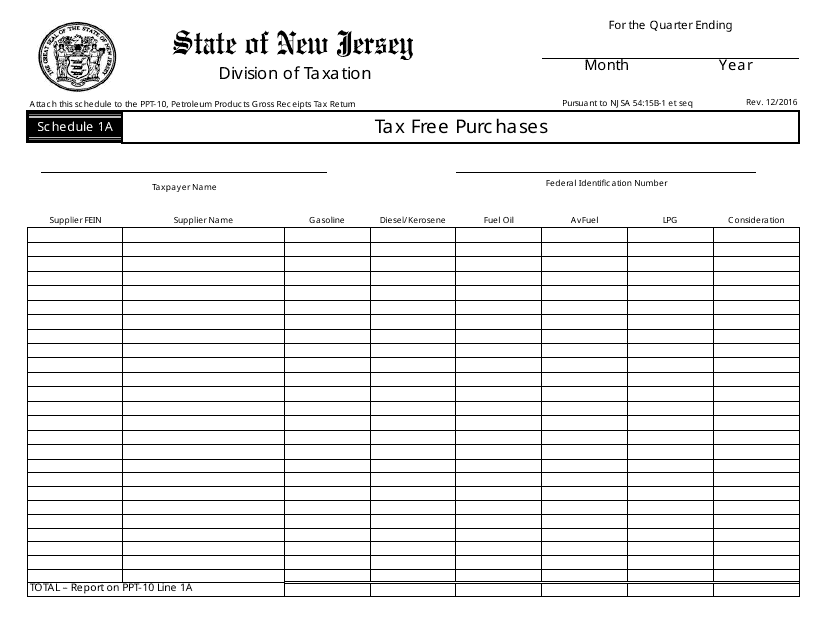

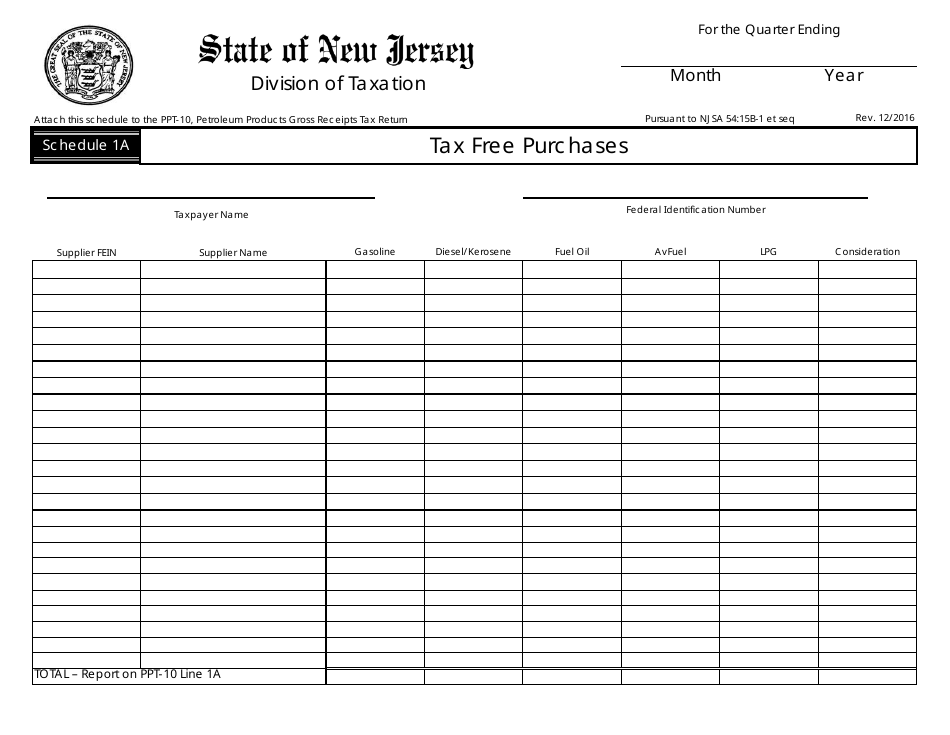

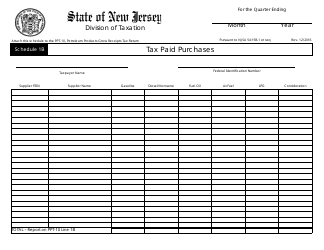

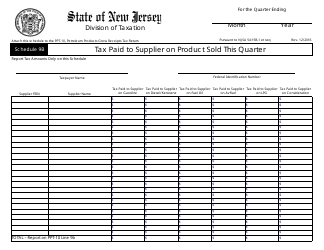

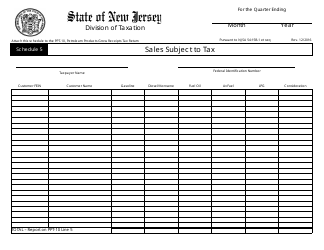

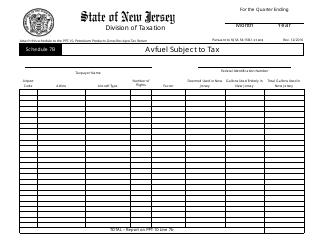

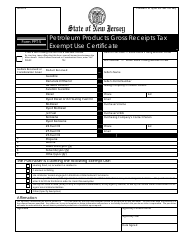

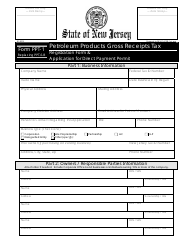

Form PPT-10 Schedule 1A Tax Free Purchases - New Jersey

What Is Form PPT-10 Schedule 1A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form PPT-10, Petroleum Products Gross Receipts Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-10?

A: Form PPT-10 is a tax form used in New Jersey.

Q: What is Schedule 1A?

A: Schedule 1A is a section of Form PPT-10.

Q: What are tax free purchases?

A: Tax free purchases are purchases that are exempt from sales tax.

Q: Who should use Form PPT-10 Schedule 1A?

A: Anyone who made tax free purchases in New Jersey should use Form PPT-10 Schedule 1A.

Q: How do I report tax free purchases?

A: You report tax free purchases on Schedule 1A of Form PPT-10.

Q: Are all purchases tax free in New Jersey?

A: No, not all purchases are tax free in New Jersey. Only certain items are exempt from sales tax.

Q: What types of purchases are tax free in New Jersey?

A: Examples of tax free purchases in New Jersey include food, prescription medications, and clothing purchased for children.

Q: Do I need to keep receipts for tax free purchases?

A: Yes, you should keep receipts as proof of your tax free purchases in case of an audit.

Q: When is the deadline to file Form PPT-10 Schedule 1A?

A: The deadline to file Form PPT-10 Schedule 1A is usually April 15th, but it may vary depending on the year and any extensions granted.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPT-10 Schedule 1A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.