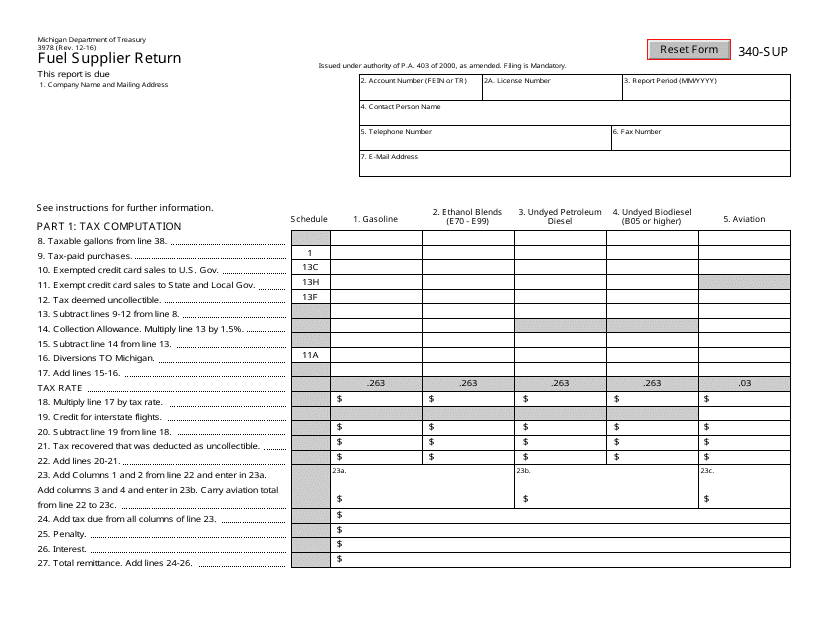

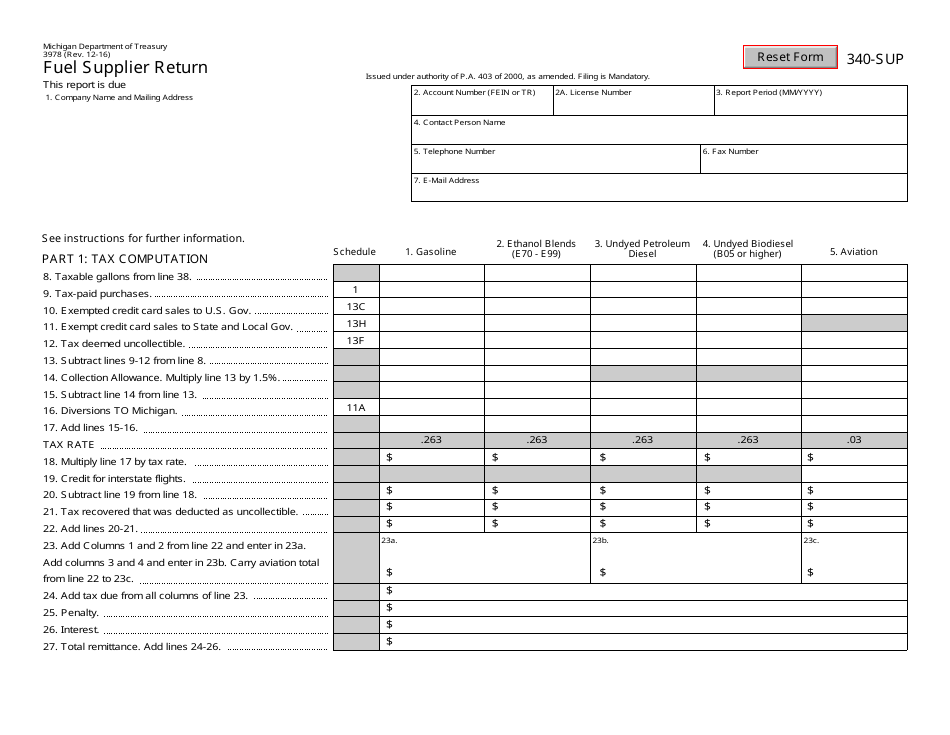

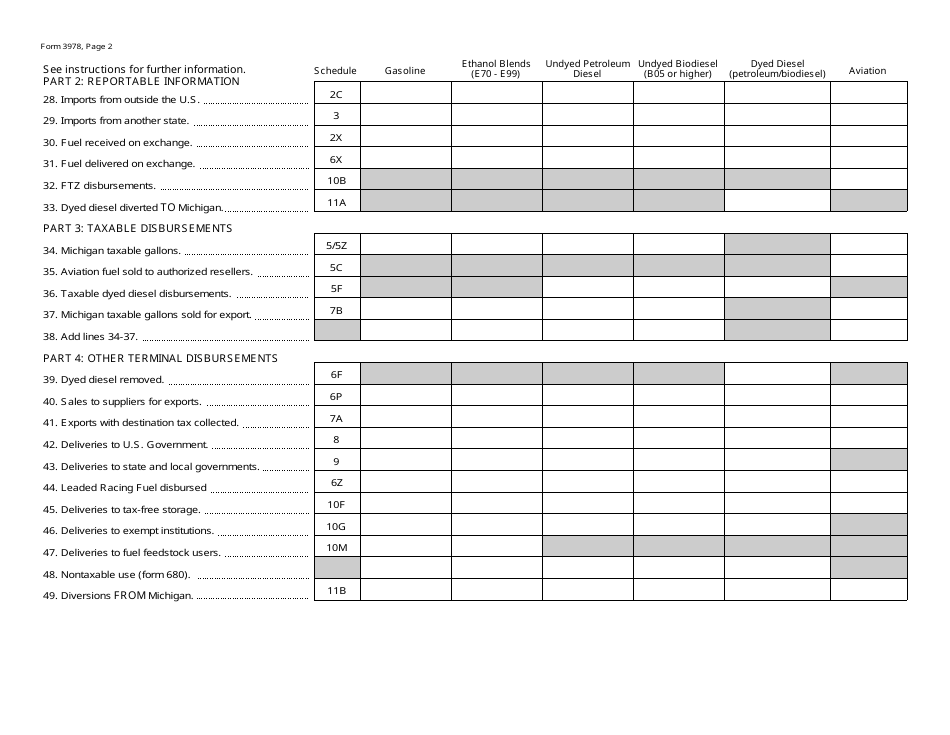

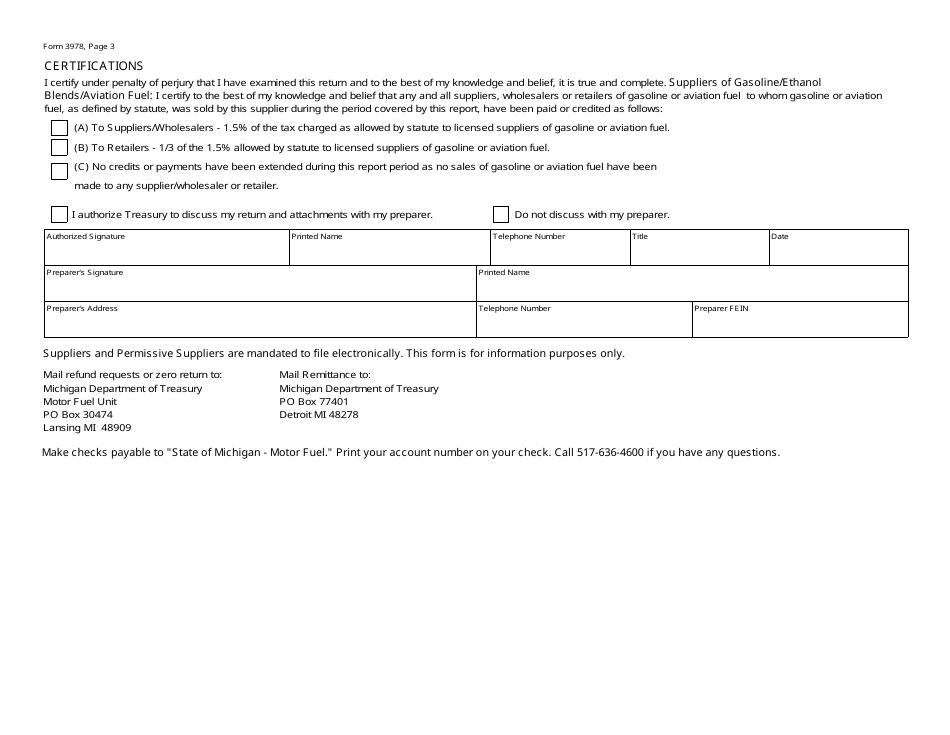

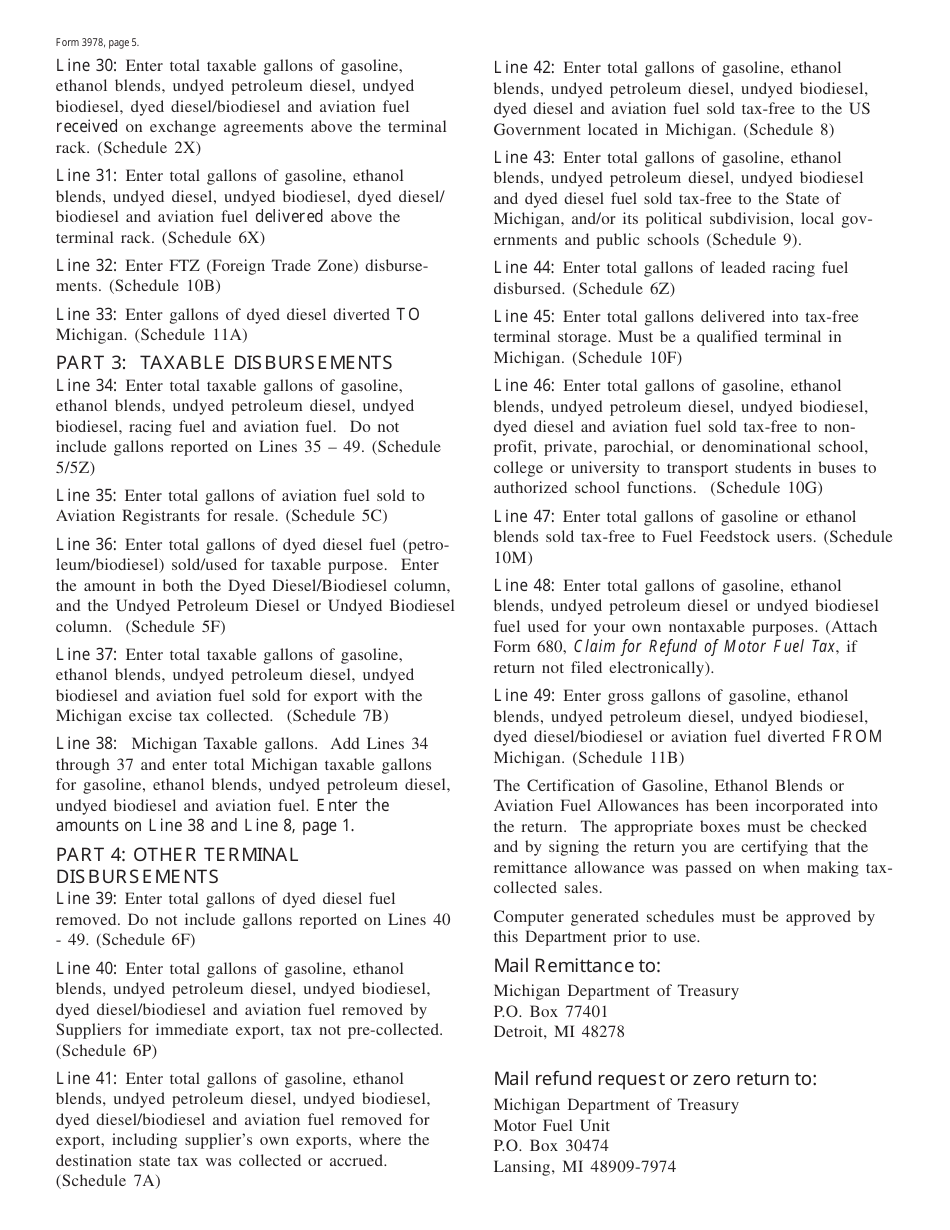

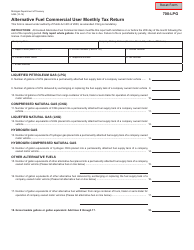

Form 3978 Fuel Supplier Return - Michigan

What Is Form 3978?

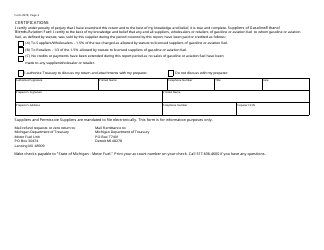

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3978?

A: Form 3978 is the Fuel Supplier Return used in the state of Michigan.

Q: Who needs to file Form 3978?

A: Fuel suppliers in Michigan need to file Form 3978.

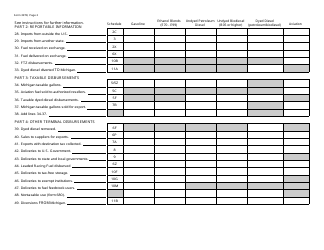

Q: What is the purpose of Form 3978?

A: Form 3978 is used to report fuel sales and pay fuel taxes in Michigan.

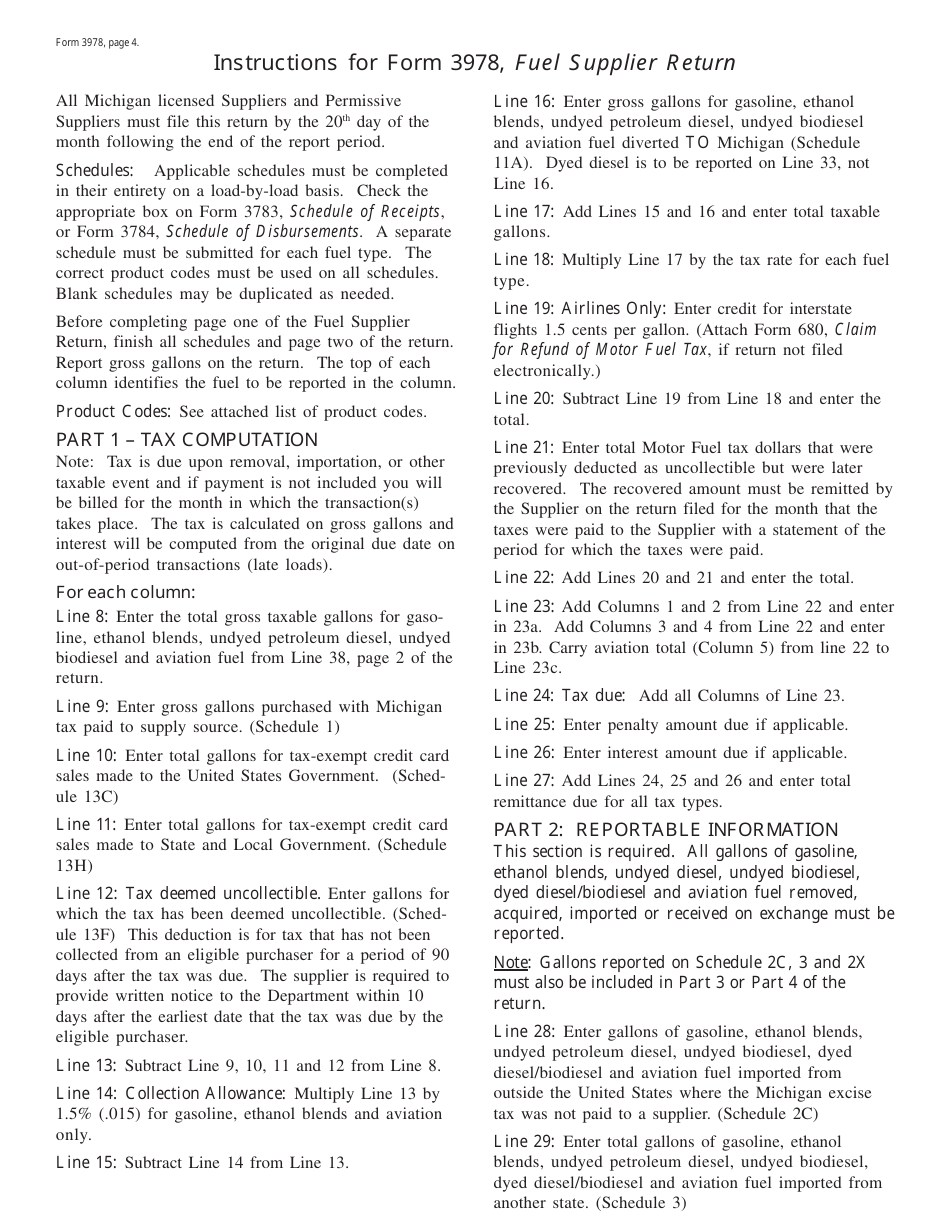

Q: When is Form 3978 due?

A: Form 3978 is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form 3978?

A: Yes, there may be penalties for late filing of Form 3978, including interest charges on outstanding tax payments.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3978 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.