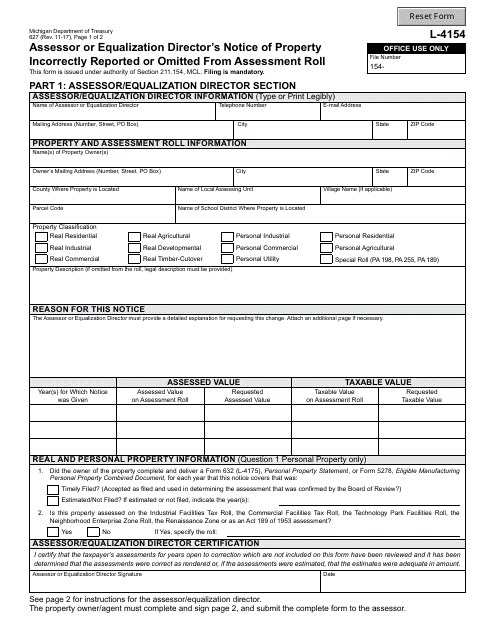

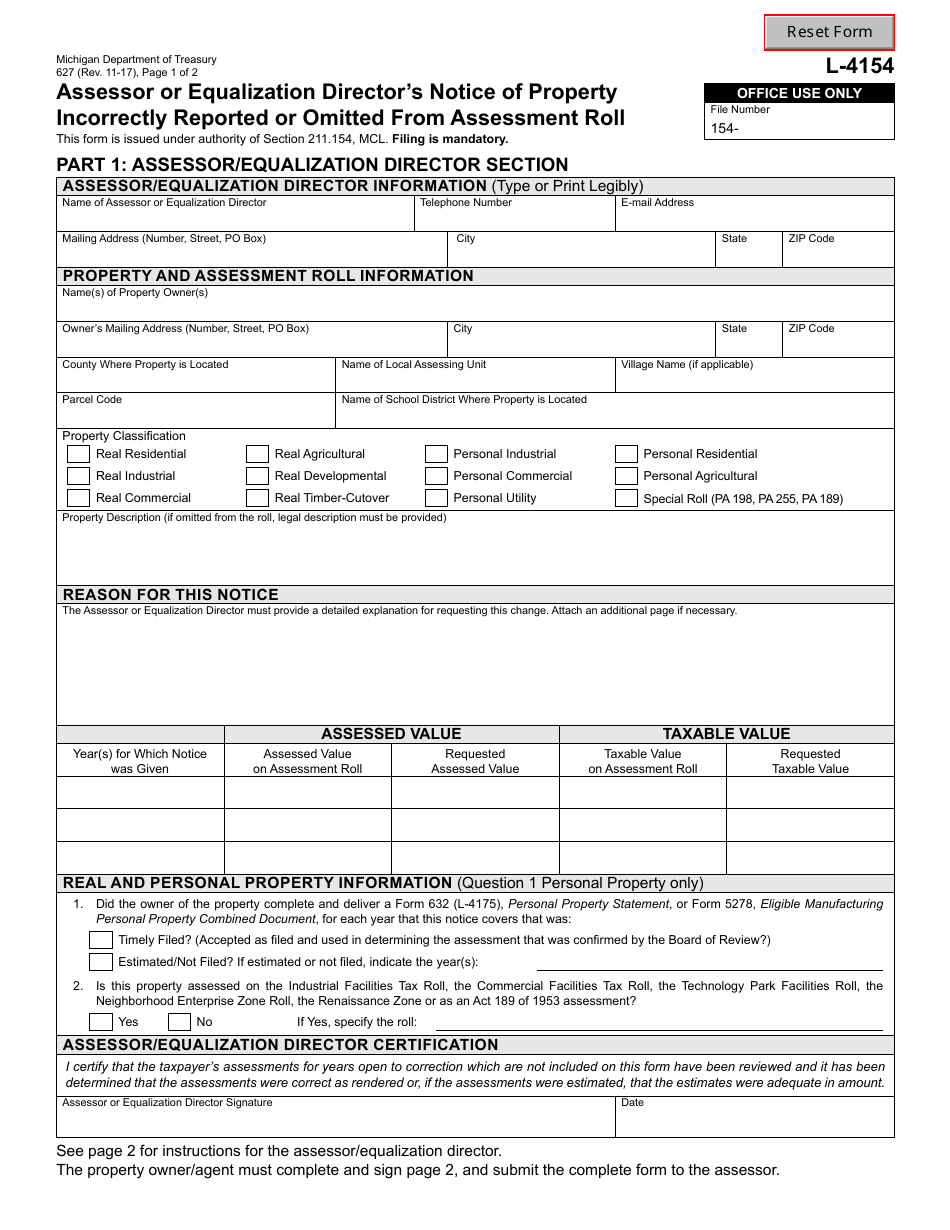

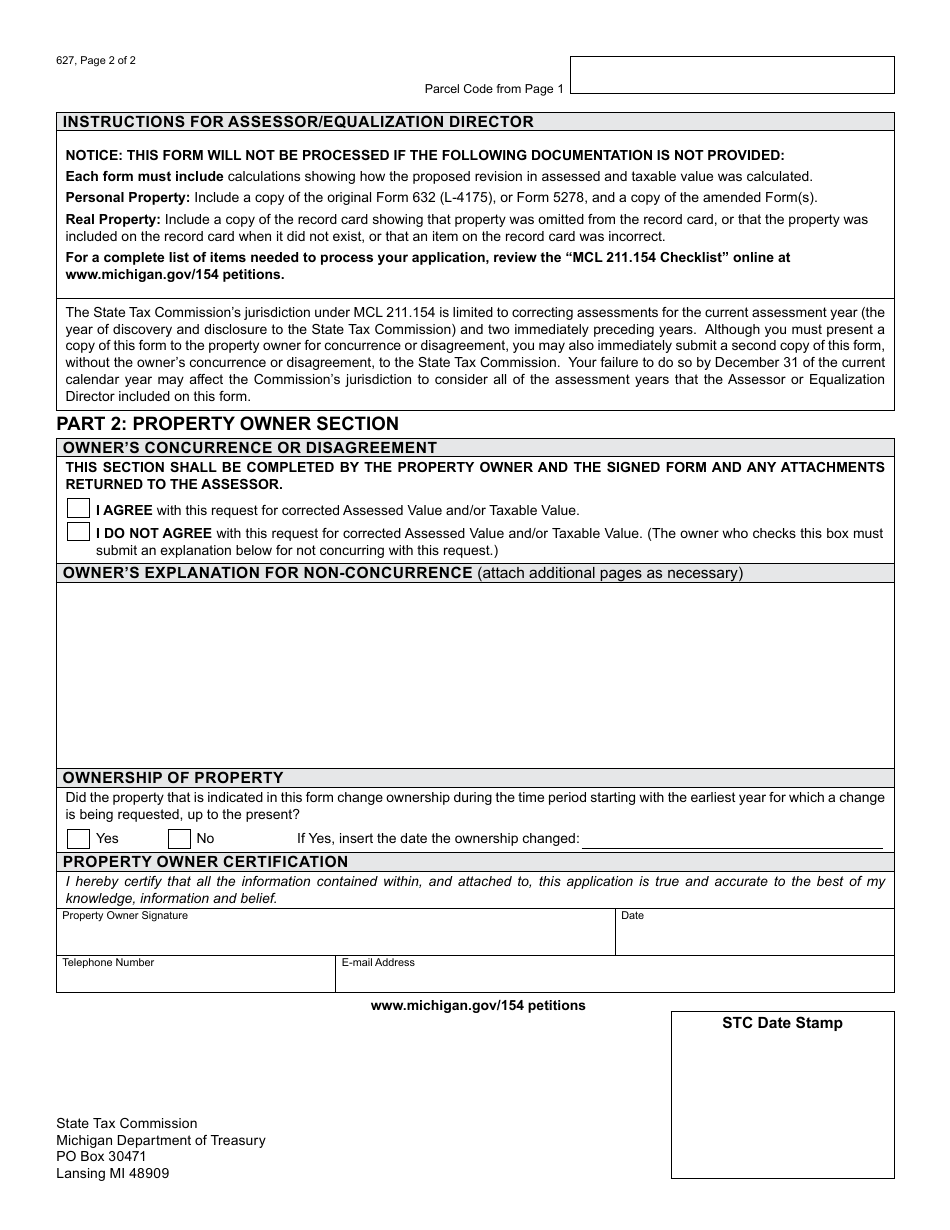

Form 627 Assessor or Equalization Director's Notice of Property Incorrectly Reported or Omitted From Assessment Roll - Michigan

What Is Form 627?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 627?

A: Form 627 is a notice used by the Assessor or Equalization Director in Michigan to report property that has been incorrectly reported or omitted from the assessment roll.

Q: Who uses Form 627?

A: The Assessor or Equalization Director in Michigan uses Form 627 to report property that has been incorrectly reported or omitted from the assessment roll.

Q: What is the purpose of Form 627?

A: The purpose of Form 627 is to correct any errors or omissions in the assessment roll by reporting property that has been incorrectly reported or omitted.

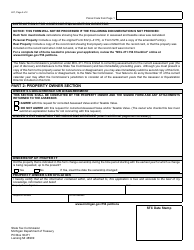

Q: How do I use Form 627?

A: To use Form 627, you need to fill out the required information about the property that has been incorrectly reported or omitted, and submit the form to the Assessor or Equalization Director in Michigan.

Q: What happens after I submit Form 627?

A: After you submit Form 627, the Assessor or Equalization Director will review the information provided and take appropriate actions to correct the errors or omissions in the assessment roll.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 627 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.