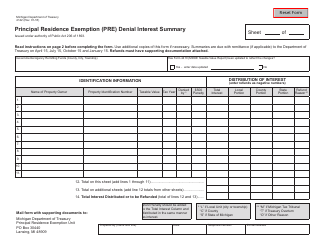

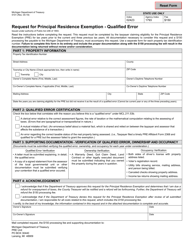

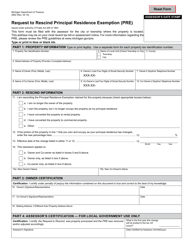

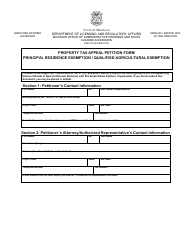

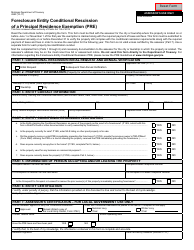

Instructions for Form 4142 Principal Residence Exemption (Pre) Denial Interest Summary - Michigan

This document contains official instructions for Form 4142 , Principal Residence Exemption (Pre) Denial Interest Summary - a form released and collected by the Michigan Department of Treasury. An up-to-date fillable Form 4142 is available for download through this link.

FAQ

Q: What is Form 4142?

A: Form 4142 is a Principal Residence Exemption (PRE) Denial Interest Summary specific to Michigan.

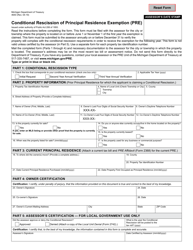

Q: What is the purpose of Form 4142?

A: The purpose of Form 4142 is to summarize the interest that may be due if a Principal Residence Exemption (PRE) is denied.

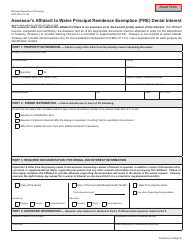

Q: Who needs to complete Form 4142?

A: Form 4142 needs to be completed by individuals who have a Principal Residence Exemption (PRE) denial in Michigan and may be liable for interest.

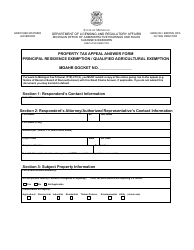

Q: What is a Principal Residence Exemption (PRE) denial?

A: A Principal Residence Exemption (PRE) denial occurs when a property owner is not eligible for the exemption and needs to pay back any taxes that were not collected due to the exemption.

Q: What information is required on Form 4142?

A: Form 4142 requires the property owner's name, address, Social Security Number, and the amount of interest due if the Principal Residence Exemption (PRE) is denied.

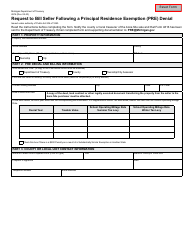

Q: When should Form 4142 be submitted?

A: Form 4142 should be submitted within 60 days of the Principal Residence Exemption (PRE) denial.

Q: What happens after submitting Form 4142?

A: After submitting Form 4142, the Michigan Department of Treasury will review the information and determine the amount of interest due, if any.

Q: Is there a fee to submit Form 4142?

A: No, there is no fee to submit Form 4142.

Q: What if I disagree with the amount of interest determined by the Michigan Department of Treasury?

A: If you disagree with the amount of interest determined by the Michigan Department of Treasury, you may request a redetermination or file an appeal.

Instruction Details:

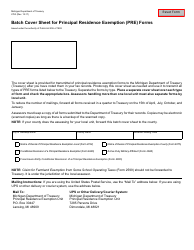

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Michigan Department of Treasury.