This version of the form is not currently in use and is provided for reference only. Download this version of

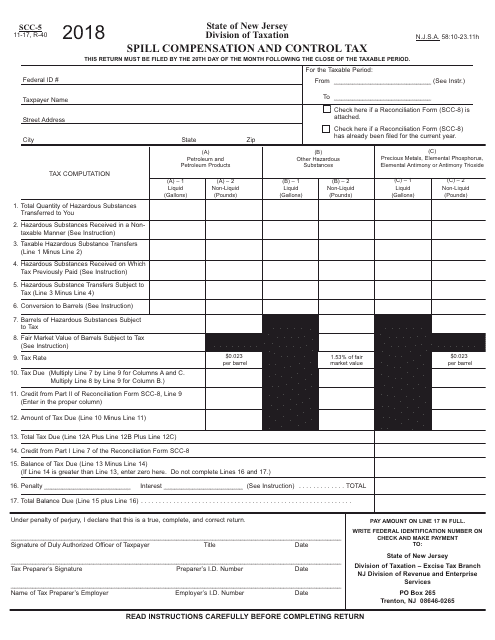

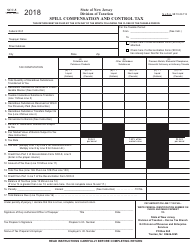

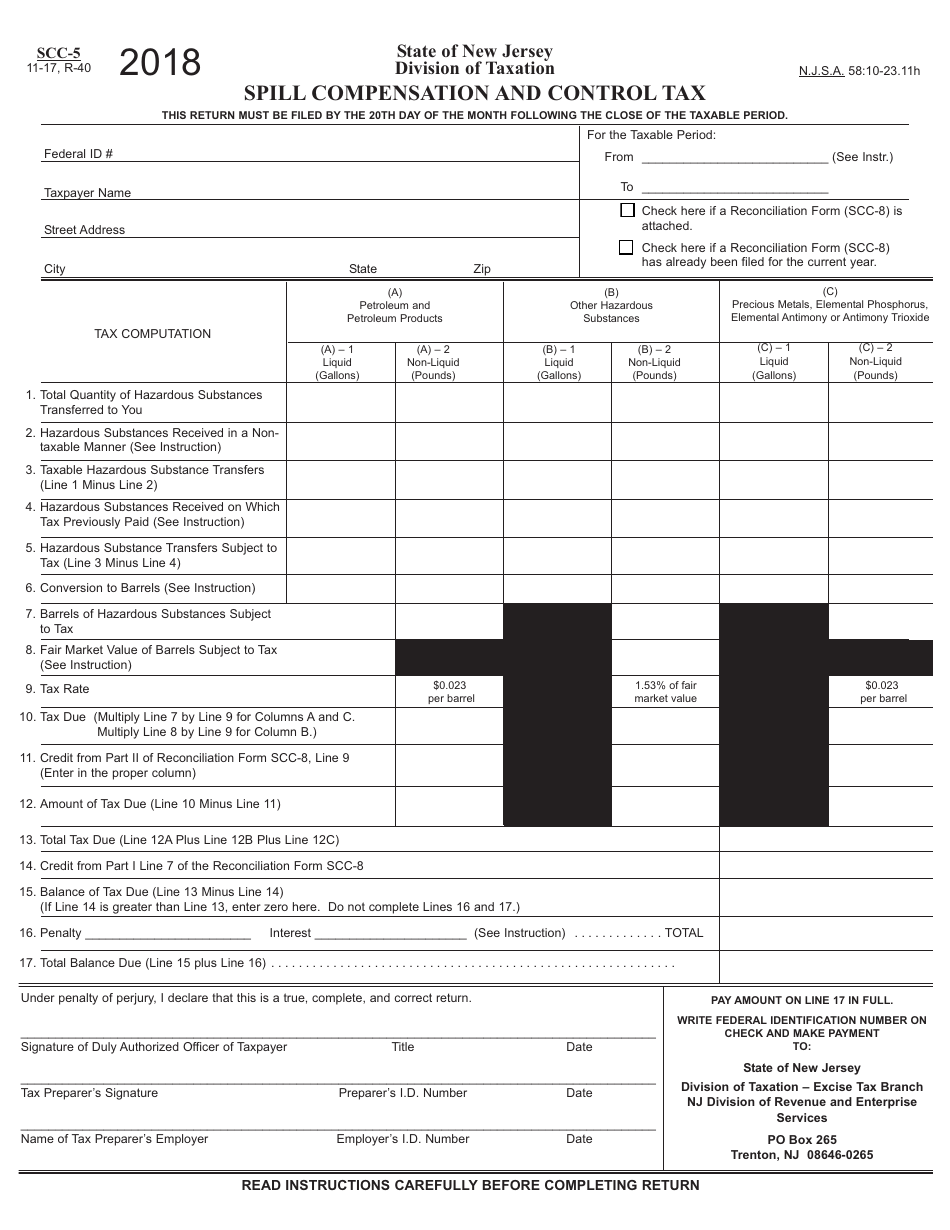

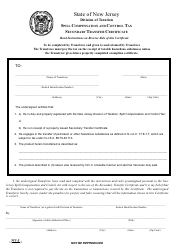

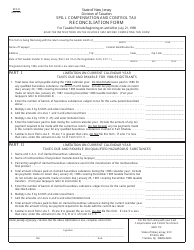

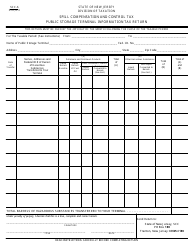

Form SCC-5

for the current year.

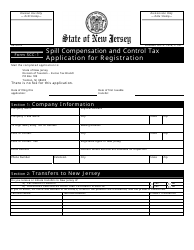

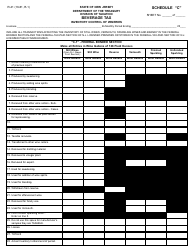

Form SCC-5 Spill Compensation and Control Tax - New Jersey

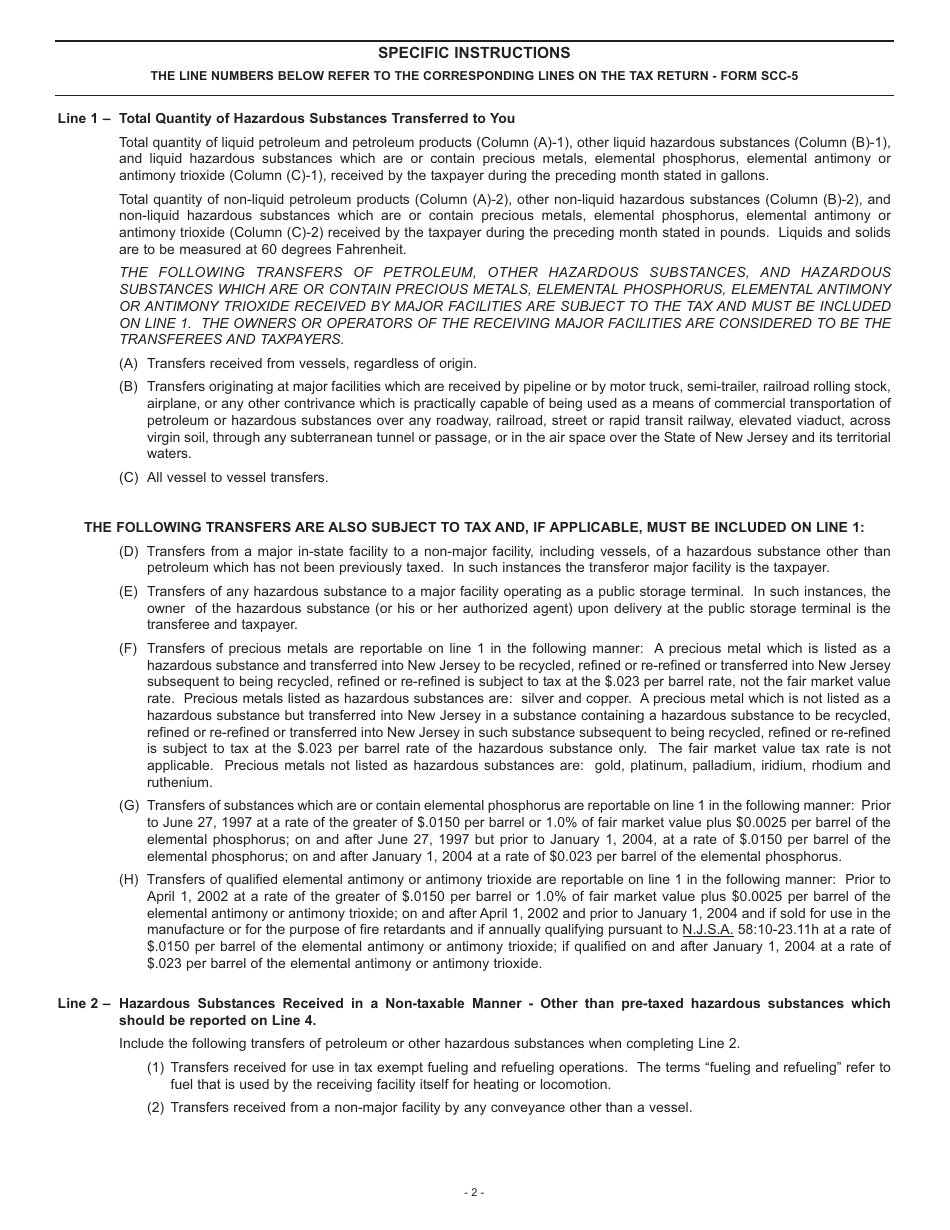

What Is Form SCC-5?

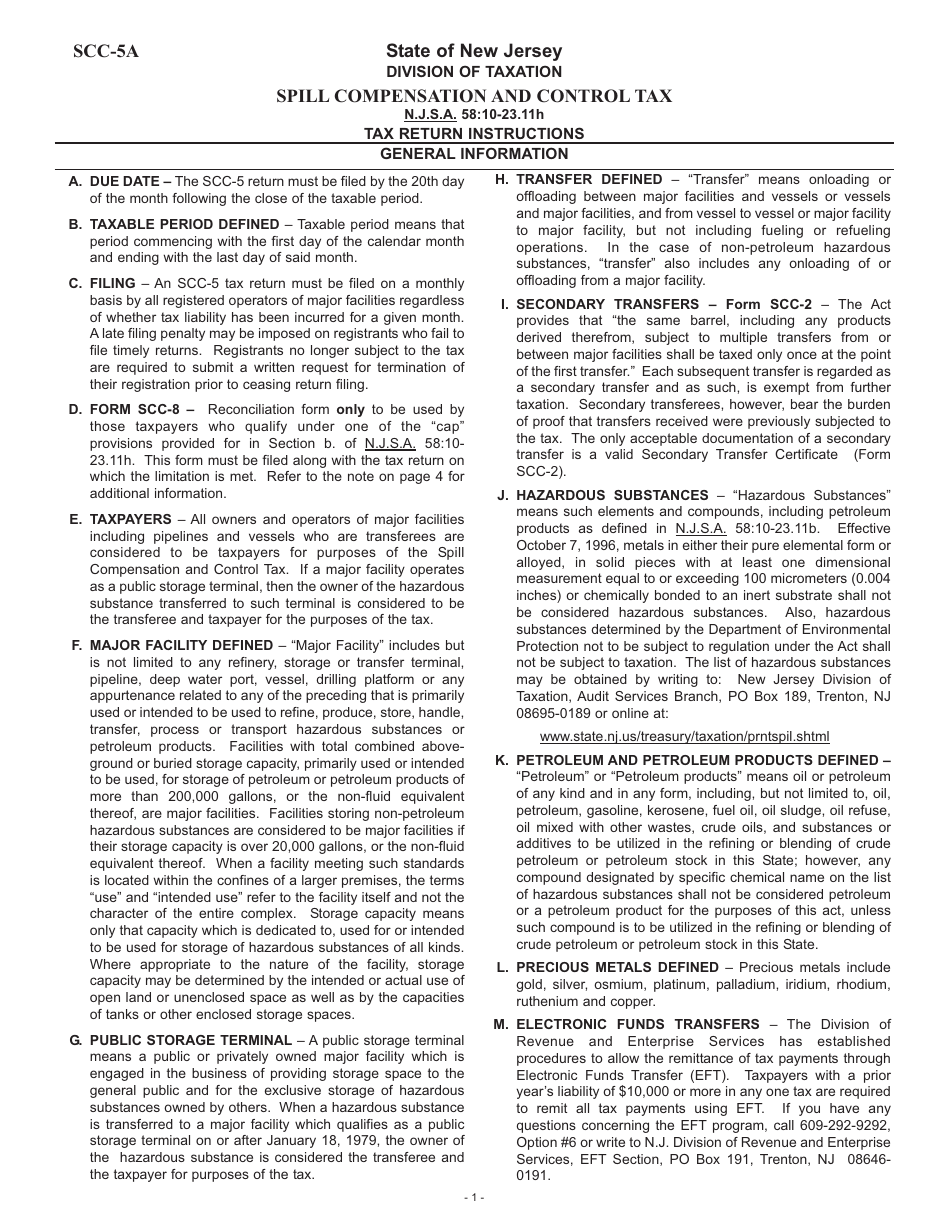

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SCC-5 Spill Compensation and Control Tax?

A: The SCC-5 Spill Compensation and Control Tax is a tax imposed by the state of New Jersey on certain hazardous substances.

Q: Why is the SCC-5 Spill Compensation and Control Tax imposed?

A: The tax is imposed to fund the cleanup and remediation of hazardous substance spills in New Jersey.

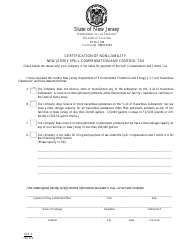

Q: Who is required to pay the SCC-5 Spill Compensation and Control Tax?

A: Owners, operators, and transporters of taxable hazardous substances are required to pay the tax.

Q: What are taxable hazardous substances?

A: Taxable hazardous substances include petroleum products, hazardous wastes, and certain chemicals.

Q: How is the SCC-5 Spill Compensation and Control Tax calculated?

A: The tax is calculated based on the volume or weight of the taxable hazardous substance and the tax rate set by the state.

Q: When is the SCC-5 Spill Compensation and Control Tax due?

A: The tax is due annually and the due date is typically March 1st.

Q: Are there any exemptions to the SCC-5 Spill Compensation and Control Tax?

A: Yes, certain exemptions exist for specific types of facilities or activities, such as government entities or farmers using fuel in agricultural operations.

Q: What happens if I fail to pay the SCC-5 Spill Compensation and Control Tax?

A: Failure to pay the tax may result in penalties, interest, and enforcement actions by the state of New Jersey.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.