This version of the form is not currently in use and is provided for reference only. Download this version of

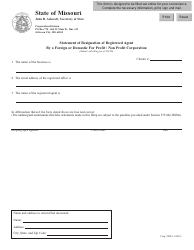

Form MO-MS

for the current year.

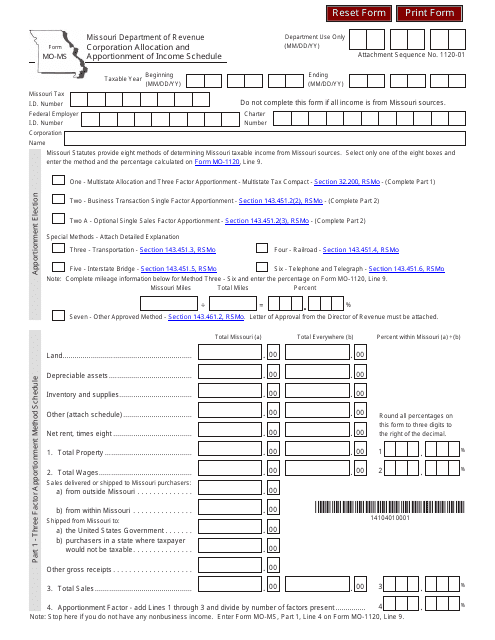

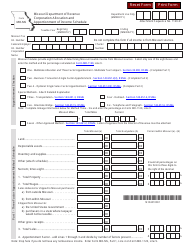

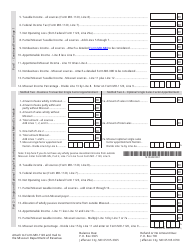

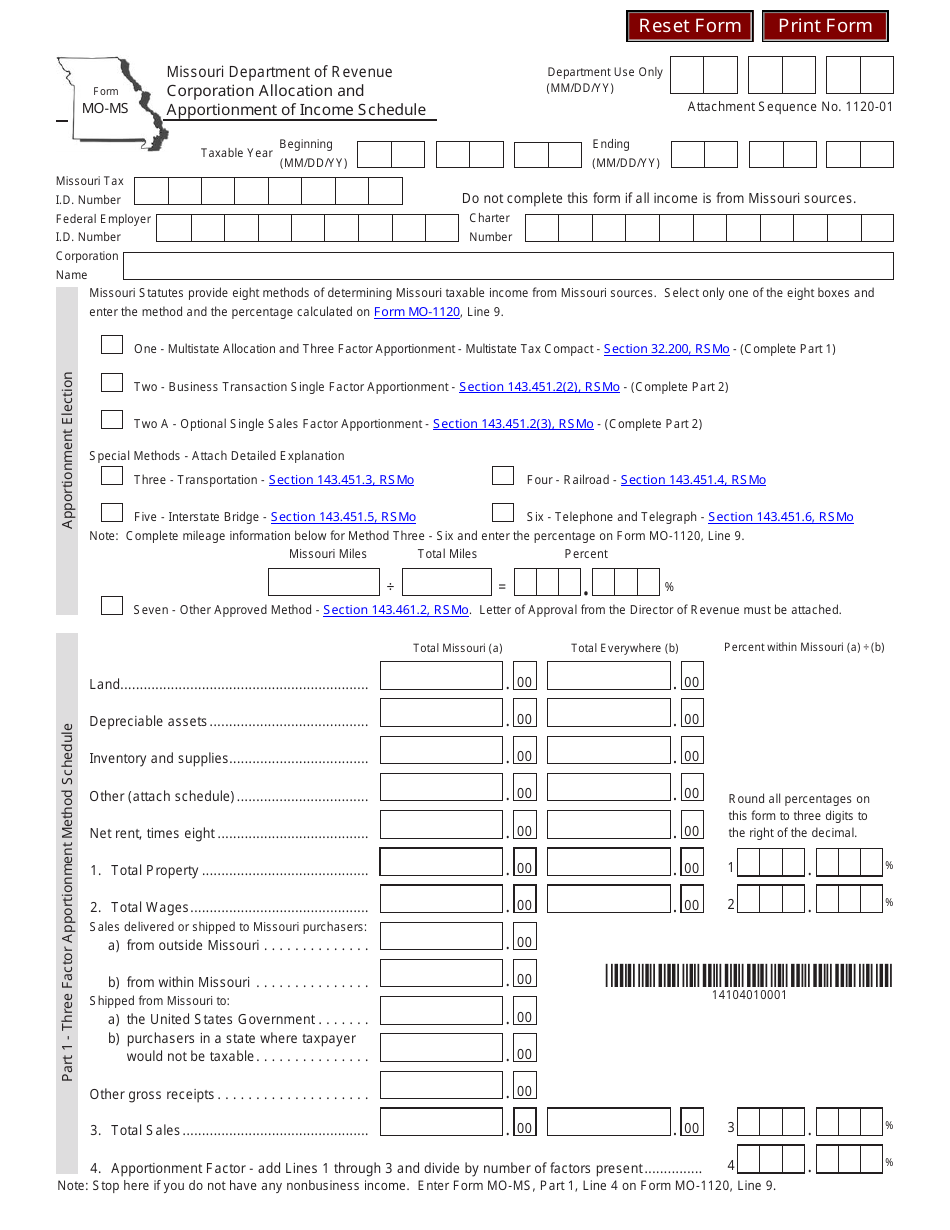

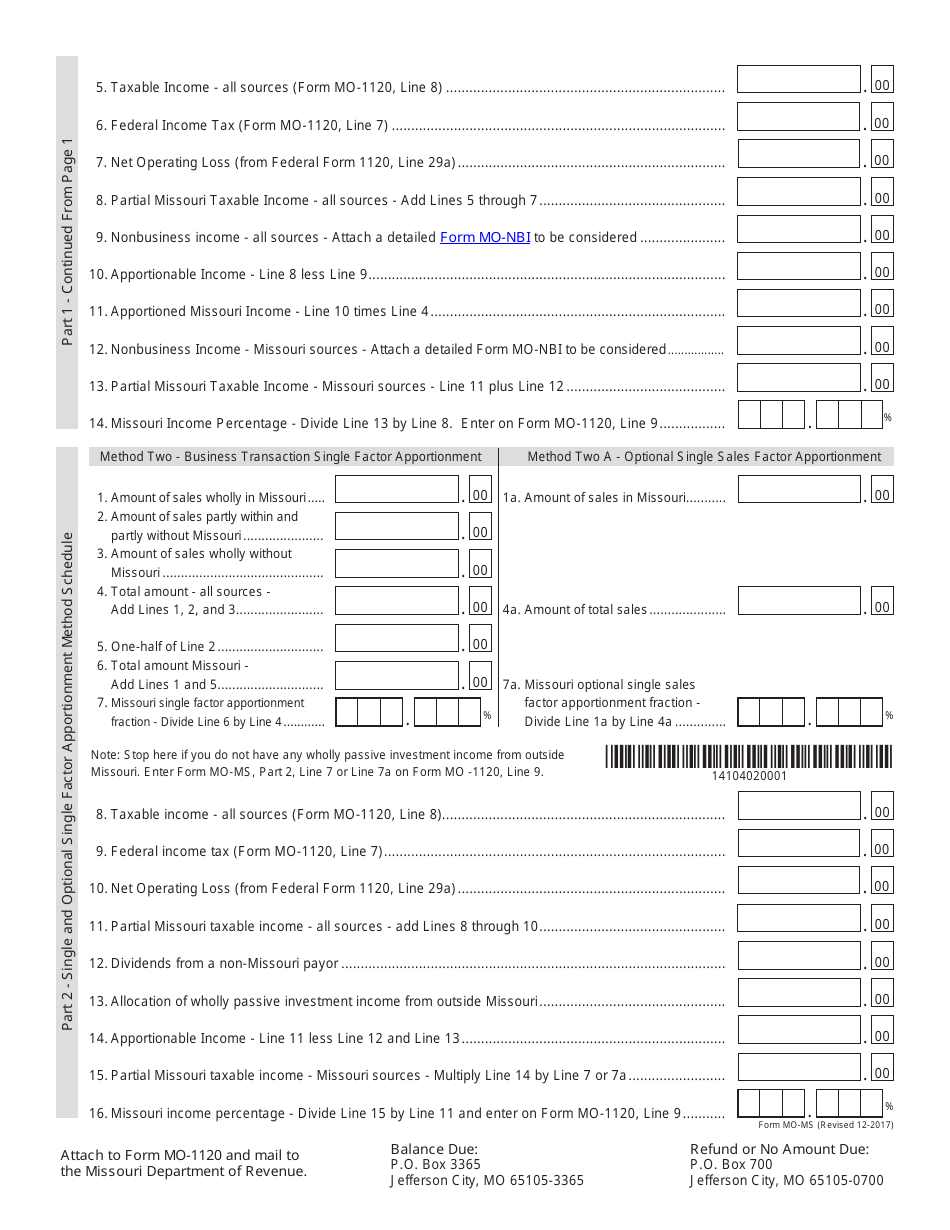

Form MO-MS Corporation Allocation and Apportionment of Income Schedule - Missouri

What Is Form MO-MS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the MO-MS Corporation Allocation and Apportionment of Income Schedule?

A: The purpose of this schedule is to calculate the allocation and apportionment of income for corporations in Missouri.

Q: Who is required to file the MO-MS Corporation Allocation and Apportionment of Income Schedule?

A: Corporations that have income from sources both within and outside of Missouri are required to file this schedule.

Q: What information is required to complete the MO-MS Corporation Allocation and Apportionment of Income Schedule?

A: The schedule requires information about a corporation's total income, income from Missouri sources, and the factors used to allocate and apportion income.

Q: What is the purpose of allocating and apportioning income?

A: Allocating and apportioning income determines how much of a corporation's income is attributable to Missouri and subject to Missouri income tax.

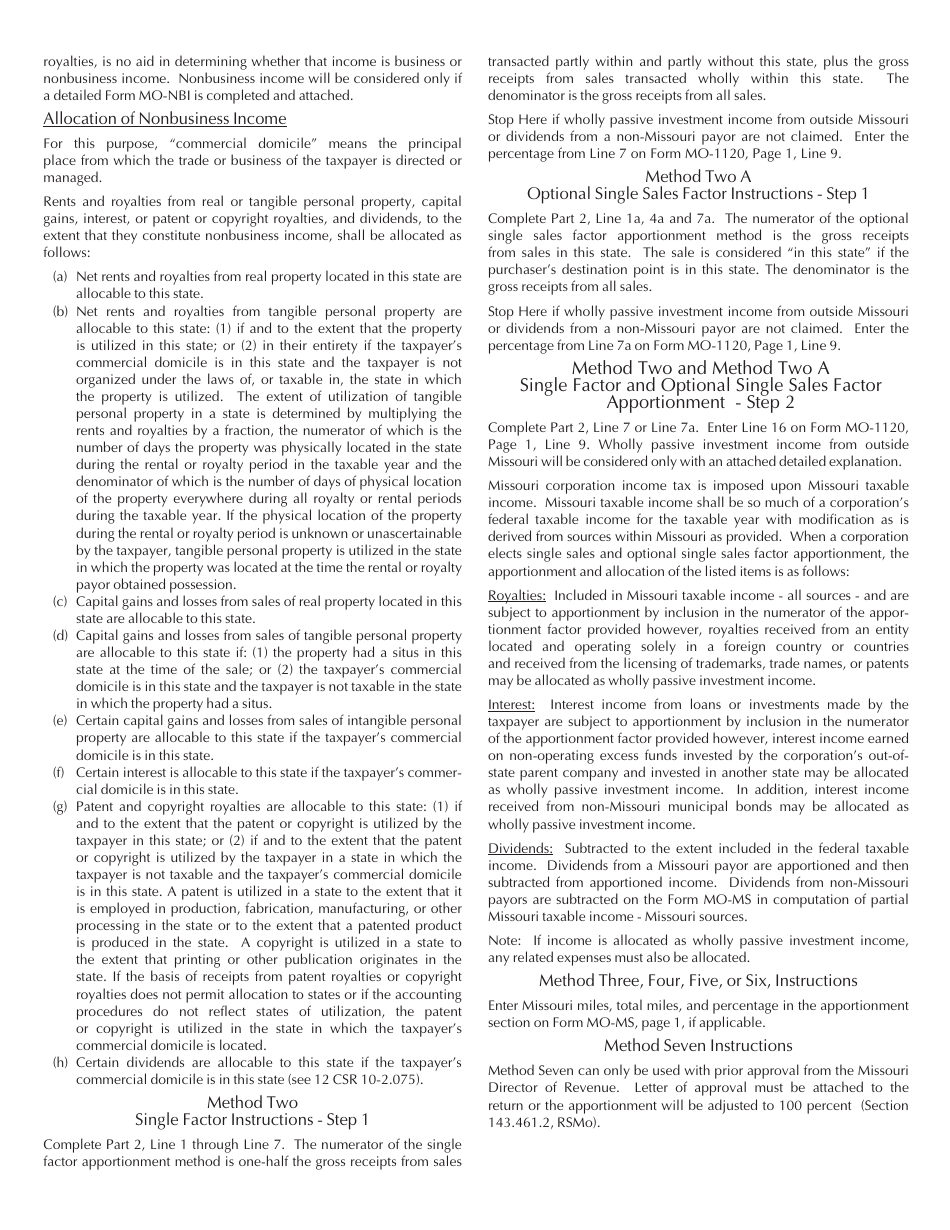

Q: Are there any special rules or formulas for allocating and apportioning income in Missouri?

A: Yes, Missouri has specific rules and formulas for determining how income is allocated and apportioned based on factors like sales, property, and payroll within the state.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-MS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.