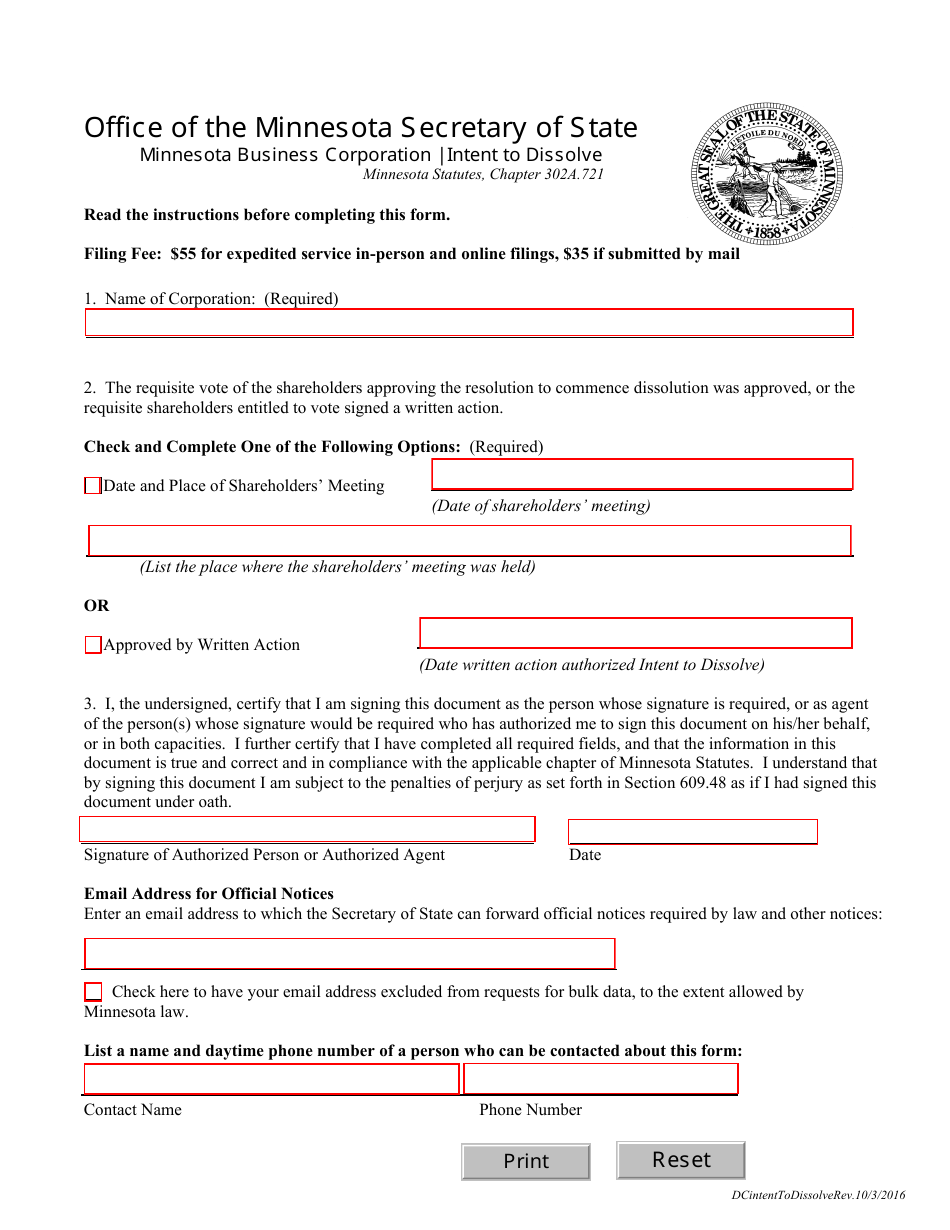

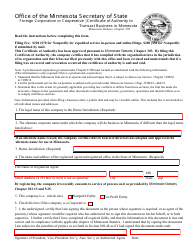

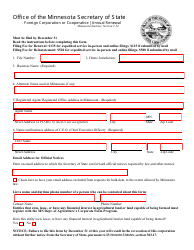

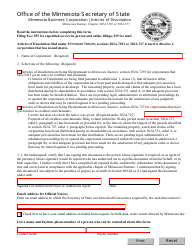

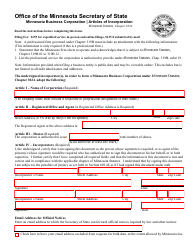

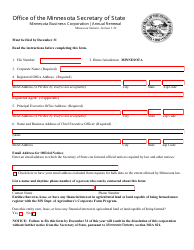

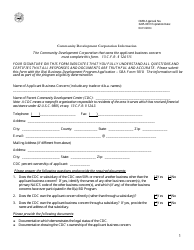

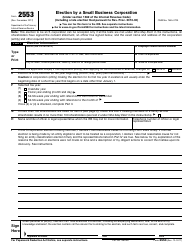

Minnesota Business Corporation Intent to Dissolve Form - Minnesota

Minnesota Business Corporation Intent to Dissolve Form is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

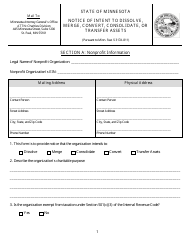

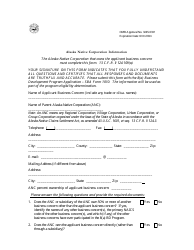

Q: What is the Minnesota Business Corporation Intent to Dissolve Form?

A: The Minnesota Business Corporation Intent to Dissolve Form is a legal document that a corporation in Minnesota can file to officially declare their intent to dissolve and wind up their business operations.

Q: Why would a corporation in Minnesota want to dissolve?

A: There are various reasons why a corporation in Minnesota may want to dissolve, such as the company reaching the end of its planned lifespan, an owner's decision to retire or exit the business, or financial difficulties.

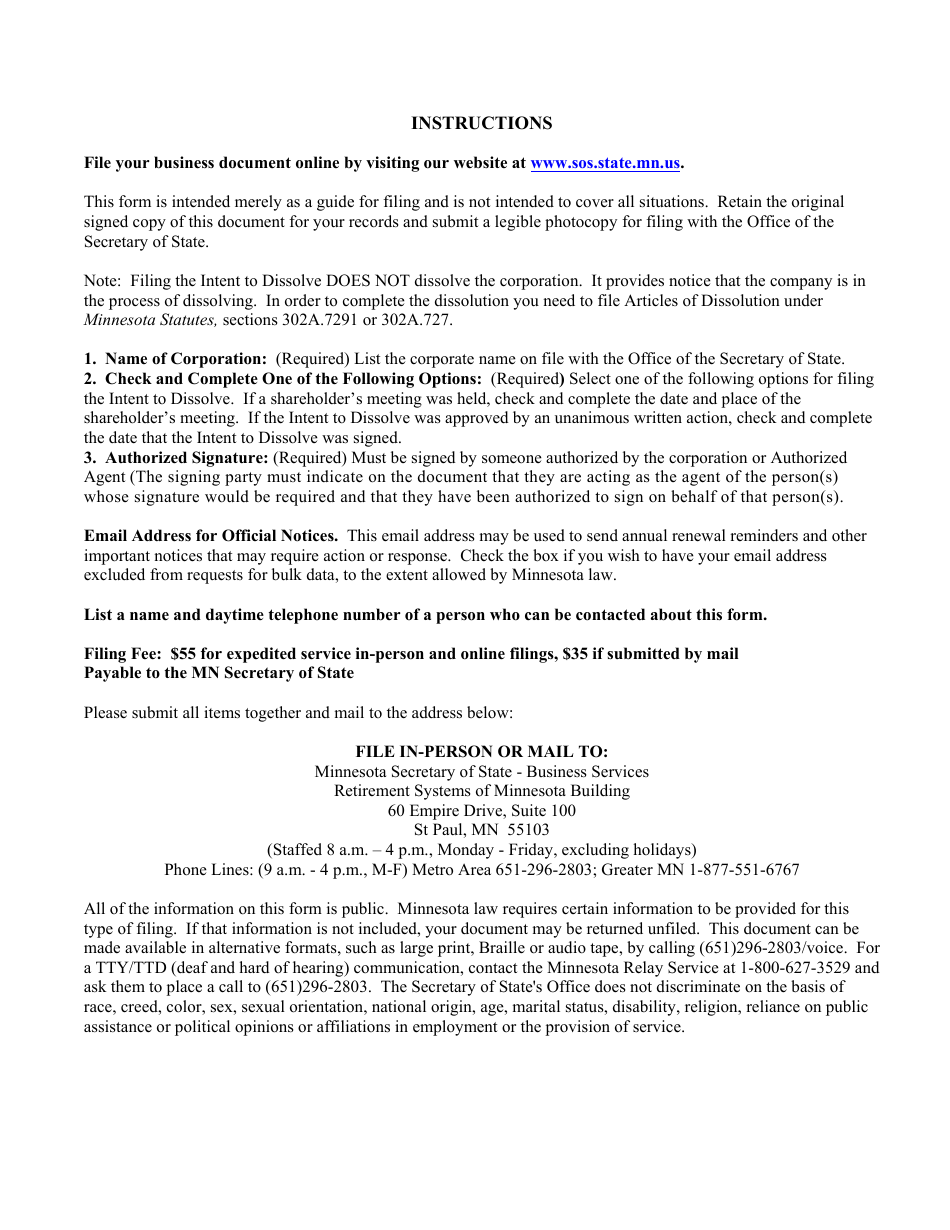

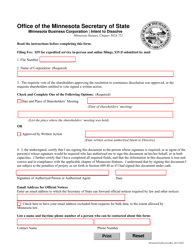

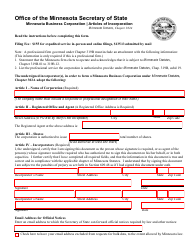

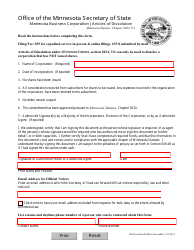

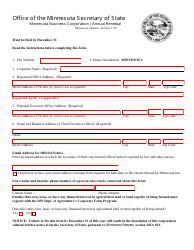

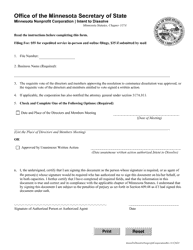

Q: What is the process for filing the Minnesota Business Corporation Intent to Dissolve Form?

A: To file the form, the corporation's board of directors must adopt a resolution to dissolve, and then the form must be completed and filed with the Minnesota Secretary of State's office.

Q: Are there any fees associated with filing the Minnesota Business Corporation Intent to Dissolve Form?

A: Yes, there is a filing fee that must be submitted along with the form. The fee amount can vary, so it's best to check with the Minnesota Secretary of State's office for the current fee schedule.

Q: What happens after the Minnesota Business Corporation Intent to Dissolve Form is filed?

A: Once the form is filed and accepted by the Minnesota Secretary of State's office, the corporation will enter into a winding up period where they will complete any remaining business activities, settle outstanding debts and obligations, and distribute remaining assets to shareholders.

Q: Are there any legal requirements or obligations that the corporation must fulfill during the winding up period?

A: Yes, during the winding up period, the corporation must continue to fulfill any legal requirements or obligations, such as filing tax returns, paying taxes, and maintaining records.

Q: Can a corporation in Minnesota change its mind after filing the Intent to Dissolve form?

A: Yes, if the corporation decides to continue its business operations after filing the Intent to Dissolve form, they can withdraw the dissolution by filing a Withdrawal of Intent to Dissolve form with the Minnesota Secretary of State's office.

Form Details:

- Released on October 3, 2016;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.