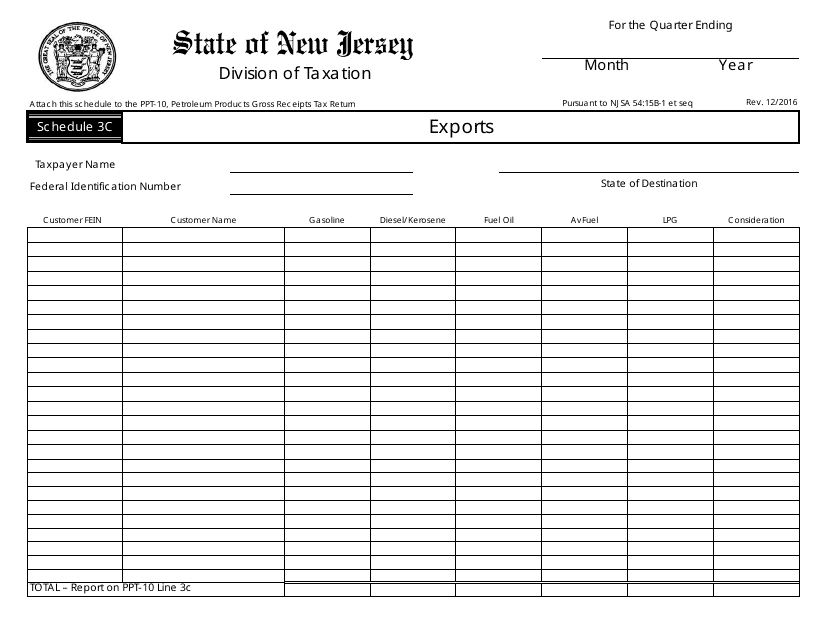

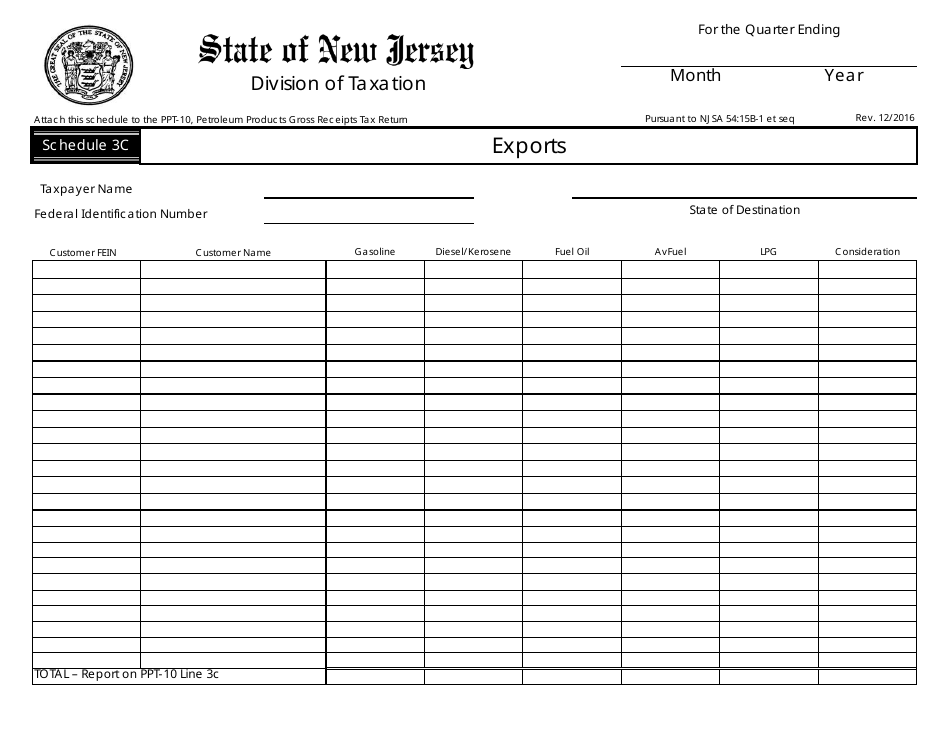

Form PPT-10 Schedule 3C Exports - New Jersey

What Is Form PPT-10 Schedule 3C?

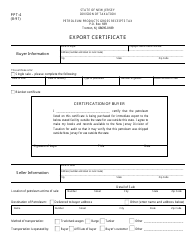

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10 Schedule 3C?

A: Form PPT-10 Schedule 3C is a document used for reporting exports from New Jersey.

Q: Who needs to fill out Form PPT-10 Schedule 3C?

A: Anyone who exports goods from New Jersey needs to fill out Form PPT-10 Schedule 3C.

Q: What information is required on Form PPT-10 Schedule 3C?

A: Form PPT-10 Schedule 3C requires information such as the exporter's name and address, description of the exported goods, and the destination country.

Q: When is the deadline for filing Form PPT-10 Schedule 3C?

A: The deadline for filing Form PPT-10 Schedule 3C is usually the same as the deadline for filing the annual business personal property tax return in New Jersey.

Q: Are there any penalties for not filing Form PPT-10 Schedule 3C?

A: Yes, there may be penalties for not filing Form PPT-10 Schedule 3C, including monetary fines and potential legal consequences.

Q: Can I amend my Form PPT-10 Schedule 3C after filing?

A: Yes, you can amend your Form PPT-10 Schedule 3C after filing by submitting a revised form to the New Jersey Division of Taxation.

Q: What should I do if I have questions about Form PPT-10 Schedule 3C?

A: If you have questions about Form PPT-10 Schedule 3C, you should contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 3C by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.