This version of the form is not currently in use and is provided for reference only. Download this version of

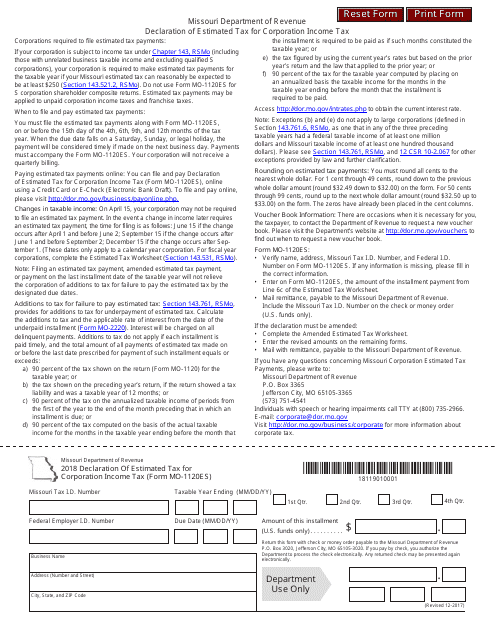

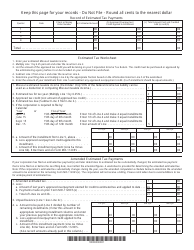

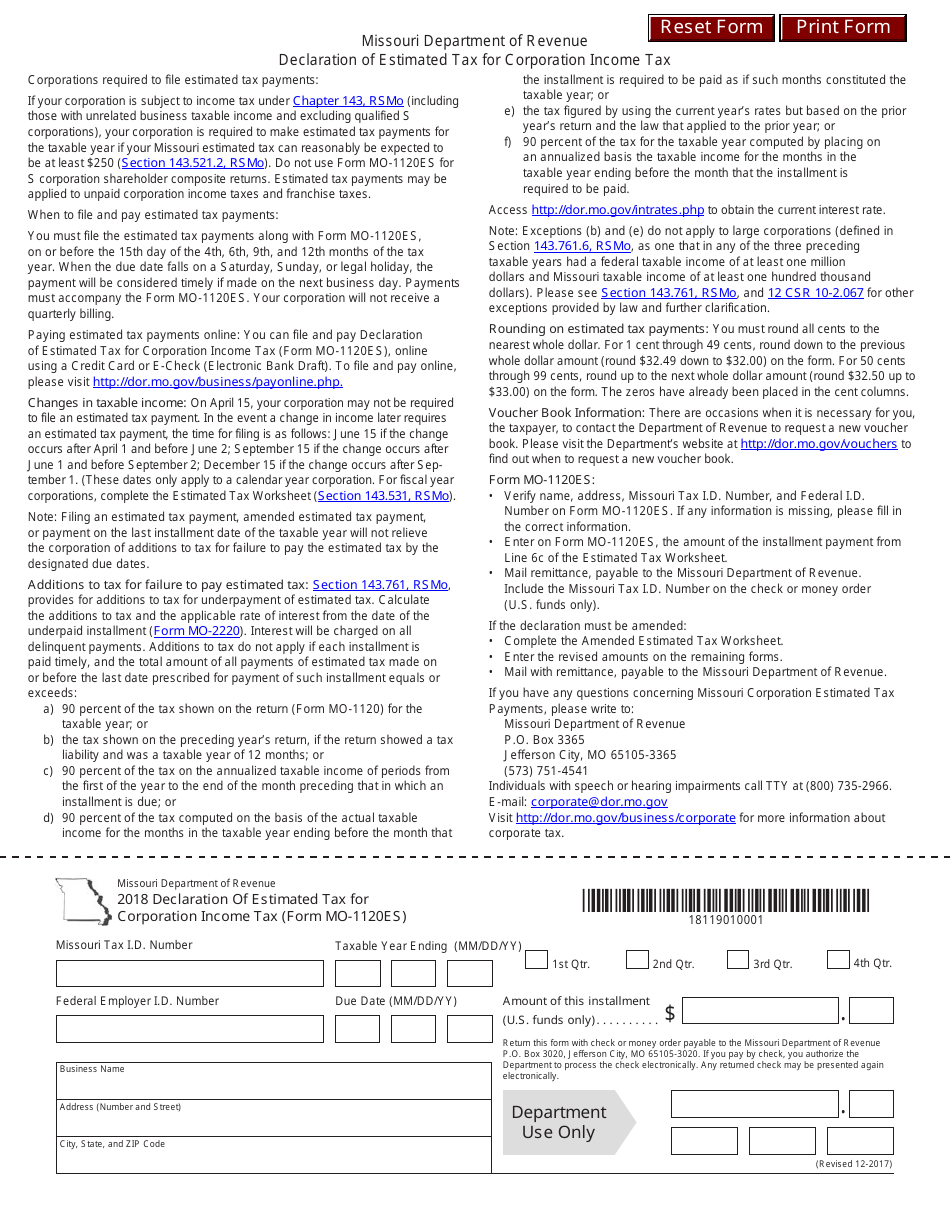

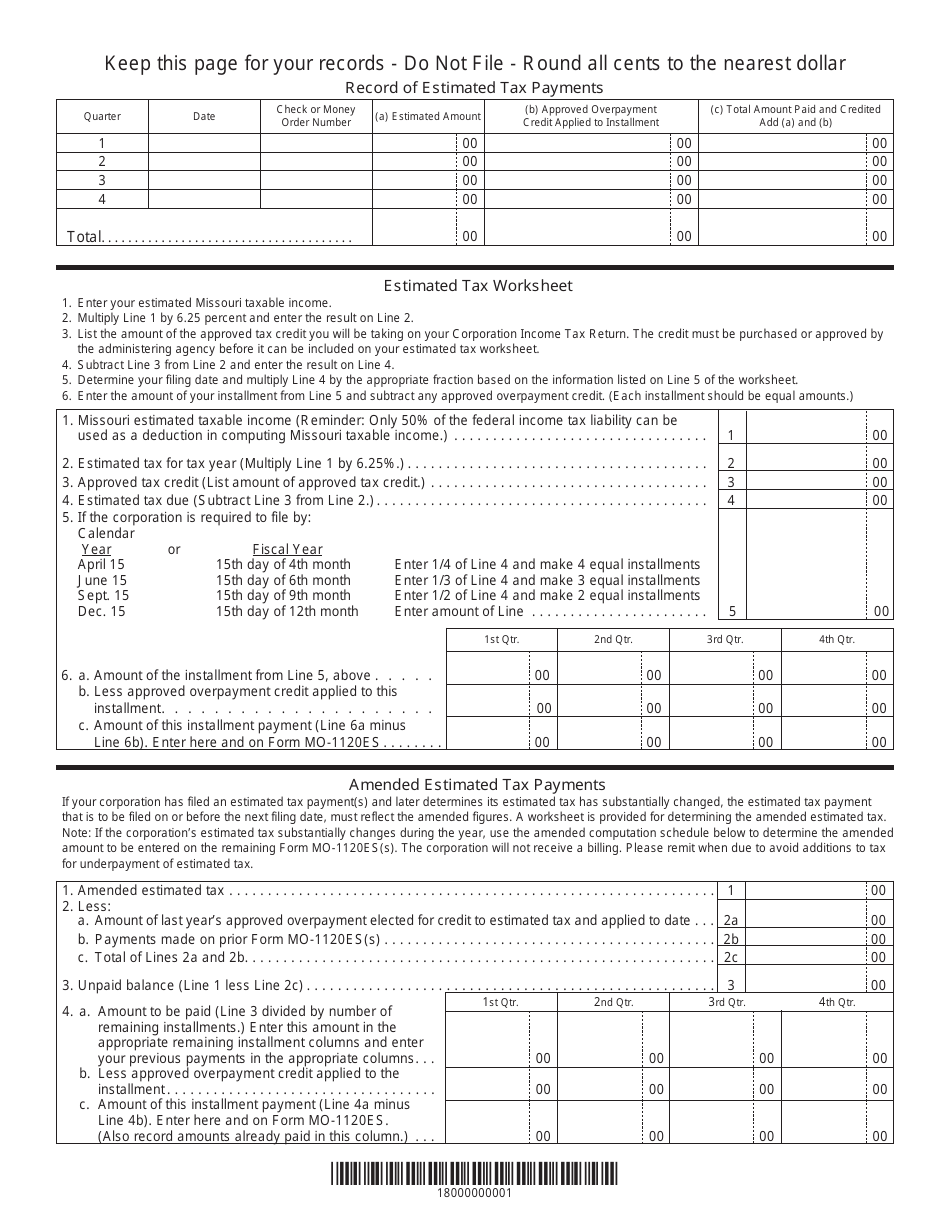

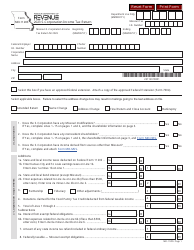

Form MO-1120ES

for the current year.

Form MO-1120ES Declaration of Estimated Tax for Corporation Income Tax - Missouri

What Is Form MO-1120ES?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120ES?

A: Form MO-1120ES is the Declaration of Estimated Tax for Corporation Income Tax in Missouri.

Q: Who needs to file Form MO-1120ES?

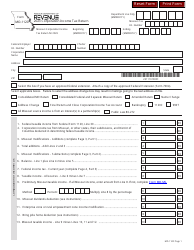

A: Corporations in Missouri who expect to owe more than $200 in income tax for the tax year must file Form MO-1120ES.

Q: What is the purpose of Form MO-1120ES?

A: The purpose of Form MO-1120ES is to estimate and pay the required amount of estimated tax for the tax year.

Q: When is Form MO-1120ES due?

A: Form MO-1120ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120ES by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.