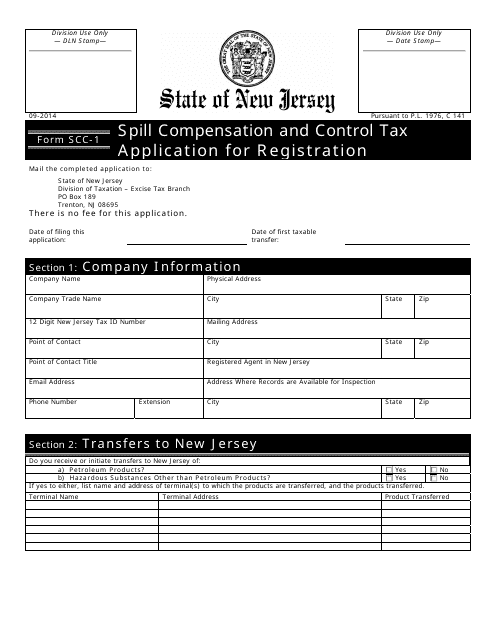

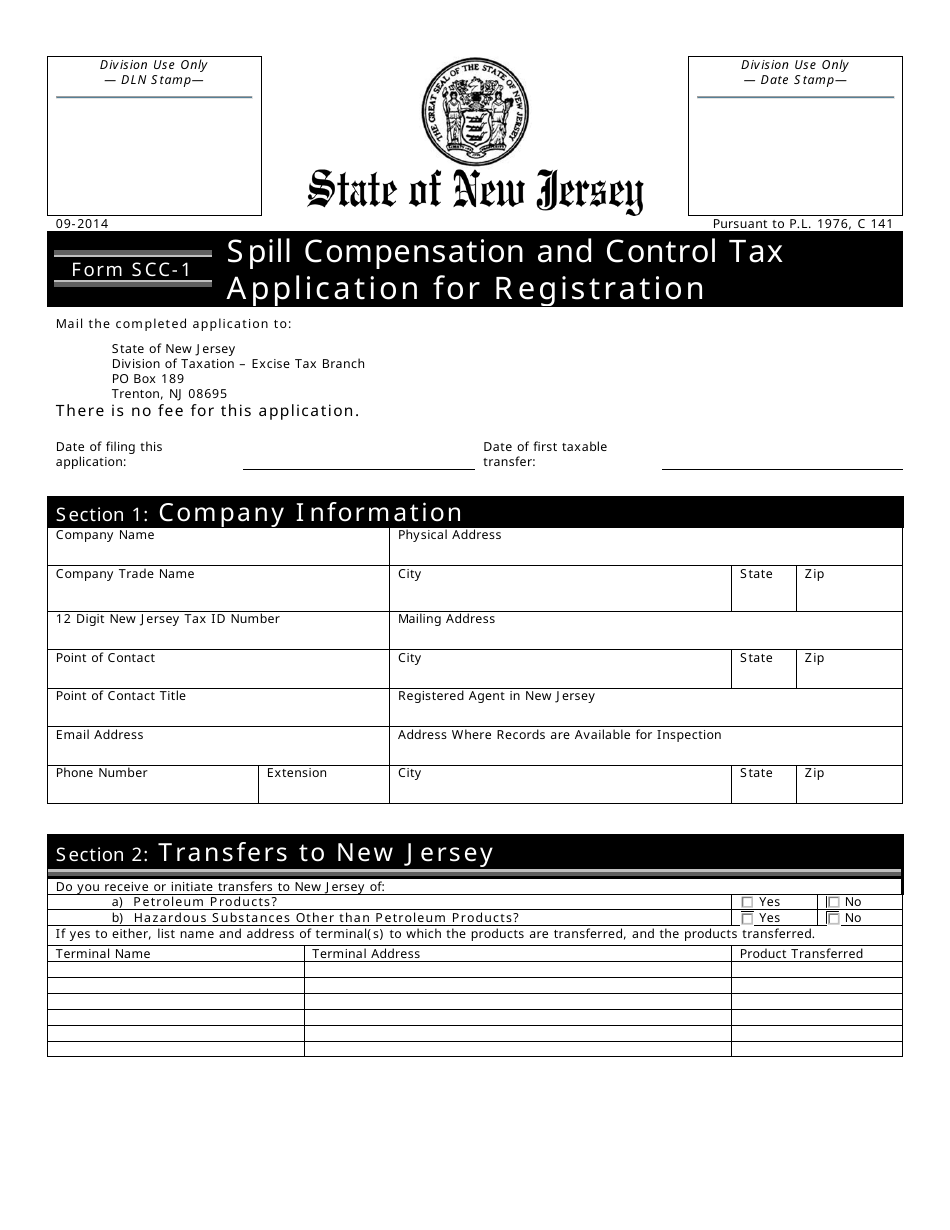

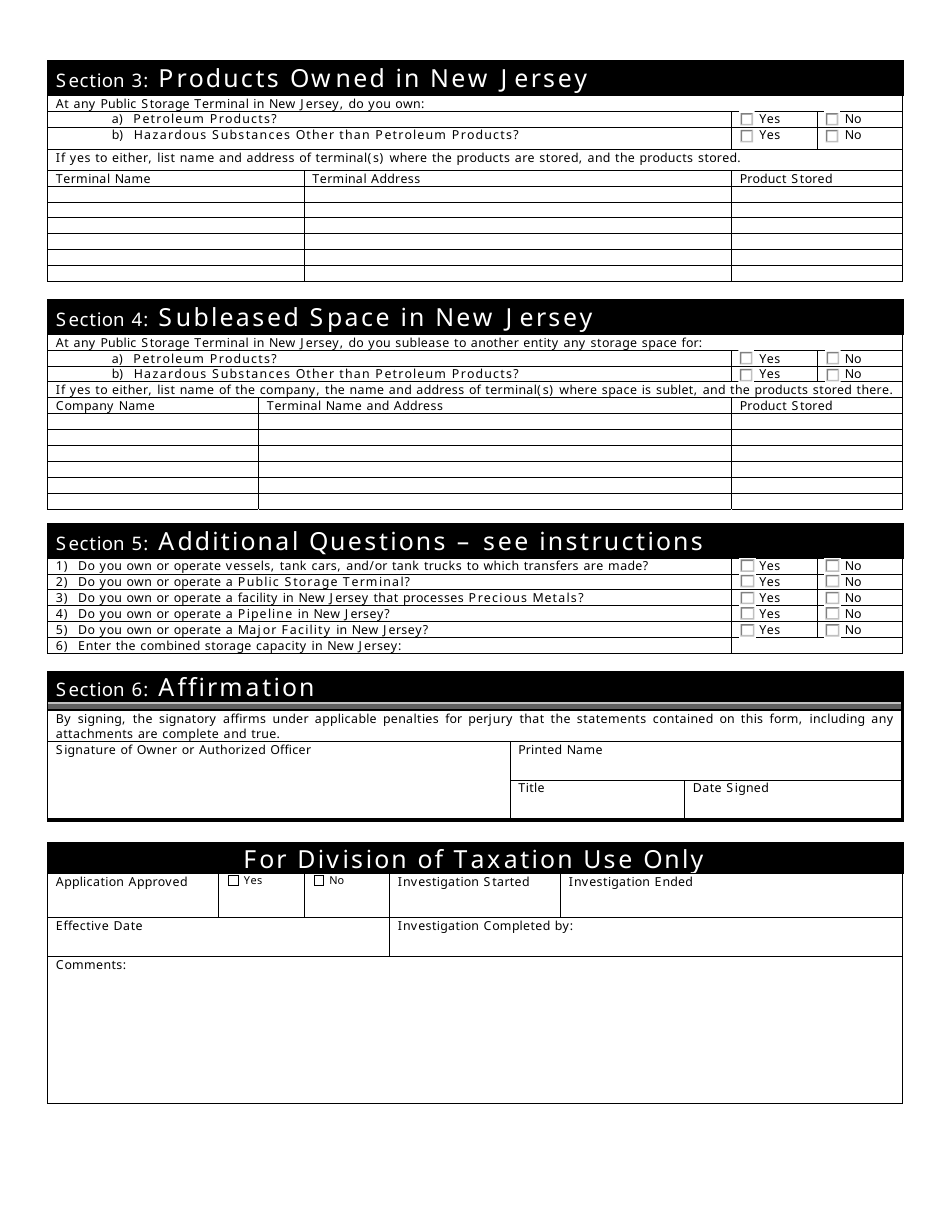

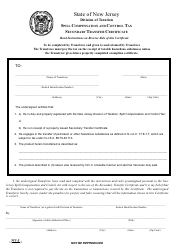

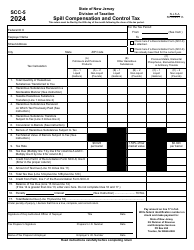

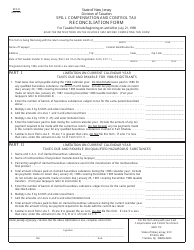

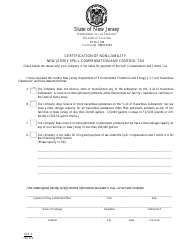

Form SCC-1 Spill Compensation and Control Tax Application for Registration - New Jersey

What Is Form SCC-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form SCC-1?

A: Form SCC-1 is the Spill Compensation and Control Tax Application for Registration in New Jersey.

Q: What is the purpose of Form SCC-1?

A: The purpose of Form SCC-1 is to register for the payment of the Spill Compensation and Control Tax in New Jersey.

Q: Who needs to file Form SCC-1?

A: Any person or entity engaged in certain activities defined in the New Jersey Spill Compensation and Control Act must file Form SCC-1.

Q: What activities are subject to the Spill Compensation and Control Tax?

A: Activities such as the sale, receipt, or transfer of petroleum products in New Jersey are subject to the Spill Compensation and Control Tax.

Q: Is there a deadline for filing Form SCC-1?

A: Yes, Form SCC-1 must be filed by the 20th day of the month following the end of each quarter.

Q: Are there any penalties for late filing?

A: Yes, failure to file Form SCC-1 by the deadline may result in penalties and interest on the unpaid tax.

Q: What should I do if I have questions about Form SCC-1?

A: If you have questions about Form SCC-1, you can contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.