This version of the form is not currently in use and is provided for reference only. Download this version of

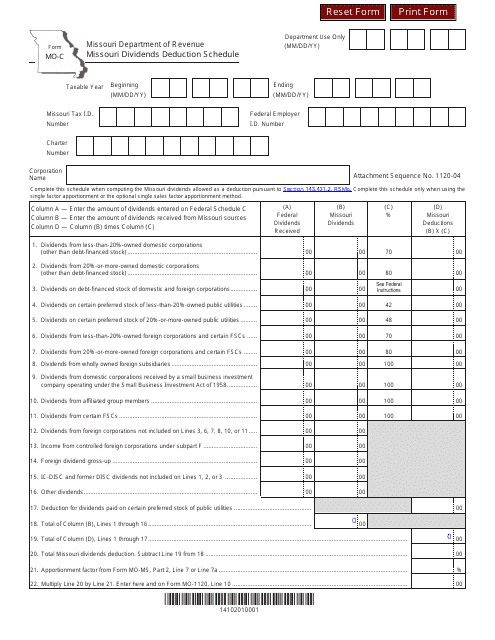

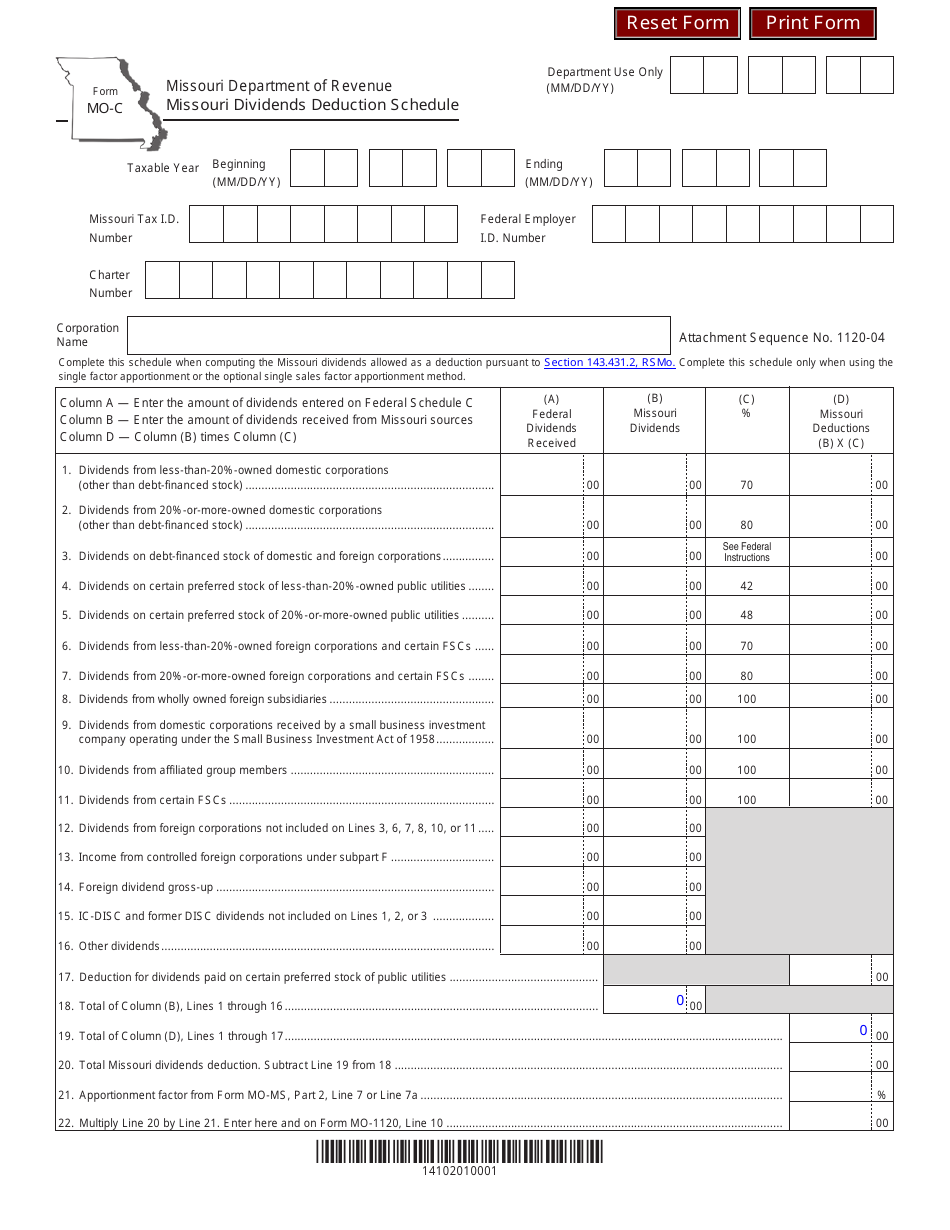

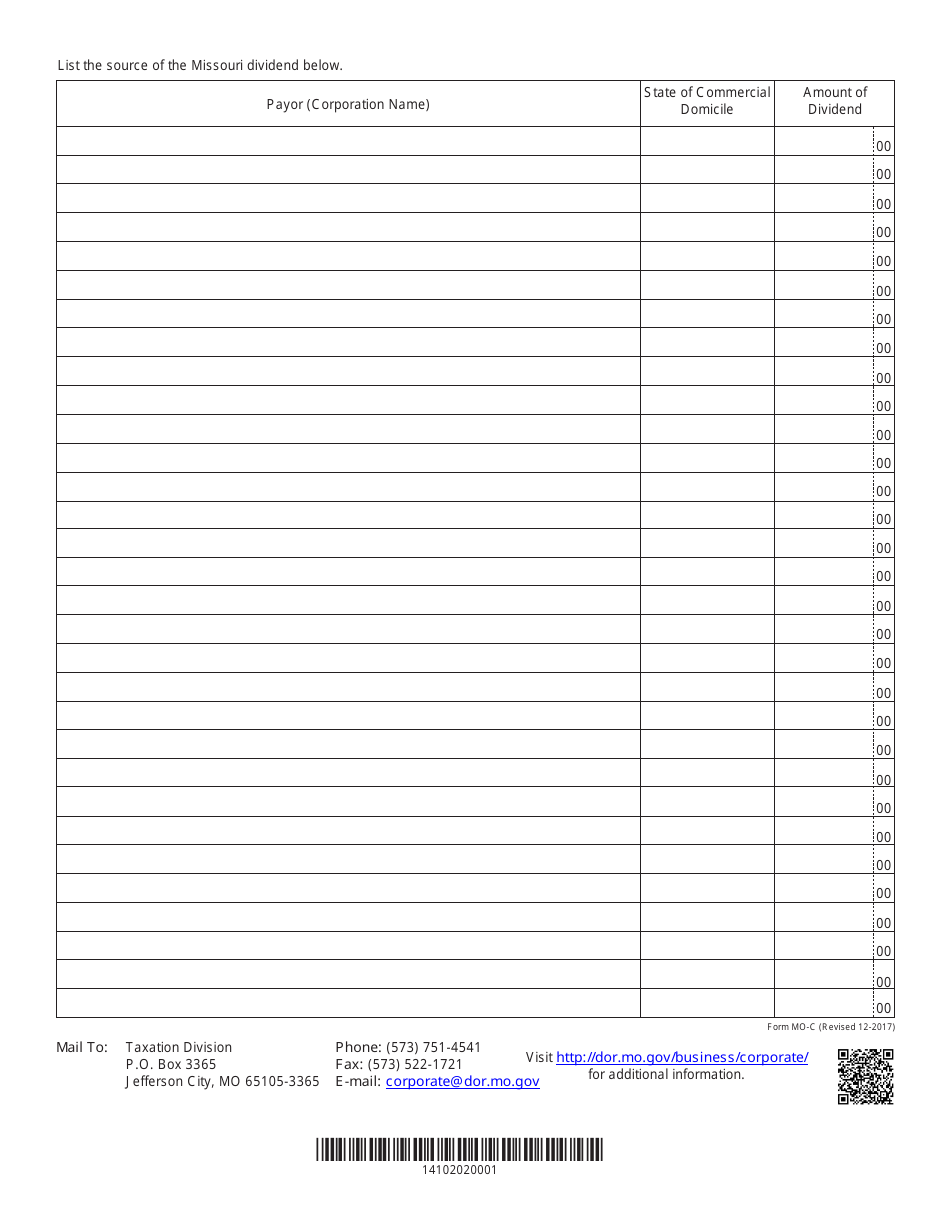

Form MO-C

for the current year.

Form MO-C Missouri Dividends Deduction Schedule - Missouri

What Is Form MO-C?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-C?

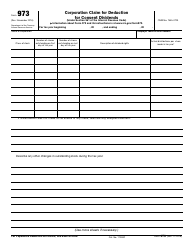

A: Form MO-C is the Missouri Dividends Deduction Schedule.

Q: What is the purpose of Form MO-C?

A: Form MO-C is used to claim a deduction for qualified dividends received.

Q: Who needs to file Form MO-C?

A: Residents of Missouri who received qualified dividends need to file Form MO-C.

Q: What are qualified dividends?

A: Qualified dividends are dividends that meet certain IRS requirements.

Q: What information is required on Form MO-C?

A: Form MO-C requires you to provide information about the qualified dividends you received, including the payer's name and federal identification number.

Q: When is the deadline to file Form MO-C?

A: The deadline to file Form MO-C is the same as your Missouri income tax return, which is generally April 15th.

Q: Can I e-file Form MO-C?

A: Yes, you can e-file Form MO-C if you are filing your Missouri income tax return electronically.

Q: Is there a filing fee for Form MO-C?

A: No, there is no filing fee for Form MO-C.

Q: What should I do if I have additional questions about Form MO-C?

A: If you have additional questions about Form MO-C, you can contact the Missouri Department of Revenue for assistance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-C by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.