This version of the form is not currently in use and is provided for reference only. Download this version of

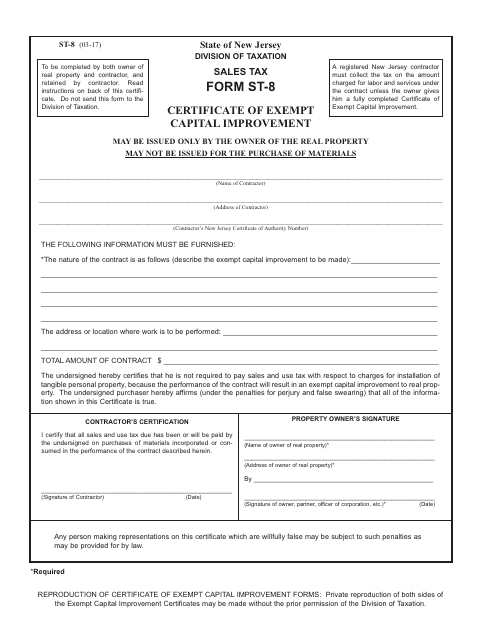

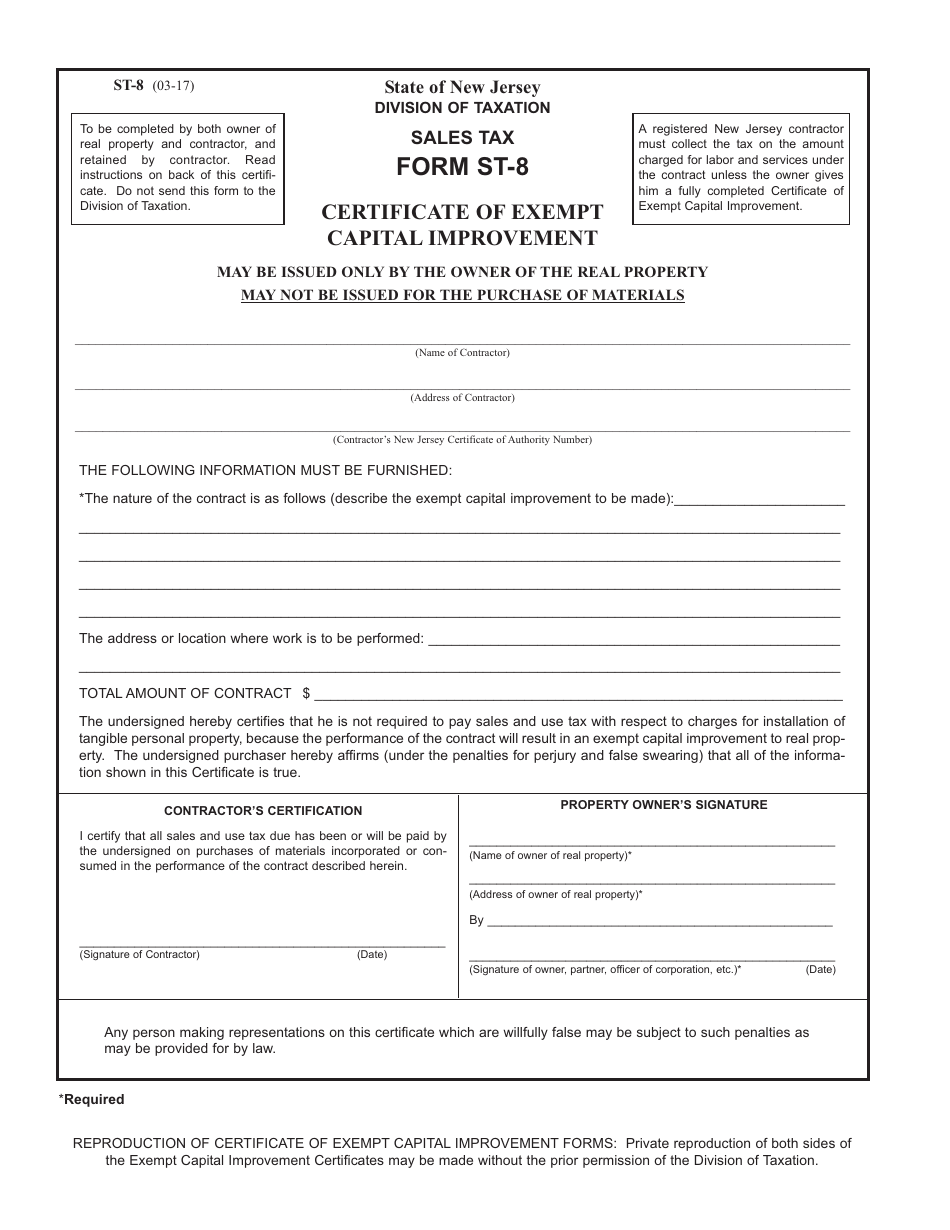

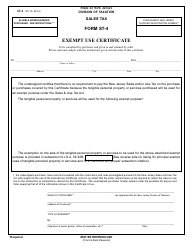

Form ST-8

for the current year.

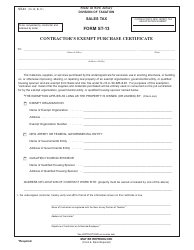

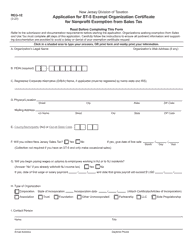

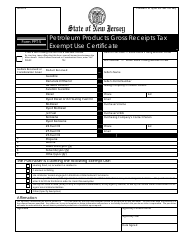

Form ST-8 Certificate of Exempt - Capital Improvement - New Jersey

What Is Form ST-8?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-8 Certificate of Exempt - Capital Improvement?

A: The Form ST-8 Certificate of Exempt - Capital Improvement is a tax form used in New Jersey.

Q: What is the purpose of Form ST-8?

A: The purpose of Form ST-8 is to certify that a capital improvement is exempt from sales tax in New Jersey.

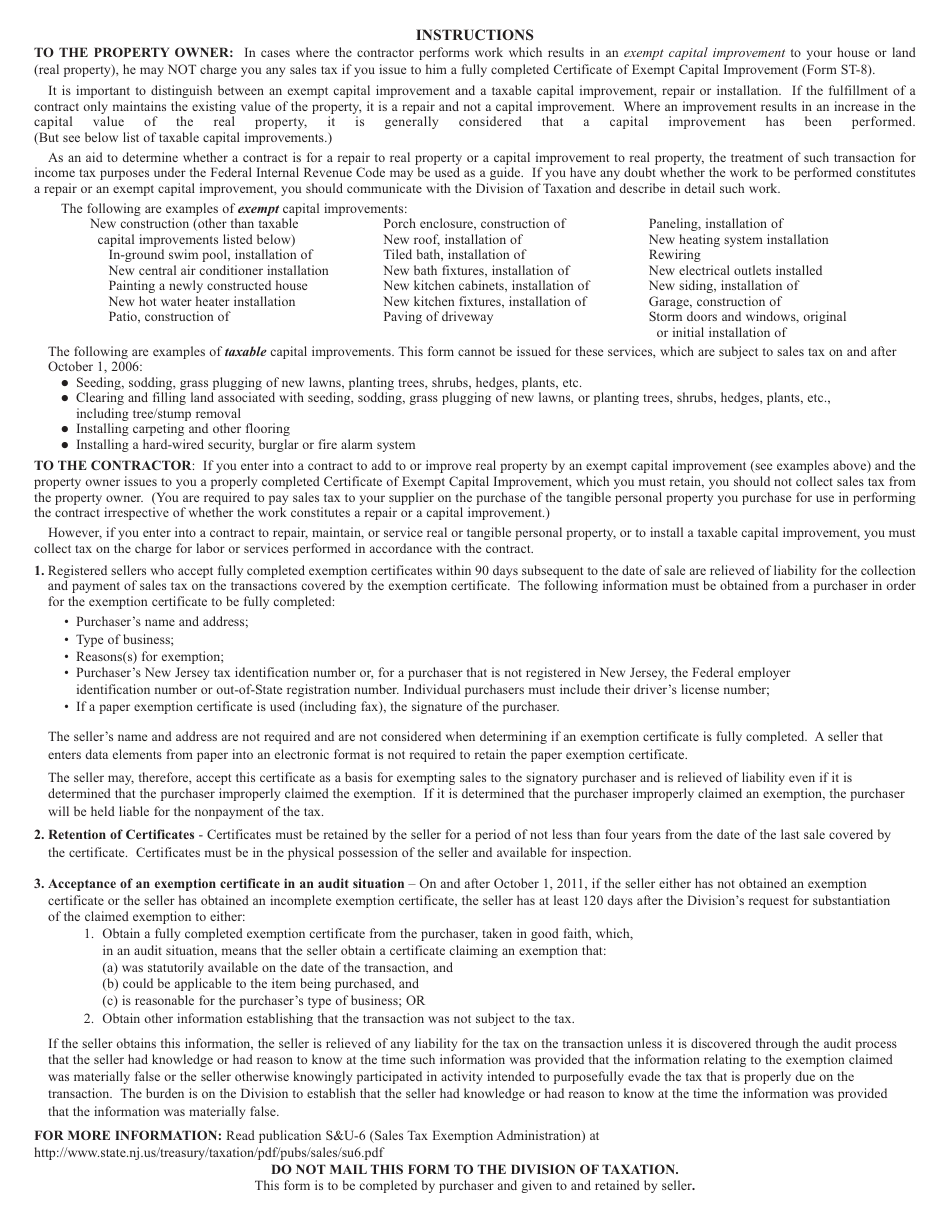

Q: What is considered a capital improvement in New Jersey?

A: In New Jersey, a capital improvement is defined as a permanent improvement or addition to real property.

Q: Who needs to fill out Form ST-8?

A: Contractors or property owners who are making capital improvements in New Jersey need to fill out Form ST-8.

Q: When should Form ST-8 be submitted?

A: Form ST-8 should be submitted to the New Jersey Division of Taxation within 90 days of completion of the capital improvement.

Q: Can I claim a tax exemption for capital improvements in New Jersey?

A: Yes, you can claim a tax exemption for qualifying capital improvements by filling out Form ST-8.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-8 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.