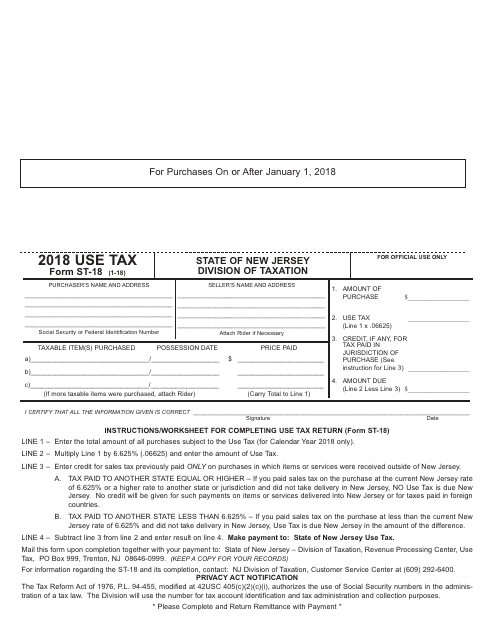

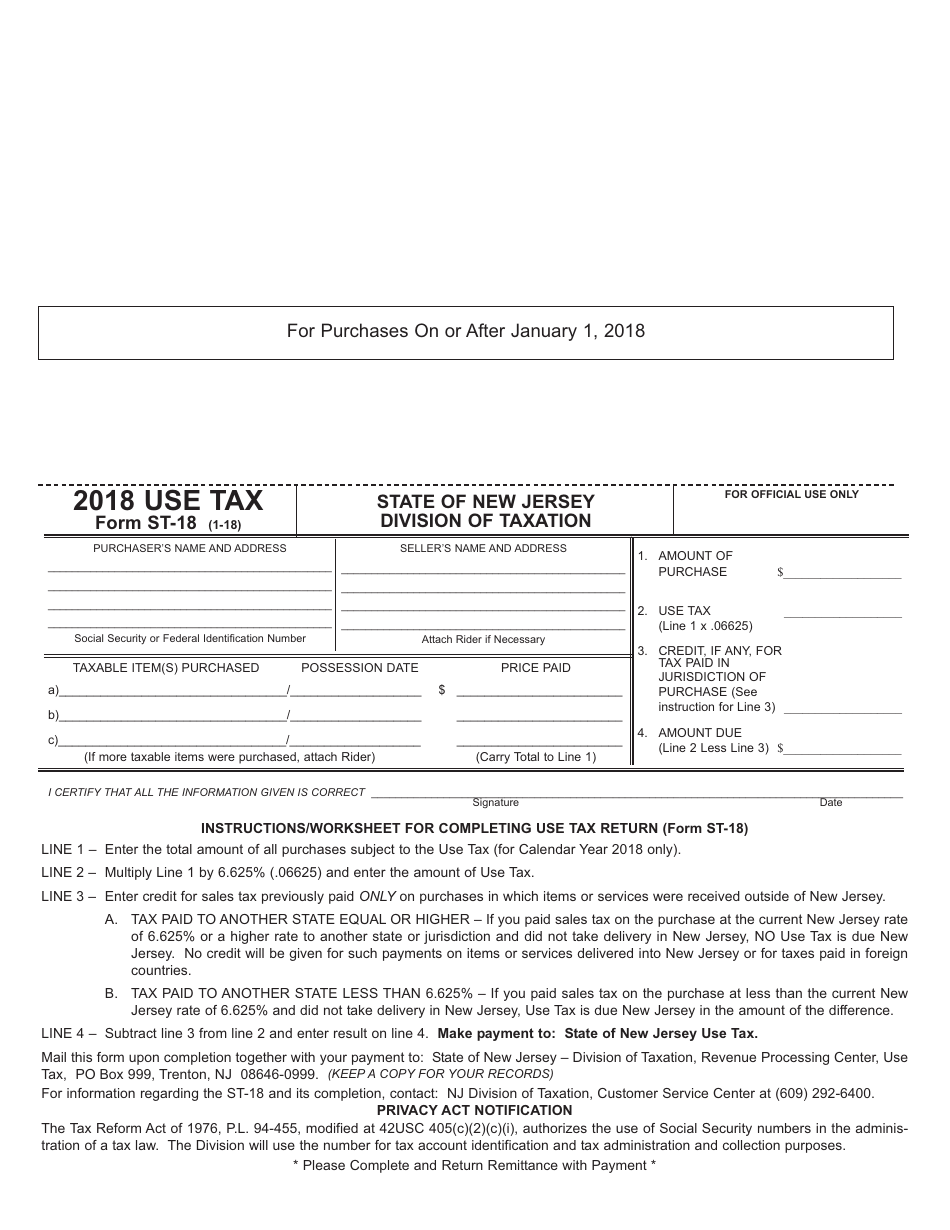

Form ST-18 Use Tax - New Jersey

What Is Form ST-18?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-18?

A: Form ST-18 is the Use Tax Return for individuals in the state of New Jersey.

Q: Who needs to file Form ST-18?

A: Individuals who have purchased taxable items for use in New Jersey and did not pay sales tax at the time of purchase need to file Form ST-18.

Q: What is the purpose of Form ST-18?

A: The purpose of Form ST-18 is to report and pay the use tax owed on taxable items purchased for use in New Jersey.

Q: When is Form ST-18 due?

A: Form ST-18 is due on the 15th day of the month following the end of the reporting period.

Q: Do I need to include receipts with Form ST-18?

A: No, you do not need to include receipts with Form ST-18. However, you should keep them for your records in case of an audit.

Q: What happens if I don't file Form ST-18?

A: If you do not file Form ST-18 or pay the use tax owed, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-18 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.