This version of the form is not currently in use and is provided for reference only. Download this version of

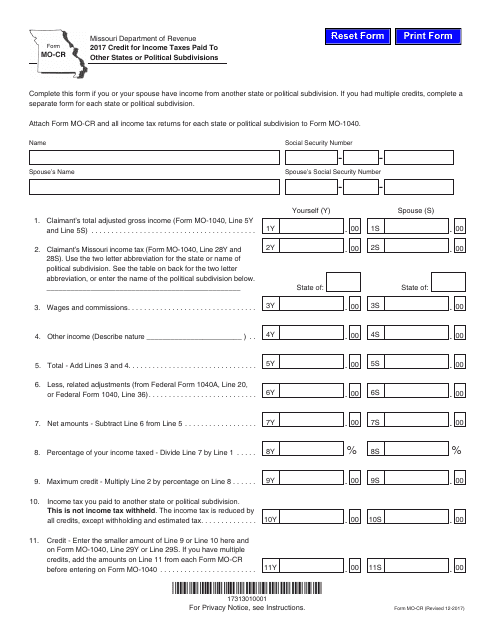

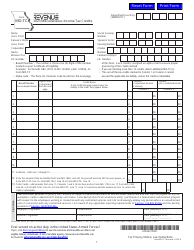

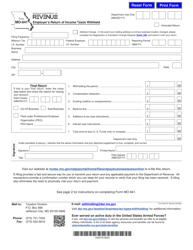

Form MO-CR

for the current year.

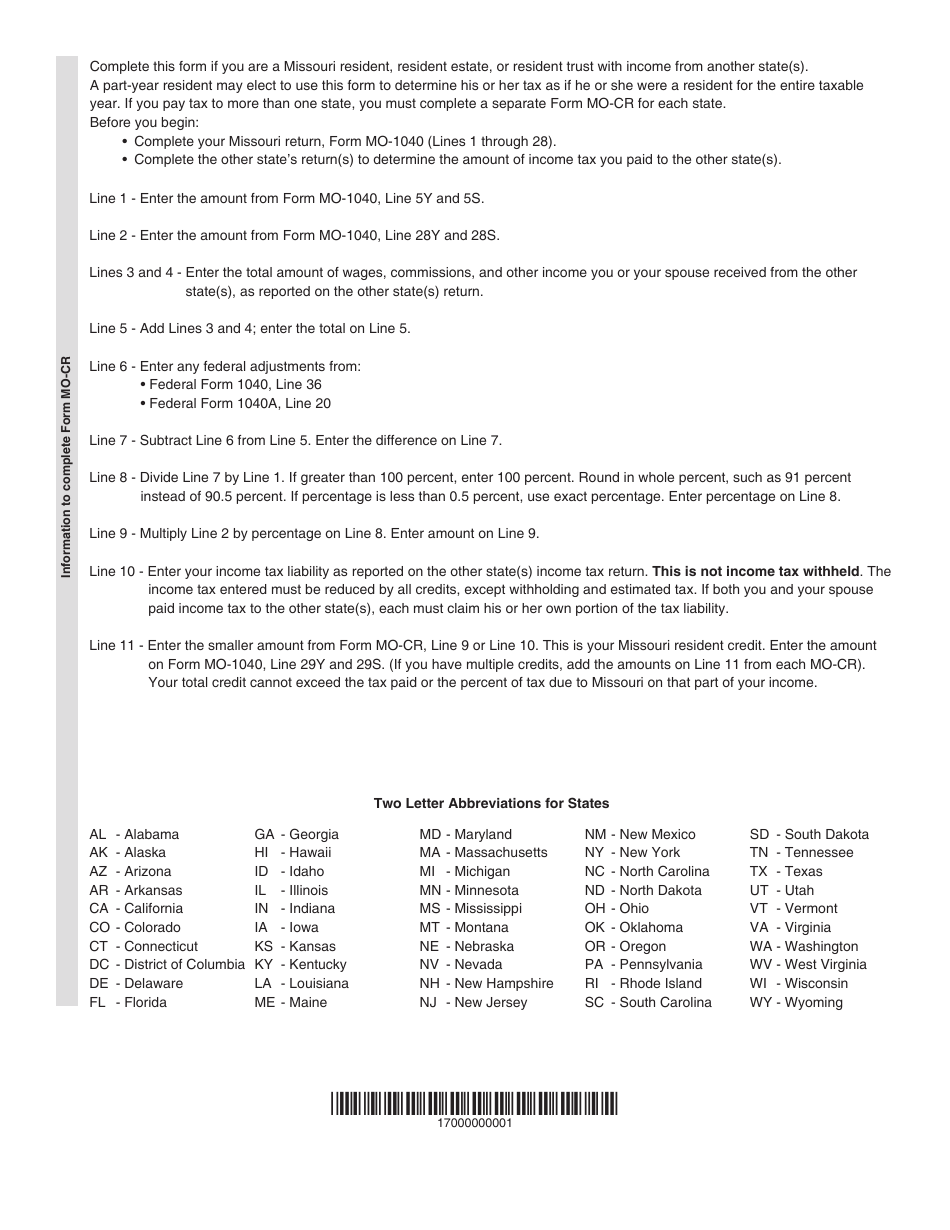

Form MO-CR Credit for Income Taxes Paid to Other States or Political Subdivisions - Missouri

What Is Form MO-CR?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-CR?

A: Form MO-CR is the Credit for Income Taxes Paid to Other States or Political Subdivisions form in Missouri.

Q: What is the purpose of Form MO-CR?

A: The purpose of Form MO-CR is to claim a credit for income taxes paid to other states or political subdivisions.

Q: Who should file Form MO-CR?

A: Any taxpayer who paid income taxes to other states or political subdivisions and wants to claim a credit for that amount on their Missouri tax return should file Form MO-CR.

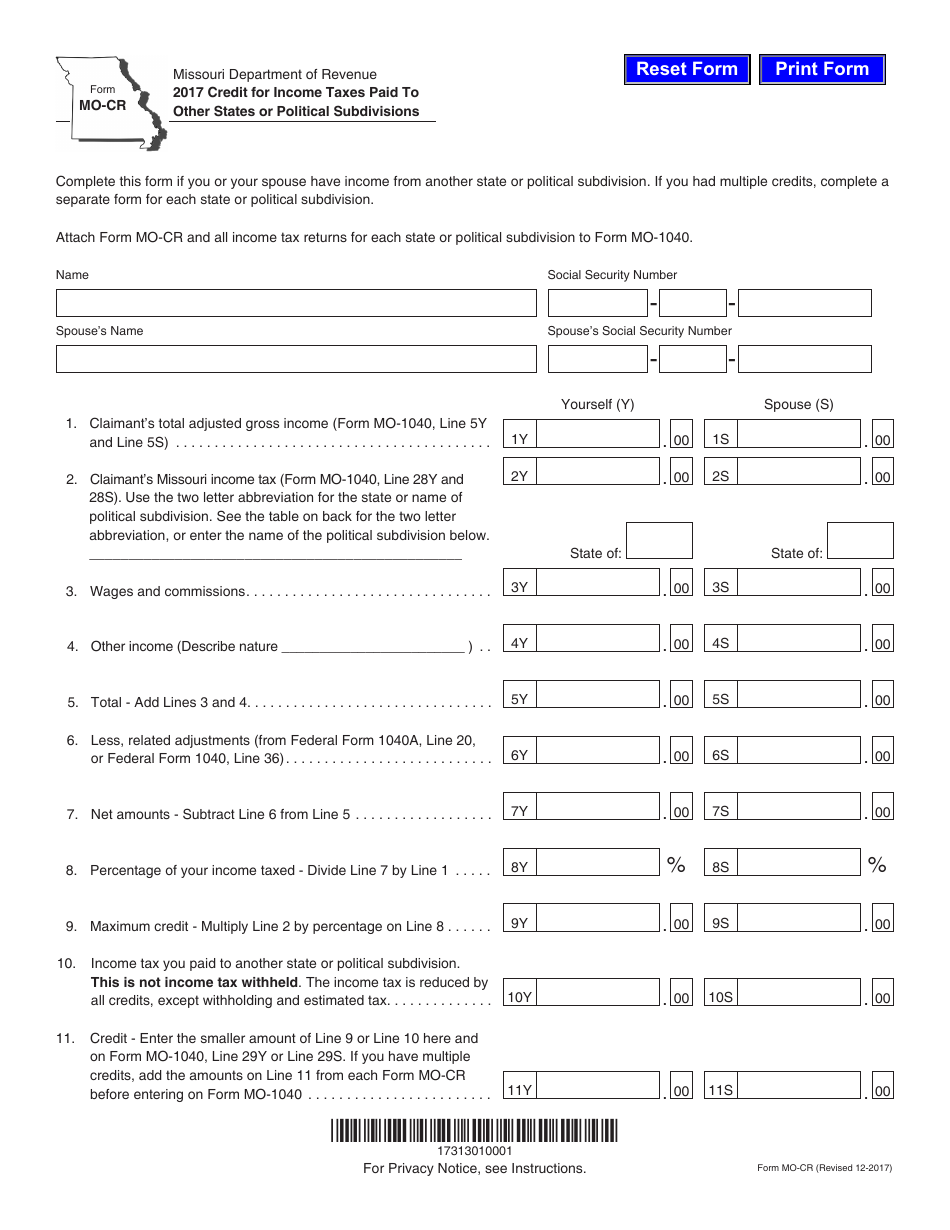

Q: How do I fill out Form MO-CR?

A: You need to enter information about the income taxes you paid to other states or political subdivisions and calculate the credit amount.

Q: When is the deadline to file Form MO-CR?

A: The deadline to file Form MO-CR is the same as the deadline for your Missouri tax return, which is usually April 15th.

Q: Is there a fee to file Form MO-CR?

A: No, there is no fee to file Form MO-CR.

Q: What supporting documents do I need to attach to Form MO-CR?

A: You may need to attach copies of your tax returns or other documentation to support the income taxes paid to other states or political subdivisions.

Q: Will I receive a refund if I claim the credit on Form MO-CR?

A: If the credit amount exceeds your Missouri tax liability, you may be eligible for a refund.

Q: Can I amend my Missouri tax return to claim the credit if I didn't include it on my original return?

A: Yes, you can file an amended Missouri tax return using Form MO-1040X to claim the credit if you didn't include it on your original return.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-CR by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.