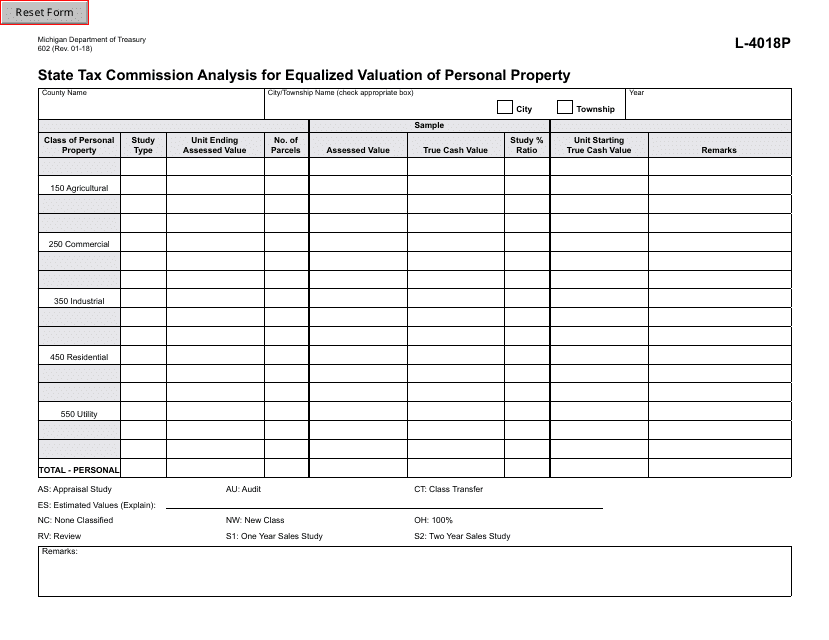

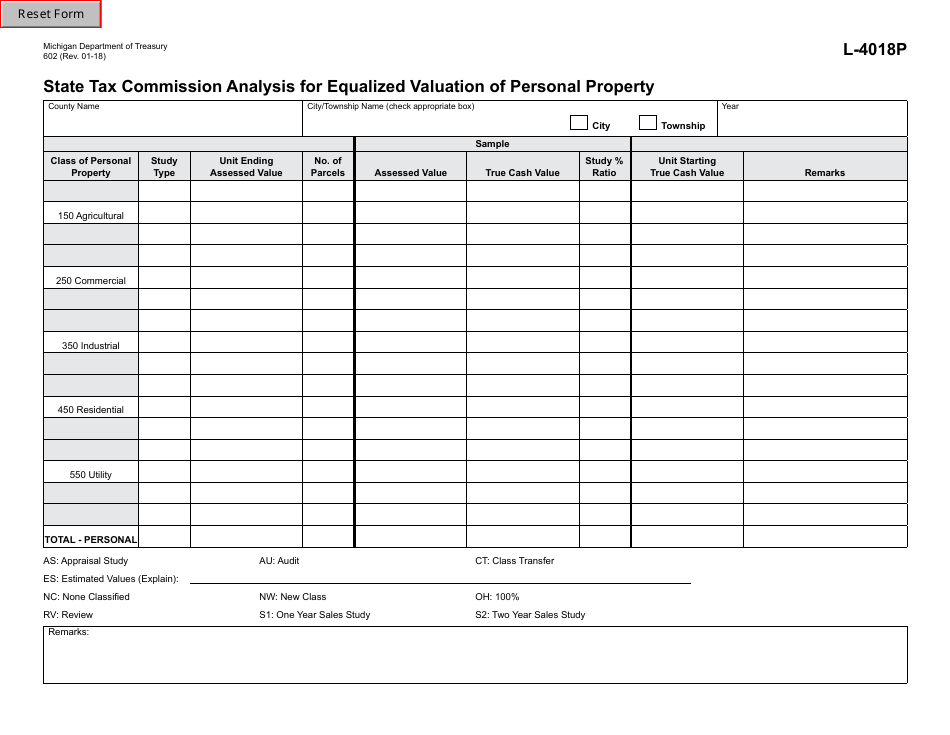

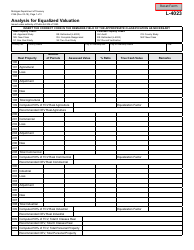

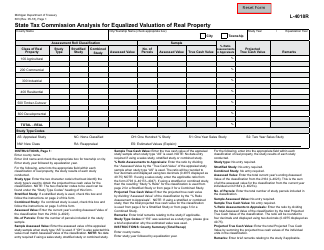

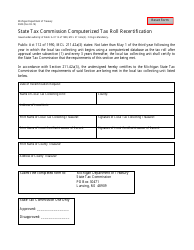

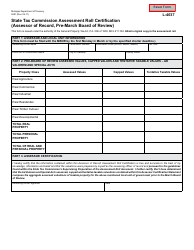

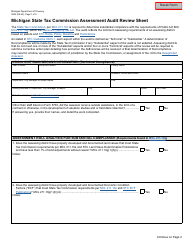

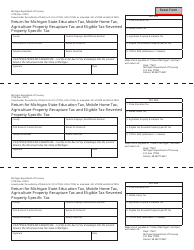

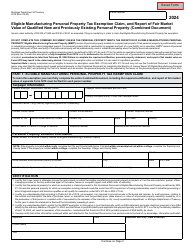

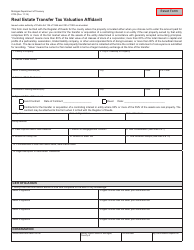

Form 602 State Tax Commission Analysis for Equalized Valuation of Personal Property - Michigan

What Is Form 602?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 602?

A: Form 602 is a State Tax Commission analysis for equalized valuation of personal property in Michigan.

Q: What is the purpose of Form 602?

A: The purpose of Form 602 is to provide an analysis of the equalized valuation of personal property for tax assessment purposes in Michigan.

Q: Who uses Form 602?

A: Form 602 is used by the State Tax Commission in Michigan.

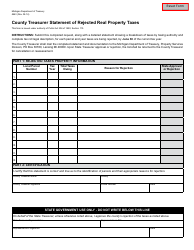

Q: What does the analysis on Form 602 entail?

A: The analysis on Form 602 includes the equalized valuation of personal property in various tax districts.

Q: Why is equalized valuation important for personal property?

A: Equalized valuation ensures fair and equitable tax assessments for personal property across different tax districts in Michigan.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 602 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.