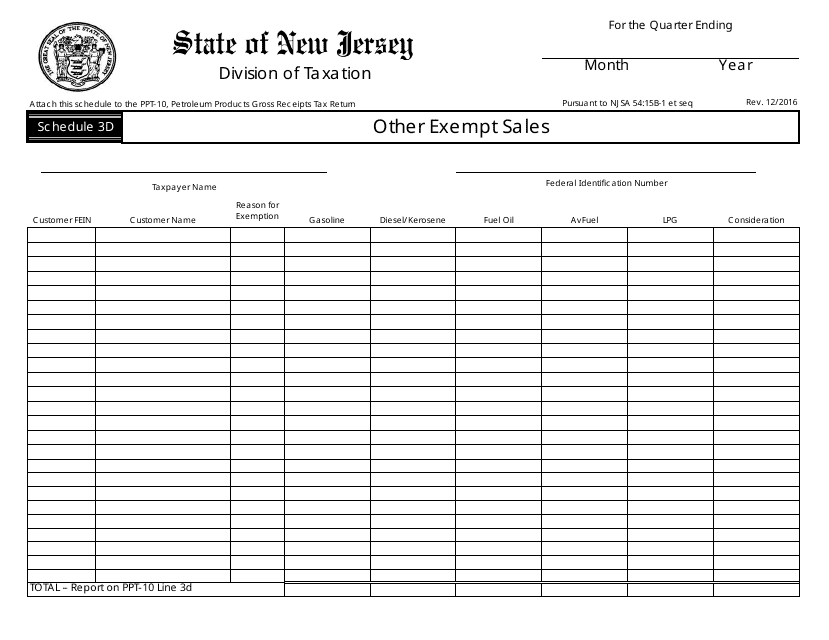

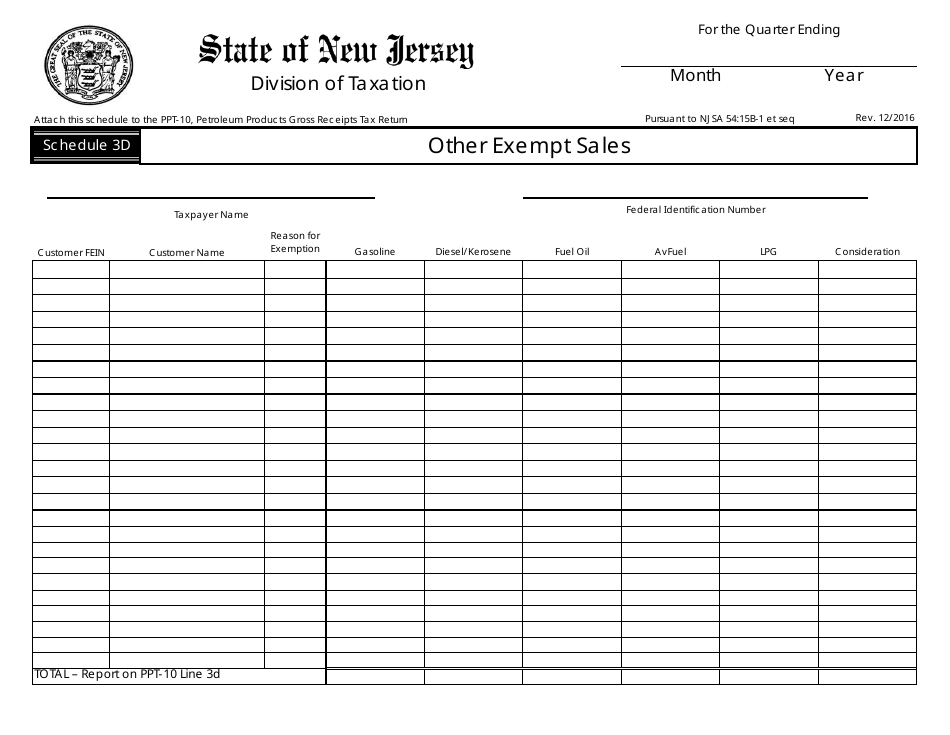

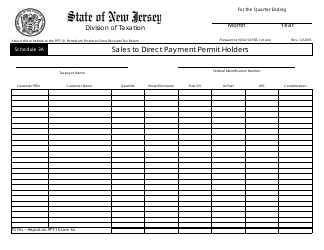

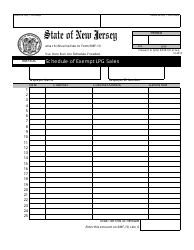

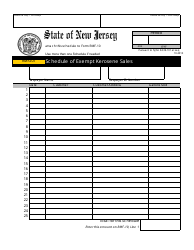

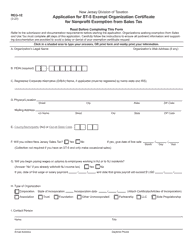

Form PPT-10 Schedule 3D Other Exempt Sales - New Jersey

What Is Form PPT-10 Schedule 3D?

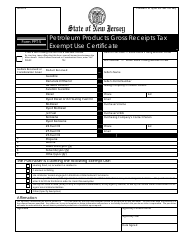

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10?

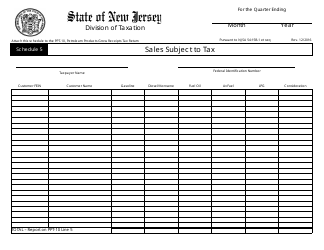

A: Form PPT-10 is a sales tax form used in New Jersey.

Q: What is Schedule 3D?

A: Schedule 3D is a section of Form PPT-10 that relates to other exempt sales.

Q: What are exempt sales?

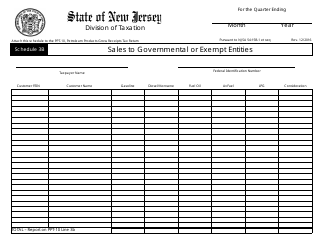

A: Exempt sales are sales that are not subject to sales tax.

Q: What types of sales are considered exempt?

A: There are various types of exempt sales, such as sales to government entities, sales of certain groceries, and sales of prescription drugs.

Q: Why is Schedule 3D important?

A: Schedule 3D is important because it helps track and report other exempt sales made in New Jersey.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 3D by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.