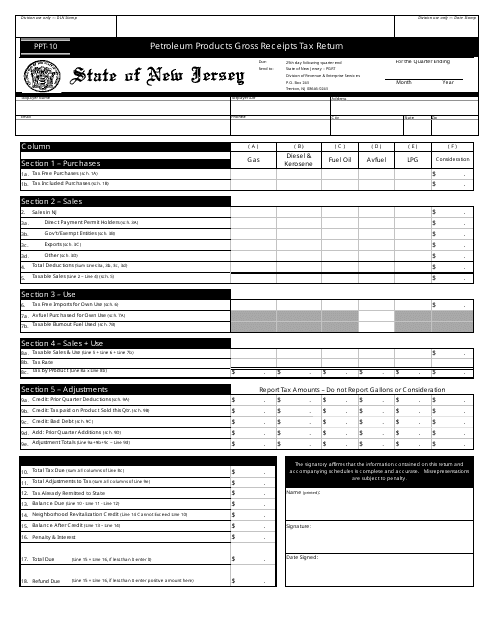

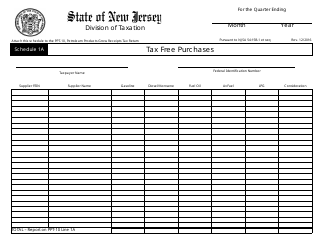

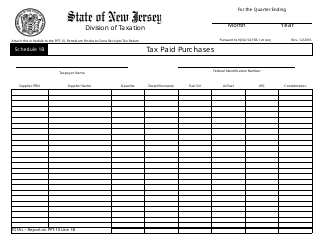

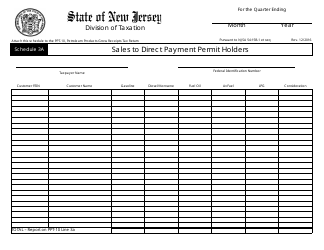

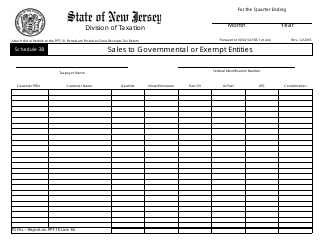

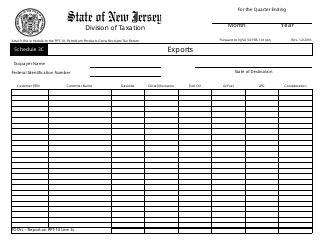

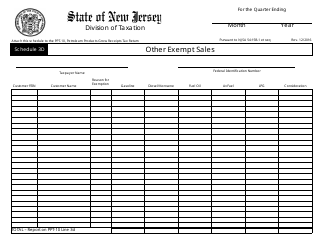

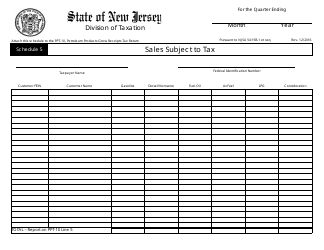

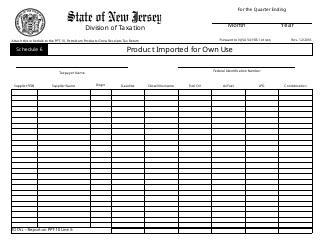

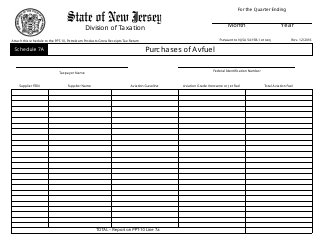

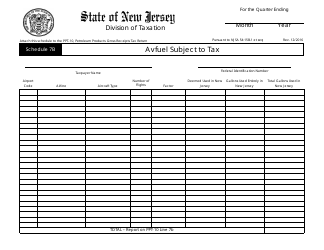

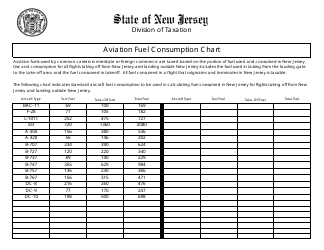

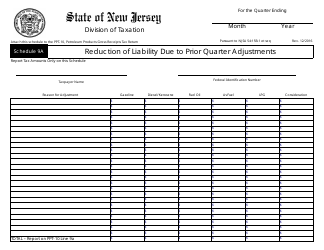

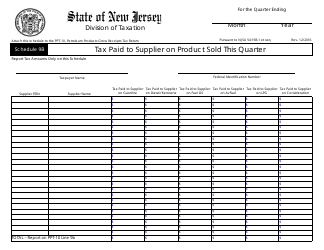

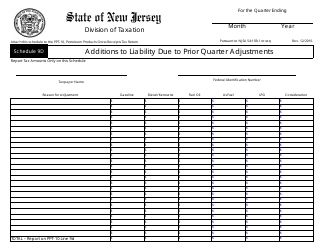

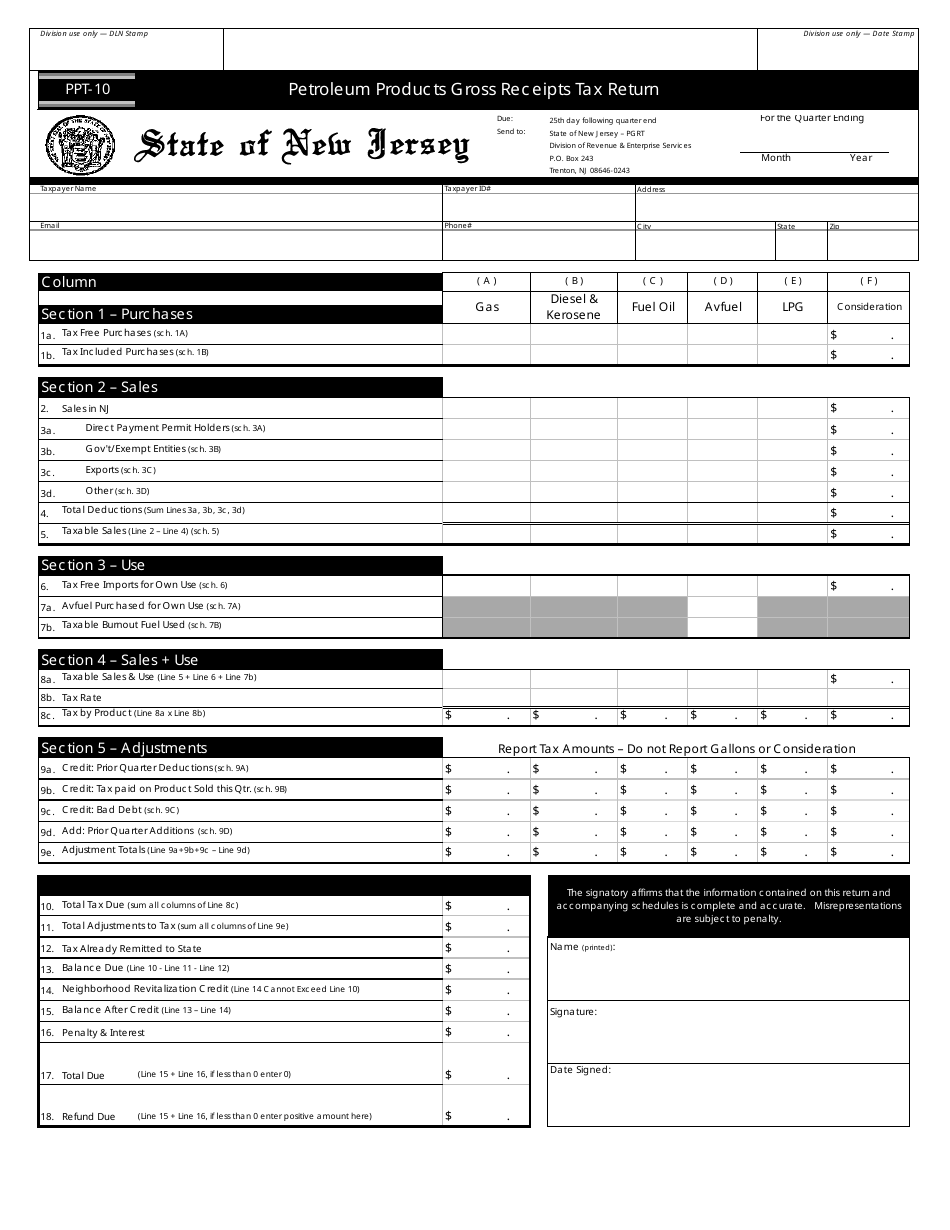

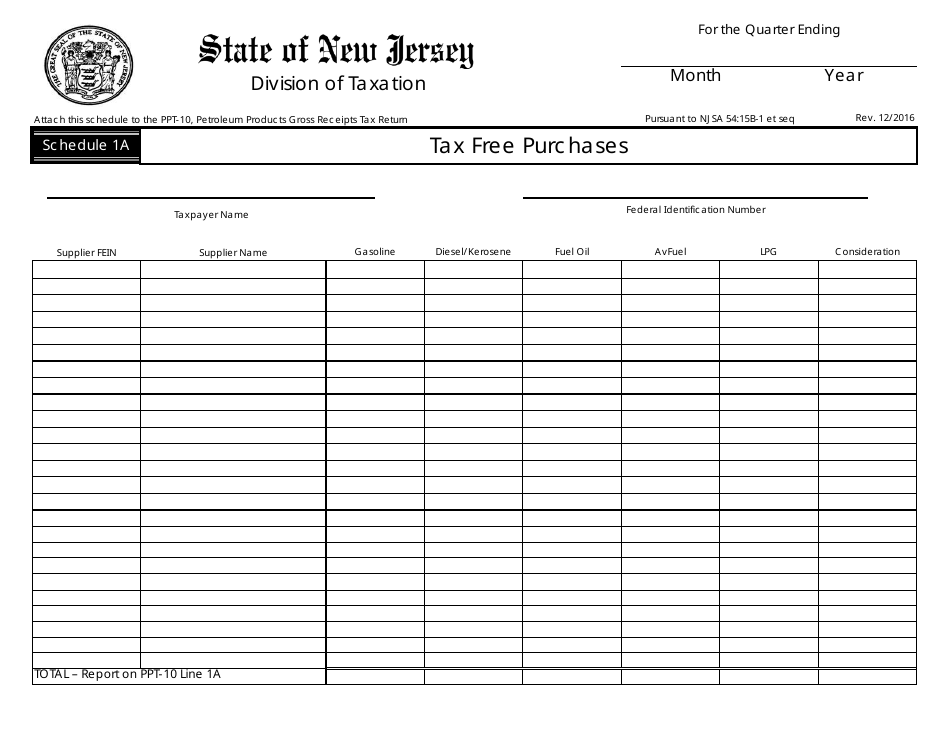

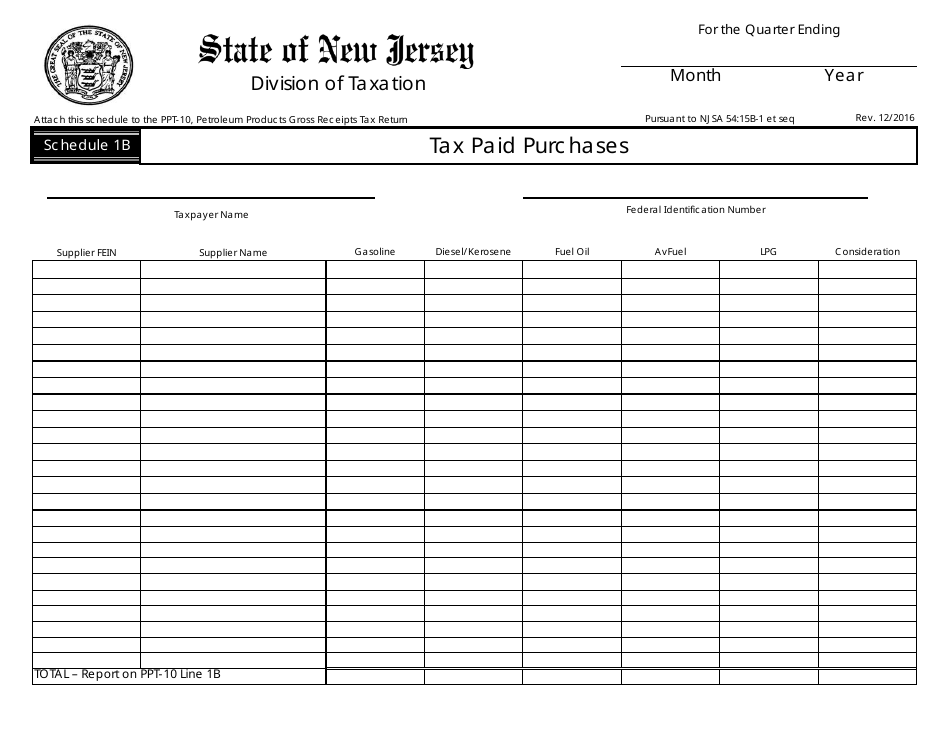

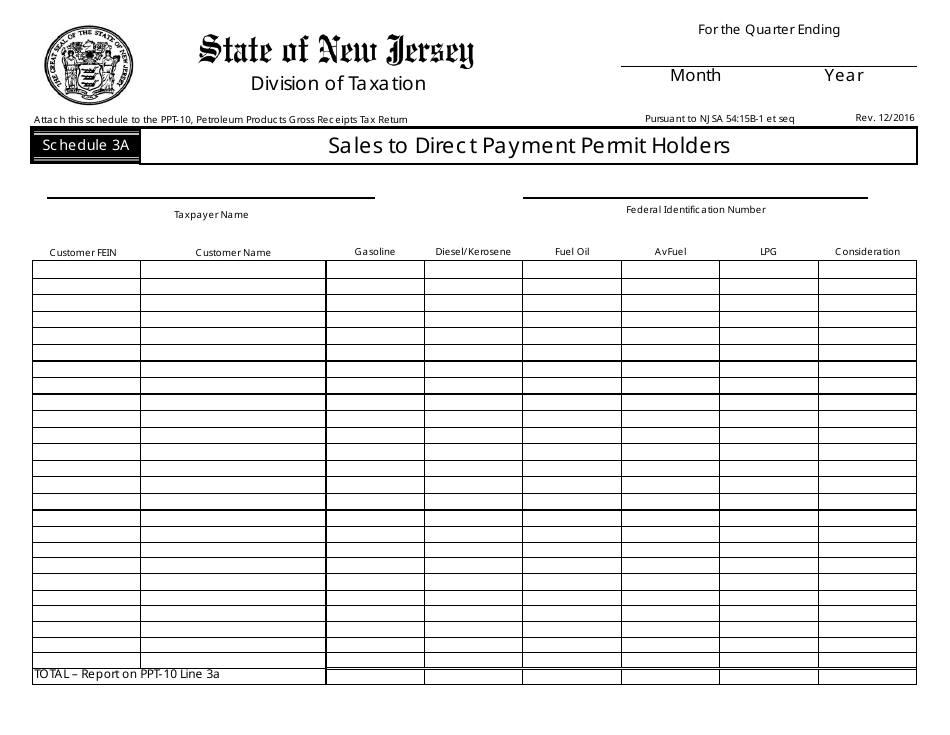

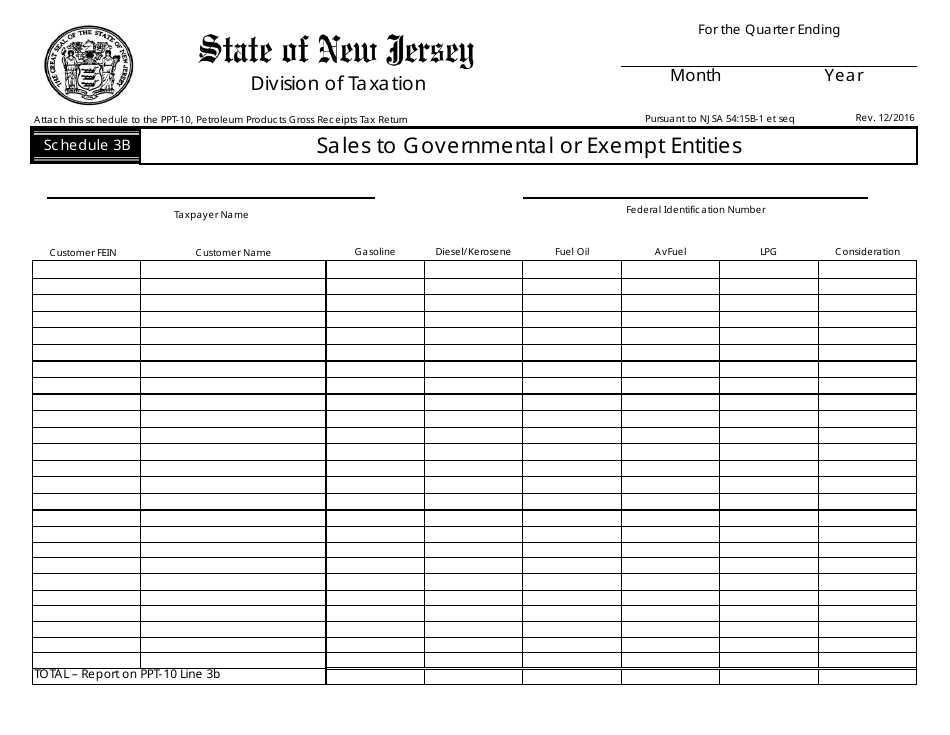

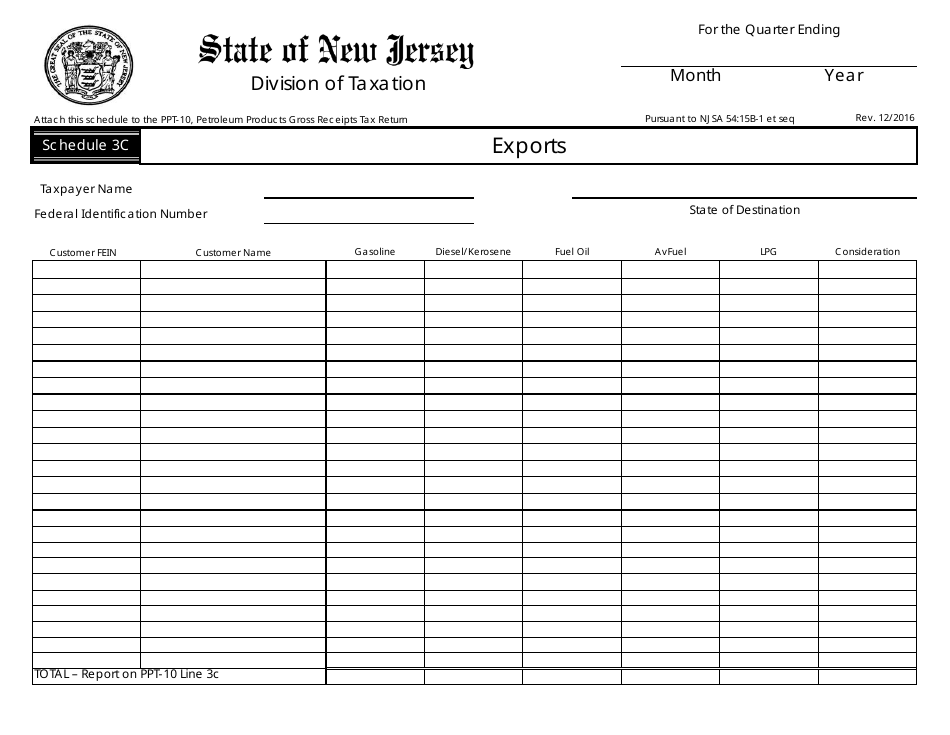

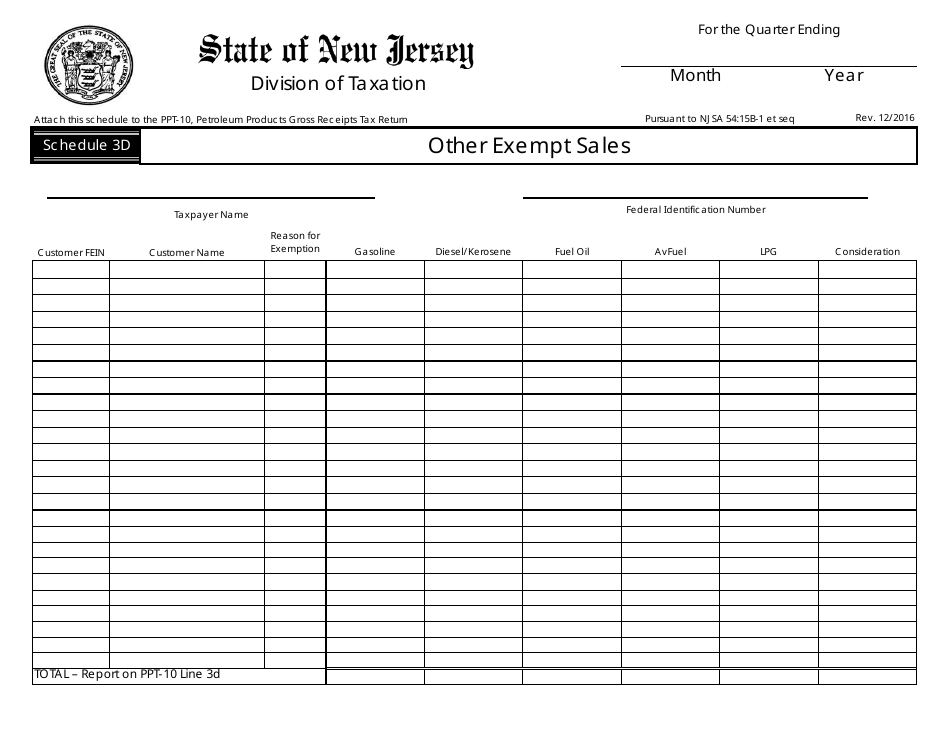

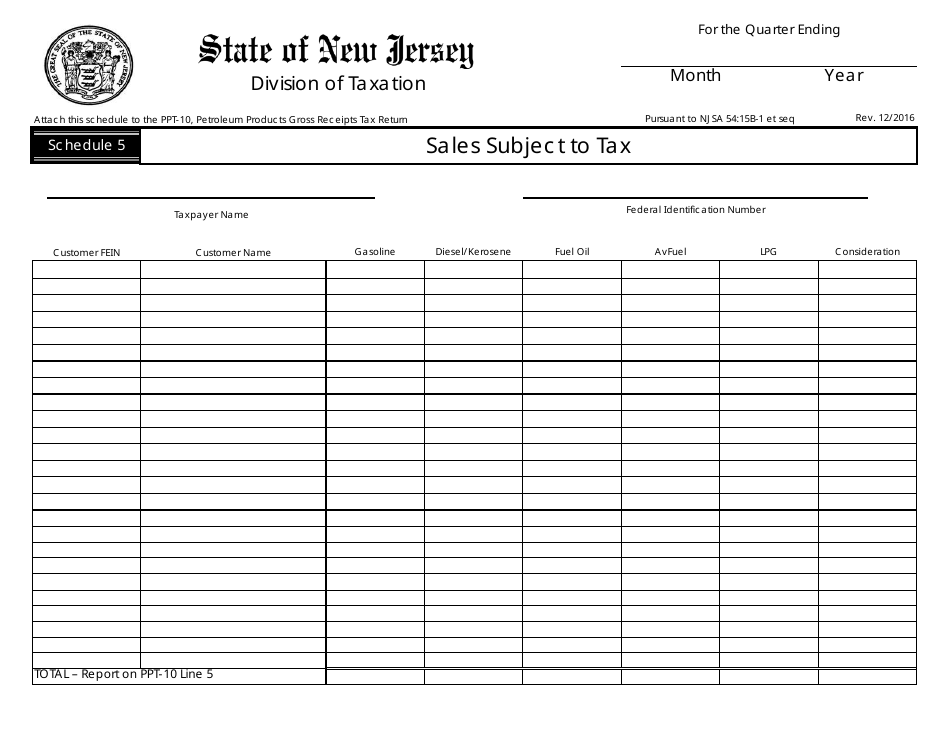

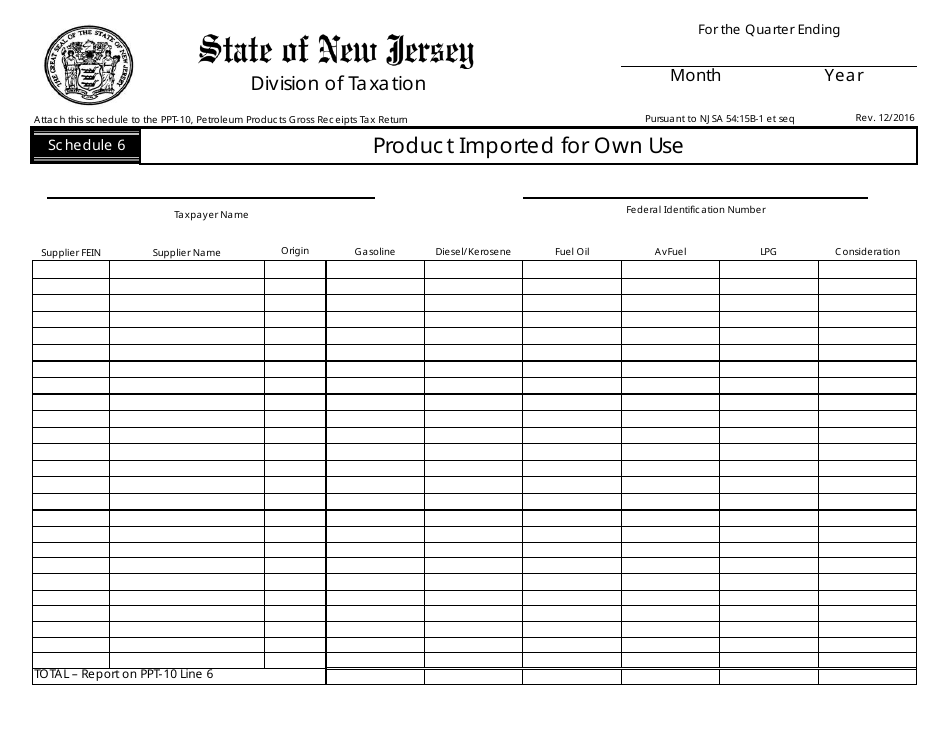

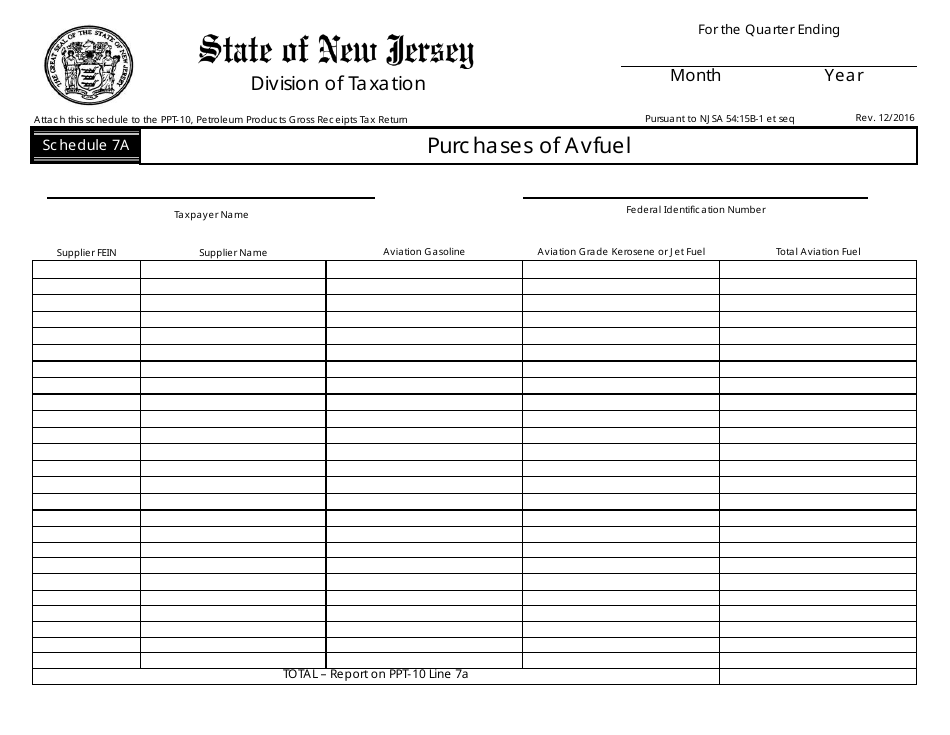

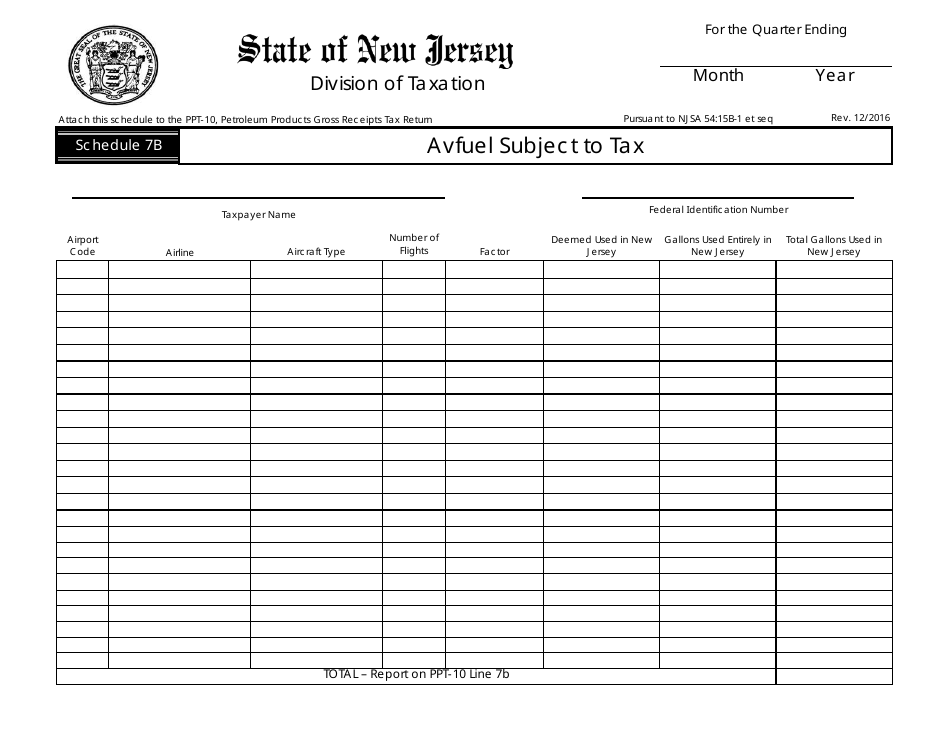

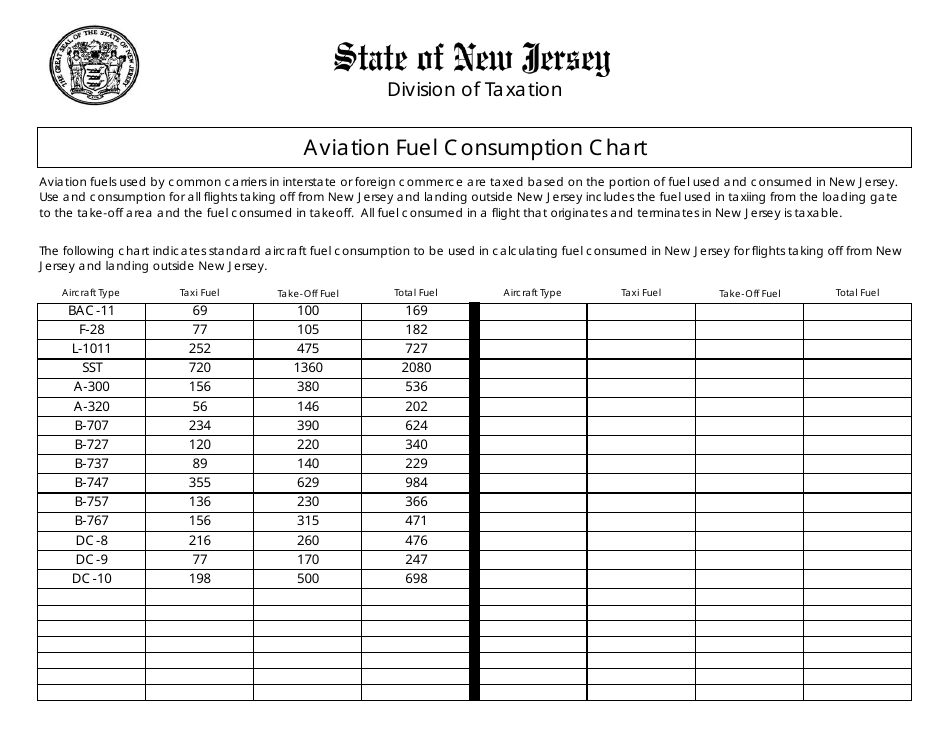

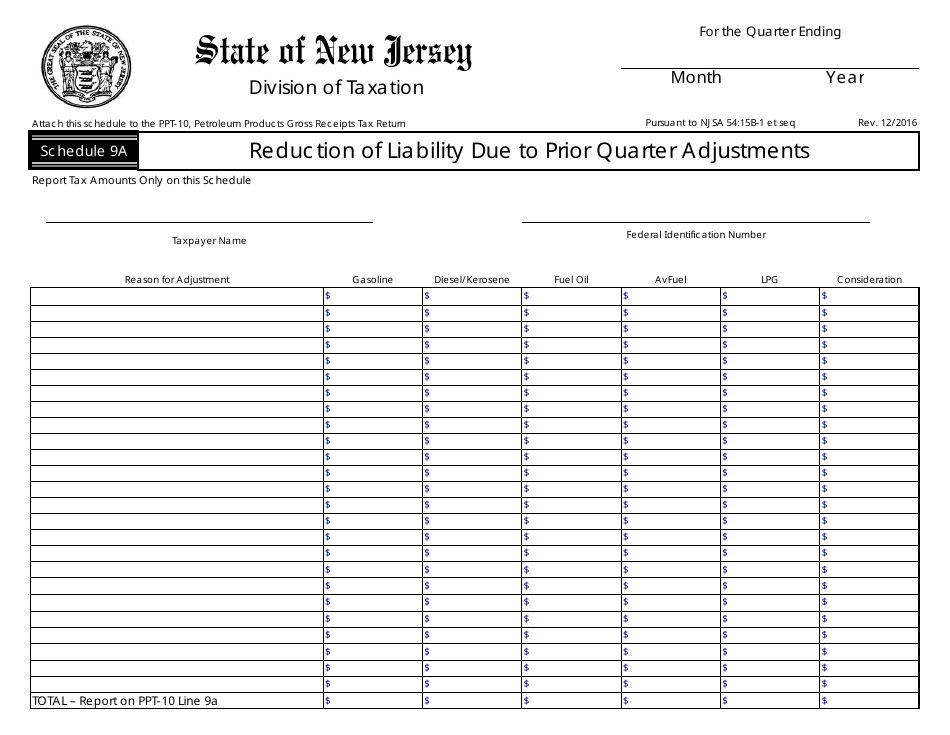

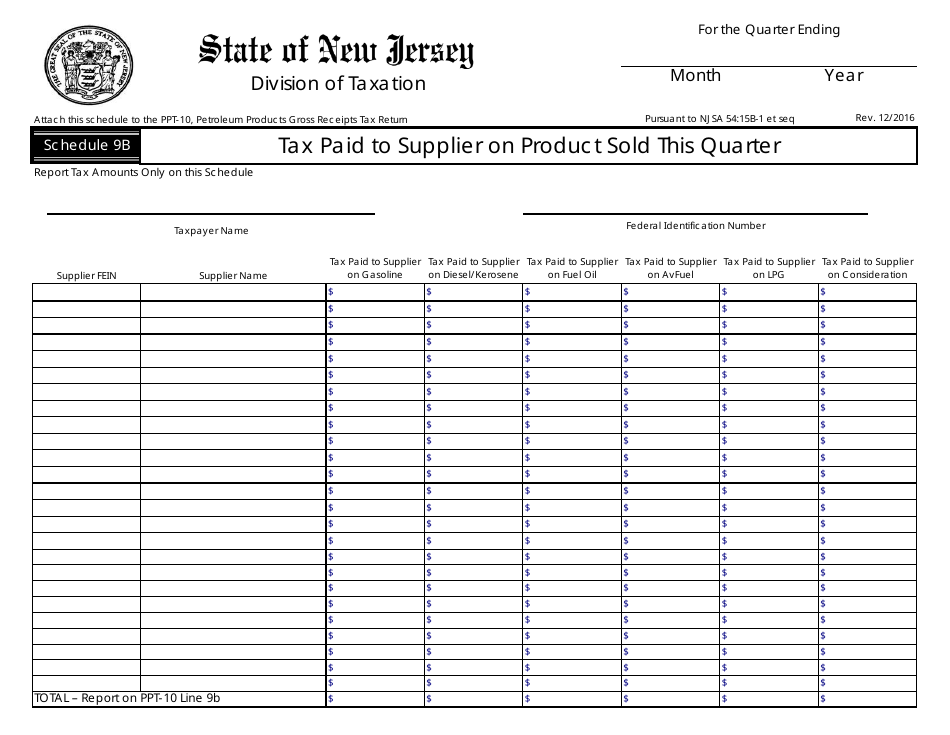

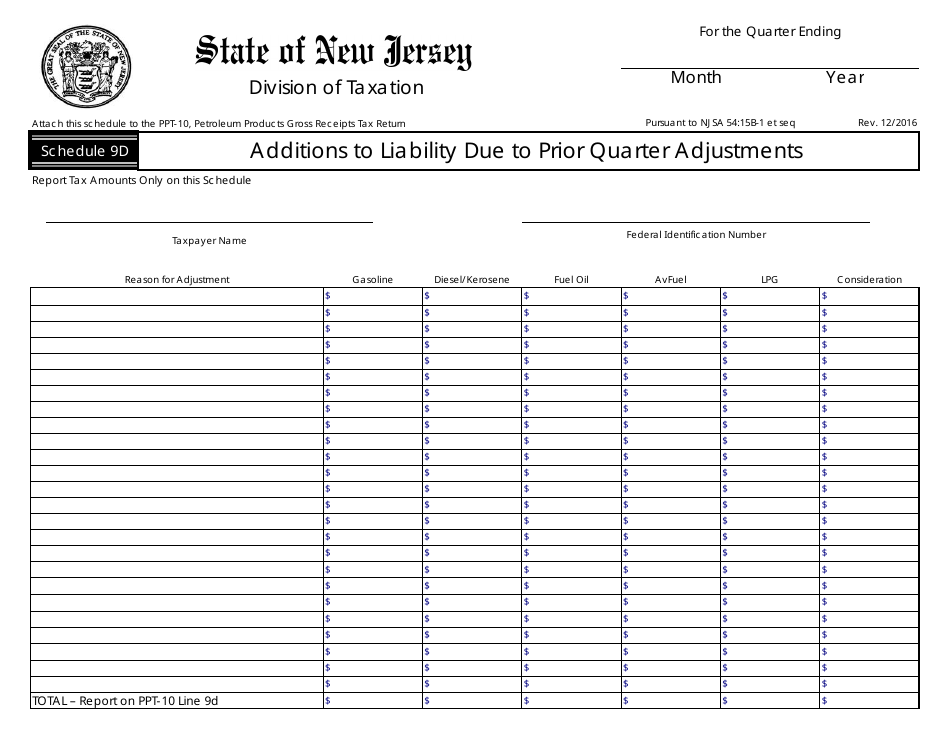

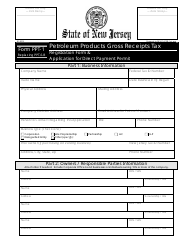

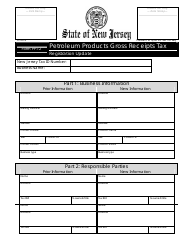

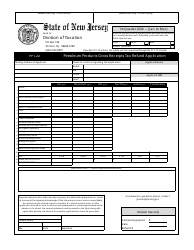

Form PPT-10 Petroleum Products Gross Receipts Tax Return - New Jersey

What Is Form PPT-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form PPT-10?

A: Form PPT-10 is the Petroleum Products Gross Receipts Tax Return in New Jersey.

Q: Who needs to file Form PPT-10?

A: Businesses engaged in the sale, distribution, or transfer of petroleum products in New Jersey need to file Form PPT-10.

Q: What is the purpose of Form PPT-10?

A: Form PPT-10 is used to report and pay the gross receipts tax on petroleum products sold or distributed in New Jersey.

Q: When is Form PPT-10 due?

A: Form PPT-10 is typically due on a quarterly basis, with the following deadlines: April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing and non-compliance, including interest charges and possible fines.

Q: Is there a minimum threshold for reporting on Form PPT-10?

A: Yes, businesses with gross receipts of $10,000 or more from petroleum products sales or distribution need to report on Form PPT-10.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.