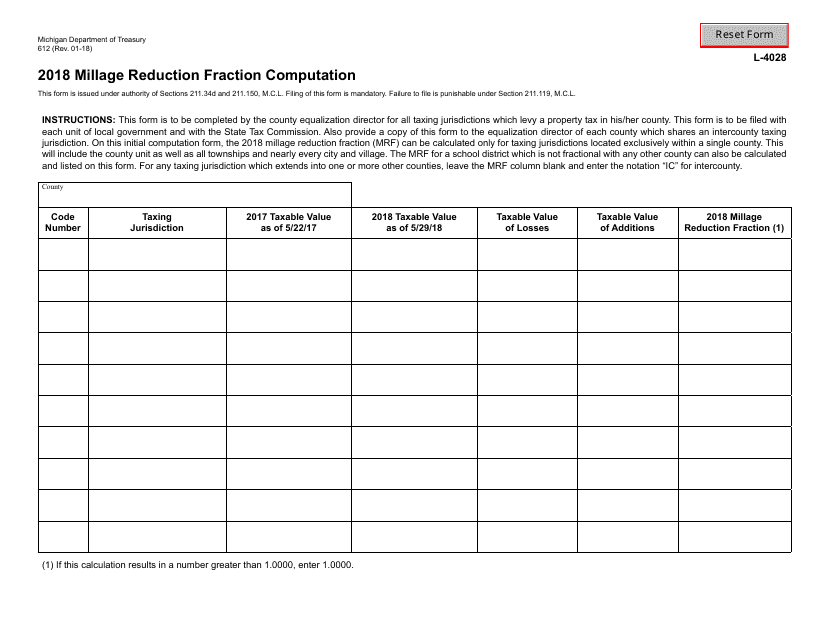

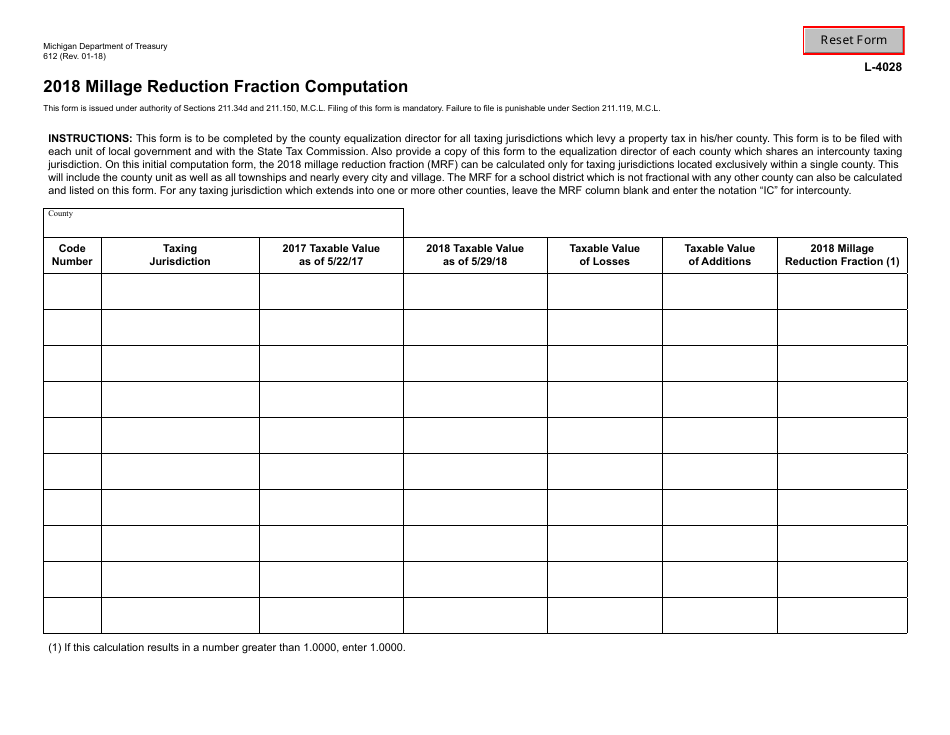

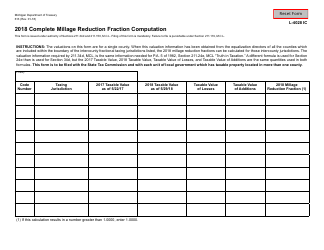

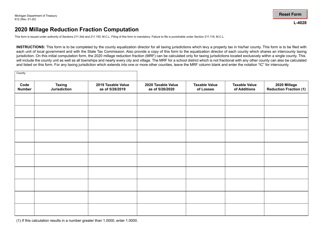

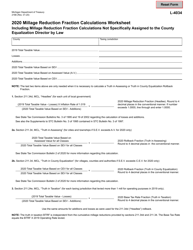

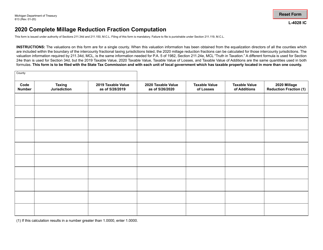

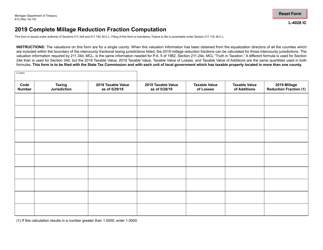

Form 612 Millage Reduction Fraction Computation - Michigan

What Is Form 612?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 612?

A: Form 612 is a form used for calculating the Millage Reduction Fraction in Michigan.

Q: What is the Millage Reduction Fraction?

A: The Millage Reduction Fraction is a fraction that determines the amount of property tax reduction that a school district is eligible for.

Q: Who needs to fill out Form 612?

A: School districts in Michigan need to fill out Form 612 to calculate the Millage Reduction Fraction.

Q: What is the purpose of the Millage Reduction Fraction?

A: The purpose is to provide property tax relief to school districts that have high property values.

Q: When should Form 612 be filed?

A: Form 612 should be filed annually by February 14th.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 612 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.