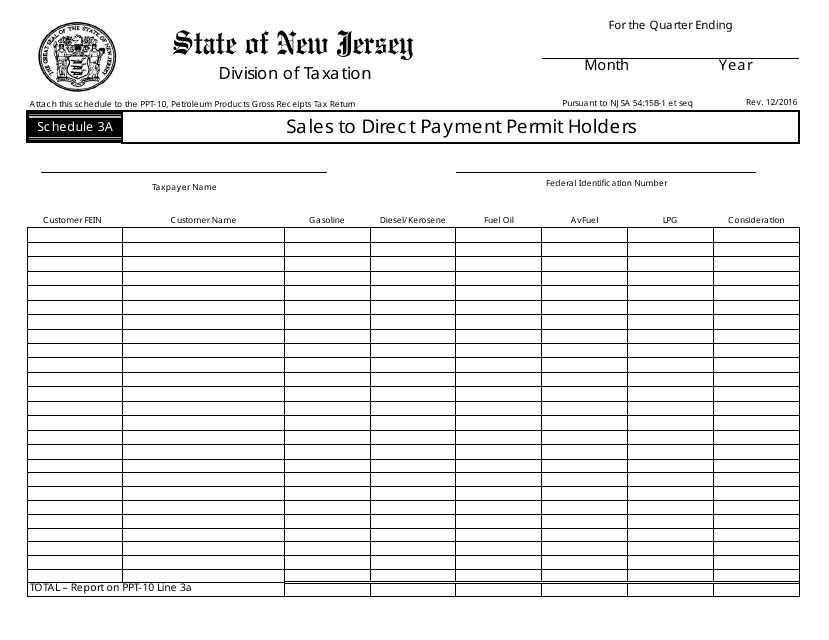

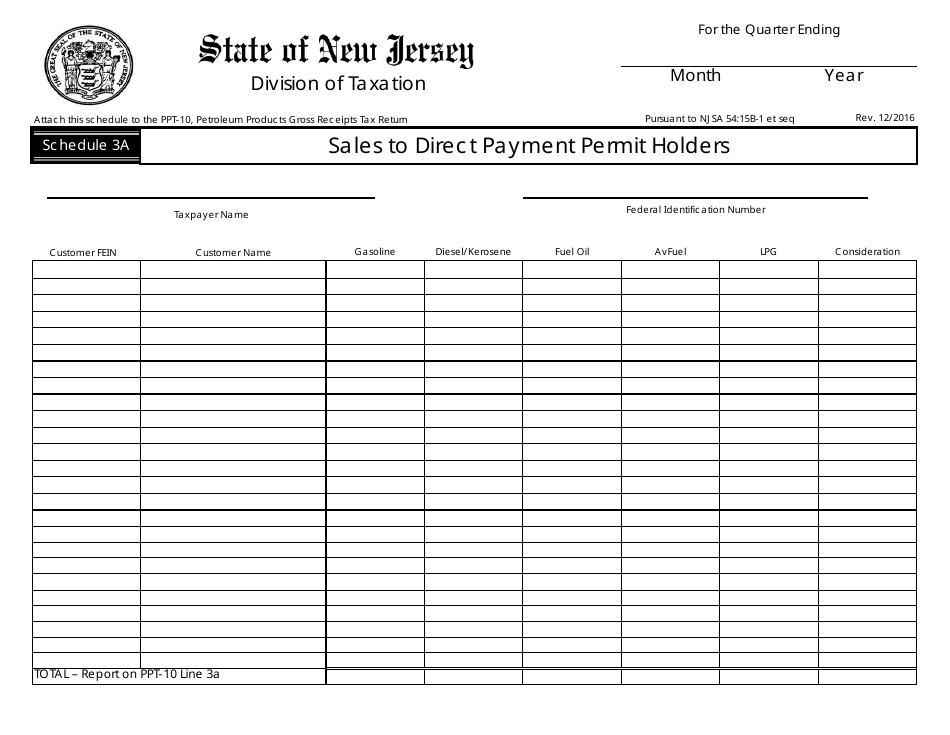

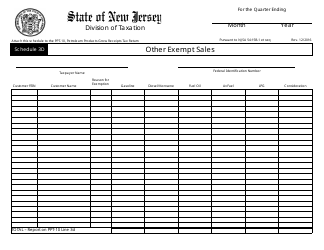

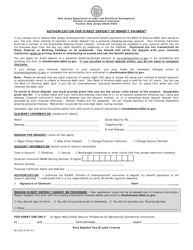

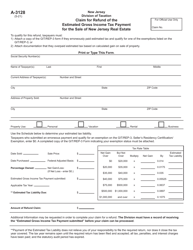

Form PPT-10 Schedule 3A Sales to Direct Payment Permit Holders - New Jersey

What Is Form PPT-10 Schedule 3A?

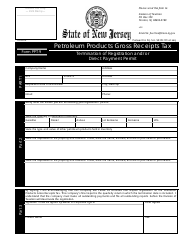

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

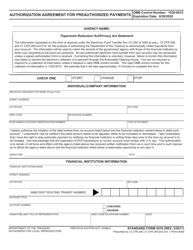

Q: What is Form PPT-10 Schedule 3A?

A: Form PPT-10 Schedule 3A is a form used for reporting sales to Direct Payment Permit Holders in New Jersey.

Q: Who uses Form PPT-10 Schedule 3A?

A: Businesses that have made sales to Direct Payment Permit Holders in New Jersey use this form.

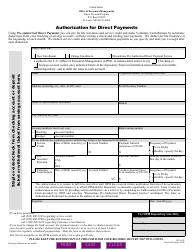

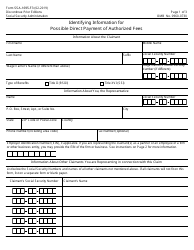

Q: What is a Direct Payment Permit Holder?

A: A Direct Payment Permit Holder is a business that is authorized to pay sales or use tax directly to the state.

Q: Why do businesses need to report sales to Direct Payment Permit Holders?

A: Businesses need to report these sales for tax compliance and record-keeping purposes.

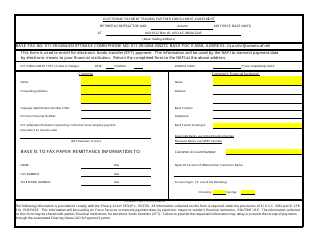

Q: Are there any penalties for not filing Form PPT-10 Schedule 3A?

A: Yes, failure to file or late filing may result in penalties and interest charges.

Q: When is the deadline for filing Form PPT-10 Schedule 3A?

A: The deadline for filing this form is typically on a quarterly basis. Check with the New Jersey Division of Taxation for the specific due dates.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

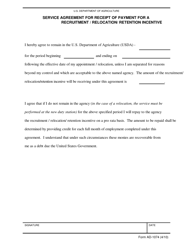

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 3A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.