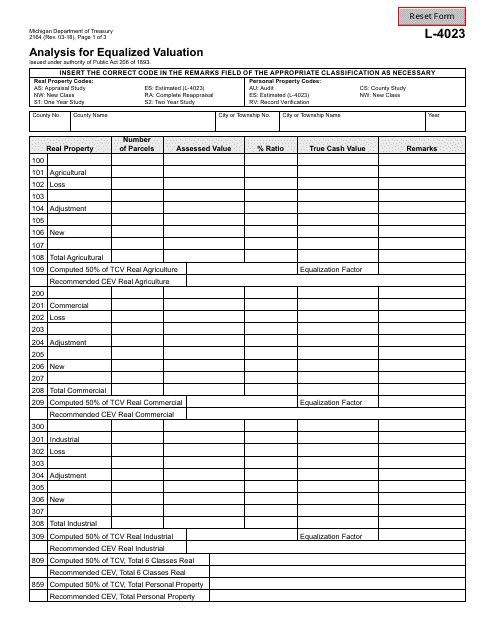

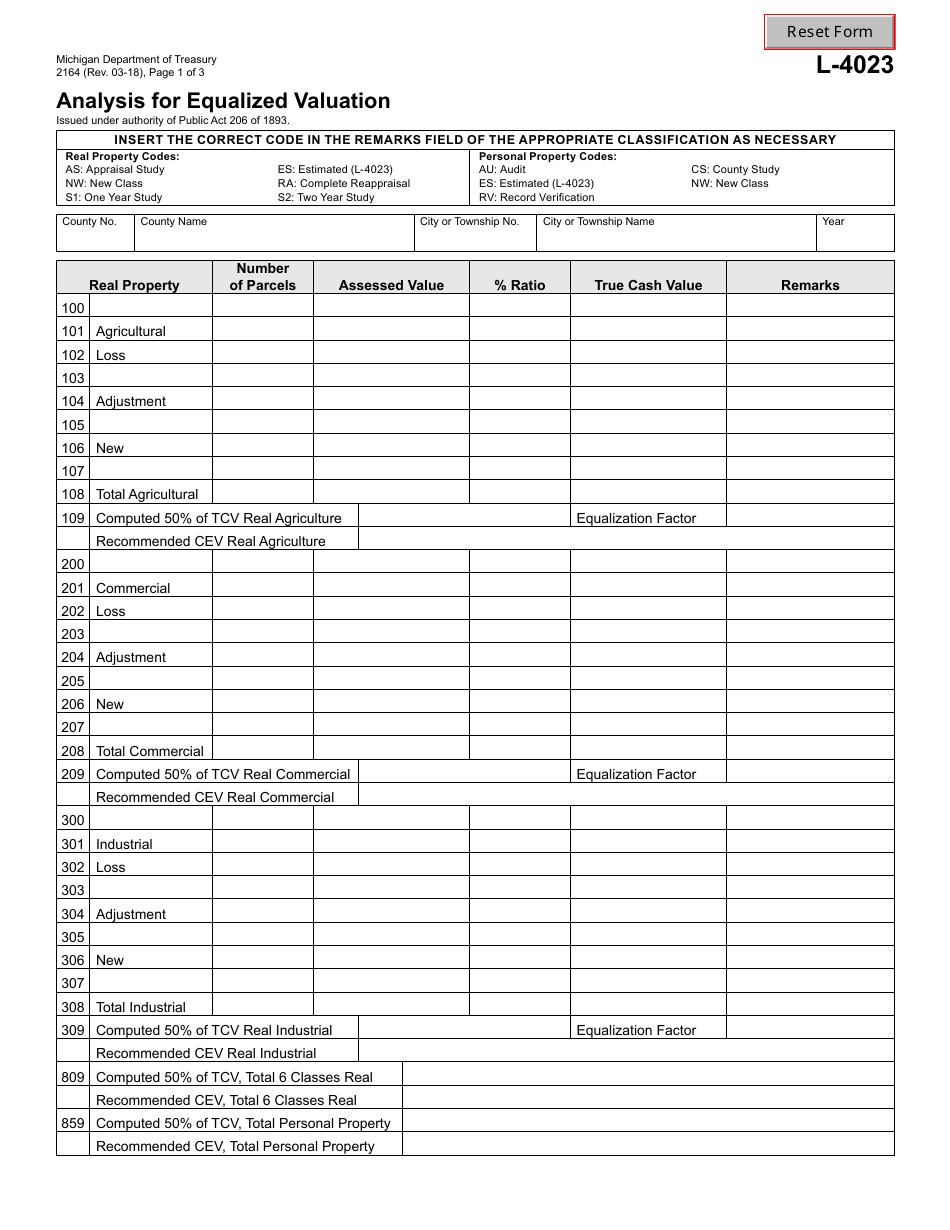

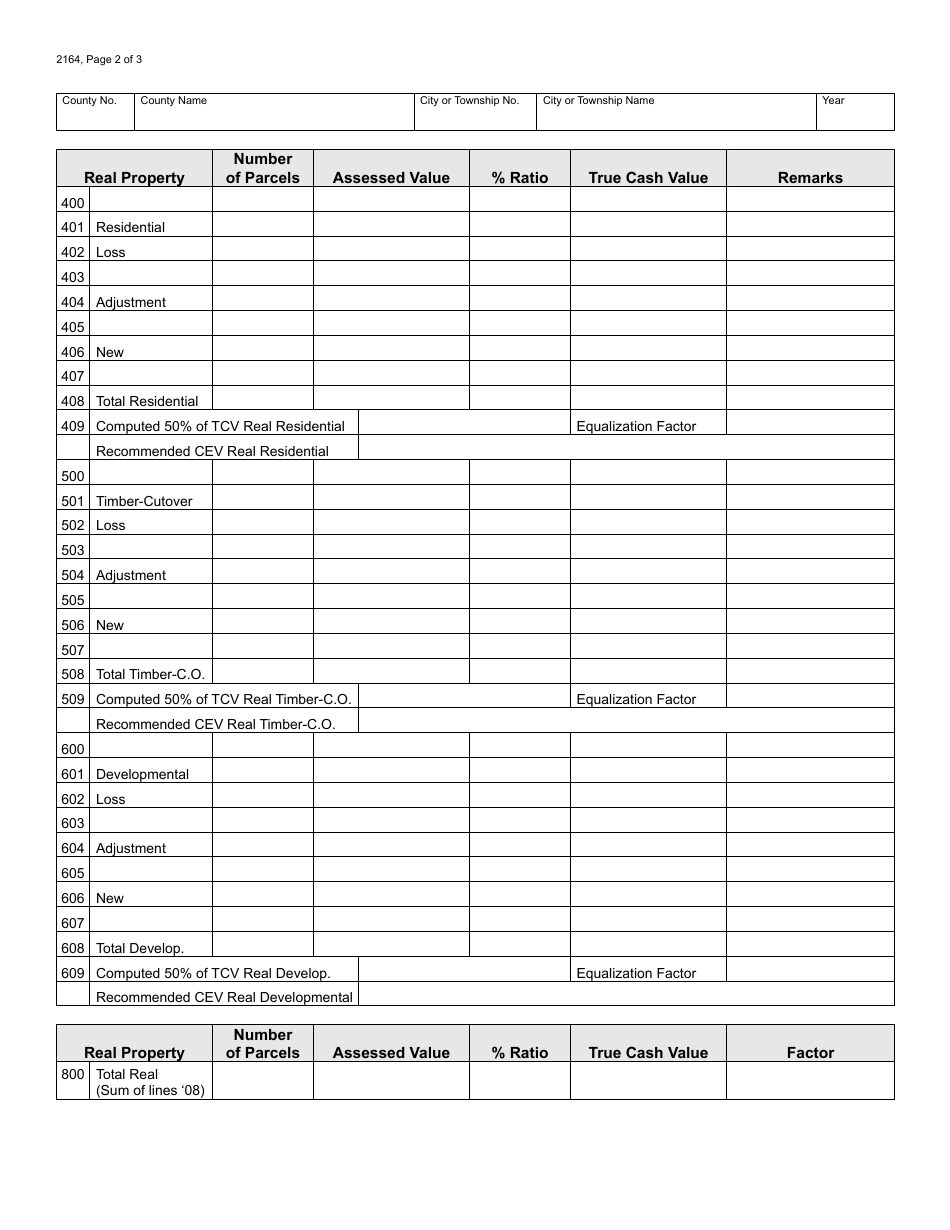

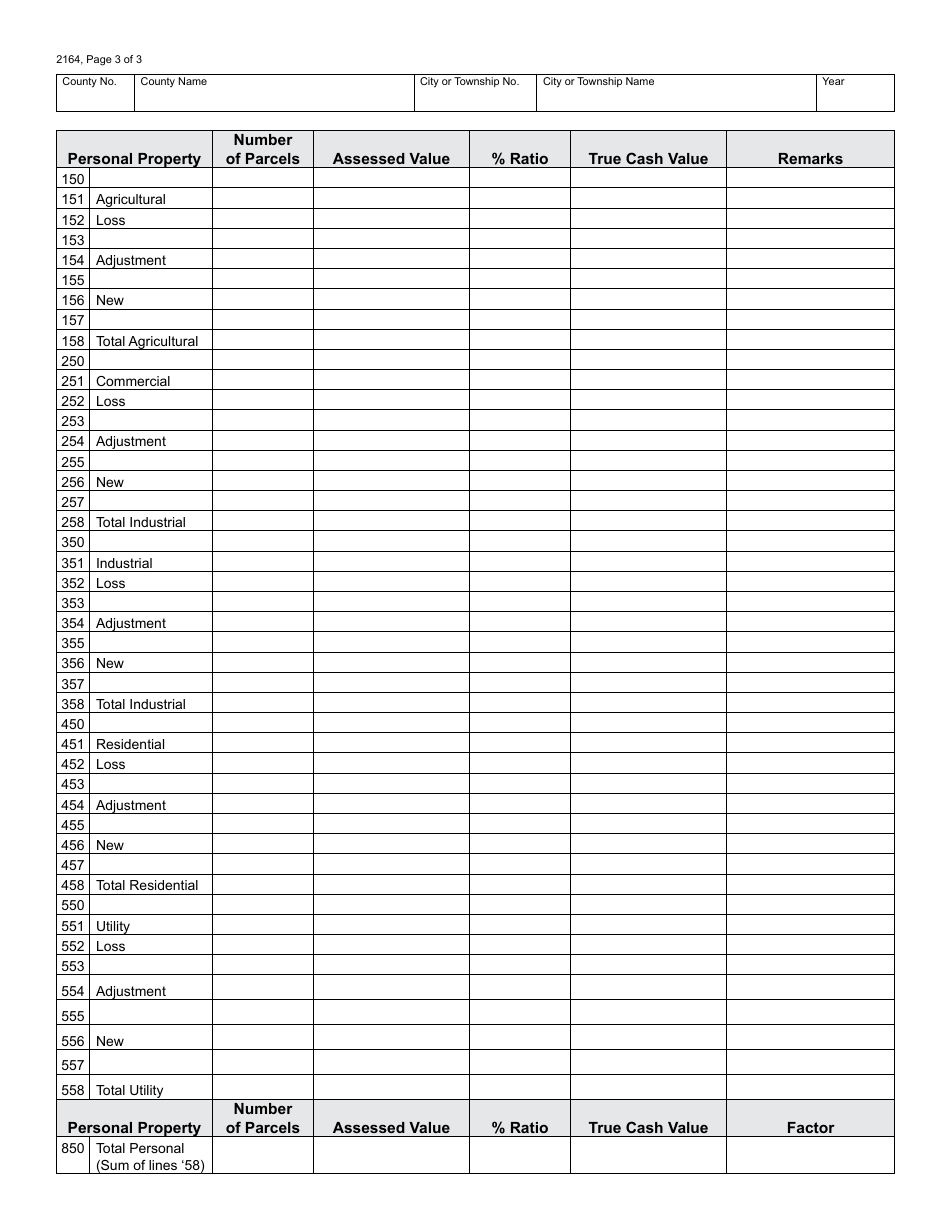

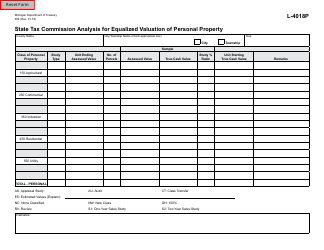

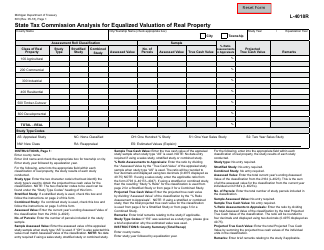

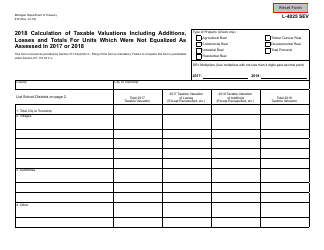

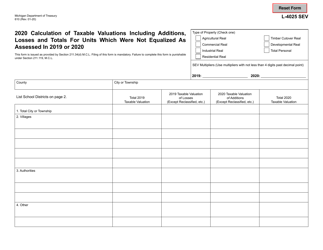

Form 2164 Analysis for Equalized Valuation - Michigan

What Is Form 2164?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2164?

A: Form 2164 is a document used in Michigan for the analysis of equalized valuation.

Q: What is equalized valuation?

A: Equalized valuation refers to the assessed value of a property that has been adjusted to reflect the true cash value in a fair and equitable manner.

Q: Why is Form 2164 used?

A: Form 2164 is used to analyze the equalized valuation of properties in Michigan to ensure that the assessments are fair and accurate.

Q: Who uses Form 2164?

A: Form 2164 is used by local government assessors and other officials involved in property valuation in Michigan.

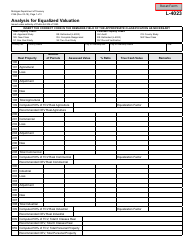

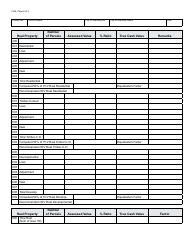

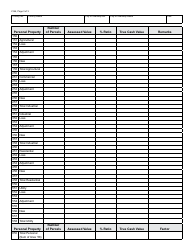

Q: What information does Form 2164 provide?

A: Form 2164 provides information such as property details, assessment information, and calculations to determine the equalized valuation of a property.

Q: Why is equalized valuation important?

A: Equalized valuation is important because it determines the amount of property taxes that a property owner will be required to pay.

Q: How is equalized valuation determined?

A: Equalized valuation is determined through a process that involves analyzing property sales data and comparing it to assessed values to ensure fairness and equity.

Q: Can I appeal the equalized valuation of my property?

A: Yes, property owners have the right to appeal the equalized valuation of their property if they believe it is inaccurate or unfair. They should contact their local assessor's office for information on the appeals process.

Q: What happens after the equalized valuation is determined?

A: After the equalized valuation is determined, it is used to calculate the property taxes that the owner will owe.

Q: Are there any exemptions or relief programs available for property owners?

A: Yes, there are exemptions and relief programs available for certain property owners, such as the Homestead Exemption for primary residences and the Poverty Exemption for eligible low-income individuals. These programs can reduce the property taxes owed.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2164 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.