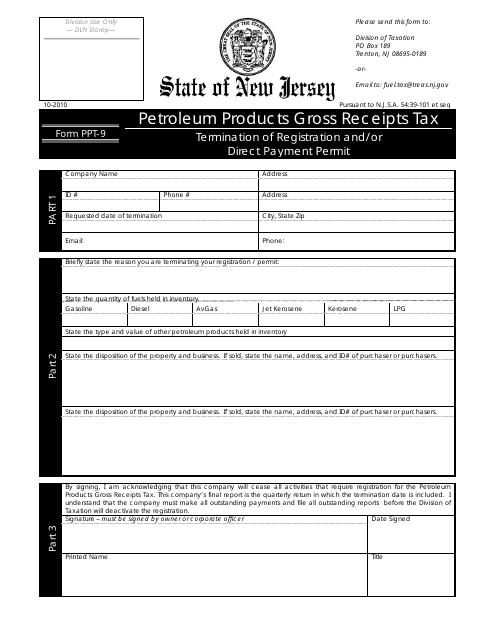

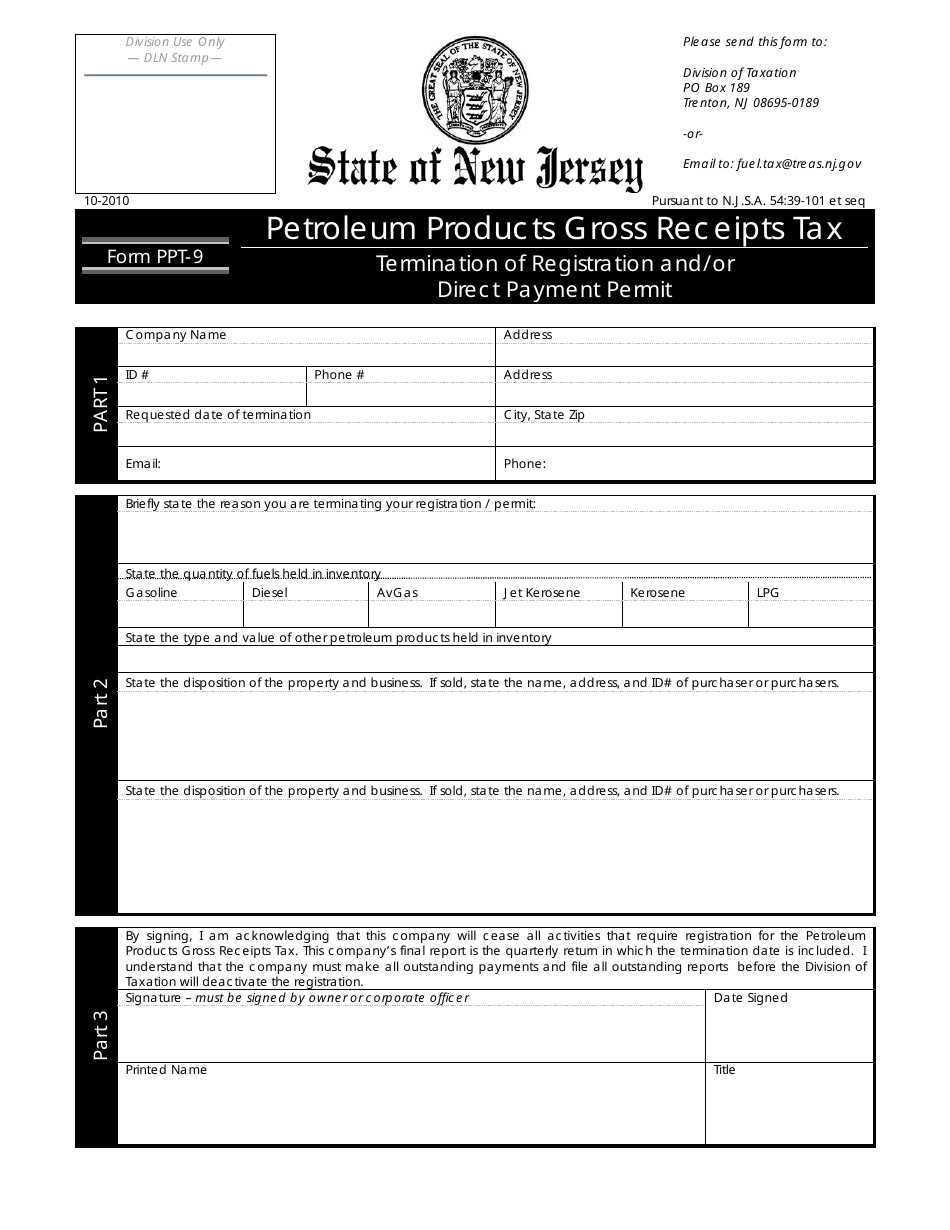

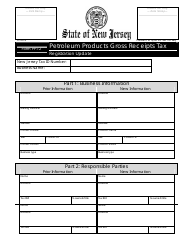

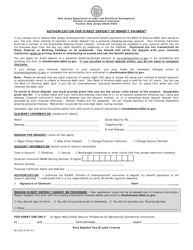

Form PPT-9 Termination of Registration and / or Direct Payment Permit - New Jersey

What Is Form PPT-9?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

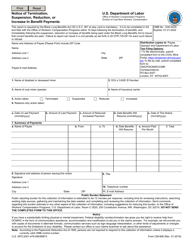

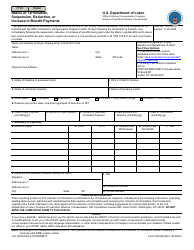

Q: What is form PPT-9?

A: Form PPT-9 is a document used for the Termination of Registration and/or Direct Payment Permit in New Jersey.

Q: What does Termination of Registration mean?

A: Termination of Registration refers to the cancellation or ending of a registration with the state.

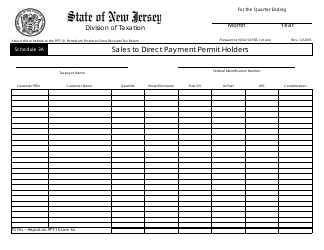

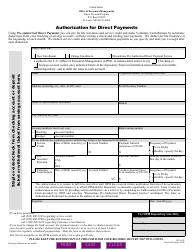

Q: What is a Direct Payment Permit?

A: A Direct Payment Permit allows businesses to pay sales tax directly to the state instead of collecting it from customers.

Q: Who needs to use form PPT-9?

A: Any business or individual in New Jersey that wants to terminate their registration or cancel a Direct Payment Permit needs to use form PPT-9.

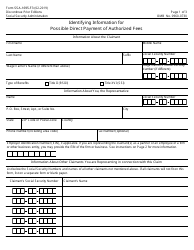

Q: Are there any fees associated with the termination of registration or Direct Payment Permit?

A: No, there are no fees associated with the termination of registration or Direct Payment Permit.

Q: How long does it take to process form PPT-9?

A: The processing time for form PPT-9 varies, but it typically takes around 4-6 weeks.

Q: Are there any penalties for not filing form PPT-9?

A: Yes, failure to file form PPT-9 can result in penalties and interest.

Q: What should I do after filing form PPT-9?

A: After filing form PPT-9, you should receive confirmation from the New Jersey Division of Taxation. It is important to keep a copy of the confirmation for your records.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPT-9 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.