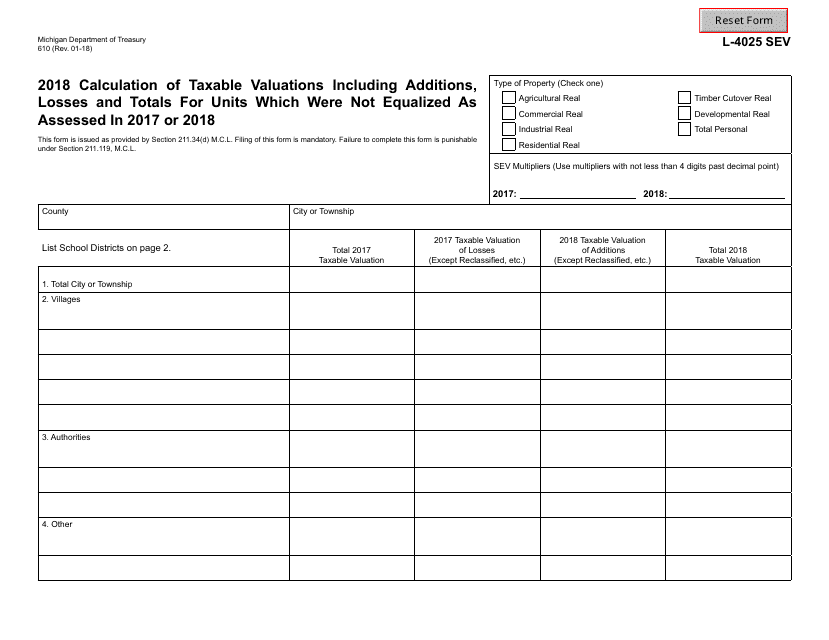

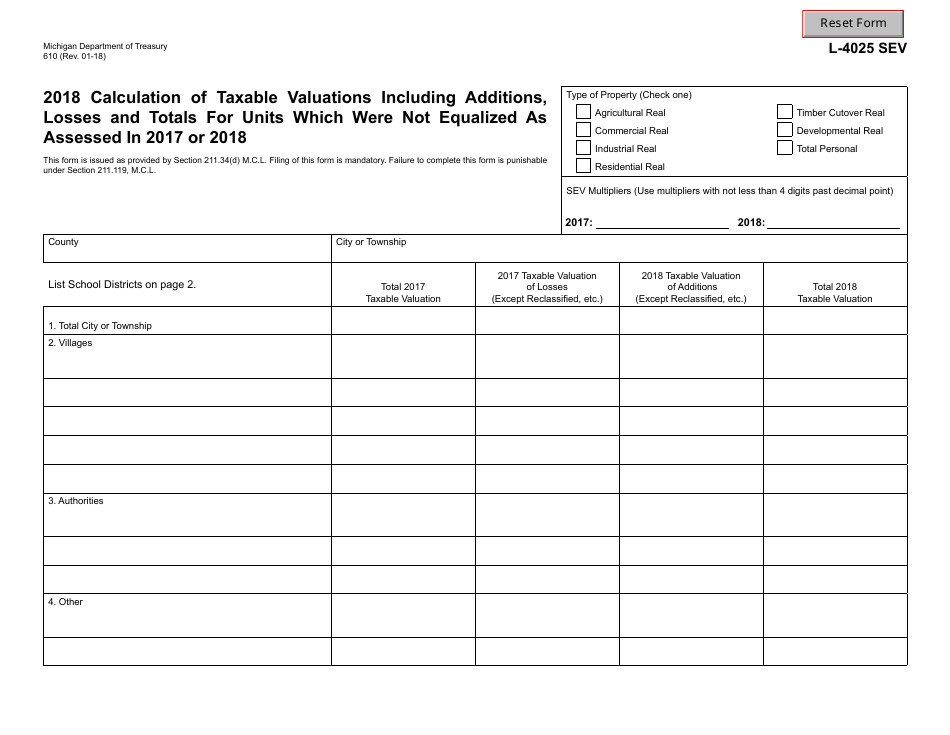

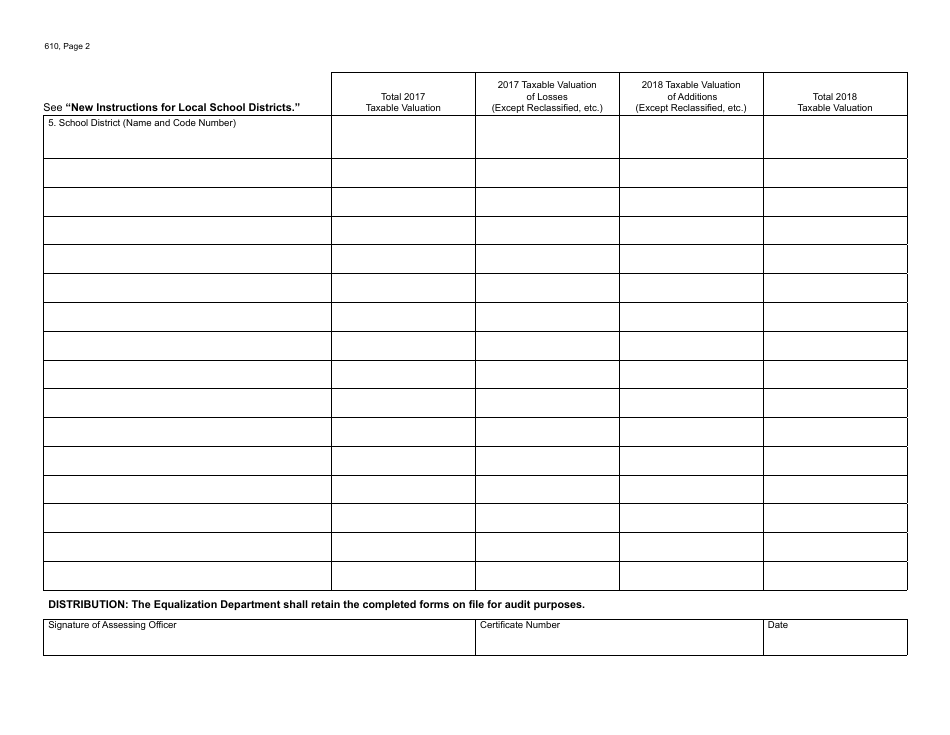

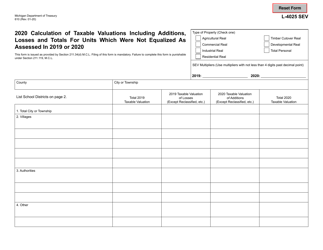

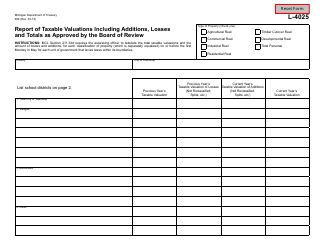

Form 610 Calculation of Taxable Valuations Including Additions, Losses and Totals for Units Which Were Not Equalized as Assessed in 2017 or 2018 - Michigan

What Is Form 610?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 610?

A: Form 610 is a document used in Michigan to calculate the taxable valuations for units that were not equalized as assessed in 2017 or 2018.

Q: What does Form 610 include?

A: Form 610 includes calculations of taxable valuations, additions, losses, and totals for units that were not equalized as assessed in 2017 or 2018.

Q: Who uses Form 610?

A: Form 610 is used by individuals or organizations in Michigan who need to calculate the taxable valuations for units that were not equalized as assessed in 2017 or 2018.

Q: Why is Form 610 important?

A: Form 610 is important because it helps determine the taxable valuations for units that were not equalized as assessed in 2017 or 2018, which affects the amount of taxes that need to be paid.

Q: How do I fill out Form 610?

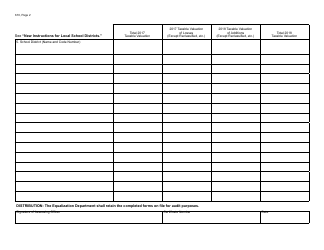

A: To fill out Form 610, you will need to provide the necessary information about the units that were not equalized as assessed in 2017 or 2018, and calculate the taxable valuations, additions, losses, and totals according to the instructions provided on the form.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 610 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.