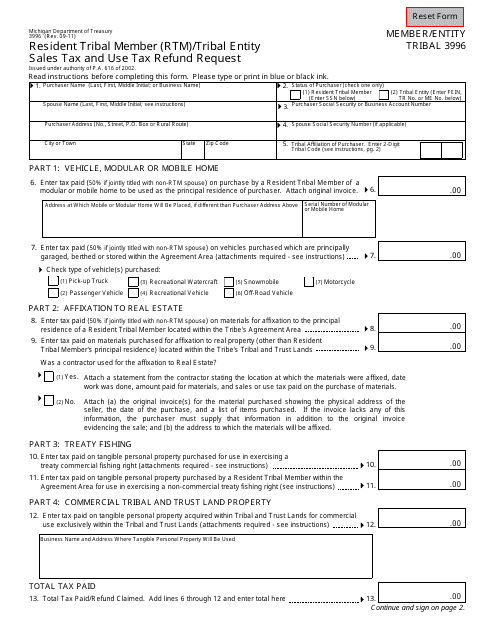

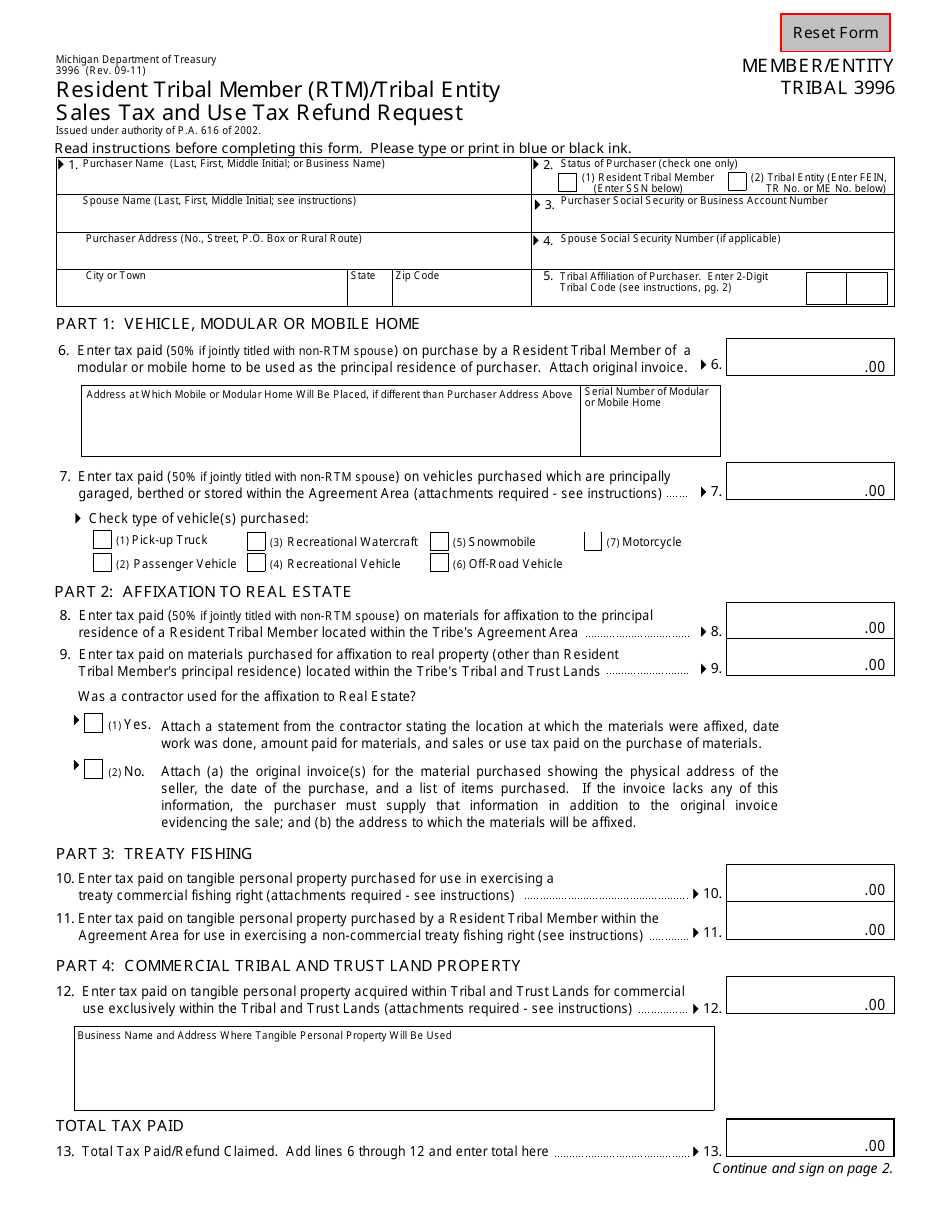

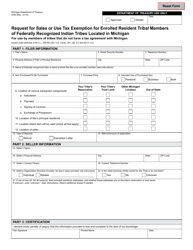

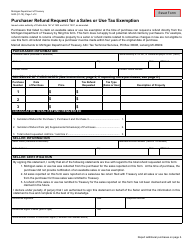

Form 3996 Resident Tribal Member (Rtm) / Tribal Entity Sales Tax and Use Tax Refund Request - Michigan

What Is Form 3996?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3996?

A: Form 3996 is a Resident Tribal Member (RTM)/Tribal Entity Sales Tax and Use Tax Refund Request.

Q: Who can use Form 3996?

A: Form 3996 can be used by Resident Tribal Members (RTM) and Tribal Entities in Michigan.

Q: What is the purpose of Form 3996?

A: The purpose of Form 3996 is to request a refund for sales tax and use tax paid by Resident Tribal Members or Tribal Entities in Michigan.

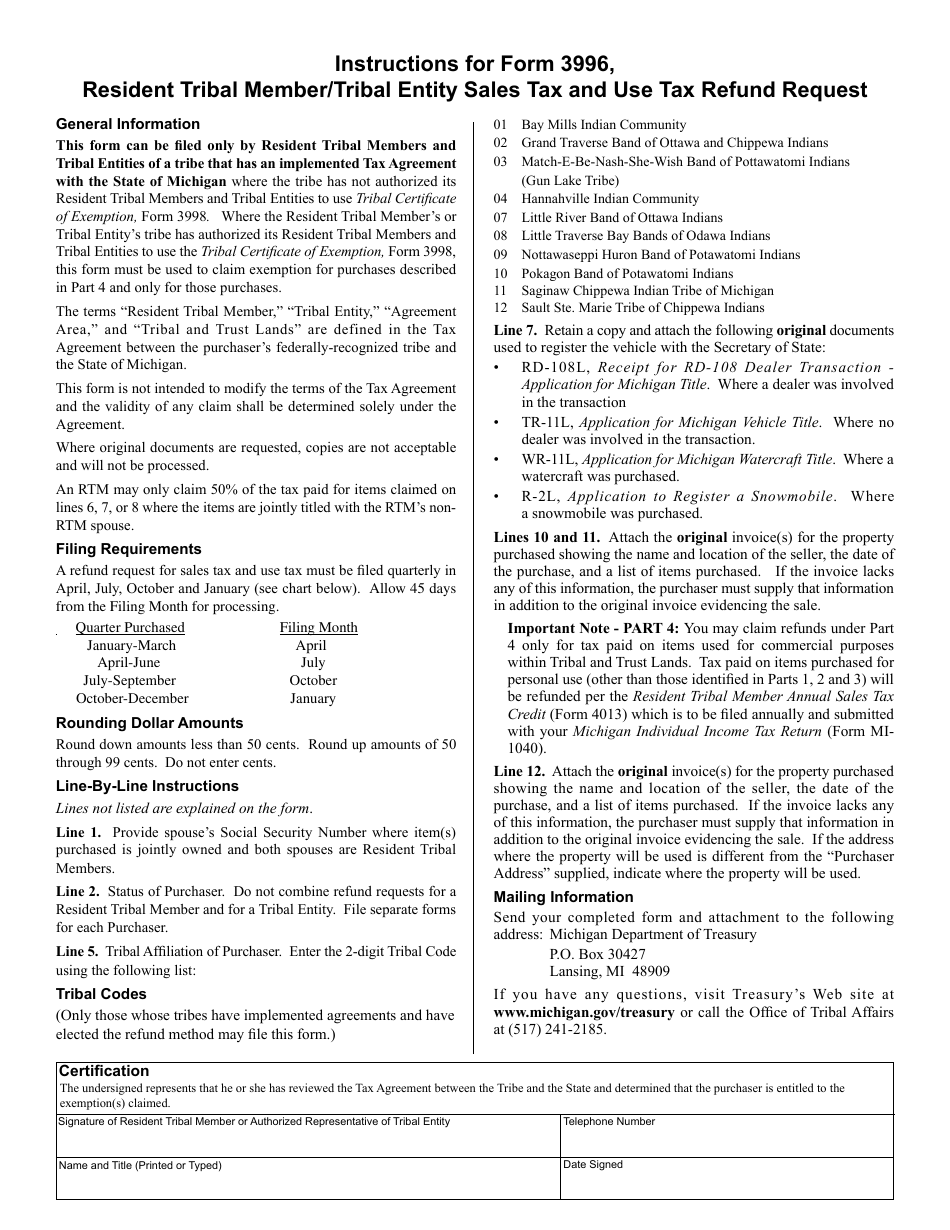

Q: What documentation do I need to file Form 3996?

A: You will need to provide documentation such as receipts, invoices, and other supporting documents to substantiate your refund claim.

Q: Is there a deadline for filing Form 3996?

A: Yes, Form 3996 must be filed within 4 years from the original due date of the return or within 1 year from the date of payment, whichever is later.

Q: Are there any fees associated with filing Form 3996?

A: No, there are no fees associated with filing Form 3996.

Q: Can I file Form 3996 if I am not a resident of Michigan?

A: No, Form 3996 is specifically for Resident Tribal Members or Tribal Entities in Michigan.

Q: What should I do if I have additional questions about Form 3996?

A: If you have additional questions about Form 3996, you can contact the Michigan Department of Treasury's customer service for assistance.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3996 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.