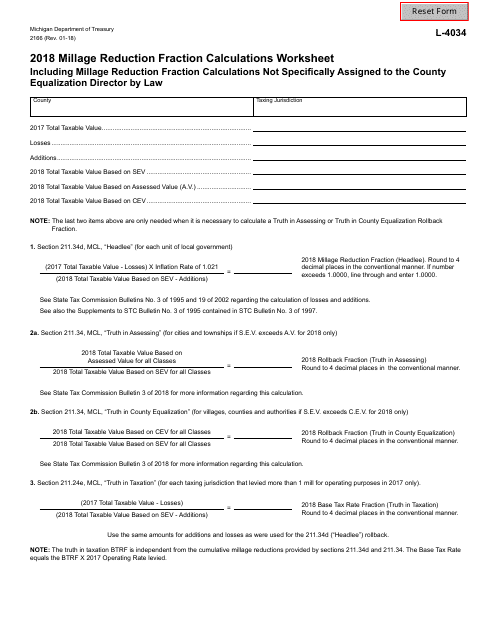

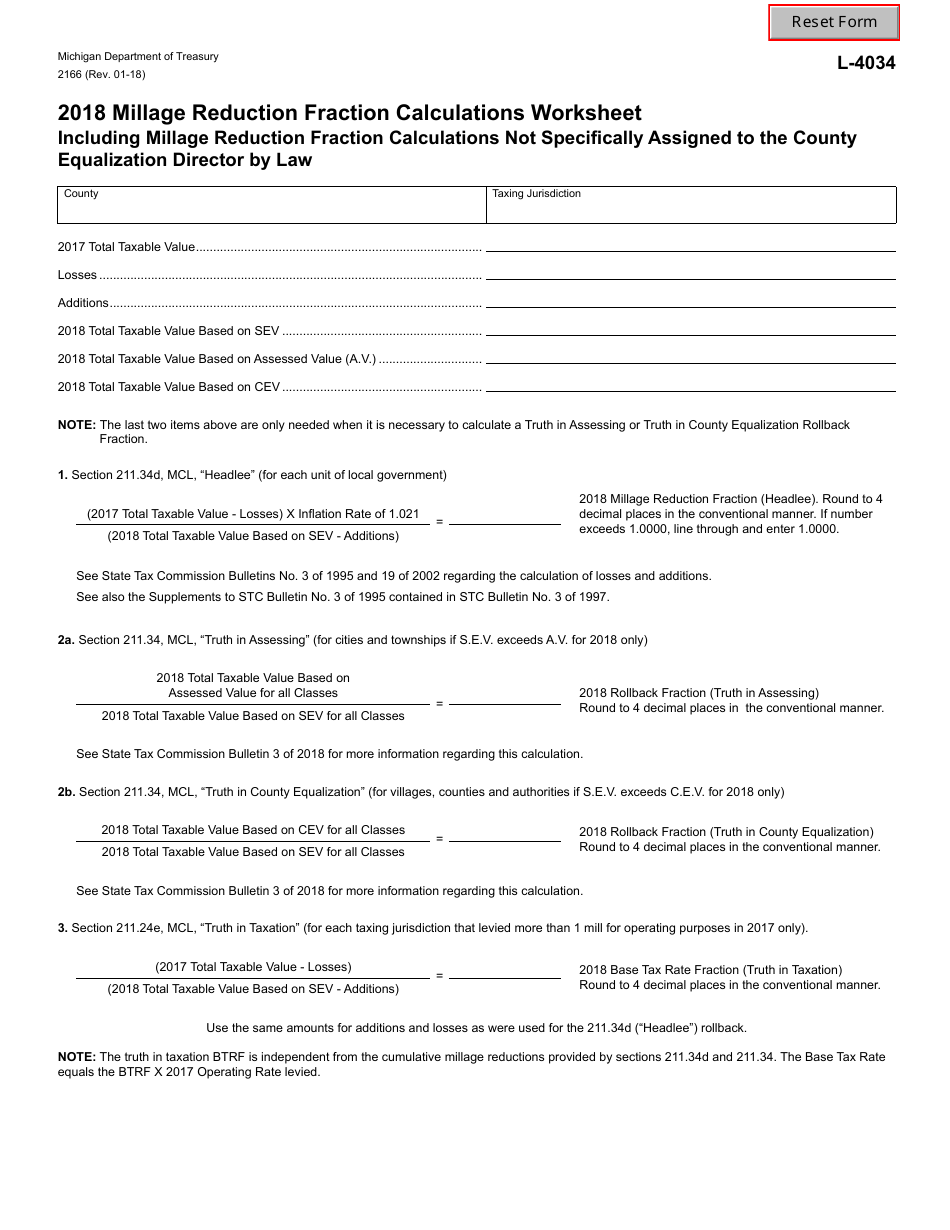

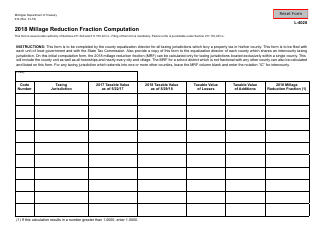

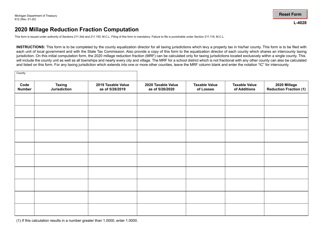

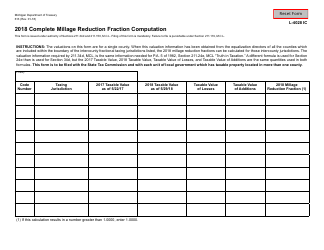

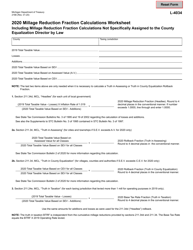

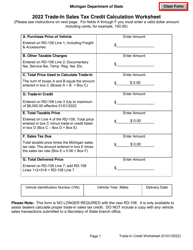

Form 2166 Millage Reduction Fraction Calculations Worksheet - Michigan

What Is Form 2166?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2166 Millage Reduction Fraction Calculations Worksheet?

A: Form 2166 is a worksheet used in Michigan to calculate the millage reduction fraction for property tax purposes.

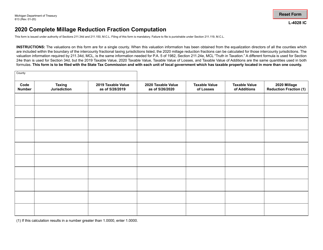

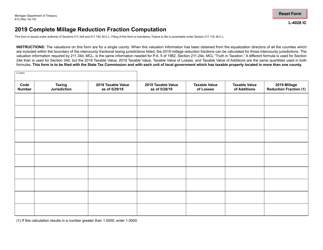

Q: Why do I need to calculate the millage reduction fraction?

A: The millage reduction fraction is used to determine the taxable value of qualified property for certain millage rates in Michigan.

Q: How is the millage reduction fraction calculated?

A: The millage reduction fraction is calculated by dividing the State Equalized Value (SEV) of the qualified property by the Taxable Value (TV) of the qualified property.

Q: What is the State Equalized Value (SEV)?

A: The State Equalized Value is the assessed value of the property after equalization by the state.

Q: What is the Taxable Value (TV)?

A: The Taxable Value is the value of the property that is subject to property tax, which is capped at the rate of inflation or 5%, whichever is lower, in Michigan.

Q: Who needs to fill out Form 2166?

A: Property owners in Michigan who have qualified property and want to calculate the millage reduction fraction for property tax purposes need to fill out Form 2166.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2166 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.