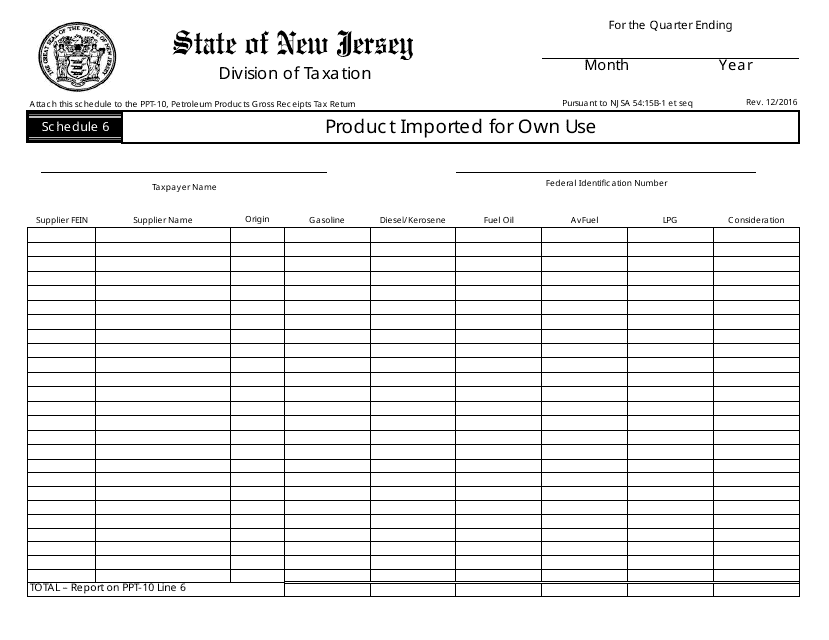

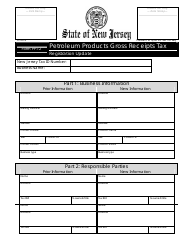

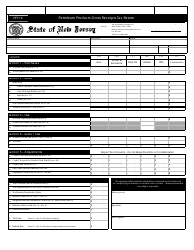

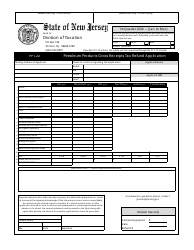

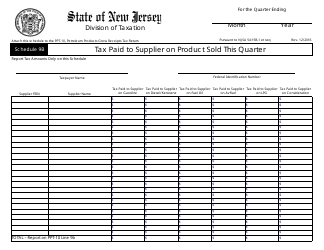

Form PPT-10 Schedule 6 Product Imported for Own Use - New Jersey

What Is Form PPT-10 Schedule 6?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10?

A: Form PPT-10 is a form used in the state of New Jersey.

Q: What is Schedule 6?

A: Schedule 6 is a specific section of Form PPT-10.

Q: What is the purpose of Schedule 6?

A: Schedule 6 is used to report products imported for personal use in New Jersey.

Q: Who needs to fill out Form PPT-10 Schedule 6?

A: Individuals who have imported products for personal use in New Jersey.

Q: Is Form PPT-10 Schedule 6 applicable only to businesses?

A: No, it is applicable to individuals who have imported products for personal use.

Q: What information needs to be provided in Schedule 6?

A: The form requires information about the imported products, such as their description and quantity.

Q: Are there any deadlines for submitting Form PPT-10 Schedule 6?

A: Yes, the form must be filed annually by January 31st of the following year.

Q: Is there a penalty for late submission of Form PPT-10 Schedule 6?

A: Yes, late filing may result in penalties and interest charges.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 6 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.