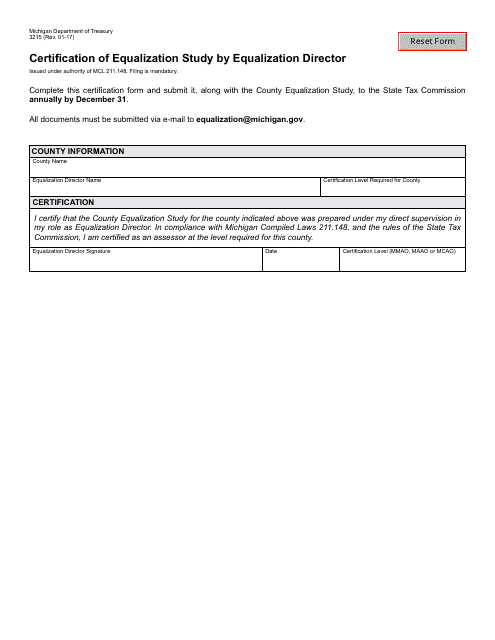

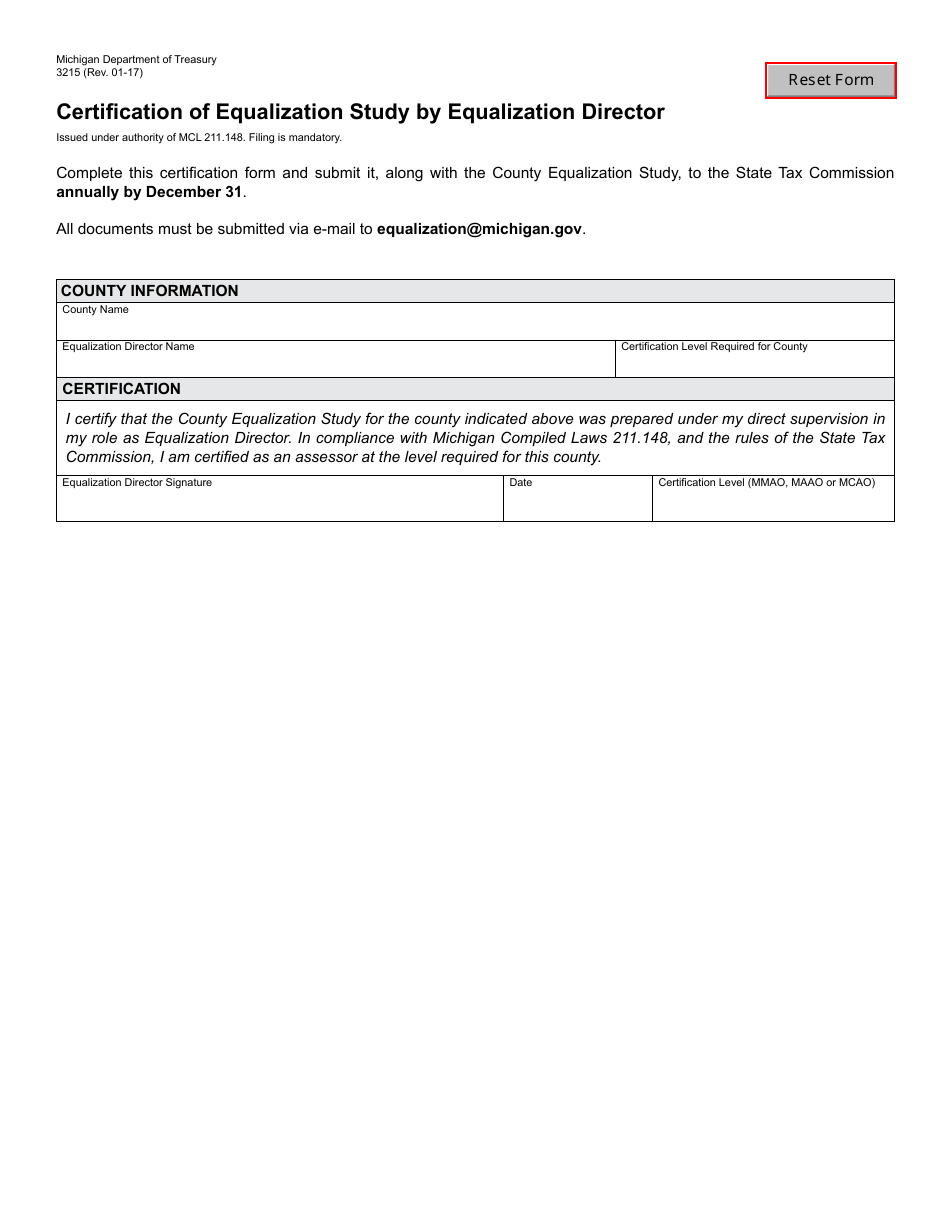

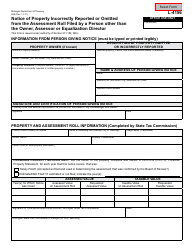

Form 3215 Certification of Equalization Study by Equalization Director - Michigan

What Is Form 3215?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3215?

A: Form 3215 is the Certification of Equalization Study by Equalization Director in Michigan.

Q: What is the purpose of Form 3215?

A: The purpose of Form 3215 is to certify the equalization study conducted by the Equalization Director.

Q: Who is responsible for completing Form 3215?

A: The Equalization Director is responsible for completing Form 3215.

Q: What does the Equalization Director certify in Form 3215?

A: The Equalization Director certifies the accuracy and completeness of the equalization study.

Q: Why is the equalization study important?

A: The equalization study helps to ensure fair and equitable property assessments for taxation purposes.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3215 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.