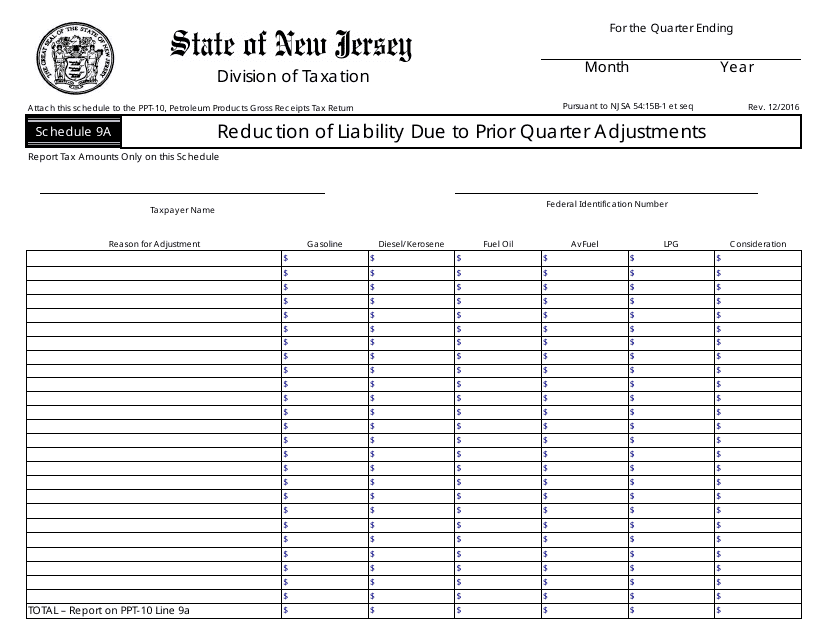

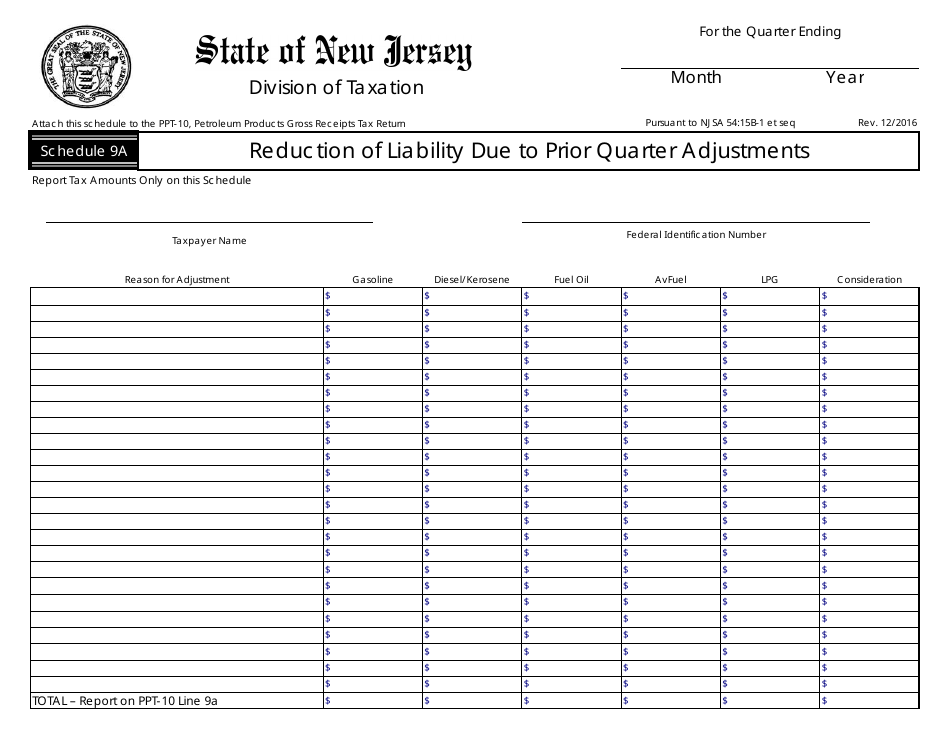

Form PPT-10 Schedule 9A Reduction of Liability Due to Prior Quarter Adjustments - New Jersey

What Is Form PPT-10 Schedule 9A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10?

A: Form PPT-10 is a tax form used in New Jersey.

Q: What is Schedule 9A?

A: Schedule 9A is a part of Form PPT-10.

Q: What does Schedule 9A calculate?

A: Schedule 9A calculates the reduction of liability due to prior quarter adjustments.

Q: Who needs to file Form PPT-10 Schedule 9A?

A: Anyone in New Jersey who needs to report and calculate the reduction of liability due to prior quarter adjustments.

Q: Is Form PPT-10 Schedule 9A specific to New Jersey?

A: Yes, it is specific to New Jersey.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 9A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.