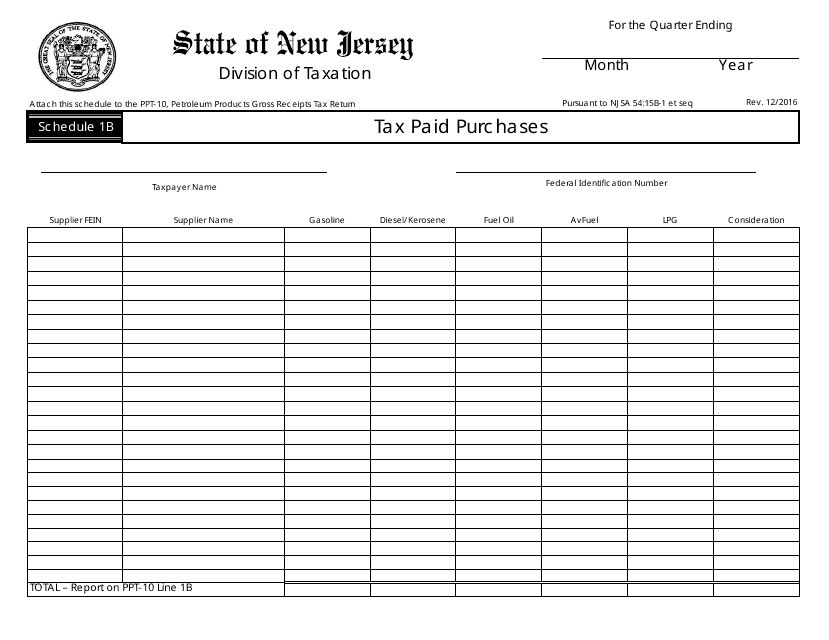

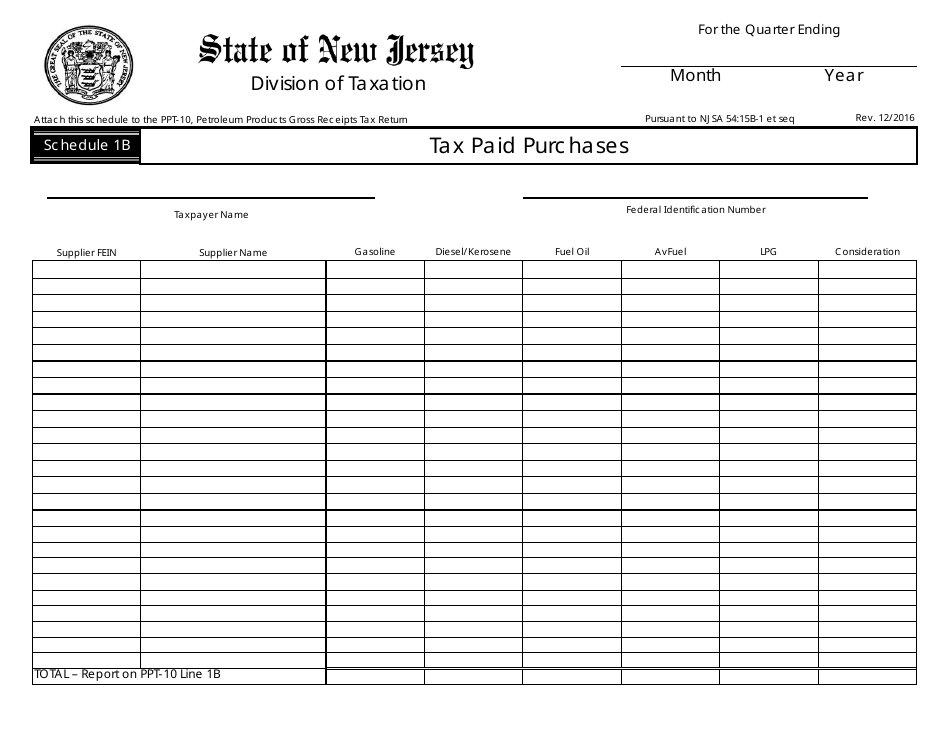

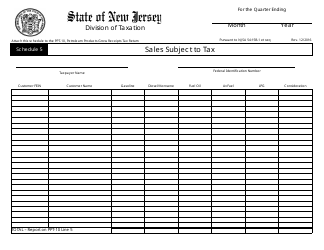

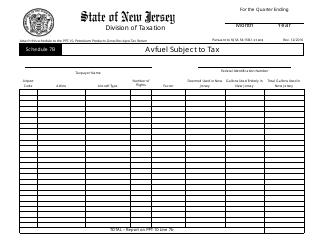

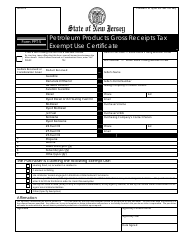

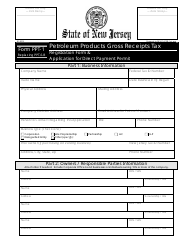

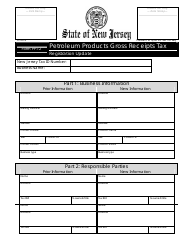

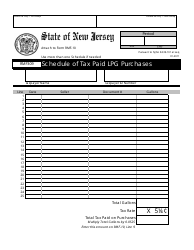

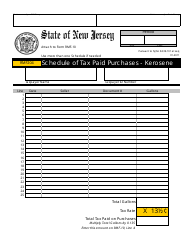

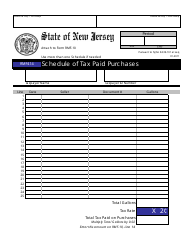

Form PPT-10 Schedule 1B Tax Paid Purchases - New Jersey

What Is Form PPT-10 Schedule 1B?

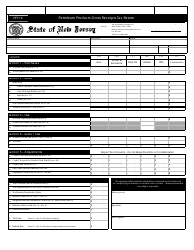

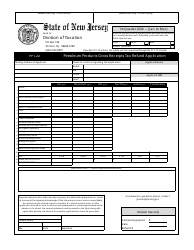

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10 Schedule 1B?

A: Form PPT-10 Schedule 1B is a tax form used in New Jersey.

Q: What is the purpose of Form PPT-10 Schedule 1B?

A: Form PPT-10 Schedule 1B is used to report tax paid purchases in New Jersey.

Q: Who needs to file Form PPT-10 Schedule 1B?

A: Businesses that have made tax paid purchases in New Jersey need to file this form.

Q: When is Form PPT-10 Schedule 1B due?

A: The due date for filing Form PPT-10 Schedule 1B varies, so you should consult the instructions or the New Jersey Division of Taxation for the specific deadline.

Q: What information do I need to complete Form PPT-10 Schedule 1B?

A: You will need information about your tax paid purchases in New Jersey, including the vendor name, purchase amount, and tax paid.

Q: Can I file Form PPT-10 Schedule 1B electronically?

A: Currently, you cannot file Form PPT-10 Schedule 1B electronically. It must be filed by mail.

Q: Are there any penalties for not filing Form PPT-10 Schedule 1B?

A: Yes, there may be penalties for not filing Form PPT-10 Schedule 1B or for filing it late. You should timely file the form to avoid any penalties.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 1B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.