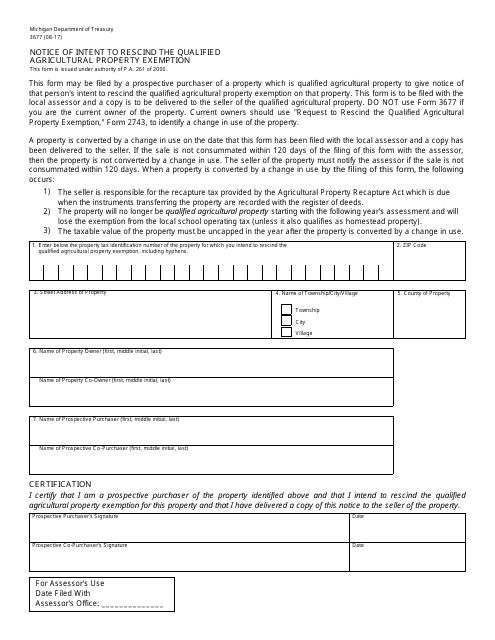

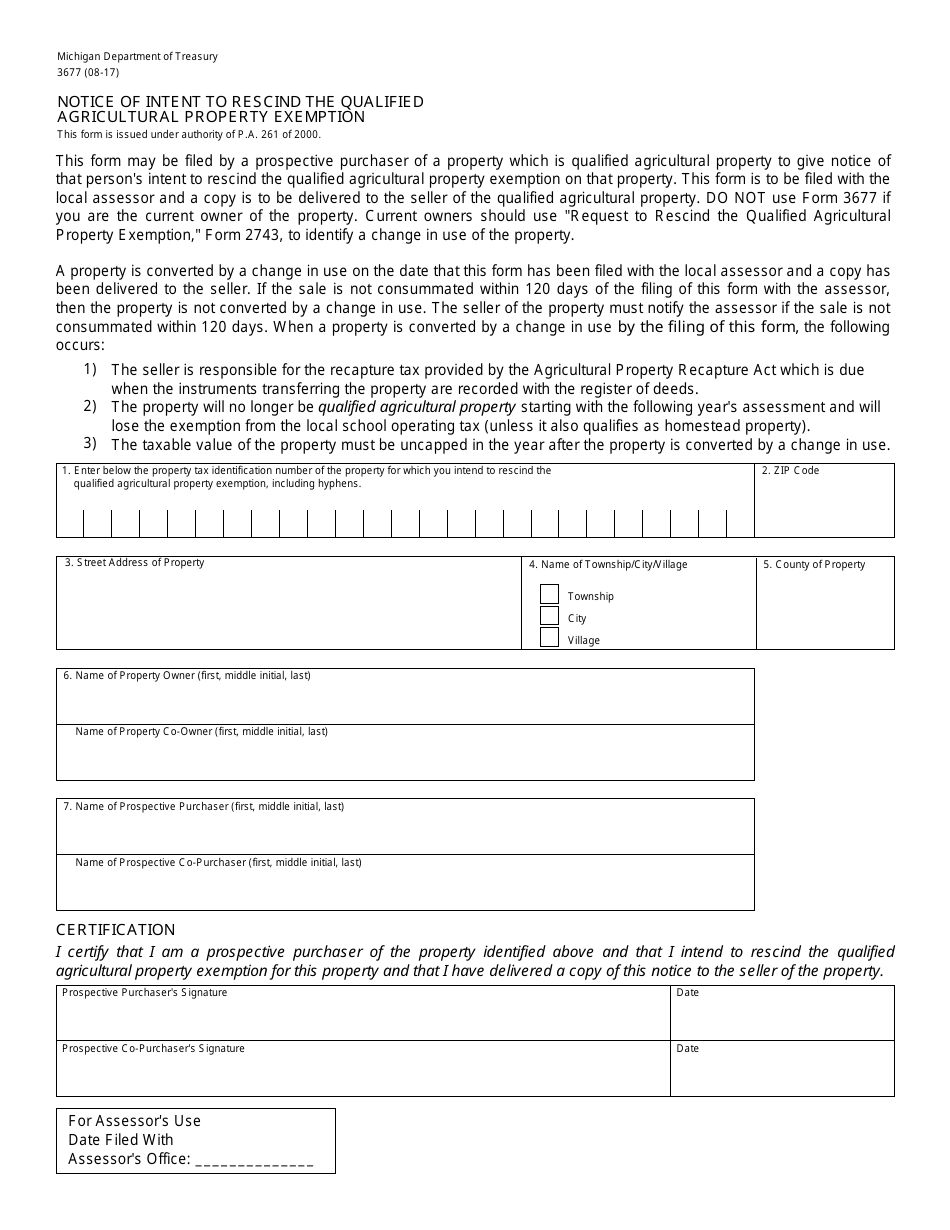

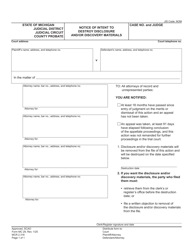

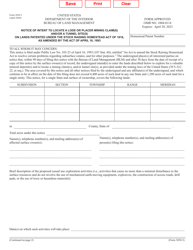

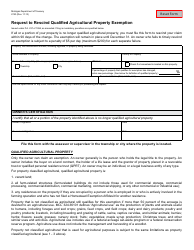

Form 3677 Notice of Intent to Rescind the Qualified Agricultural Property Exemption - Michigan

What Is Form 3677?

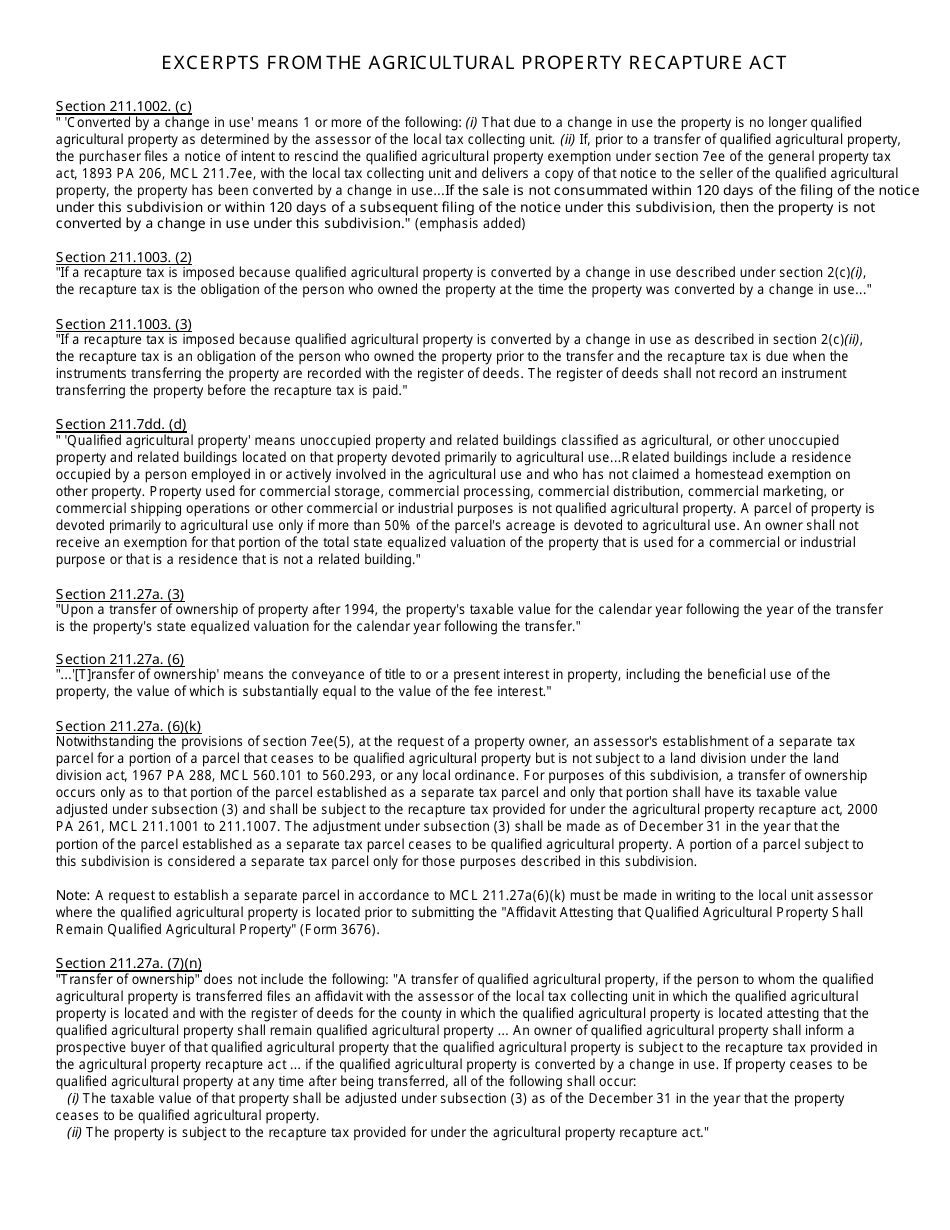

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3677?

A: Form 3677 is the Notice of Intent to Rescind the Qualified Agricultural Property Exemption in Michigan.

Q: What does the form do?

A: The form is used to notify the local assessor of your intent to rescind the qualified agricultural property exemption.

Q: Who needs to file Form 3677?

A: Property owners who wish to rescind the qualified agricultural property exemption in Michigan need to file Form 3677.

Q: When should Form 3677 be filed?

A: Form 3677 should be filed with the local assessor within 35 days after the change in use or transfer of ownership of the property.

Q: Is there a fee to file Form 3677?

A: There is no fee to file Form 3677.

Q: What happens after I file Form 3677?

A: After filing Form 3677, the local assessor will review the information and make a determination regarding the rescission of the qualified agricultural property exemption.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3677 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.