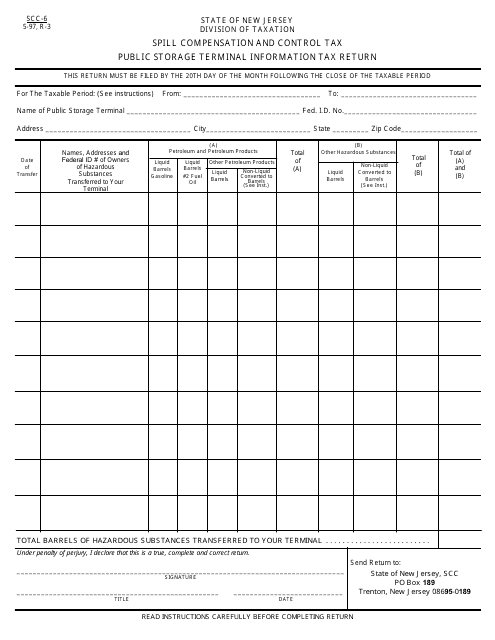

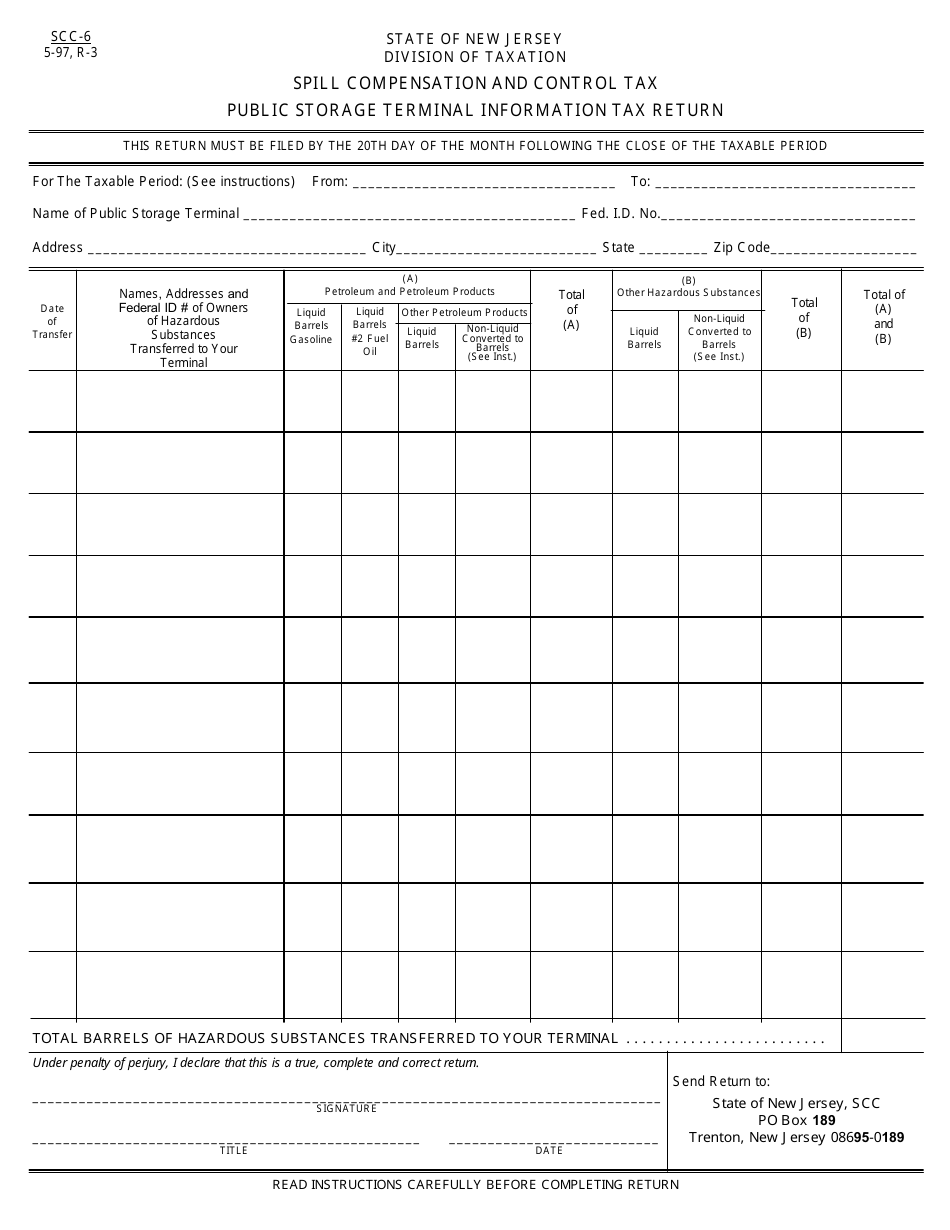

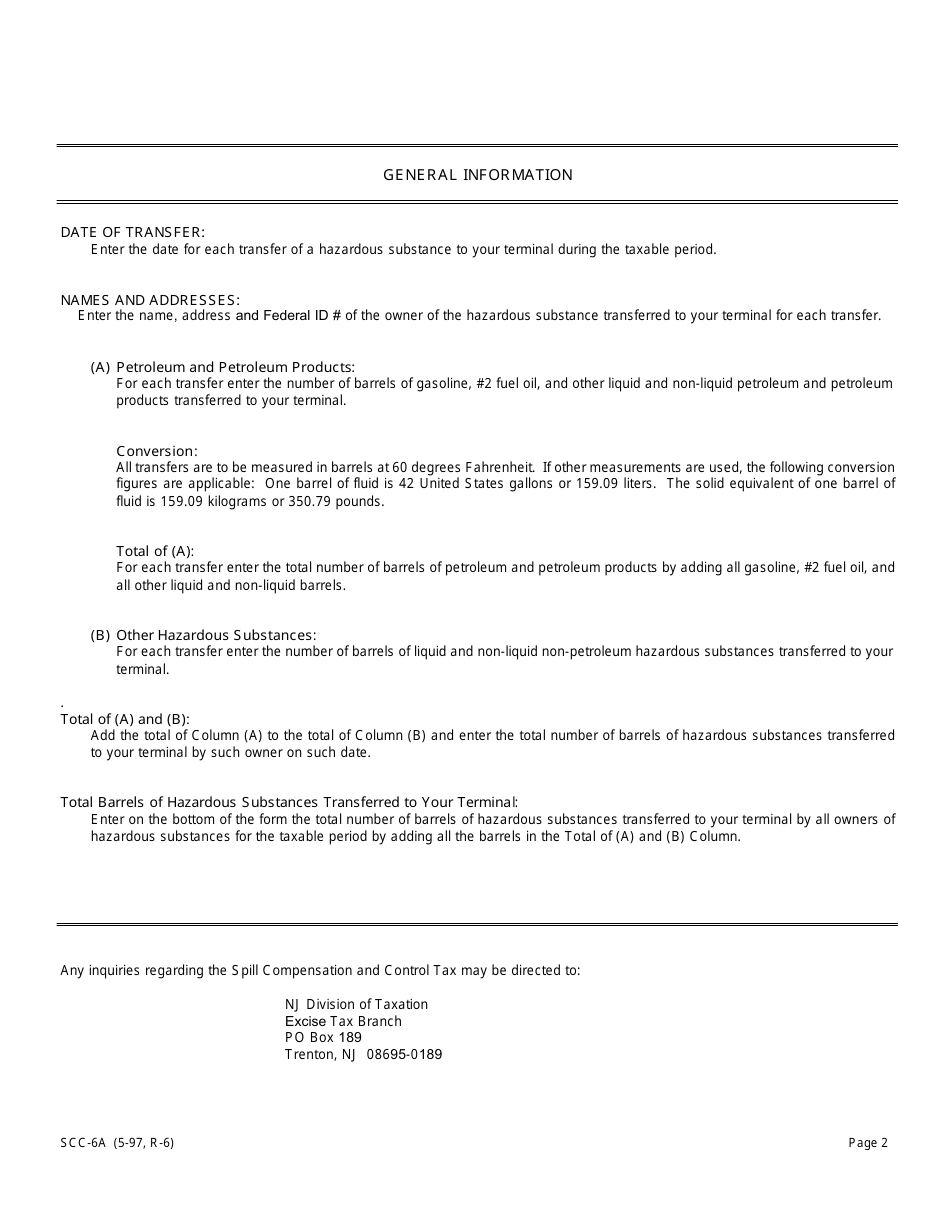

Form SCC-6 Public Storage Terminal Information Tax Return - New Jersey

What Is Form SCC-6?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

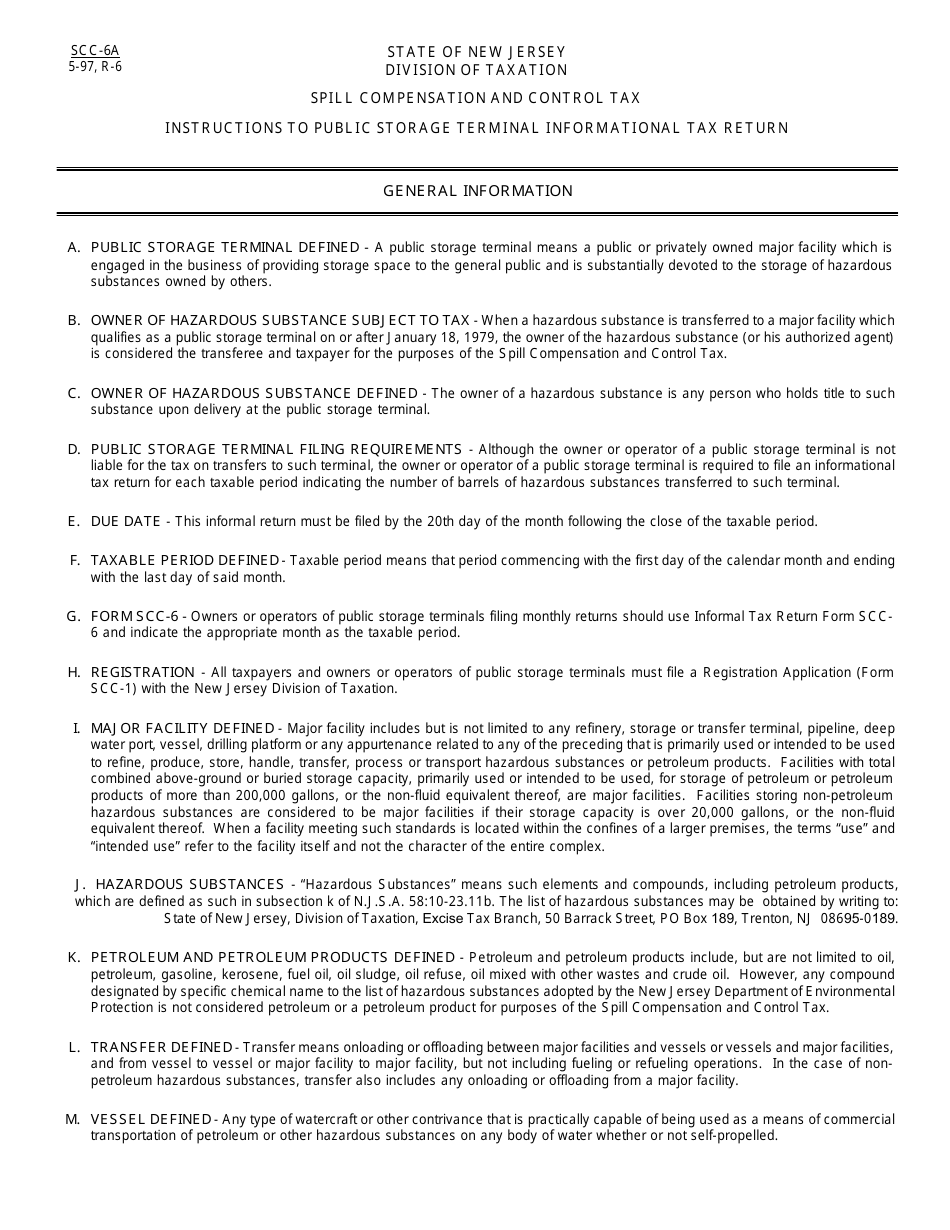

Q: What is the SCC-6 Public Storage Terminal Information Tax Return?

A: The SCC-6 Public Storage Terminal Information Tax Return is a tax form used in the state of New Jersey to report information about public storage terminals.

Q: Who needs to file the SCC-6 Public Storage Terminal Information Tax Return?

A: Any person or company operating a public storage terminal in New Jersey is required to file the SCC-6 form.

Q: What information is required to be reported on the SCC-6 form?

A: The SCC-6 form requires reporting details such as the location of the storage terminal, the number of storage spaces, and the average monthly rental charge per storage space.

Q: When is the deadline to file the SCC-6 Public Storage Terminal Information Tax Return?

A: The SCC-6 form must be filed annually by February 20th.

Q: Are there any penalties for late or non-filing of the SCC-6 form?

A: Yes, there are penalties for late or non-filing of the SCC-6 form. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on May 1, 1997;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-6 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.