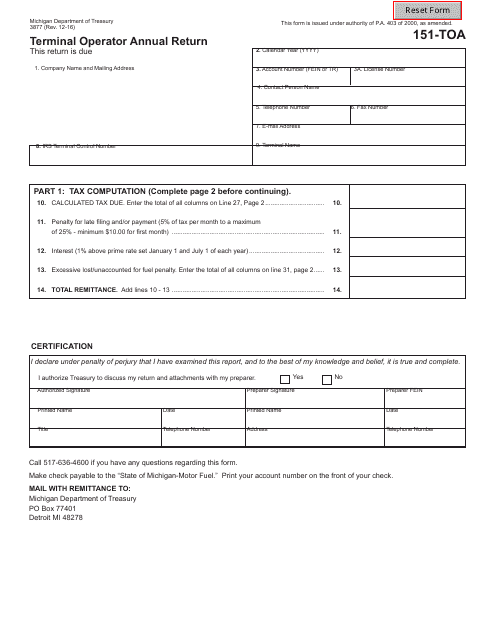

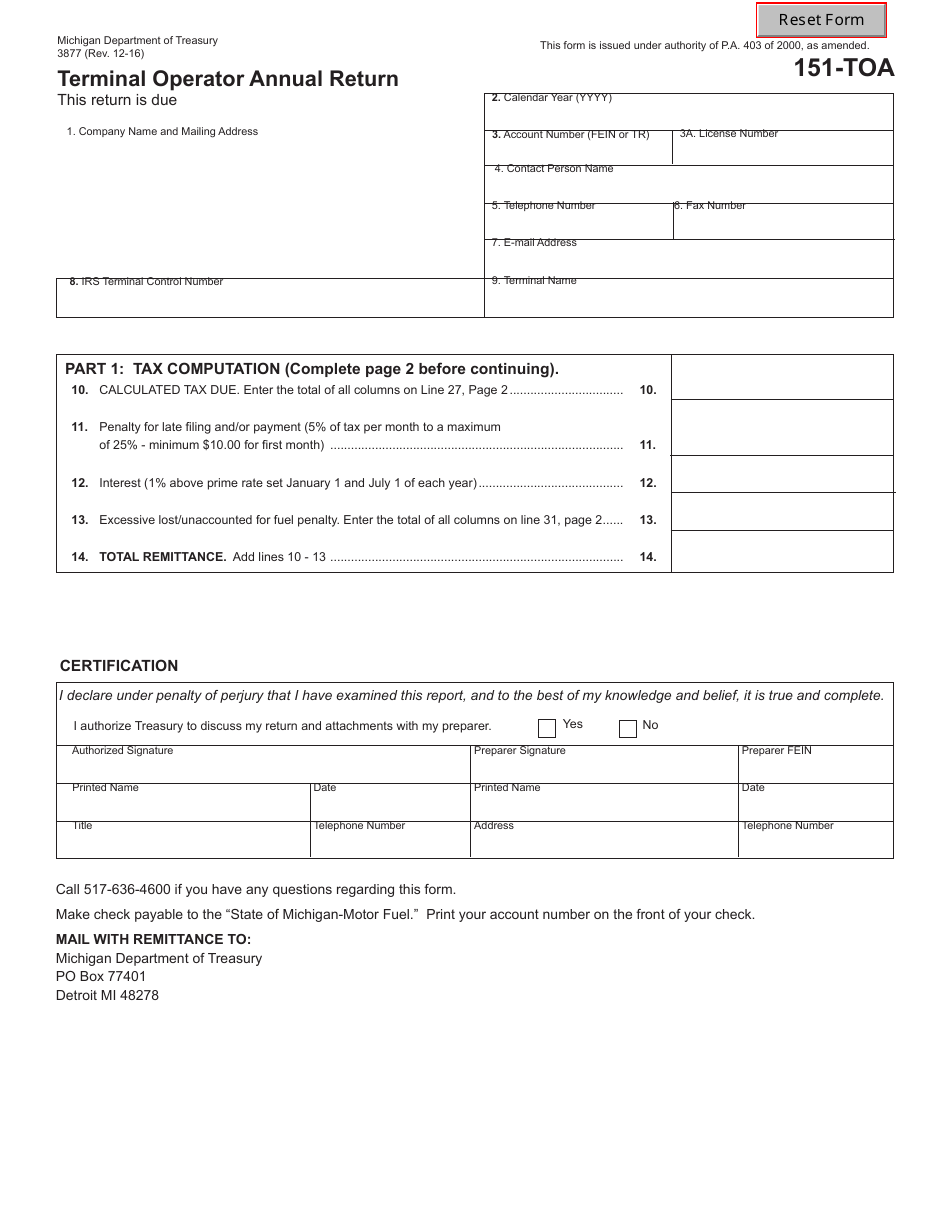

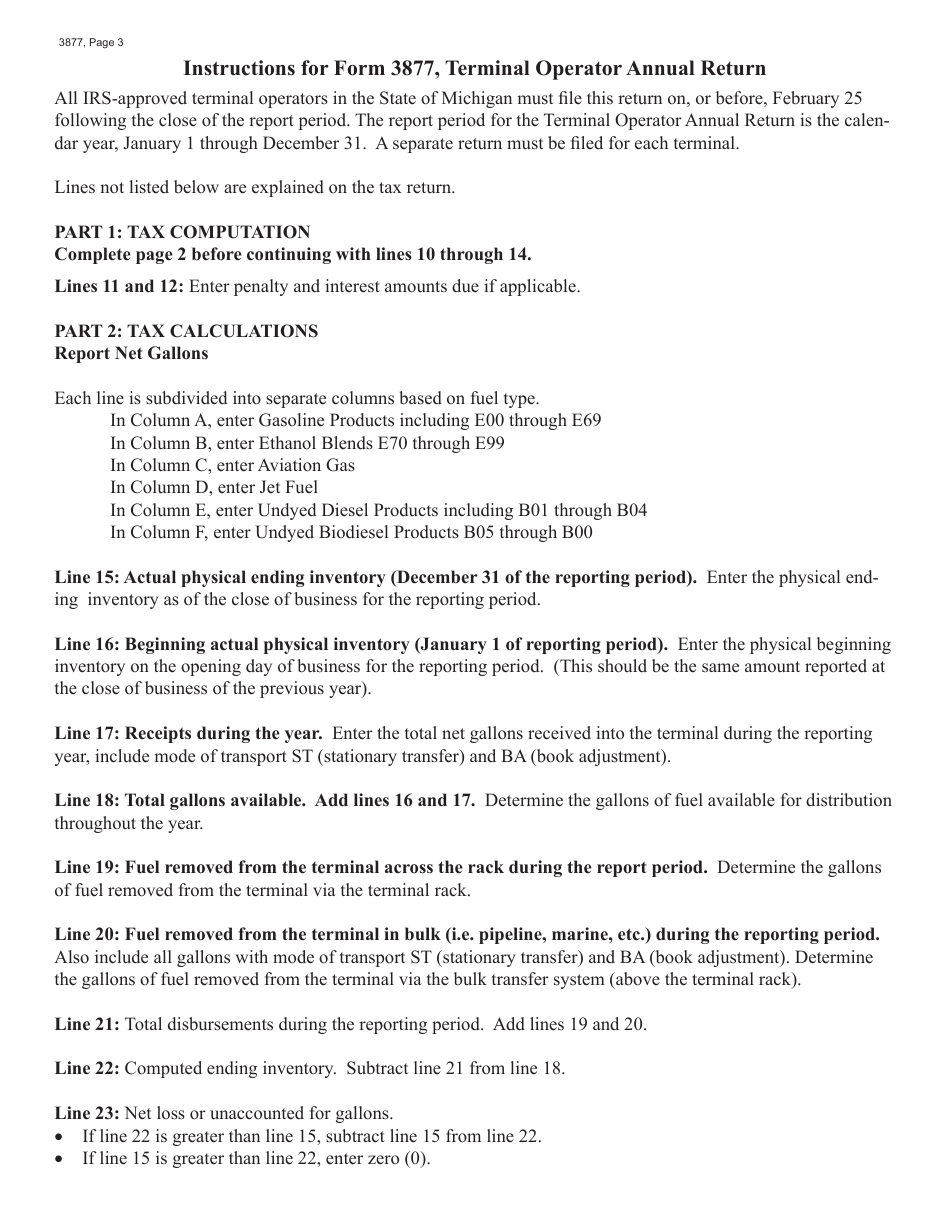

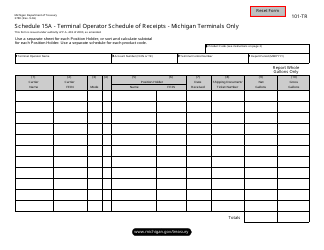

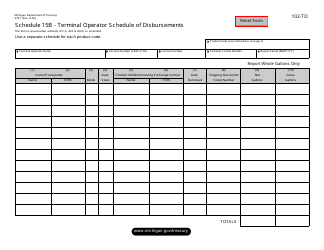

Form 3877 Terminal Operator Annual Return - Michigan

What Is Form 3877?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3877?

A: Form 3877 is the Terminal Operator Annual Return.

Q: Who needs to file Form 3877?

A: Terminal operators in Michigan need to file Form 3877.

Q: What is the purpose of Form 3877?

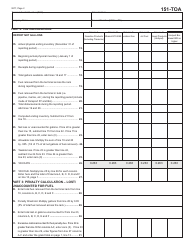

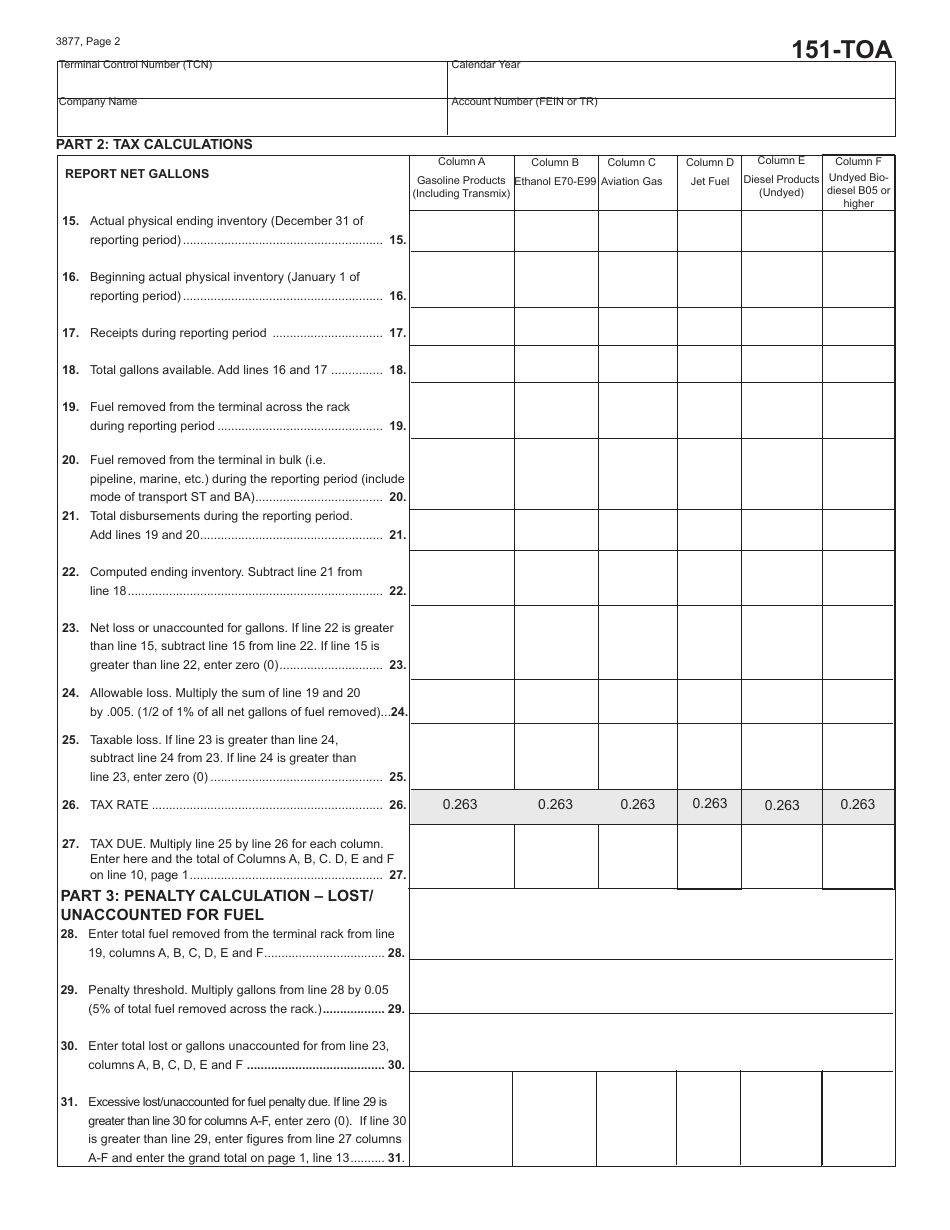

A: Form 3877 is used to report the annual activities and operations of terminal operators.

Q: When is Form 3877 due?

A: Form 3877 is due on or before the 15th day of the fourth month following the close of the calendar year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form 3877.

Q: Are there any fees associated with Form 3877?

A: No, there are no fees associated with filing Form 3877.

Q: Can Form 3877 be filed electronically?

A: Yes, Form 3877 can be filed electronically.

Q: What should I do if I have questions about Form 3877?

A: If you have questions about Form 3877, you should contact the Michigan Department of Treasury.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3877 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.