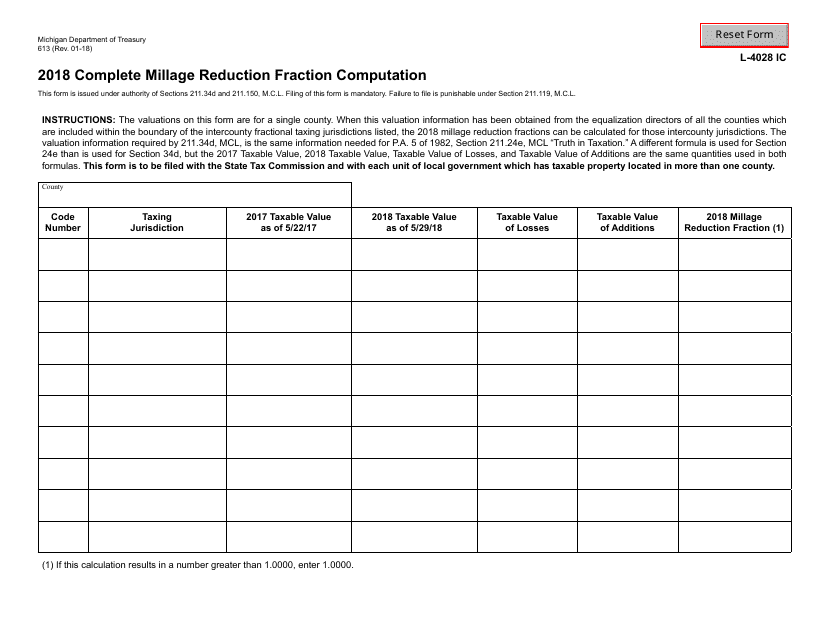

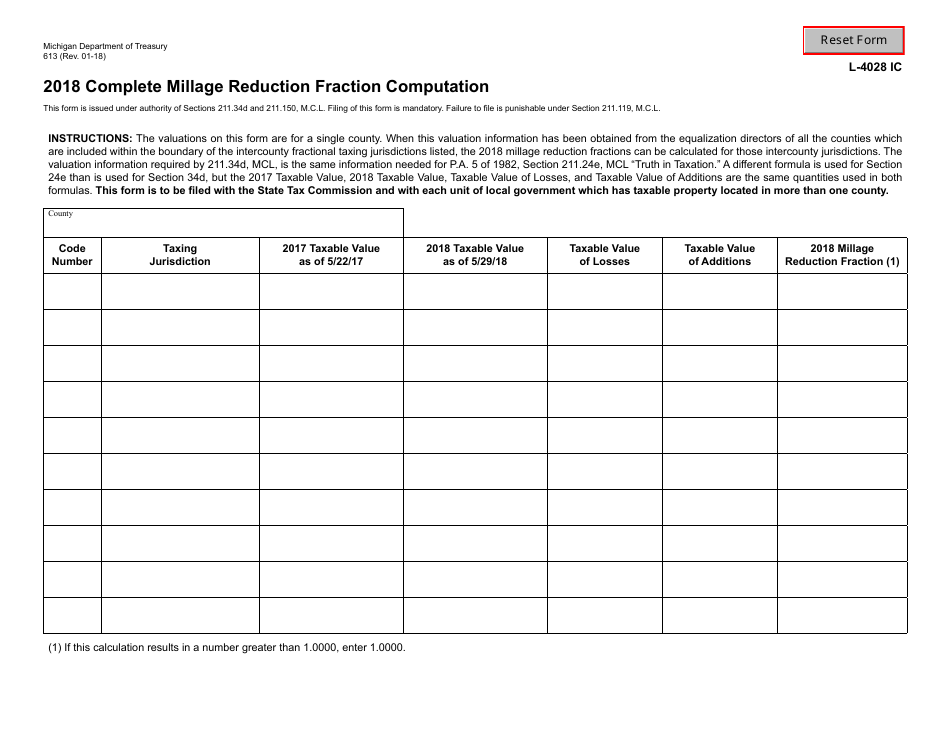

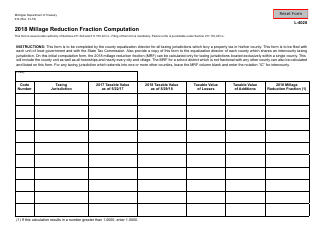

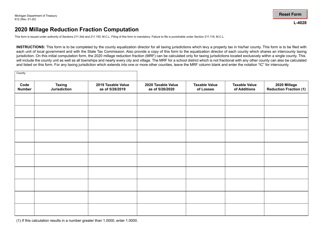

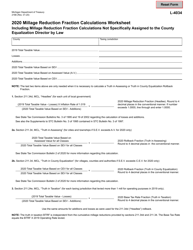

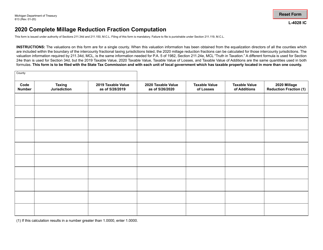

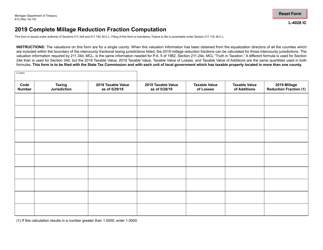

Form 613 Complete Millage Reduction Fraction Computation - Michigan

What Is Form 613?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 613?

A: Form 613 is a document used for calculating the Millage Reduction Fraction in Michigan.

Q: What is the Millage Reduction Fraction?

A: The Millage Reduction Fraction is a calculation used to determine the portion of a property's assessed value that is eligible for a reduction in property taxes.

Q: How do I complete Form 613?

A: To complete Form 613, you will need information about the property's taxable value, the millage rates in your locality, and any applicable reductions or exemptions.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 613 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.