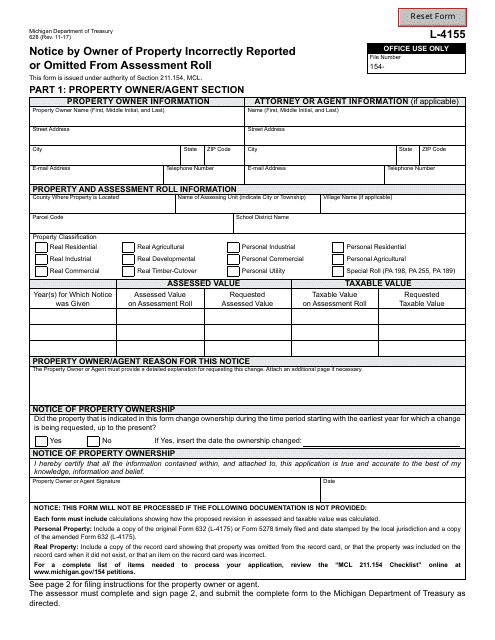

Form 628 Notice by Owner of Property Incorrectly Reported or Omitted From Assessment Roll - Michigan

What Is Form 628?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 628?

A: Form 628 is a notice by the owner of a property that has been incorrectly reported or omitted from the assessment roll in Michigan.

Q: Who can use Form 628?

A: Owners of properties in Michigan that have been incorrectly reported or omitted from the assessment roll can use Form 628.

Q: What is the purpose of Form 628?

A: The purpose of Form 628 is for property owners to notify the authorities about the incorrect reporting or omission of their property from the assessment roll in Michigan.

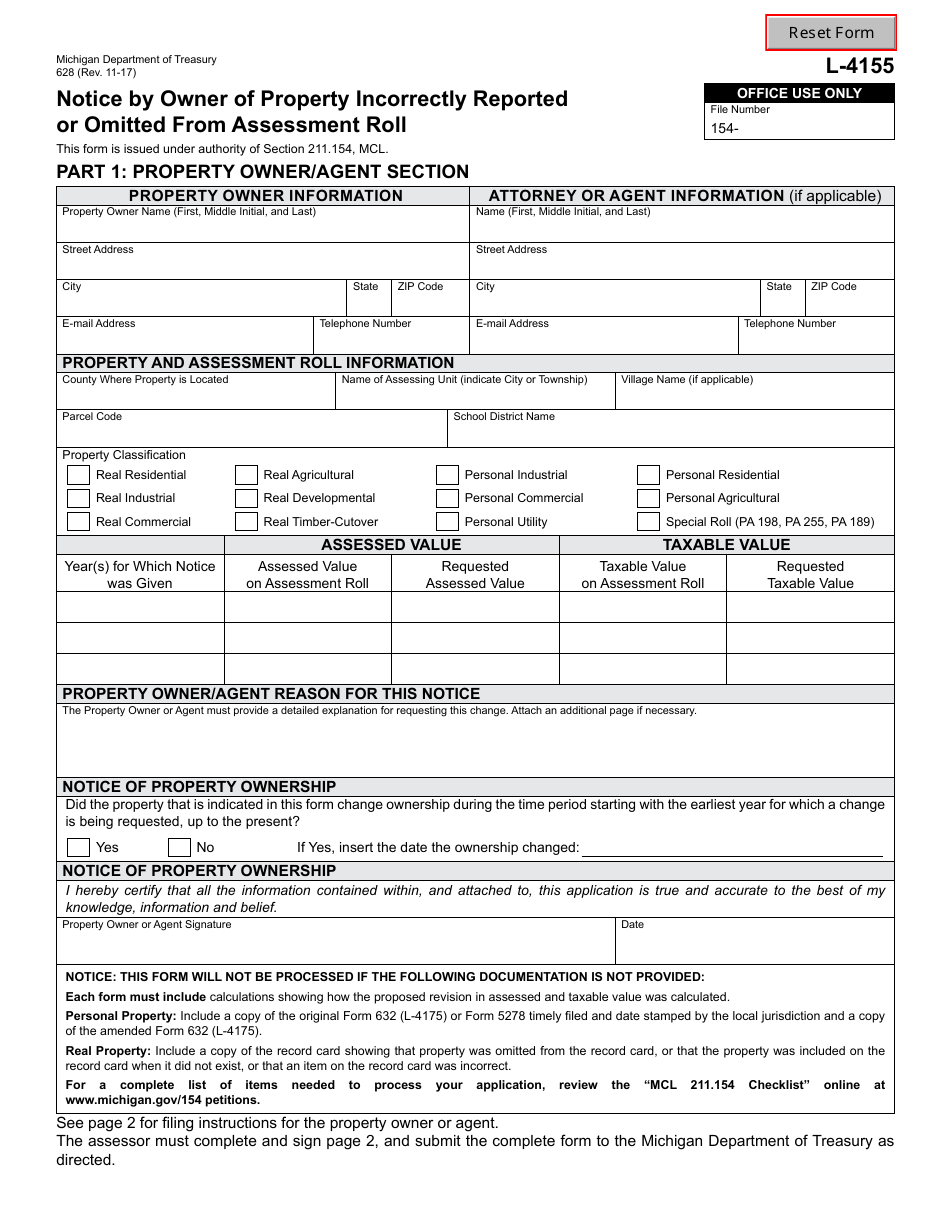

Q: What information is required on Form 628?

A: Form 628 requires the property owner to provide their contact information, details about the incorrectly reported or omitted property, and any supporting documentation.

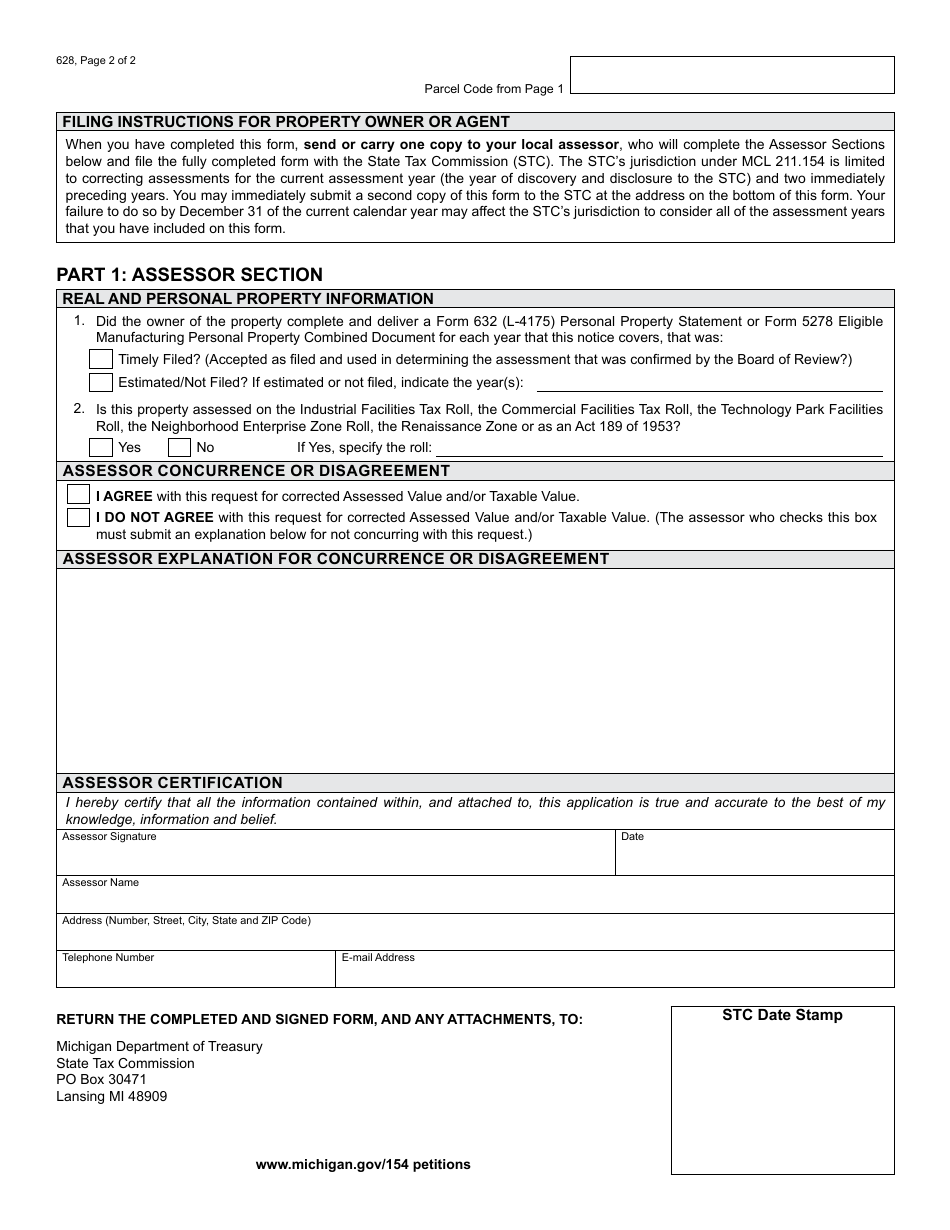

Q: What should I do with Form 628 once completed?

A: Once completed, the property owner should submit Form 628 to the local assessor's office in Michigan.

Q: Are there any fees to submit Form 628?

A: There should be no fees associated with submitting Form 628 to the local assessor's office in Michigan.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 628 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.