4813?

A: Form 4813 requires information such as the property owner's name, address, property identification number, the reason for the denial of the Principal Residence Exemption (PRE), and the request for a waiver of interest.

Q: Are there any fees associated with submitting Form 4813?

A: No, there are no fees associated with submitting Form 4813.

Q: Is there a deadline to submit Form 4813?

A: Yes, Form 4813 must be submitted within 35 days after the mailing of the notice of denial of the Principal Residence Exemption (PRE).

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4813 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.