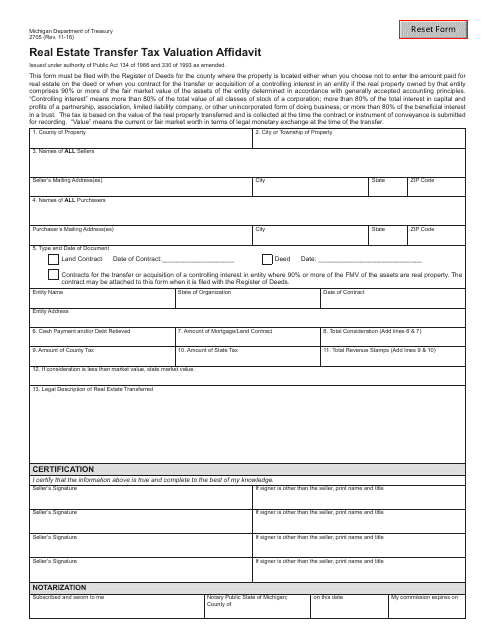

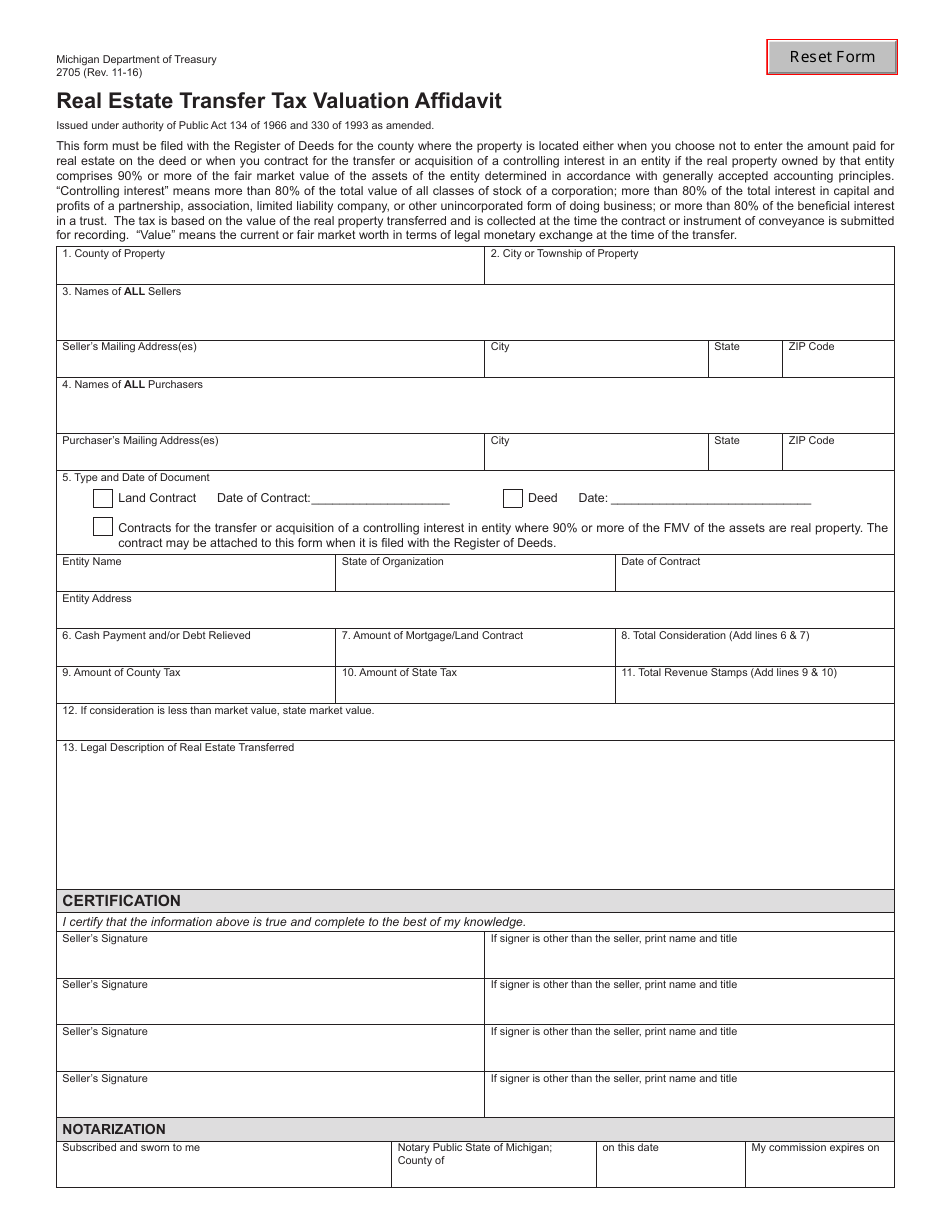

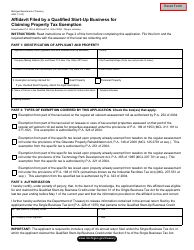

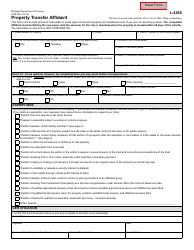

Form 2705 Real Estate Transfer Tax Valuation Affidavit - Michigan

What Is Form 2705?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 2705?

A: Form 2705 is a Real Estate TransferTax Valuation Affidavit used in Michigan.

Q: What is the purpose of Form 2705?

A: The purpose of Form 2705 is to declare the true cash value of real estate for the calculation of transfer taxes in Michigan.

Q: Who needs to fill out Form 2705?

A: The buyer or the buyer's agent is typically responsible for completing Form 2705.

Q: What information is required on Form 2705?

A: Form 2705 requires information about the property being transferred, the buyer, the seller, and the transaction details.

Q: Are there any filing fees for Form 2705?

A: Yes, there may be filing fees associated with submitting Form 2705. The specific fees vary by county.

Q: When should Form 2705 be filed?

A: Form 2705 should be filed within 45 days of the transfer of real estate in Michigan.

Q: What happens if Form 2705 is not filed?

A: Failure to file Form 2705 may result in penalties and interest being assessed on the transfer tax amount.

Q: Can Form 2705 be filed electronically?

A: Yes, some counties in Michigan allow for electronic filing of Form 2705.

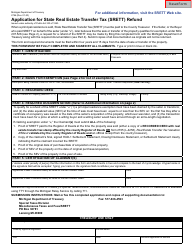

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2705 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.