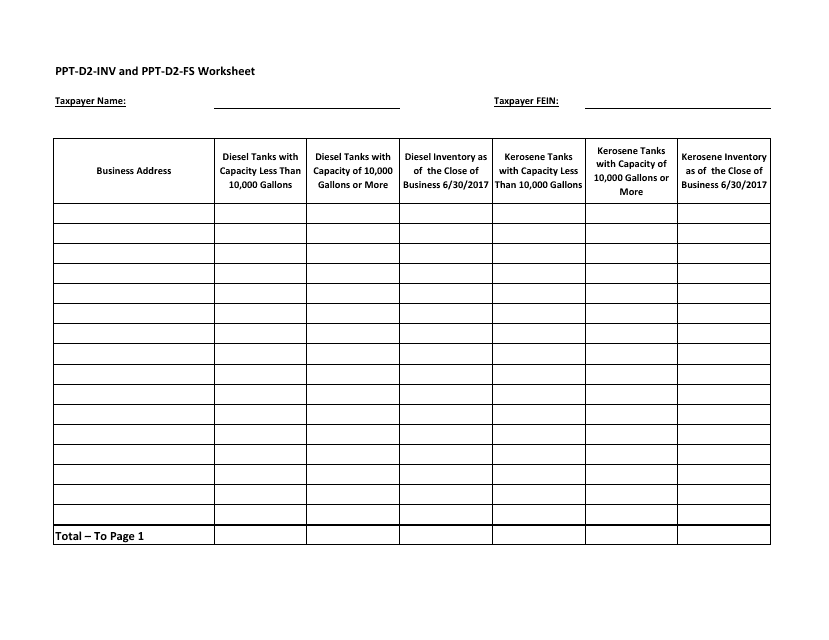

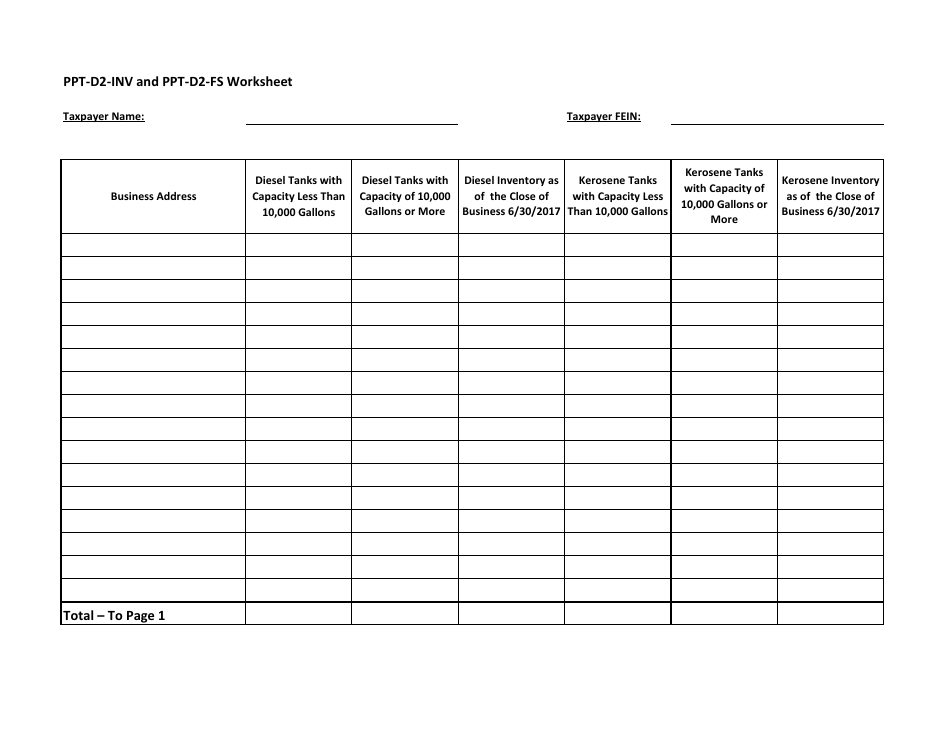

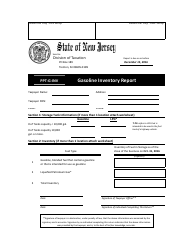

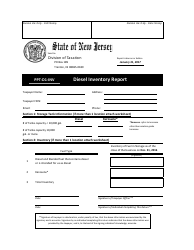

Form PPT-D2-INV (PPT-D2-FS) - New Jersey

What Is Form PPT-D2-INV (PPT-D2-FS)?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PPT-D2-INV?

A: Form PPT-D2-INV (also known as PPT-D2-FS) is a form used in New Jersey.

Q: When is Form PPT-D2-INV used?

A: Form PPT-D2-INV is used for reporting inventory for New Jersey's Business Personal Property Tax.

Q: Who needs to file Form PPT-D2-INV?

A: Businesses in New Jersey that have inventory are required to file Form PPT-D2-INV.

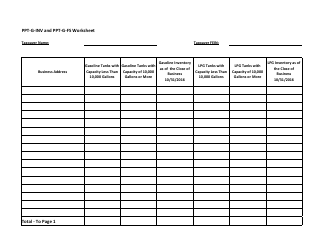

Q: What information is required on Form PPT-D2-INV?

A: Form PPT-D2-INV requires information about the inventory, including its cost and estimated value.

Q: When is the deadline for filing Form PPT-D2-INV?

A: The deadline for filing Form PPT-D2-INV in New Jersey is typically May 1st each year.

Q: Are there any penalties for late filing of Form PPT-D2-INV?

A: Yes, there may be penalties for late filing of Form PPT-D2-INV in New Jersey. It is important to file the form by the deadline to avoid penalties.

Q: Do I need to include supporting documents with Form PPT-D2-INV?

A: You may be required to include supporting documents, such as a detailed inventory list, with Form PPT-D2-INV.

Q: What should I do if I have questions about Form PPT-D2-INV?

A: If you have questions about Form PPT-D2-INV, you should contact the New Jersey Division of Taxation for assistance.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-D2-INV (PPT-D2-FS) by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.