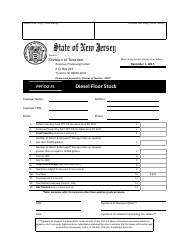

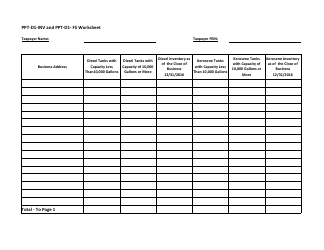

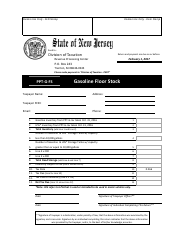

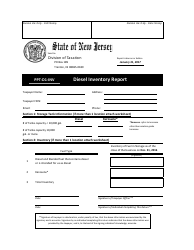

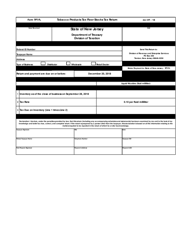

Instructions for Form PPT-D1-FS Petroleum Products Gross Receipts Tax - Floor Stocks Tax Return - New Jersey

This document contains official instructions for Form PPT-D1-FS , Petroleum Products Gross Receipts Tax - Floor Stocks Tax Return - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form PPT-D1-FS is available for download through this link.

FAQ

Q: What is Form PPT-D1-FS?

A: Form PPT-D1-FS is the Petroleum Products Gross Receipts Tax - Floor Stocks Tax Return.

Q: What is the purpose of Form PPT-D1-FS?

A: Form PPT-D1-FS is used to report and pay the floor stocks tax on petroleum products in New Jersey.

Q: Who needs to file Form PPT-D1-FS?

A: Any person or entity that possesses, stores, or consumes taxable petroleum products in New Jersey as of the effective date of a tax rate change may be liable for the floor stocks tax and must file this form.

Q: What are taxable petroleum products?

A: Taxable petroleum products include motor fuel, aviation fuel, heating oil, kerosene, and other products subject to the Petroleum Products Gross Receipts Tax.

Q: When is Form PPT-D1-FS due?

A: Form PPT-D1-FS is due on or before the 15th day of the second month following the effective date of a tax rate change.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing and non-compliance with the New Jersey Petroleum Products Gross Receipts Tax law. It is important to file and pay the tax on time to avoid penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.