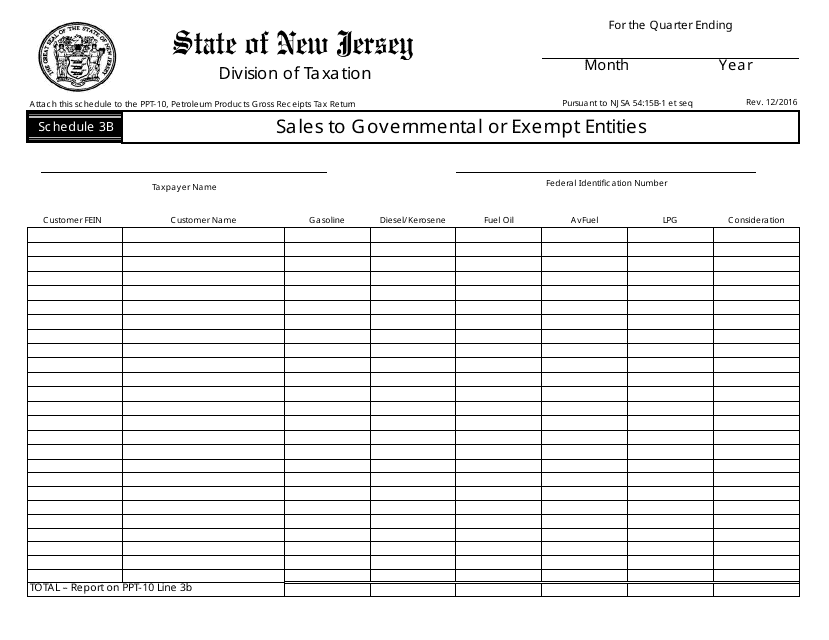

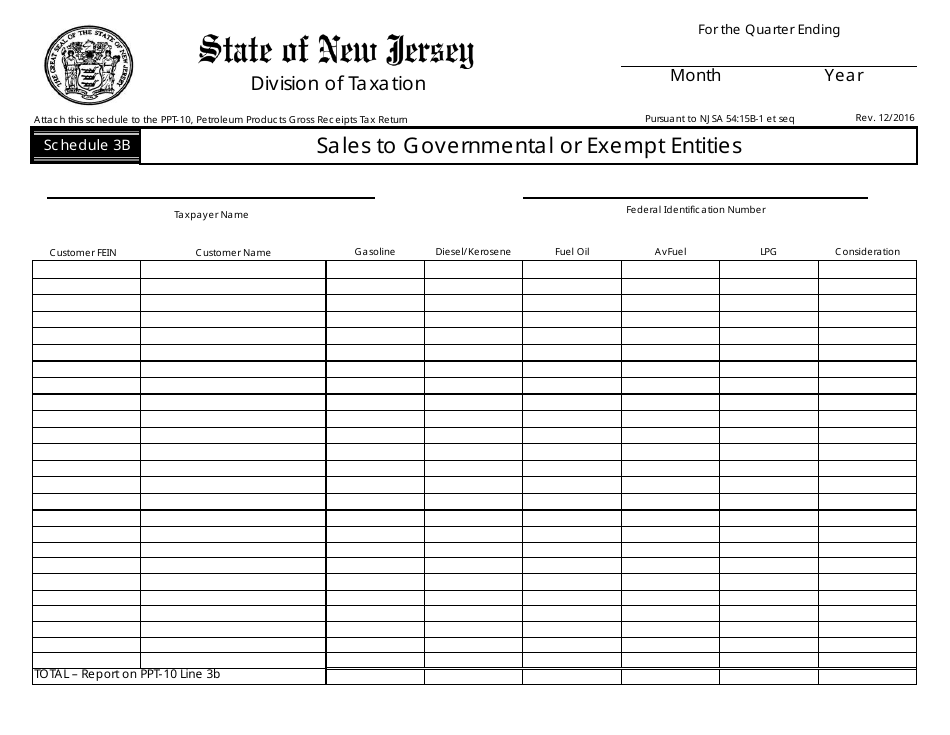

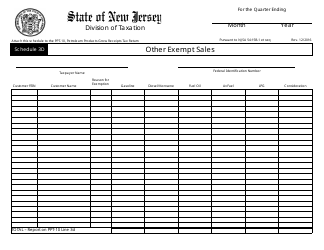

Form PPT-10 Schedule 3B Sales to Governmental or Exempt Entities - New Jersey

What Is Form PPT-10 Schedule 3B?

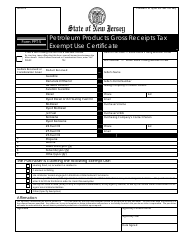

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10 Schedule 3B?

A: Form PPT-10 Schedule 3B is a specific form used in New Jersey for reporting sales made to governmental or exempt entities.

Q: What does Schedule 3B report?

A: Schedule 3B reports sales made to governmental or exempt entities.

Q: Who should use Schedule 3B?

A: Businesses in New Jersey that have made sales to governmental or exempt entities should use Schedule 3B.

Q: What is considered a governmental or exempt entity?

A: Governmental or exempt entities include government agencies, schools, hospitals, and other organizations that are exempt from certain taxes.

Q: Do I need to file Form PPT-10 Schedule 3B?

A: If you have made sales to governmental or exempt entities in New Jersey, you are required to file Form PPT-10 Schedule 3B.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 3B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.