This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4075

for the current year.

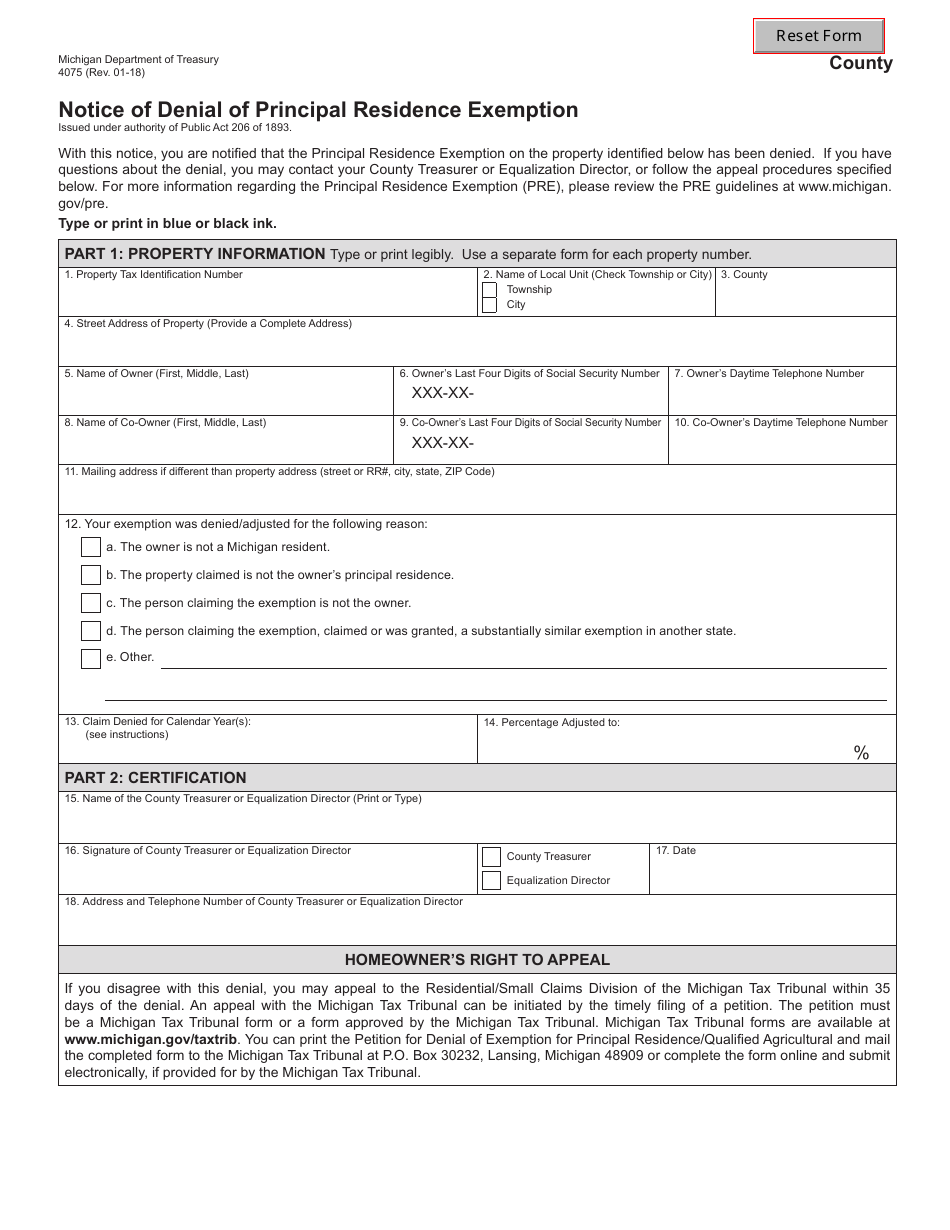

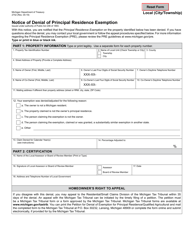

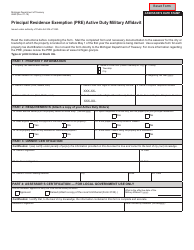

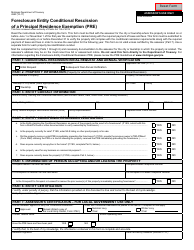

Form 4075 Notice of Denial of Principal Residence Exemption - Michigan

What Is Form 4075?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4075?

A: Form 4075 is a notice of denial of Principal Residence Exemption (PRE) in Michigan.

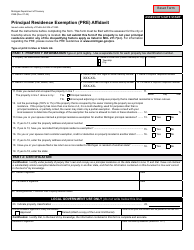

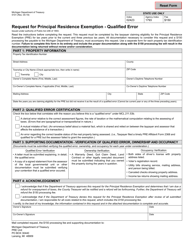

Q: What is a Principal Residence Exemption?

A: Principal Residence Exemption (PRE) is a tax exemption that reduces the property taxes on an individual's primary residence.

Q: Who receives Form 4075?

A: Form 4075 is received by individuals who have been denied the Principal Residence Exemption (PRE) in Michigan.

Q: Why would someone be denied the Principal Residence Exemption?

A: Someone may be denied the Principal Residence Exemption if they fail to meet the eligibility requirements, such as not using the property as their primary residence.

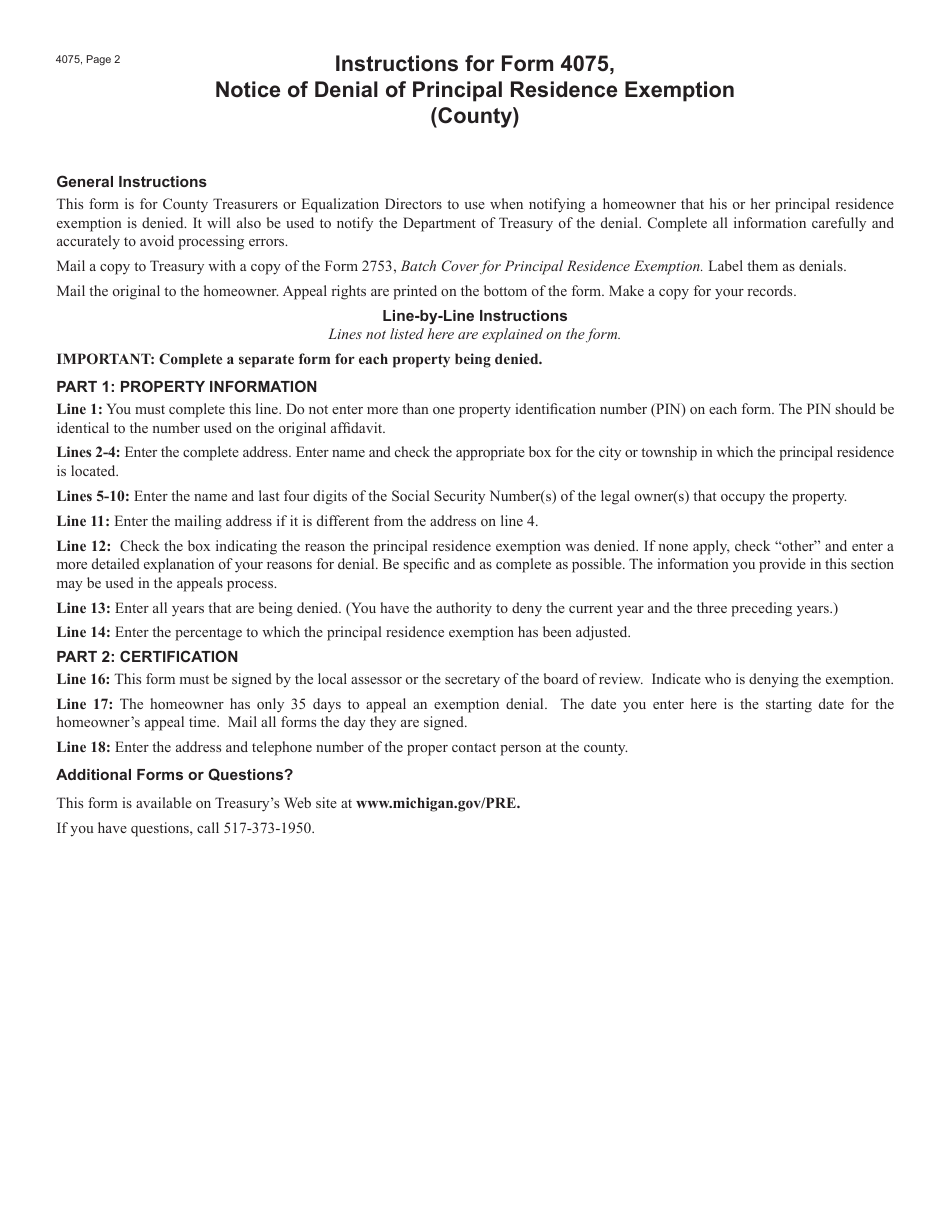

Q: What should I do if I receive Form 4075?

A: If you receive Form 4075, you should review the reasons for the denial and provide any necessary documentation or information to support your claim for the Principal Residence Exemption.

Q: Can I appeal a denial of the Principal Residence Exemption?

A: Yes, you can appeal a denial of the Principal Residence Exemption by following the instructions provided on Form 4075.

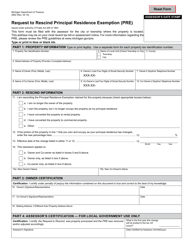

Q: What happens if my appeal is successful?

A: If your appeal is successful, you will be granted the Principal Residence Exemption and your property taxes will be adjusted accordingly.

Q: What if I disagree with the denial of the Principal Residence Exemption?

A: If you disagree with the denial of the Principal Residence Exemption, you should follow the appeal process outlined on Form 4075.

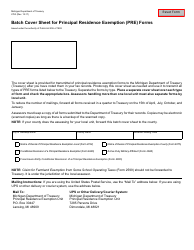

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4075 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.