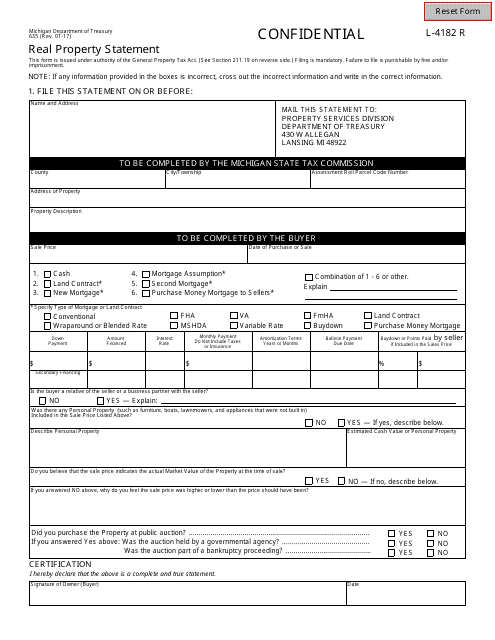

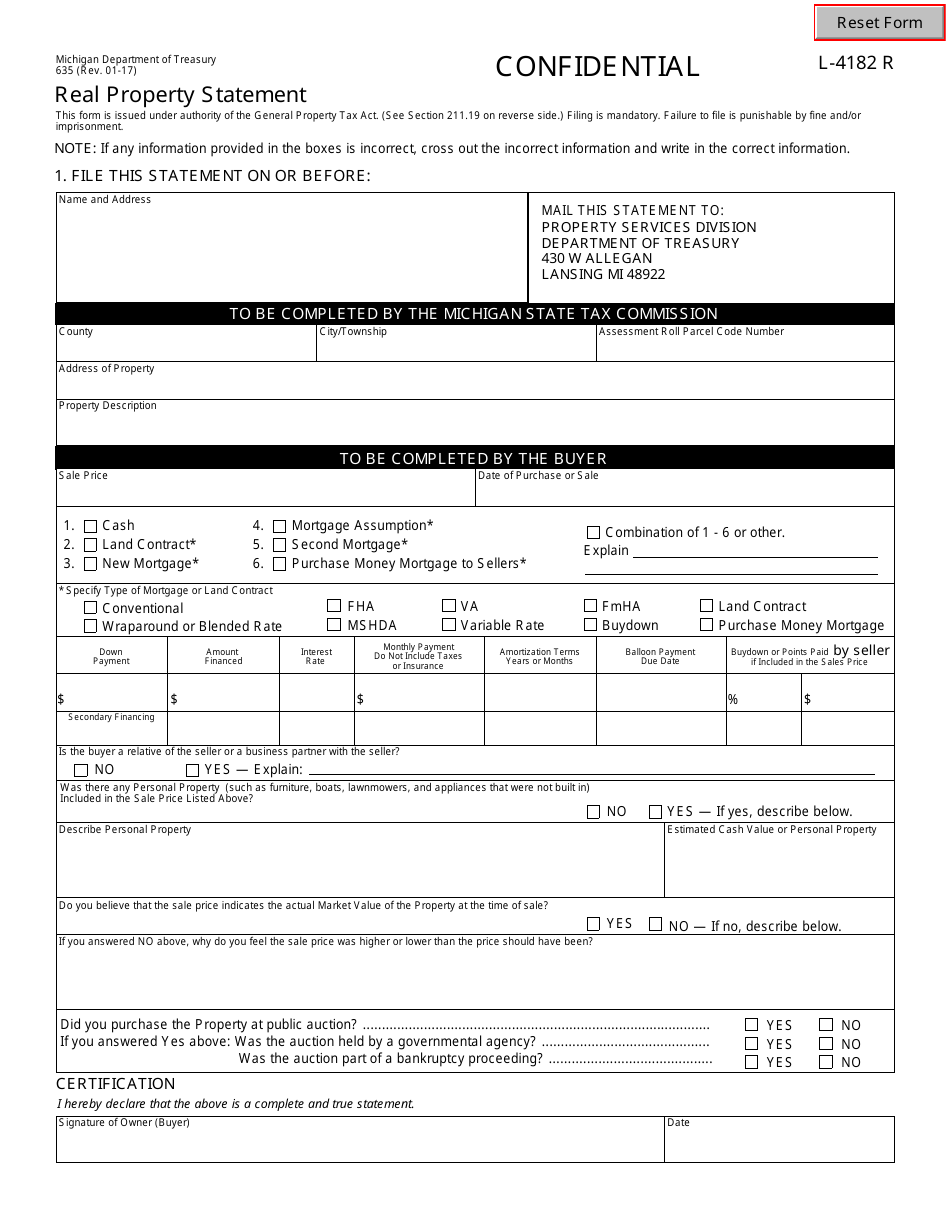

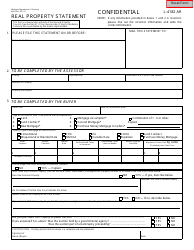

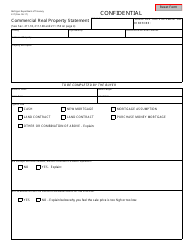

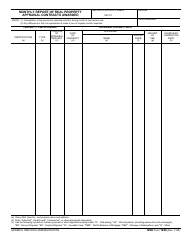

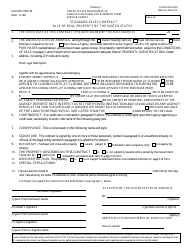

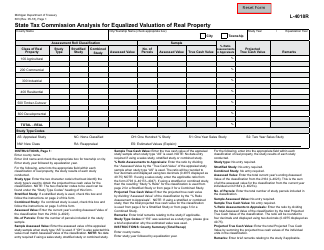

Form 635 Real Property Statement - Michigan

What Is Form 635?

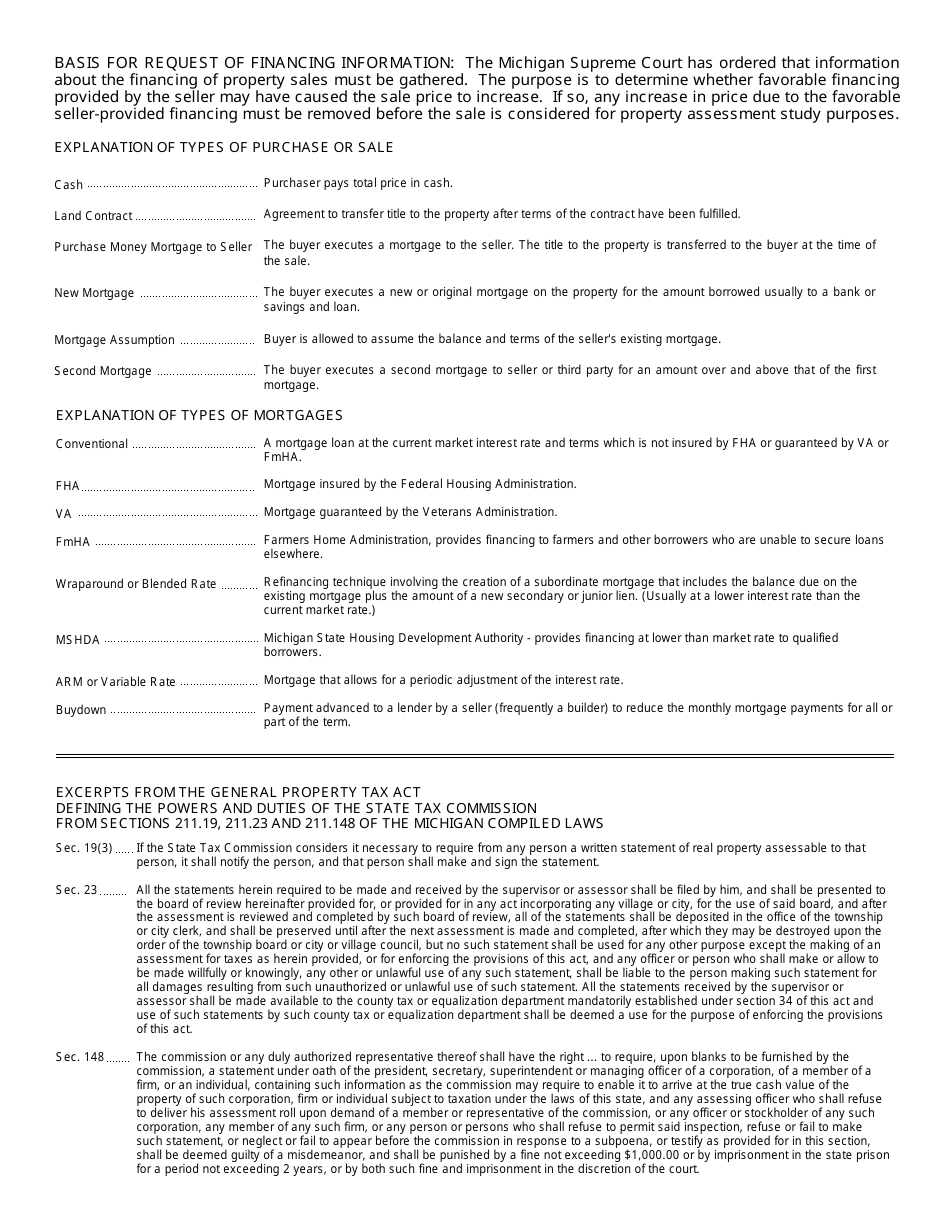

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 635 Real Property Statement?

A: Form 635 Real Property Statement is a document used in Michigan to report real property holdings.

Q: Who needs to file Form 635?

A: Property owners in Michigan who have real property holdings are required to file Form 635.

Q: When is Form 635 due?

A: Form 635 is due on February 20th of each year.

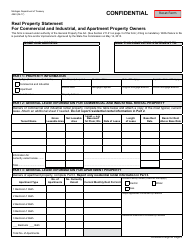

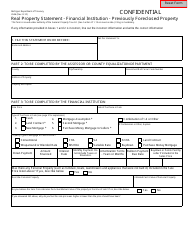

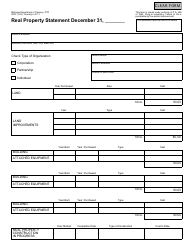

Q: What information is required on Form 635?

A: Form 635 requires information regarding the property owner, property location, property type, and other property details.

Q: Are there any penalties for not filing Form 635?

A: Yes, failure to file Form 635 may result in penalties and interest being assessed by the Michigan Department of Treasury.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 635 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.